Herb and Spice Extracts Market Size

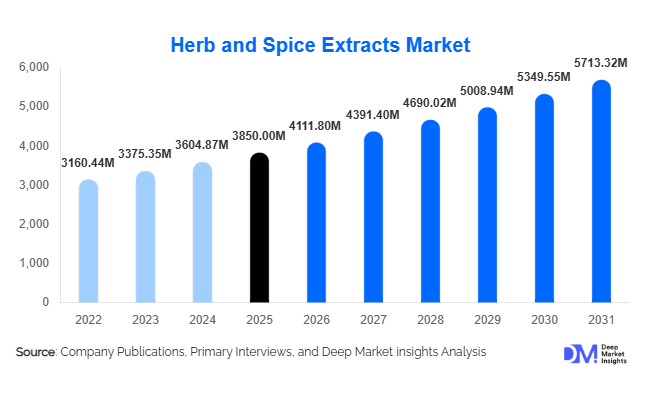

According to Deep Market Insights, the global herb and spice extracts market size was valued at USD 3,850 million in 2025 and is projected to grow from USD 4,111.80 million in 2026 to reach USD 5,713.32 million by 2031, expanding at a CAGR of 6.8% during the forecast period (2026–2031). The market growth is primarily driven by rising consumer preference for natural flavors, growing demand for functional foods and nutraceuticals, and the expanding adoption of herbal and spice extracts in the cosmetics and personal care sectors globally.

Key Market Insights

- Growing preference for natural and clean-label ingredients is fueling demand for herb and spice extracts in food, beverage, and dietary supplement applications.

- Expansion of the nutraceutical and functional food segments is creating a steady demand pipeline for high-quality botanical extracts, particularly turmeric, ginger, and garlic.

- Asia-Pacific and North America lead consumption, with India, China, and the U.S. contributing the largest shares due to high domestic production and growing health-conscious populations.

- Technological integration in extraction methods, such as supercritical CO₂ extraction and solvent-free processes, is enhancing product purity, yield, and cost-efficiency.

- Cosmetics and personal care applications are expanding rapidly, leveraging herbal extracts for anti-aging, skin-soothing, and haircare formulations.

- Export-driven growth is emerging, especially from Asia to North America and Europe, driven by demand for natural flavorings and herbal supplements.

What are the latest trends in the herb and spice extracts market?

Natural and Organic Extract Adoption

Consumer demand for organic, clean-label, and plant-based ingredients is rising sharply. Food and beverage manufacturers, as well as nutraceutical brands, are replacing synthetic flavorings and additives with herbal and spice extracts. Turmeric curcumin, gingerol-rich ginger extracts, and garlic derivatives are increasingly used in dietary supplements, fortified beverages, and functional foods. The trend toward organic certification is also becoming important, with many companies adopting EU organic or USDA organic standards to appeal to premium health-conscious consumers.

Advanced Extraction Technologies

Supercritical CO₂ extraction, microwave-assisted extraction, and solvent-free methods are becoming mainstream. These technologies enhance extraction efficiency, preserve bioactive compounds, and reduce environmental impact. As a result, products such as liquid turmeric extracts or standardized garlic powders offer higher potency, extended shelf life, and cleaner labeling, driving adoption in premium nutraceutical and cosmetic formulations. Manufacturers are also investing in R&D for high-yield extraction from low-cost botanical sources, enabling competitive pricing and scalability.

What are the key drivers in the herb and spice extracts market?

Rising Demand for Functional Foods and Nutraceuticals

The global focus on preventive healthcare and immunity-boosting products has led to increased consumption of herbal and spice extracts. Ingredients such as turmeric, ginger, garlic, and rosemary are integrated into functional foods, beverages, and dietary supplements for their antioxidant, anti-inflammatory, and digestive benefits. The growing consumer awareness regarding health and wellness, combined with the aging population in developed regions, is creating steady demand for high-quality extracts.

Growing Cosmetic and Personal Care Applications

Herb and spice extracts are increasingly utilized in skincare, haircare, and aromatherapy products. Consumers prefer natural formulations that promote skin health, reduce irritation, and provide anti-aging benefits. Ingredients such as aloe vera, turmeric, rosemary, and mint extracts are widely incorporated in creams, lotions, serums, and shampoos. The trend toward organic and vegan personal care products is expected to continue, providing long-term growth potential for extract suppliers.

Expansion in the Food and Beverage Industry

Manufacturers are leveraging herb and spice extracts for flavor enhancement, functional fortification, and preservative replacement. The bakery, dairy, confectionery, and beverage industries are witnessing increasing use of spice and herb extracts to provide natural flavors, aromas, and functional benefits. Extracts allow product differentiation, clean-label certification, and appeal to health-conscious consumers, fueling their adoption globally.

What are the restraints for the global market?

