Anti-Aging Supplements Market Size

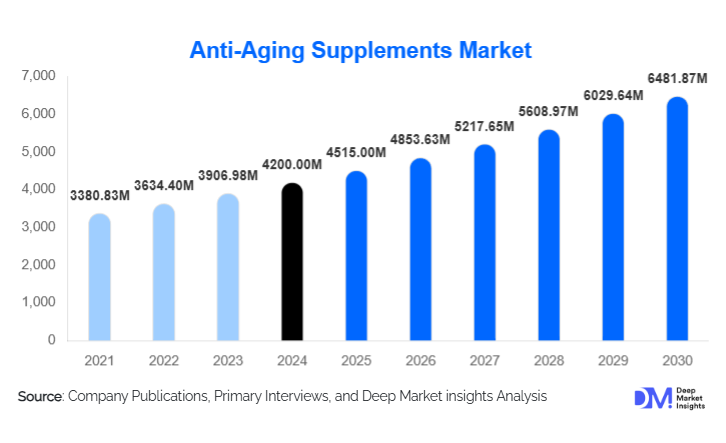

According to Deep Market Insights, the global Anti-aging Supplements market size was valued at USD 4,200 million in 2024 and is projected to grow from USD 4,515 million in 2025 to reach USD 6,481.87 million by 2030, expanding at a CAGR of 7.5% during the forecast period (2025–2030). The market growth is primarily driven by the increasing aging population, rising health and wellness awareness, and innovations in supplement ingredients and delivery formats targeting longevity and cosmetic benefits.

Key Market Insights

- Collagen and peptides dominate the ingredient segment, driven by high demand in skin, hair, and nail applications due to proven benefits and consumer familiarity.

- Hair, skin, and nail care remain the largest application segment, reflecting consumer focus on visible signs of aging and the intersection with beauty and personal care.

- North America holds the largest market share, led by the U.S., due to high disposable income, well-established distribution channels, and strong adoption of premium supplements.

- Asia-Pacific is the fastest-growing region, fueled by rising middle-class affluence, increasing awareness of preventive health, and online retail penetration.

- Online and e-commerce distribution is accelerating, with direct-to-consumer models, subscription services, and influencer-driven marketing reshaping sales channels.

- Innovative ingredients and technologies, including NMN, NAD+ precursors, and advanced formulations, are expanding premium and personalized supplement offerings globally.

What are the latest trends in the anti-aging supplements market?

Emergence of Novel Longevity Ingredients

Consumers are increasingly seeking supplements with advanced ingredients such as NMN, NAD+ precursors, sirtuin activators, and senolytics. Brands investing in clinical validation, bioavailability enhancement, and personalized formulations are differentiating themselves in the crowded market. Plant-based, clean-label, and multifunctional products are gaining traction, aligning with consumer demand for natural, sustainable, and scientifically supported solutions.

Digital and Direct-to-Consumer Expansion

E-commerce platforms, subscription models, and wellness apps are reshaping distribution channels. Direct-to-consumer approaches enable brands to build trust through transparent sourcing, quality assurance, and personalized offerings. Social media marketing, influencer engagement, and digital wellness platforms are driving higher awareness and adoption, particularly among younger demographics and health-conscious consumers in emerging markets.

What are the key drivers in the anti-aging supplements market?

Growing Aging Population

Increasing life expectancy and rising populations in the 40+ age bracket globally are fueling demand for products targeting skin, joint, cognitive, and general vitality. Older adults are actively seeking supplements to maintain quality of life, slow visible signs of aging, and support overall health, providing a stable and growing consumer base.

Health & Wellness Awareness

Preventive healthcare and wellness consciousness are accelerating market growth. Consumers are proactively using supplements to combat oxidative stress, maintain physical and cognitive health, and improve appearance. Awareness campaigns, media coverage, and clinical studies highlighting supplement efficacy are further driving adoption.

Innovative Ingredients and Delivery Formats

New ingredients, enhanced bioavailability, and convenient formulations (capsules, powders, gummies, liquids) are increasing consumer acceptance. Clinically validated actives and multifunctional products targeting multiple aspects of aging attract premium segments. Trends such as plant-based collagen, vegan formulations, and combination supplements are further expanding market potential.

What are the restraints for the global market?

Regulatory Complexity

Variation in supplement regulations across countries, including health claims, ingredient approvals, and clinical evidence requirements, can slow product launches and create compliance costs. Regulatory uncertainty for novel ingredients like NMN and senolytics remains a significant challenge for manufacturers.

