Herbal Supplements Market Size

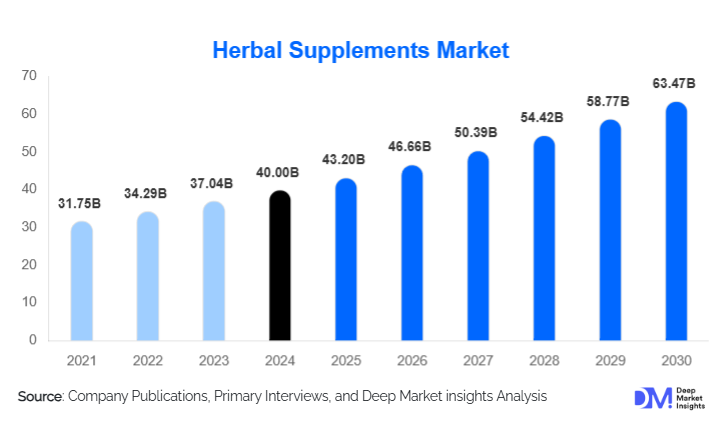

According to Deep Market Insights, the global Herbal Supplements market size was valued at USD 40.0 billion in 2024 and is projected to grow from USD 43.2 billion in 2025 to reach USD 63.47 billion by 2030, expanding at a CAGR of 8% during the forecast period (2025–2030). The herbal supplements market growth is primarily driven by the rising consumer preference for natural and plant-based products, increasing awareness of preventive healthcare, and the expansion of both online and offline distribution channels globally.

Key Market Insights

- Single botanicals dominate the market, particularly turmeric, ginseng, and moringa, due to strong consumer recognition, traditional use, and evidence-backed benefits.

- Capsules, tablets, and softgels remain the most popular formulations, while gummies, powders, and liquid extracts are rapidly gaining traction among younger and convenience-oriented consumers.

- Immune support is the leading functional segment, reflecting heightened global health consciousness post-pandemic.

- North America holds the largest market share, driven by high disposable income, regulatory clarity, and mature distribution channels.

- Asia-Pacific is the fastest-growing region, supported by traditional medicine culture, rising middle-class income, and expanding e-commerce penetration.

- Technological adoption, including advanced extraction techniques, bioavailability-enhancing formulations, and digital direct-to-consumer platforms, is transforming product development and consumer engagement.

Latest Market Trends

Rise of Clean-Label and Sustainable Products

Consumers are increasingly seeking herbal supplements with natural, organic, and sustainably sourced ingredients. The demand for clean-label products, free from synthetic additives, pesticides, and GMOs, is driving manufacturers to invest in traceable and certified supply chains. Sustainable sourcing practices, including fair-trade cultivation and ethical harvesting, are becoming key differentiators. Additionally, eco-friendly packaging and transparency in labeling are gaining importance, reinforcing brand trust and premium pricing opportunities.

Personalized and Functional Formulations

Personalized nutrition is emerging as a major trend in the herbal supplements market. Consumers now seek products tailored to their age, gender, lifestyle, and health profile. Functional formulations targeting immunity, stress relief, sleep, cognitive health, and gut wellness are expanding rapidly. Innovations such as adaptogenic blends, herbal complexes, and modular supplement systems enable customization, enhancing consumer engagement and repeat purchases. Brands integrating clinical validation, advanced extraction methods, and bioavailability enhancements are particularly well-positioned to capture market share.

Herbal Supplements Market Drivers

Increasing Preventive Healthcare Awareness

Consumers worldwide are adopting preventive health measures to manage lifestyle-related diseases, including diabetes, cardiovascular disorders, and obesity. Herbal supplements are increasingly preferred for maintaining overall wellness, boosting immunity, and supporting digestive and cognitive health. This shift toward proactive health management is driving consistent growth in the herbal supplements market, particularly in developed regions with aging populations.

Preference for Natural and Plant-Based Solutions

The growing skepticism toward synthetic ingredients and pharmaceuticals is leading consumers to favor plant-based supplements. Products emphasizing natural, vegan, and minimally processed ingredients are attracting health-conscious and environmentally aware consumers. Formulation innovations like gummies, powders, and liquid extracts are expanding accessibility and convenience, especially for younger demographics.

Expansion of E-Commerce and Digital Platforms

The rise of online retail and direct-to-consumer platforms has enabled easier access to herbal supplements across geographies. E-commerce channels allow smaller brands to reach global markets, offer personalized recommendations, and provide subscription-based solutions. Enhanced digital marketing, influencer collaborations, and social media campaigns are contributing to increased awareness and adoption, particularly in Asia-Pacific and Latin America.

Market Restraints

Regulatory Challenges and Quality Concerns

Variability in regulatory frameworks across countries creates barriers to market entry. Inconsistent labeling, safety, and efficacy requirements can limit product availability in certain regions. Additionally, quality concerns such as adulteration, contamination, and inconsistent active ingredient levels reduce consumer trust and slow market expansion.