High Raw Material Price Volatility

Fluctuating prices of raw herbs and spices, influenced by climate change, seasonal availability, and geopolitical factors, pose a challenge. Extract manufacturers face cost pressures, which can lead to increased end-product pricing, affecting market penetration in cost-sensitive regions.

Regulatory Compliance and Quality Standards

Herb and spice extracts must comply with stringent food safety, dietary supplement, and cosmetic regulations in major markets. Non-compliance can result in product recalls, fines, and restricted exports, creating barriers for smaller players and new entrants. Standardization of bioactive content and organic certification requirements also adds complexity to market operations.

What are the key opportunities in the herb and spice extracts market?

Emerging Functional Beverage and Nutraceutical Market

The rising popularity of herbal teas, fortified beverages, and immunity-boosting drinks presents an opportunity for extract manufacturers. Turmeric lattes, ginger shots, and herbal-infused waters are gaining traction globally. Market participants can innovate by developing concentrated extracts tailored for functional beverages and nutraceutical formulations, capturing higher margins and premium consumer segments.

Expansion in Cosmetic and Personal Care Products

Cosmetic brands are increasingly incorporating plant-based extracts for anti-aging, skin soothing, haircare, and aromatherapy applications. With growing consumer awareness about natural ingredients and sustainability, extracts offer a strong value proposition. Companies can leverage certified organic and ethically sourced extracts to enhance product differentiation and meet regulatory requirements.

Export and Regional Market Penetration

Developing regions such as the Asia-Pacific and Latin America are witnessing rising demand for natural flavors and health-focused ingredients. Export-oriented strategies, particularly from India, China, and Europe, enable manufacturers to tap into North American and European markets. Investment in cold-chain logistics, international certifications, and regional distribution partnerships can strengthen market presence and drive global growth.

Product Type Insights

Spice extracts, particularly turmeric, ginger, and garlic, dominate the global market, accounting for approximately 45% of the total market in 2024. This dominance is driven by high global demand for functional foods and nutraceutical applications. Herb extracts, including rosemary, basil, and mint, account for 30% and are widely used in flavoring, cosmetics, and personal care. Liquid extracts lead in product forms due to higher solubility, potency, and ease of integration across industries, while powder and capsule forms are preferred in dietary supplements and processed foods.

Application Insights

Food and beverage applications hold the largest market share at 40% in 2024, primarily driven by the need for natural flavorings, clean-label products, and functional fortification. Pharmaceutical and nutraceutical applications account for 25%, with turmeric, ginger, and garlic extracts being highly sought after for immunity and digestive health products. Cosmetics and personal care applications are the fastest-growing segment (15% CAGR) due to rising demand for plant-based, anti-aging, and haircare formulations.

Distribution Channel Insights

Direct B2B sales dominate (55%) due to bulk demand from nutraceutical, food, and cosmetic manufacturers. Online platforms and e-commerce are increasingly important (20%), providing SMEs and new entrants access to global markets. Distributors and wholesalers (15%) serve as intermediaries in regions with fragmented supply chains, while retail (10%) focuses mainly on ready-to-use products, capsules, and supplements.

| By Product Type | By Form | By Application | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounted for 28% of the global market in 2024. The U.S. leads due to high health-conscious consumption, strong nutraceutical adoption, and regulatory support for natural ingredients. Canada is also witnessing growing demand in dietary supplements and functional beverages.

Europe

Europe represents 25% of the 2024 market, with Germany, France, and the U.K. driving consumption in cosmetics and functional foods. Stringent regulatory standards for organic and natural labeling ensure high-quality products dominate the market.

Asia-Pacific

APAC is the fastest-growing region (8.2% CAGR), led by India, China, and Japan. India and China are major exporters and consumers, while Japan shows increasing demand for high-purity extracts in the nutraceutical and cosmetic sectors. Rising disposable income and health awareness further fuel regional growth.

Latin America

Brazil and Argentina are emerging markets with growing interest in natural ingredients and herbal supplements. Demand is primarily export-driven and focused on premium, functional, and natural flavoring applications.

Middle East & Africa

Regions like the UAE, Saudi Arabia, South Africa, and Egypt are seeing growing demand for herbal supplements, functional foods, and natural cosmetic ingredients. High-income populations in the Middle East are driving premium extract consumption, while Africa benefits from abundant raw material sourcing.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Herb and Spice Extracts Market

- Chr. Hansen

- Indena S.p.A.

- Sabinsa Corporation

- Kancor Ingredients Limited

- Naturex (Givaudan)

- Symrise AG

- Arjuna Natural Extracts Ltd.

- Martin Bauer Group

- Starwest Botanicals

- Vita Green Biotech

- Rita Herbs Pvt. Ltd.

- Botaneco

- Herbaland Naturals

- Emerald Health Bioceuticals

- Parry Nutraceuticals