High Product Costs

Premium anti-aging supplements, particularly those with advanced actives, can be expensive. Price sensitivity in emerging markets limits adoption. Raw material fluctuations, especially for peptides, collagen, and botanical extracts, further impact product affordability and profitability.

What are the key opportunities in the anti-aging supplements industry?

Advanced Longevity Science Integration

Brands that incorporate emerging science-backed ingredients, conduct clinical validation, and offer personalized supplement regimens can capture premium segments. Opportunities exist in integrating biotechnology, genomics, and biomarker-driven personalization, enhancing differentiation and consumer trust.

Expansion in Asia-Pacific and Emerging Markets

Rising disposable incomes, urbanization, and increased online retail penetration create significant growth opportunities in China, India, Southeast Asia, and Latin America. Localized formulations, regulatory compliance, and culturally relevant marketing can drive adoption in these fast-growing regions.

Direct-to-Consumer and Omnichannel Approaches

Digital platforms, subscription services, and e-commerce channels allow brands to engage directly with consumers, build loyalty, and provide personalized experiences. Integration with wellness clinics, fitness centers, and lifestyle apps further enhances market reach.

Product Type Insights

Capsules dominate the market due to convenience, precise dosing, and consumer familiarity, accounting for 36% of the global market in 2024. Powders, gummies, and liquids are gaining traction, particularly among younger and health-conscious consumers seeking functional, flavor-enhanced, and plant-based alternatives.

Application Insights

Hair, skin, and nail care represent the largest application (40% of the 2024 market), driven by visible aging concerns and cross-marketing with the beauty and personal care industry. Other applications include bone and joint health, cognitive support, immune function, energy, and hormonal balance, with multi-benefit formulations gaining popularity.

Distribution Channel Insights

Offline retail remains significant (55% share), driven by consumer trust in pharmacies and specialty stores. Online retail is expanding rapidly, leveraging e-commerce, D2C, and subscription models. Wellness clinics, spas, and health-focused outlets are emerging as niche distribution channels targeting premium consumers.

End-User Insights

Women account for the largest segment due to cosmetic and hormonal aging concerns. The elderly (65+) and middle-aged adults (40–64) are the fastest-growing segments, particularly for cognitive and joint health supplements. Men, young adults, athletes, and wellness enthusiasts represent emerging opportunities, especially for personalized, performance-oriented, and premium formulations.

| By Ingredient | By Benefit | By Format | By Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America dominates the market (36% share in 2024), led by the U.S. High disposable income, established retail networks, and strong adoption of premium and innovative products support growth. Canada also contributes by increasing health and wellness awareness.

Europe

Europe holds a 22% share, with Germany, France, and the U.K. driving demand. Consumers prioritize natural, organic, and clinically validated supplements. Regulations ensure product quality and safety, enhancing consumer trust and sustaining steady market growth.

Asia-Pacific

APAC is the fastest-growing region, driven by China, India, Japan, and South Korea. Rising middle-class affluence, increasing health awareness, and e-commerce adoption are key growth enablers. Chinese and Indian consumers increasingly prefer mid-range and premium supplements, creating significant opportunities for new entrants.

Latin America

Brazil, Mexico, and Argentina are emerging markets for anti-aging supplements. Affluent consumers and growing wellness awareness are driving outbound and domestic demand, with a focus on cosmetic and general wellness supplements.

Middle East & Africa

The Middle East, led by the UAE and Saudi Arabia, is growing due to high-income populations and premium consumption patterns. Africa remains a smaller market but offers niche opportunities, especially for natural and plant-based products aligned with local traditions and wellness trends.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Anti-Aging Supplements Market

- Shaklee Corporation

- Thorne

- GNC Holdings, LLC

- Life Extension

- Nu Skin Enterprises

- ChromaDex, Inc.

- Nutrova

- Cureveda

- Oziva

- Decode Age

- Herbalife Nutrition

- NOW Foods

- Swisse Wellness

- Jarrow Formulas

- Solgar

Recent Developments

- In May 2025, ChromaDex expanded its NMN and NAD+ supplement portfolio globally, focusing on clinical validation and premium packaging for direct-to-consumer sales.

- In April 2025, Life Extension launched a new line of plant-based collagen peptides targeting skin, hair, and joint health in North America and Europe.

- In February 2025, Nu Skin introduced personalized anti-aging supplement regimens leveraging biomarker-based analysis and subscription models for high-value consumers.