Supply Chain and Raw Material Volatility

The herbal supplements market is heavily reliant on natural botanical sources, making it susceptible to seasonal variations, climate impacts, and overharvesting. These factors lead to price volatility, supply disruptions, and challenges in meeting demand. Sustainable cultivation and quality control measures require additional investment, impacting margins for manufacturers.

Herbal Supplements Market Opportunities

Integration of Traditional Medicine and Modern Science

There is growing potential to merge traditional herbal knowledge with modern scientific validation. By investing in clinical trials, bioavailability research, and standardized extraction methods, manufacturers can develop products with proven efficacy, appealing to both health-conscious and evidence-seeking consumers. This approach can open doors to regulated markets and premium pricing.

Emerging Regional Markets

Asia-Pacific, Latin America, and Africa present significant growth opportunities due to rising disposable incomes, expanding middle-class populations, and strong cultural ties to herbal medicine. Export-oriented strategies and localization of production can enhance access to these high-growth markets, while government initiatives supporting traditional medicine can provide regulatory and infrastructural advantages.

Personalized and Wellness-Oriented Product Lines

Tailored supplements targeting specific demographics, health conditions, and lifestyle preferences are attracting consumers seeking functional benefits beyond general wellness. Wellness integration, including stress management, cognitive support, and beauty-from-within formulations, can expand the consumer base and drive premium product adoption.

Product Type Insights

Single botanicals, especially turmeric, ginseng, and moringa, dominate the market due to consumer familiarity, traditional use, and clinical evidence. Combination blends, targeting immunity, stress, and digestive health, are growing rapidly, reflecting consumer demand for multi-functional products. Tablets, capsules, and softgels remain the most widely used formulations, while innovative formats such as gummies, powders, and liquid extracts are driving new adoption among younger consumers.

Application Insights

Immune support supplements remain the leading application, driven by global health awareness. Other high-growth applications include stress and sleep management, cognitive health, digestive wellness, weight management, and skin/beauty supplements. Functional blends targeting multiple health concerns are increasingly popular, creating opportunities for innovation and premium positioning.

Distribution Channel Insights

Offline channels, including pharmacies, supermarkets, and specialty health stores, remain significant, but online platforms are growing fastest. Direct-to-consumer websites, e-commerce marketplaces, and subscription models are expanding market reach. Digital marketing, influencer campaigns, and targeted promotions are enhancing consumer engagement and brand loyalty in online channels.

End-User Insights

Adults represent the largest consumer base, with high demand for general wellness and preventive health supplements. The geriatric segment is growing rapidly due to joint, cognitive, and cardiovascular health needs. Women, including prenatal and maternity segments, are increasingly adopting herbal supplements for hormone balance, skin health, and prenatal nutrition. Emerging applications in functional foods, beverages, and beauty supplements are expanding end-user adoption and cross-industry integration.

| By Herb type | By Format | By End-use | By Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America holds the largest market share (40%) in 2024, led by the U.S. and Canada. High disposable income, established retail and e-commerce channels, and strong regulatory frameworks drive demand for herbal supplements. Consumers increasingly prefer premium, clinically validated, and clean-label products.

Europe

Europe accounts for 25% of the market in 2024, with Germany, the UK, and France leading consumption. Regulatory stringency, quality-conscious consumers, and strong e-commerce penetration support steady growth. Emerging interest in functional and sustainable supplements is driving innovation and adoption.

Asia-Pacific

Asia-Pacific is the fastest-growing region (CAGR 9%), with China, India, Japan, and Southeast Asia driving demand. Rising incomes, cultural affinity for herbal medicine, and rapid online penetration are key growth factors. The region is also a significant hub for raw material production and export-oriented manufacturing.

Latin America

Latin America, led by Brazil, Mexico, and Argentina, is experiencing increasing adoption, particularly for immune and digestive health supplements. Rising awareness of natural products and expanding middle-class populations support growth.

Middle East & Africa

Middle East countries, including the UAE and Saudi Arabia, show growing demand for premium herbal supplements due to high-income populations. Africa, as a major production hub, is also seeing increasing domestic consumption, particularly in South Africa and Nigeria.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Herbal Supplements Market

- Herbalife Nutrition Ltd.

- Amway Corporation

- Dr. Willmar Schwabe GmbH & Co. KG

- Blackmores Ltd

- Nature’s Bounty (Bountiful Co.)

- NOW Foods

- Gaia Herbs

- Nature’s Way

- GNC / Harbin Pharmaceutical

- Himalaya Global Holdings Ltd.

- Solgar, Inc.

- New Chapter, Inc.

- Swisse Wellness Pty Ltd

- Organic India Pvt. Ltd.

- Oriflame (Herbal Product Line)

Recent Developments

- In June 2025, Herbalife Nutrition launched a new line of turmeric-based immunity supplements with improved bioavailability and organic certification.

- In May 2025, Blackmores Ltd expanded its e-commerce operations in the Asia-Pacific region, integrating AI-driven personalized supplement recommendations.

- In March 2025, Gaia Herbs opened a state-of-the-art extraction and processing facility in North Carolina, enhancing production capacity and quality control.