Connected TV Market Size

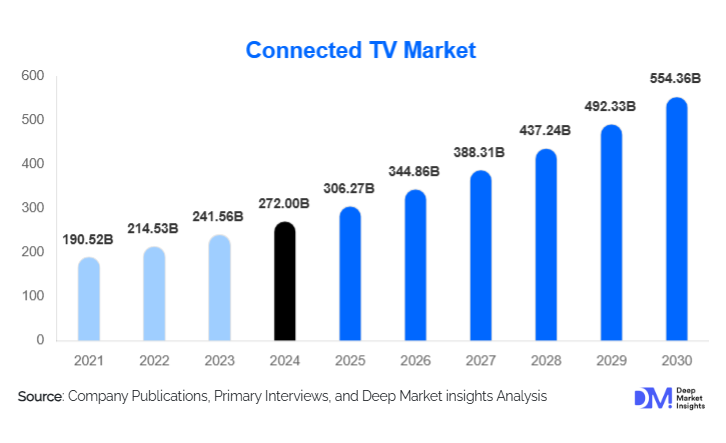

According to Deep Market Insights, the global connected TV market size was valued at USD 272 billion in 2024 and is projected to grow from USD 306.27 billion in 2025 to reach USD 554.36 billion by 2030, expanding at a CAGR of 12.6% during the forecast period (2025–2030). The Connected TV market growth is primarily driven by rising OTT streaming consumption, increasing broadband and 5G penetration, expanding adoption of Smart TVs in emerging markets, and a global shift in advertising spend from linear TV toward highly measurable CTV channels.

Key Market Insights

- Smart TVs dominate global CTV device adoption, accounting for over 70% of CTV hardware revenue in 2024 as integrated operating systems replace legacy TV formats.

- Asia-Pacific leads the global market with nearly 39% of 2024 revenues, driven by large populations, affordable Smart TVs, and rapid broadband expansion.

- Advertising-driven CTV monetization is accelerating as brands shift budgets to programmatic, interactive, and targeted CTV ads.

- Android/Google TV remains the leading CTV operating ecosystem, powering a large share of Smart TVs and devices worldwide.

- 4K and 8K adoption continues rising, supported by falling panel prices and increasing availability of high-resolution streaming content.

- Gaming and cloud gaming integration is emerging as a major new use case for Connected TVs, expanding the total addressable market value.

What are the latest trends in the Connected TV market?

Shift Toward Ad-Supported Streaming (FAST & AVOD)

A major transformation underway in the Connected TV landscape is the rapid rise of ad-supported streaming models such as FAST (Free Ad-Supported TV) and AVOD platforms. Consumers increasingly prefer free or low-cost streaming experiences, while advertisers value the precise targeting and attribution that CTV platforms offer. As streaming libraries expand and broadcasters launch FAST channels, CTV revenue from programmatic advertising continues to accelerate. This trend is particularly strong in North America and Europe, with emerging markets beginning to mirror similar consumption patterns.

Smart Home & IoT Integration Enhancing CTV Utility

Connected TVs are evolving into smart home hubs, integrating seamlessly with IoT devices such as voice assistants, home security systems, lighting, and thermostats. AI-driven recommendations, multi-device synchronization, and hands-free controls are enhancing user convenience, driving replacement demand for older TV models. As device ecosystems mature, CTVs are transitioning from passive entertainment screens into active command centers for digital households.

What are the key drivers in the Connected TV market?

Explosive Growth of OTT Streaming Platforms

The global shift toward on-demand entertainment is the single strongest driver for CTV market expansion. As platforms such as Netflix, Prime Video, Disney+, regional OTT services, and FAST networks expand content offerings, CTV devices become the preferred medium for large-screen streaming. Increasing original content investments, multilingual programs, and live streaming (sports, events) are reinforcing consumer reliance on CTV ecosystems.

Broadband Expansion & Affordable Smart TVs

Increasing penetration of high-speed broadband and rapid rollout of 5G networks are enabling seamless video streaming, which in turn fuels CTV demand. Meanwhile, Smart TV prices have fallen significantly over the past five years due to advancements in panel manufacturing and economies of scale. This combination of connectivity improvements and affordability is unlocking massive demand in emerging markets, including India, Southeast Asia, and Latin America.

Accelerating CTV Advertising Revenue

Advertisers are rapidly shifting budgets from traditional broadcast TV to Connected TV due to better targeting, measurement, and ROI tracking capabilities. With global digital ad spending rising and programmatic technologies becoming more sophisticated, CTV offers a high-value channel for brand campaigns. This monetization shift benefits both device manufacturers and platform ecosystems, reinforcing long-term market growth.

What are the restraints for the global market?

High Upfront Device Cost in Price-Sensitive Markets

Despite falling Smart TV prices, upfront device costs remain a barrier in low-income and rural regions. The disparity in affordability slows CTV penetration in markets where traditional TV or mobile streaming remains dominant. Additionally, high-end models (4K/8K, OLED) remain premium-priced, restricting uptake among budget-conscious households.

Platform Fragmentation & Compatibility Issues

The proliferation of multiple operating systems (Android TV, Roku OS, Tizen, WebOS, Fire TV OS) introduces fragmentation in app development, content distribution, and feature consistency. For advertisers and developers, differing standards complicate measurement and user experience optimization. Fragmentation also leads to inconsistent support cycles, affecting long-term device utility.

What are the key opportunities in the Connected TV industry?

Emerging Market Expansion

Asia-Pacific, Africa, and Latin America represent the largest untapped opportunities for CTV adoption. Growing middle-class households, rising smartphone-to-Smart TV upgrade cycles, and expanding broadband infrastructure create fertile ground for CTV penetration. Manufacturers offering ultra-affordable Smart TVs, localized OS interfaces, and region-specific OTT integrations stand to capture significant market share.

CTV as a Premium Advertising Channel

As CTV advertising gains sophistication through AI-based targeting, real-time measurement, and programmatic marketplaces, advertisers increasingly view CTV as a premium extension of digital video strategy. This demand supports growth in FAST channels, dynamic ad insertion, interactive ads, and retail media integrations, all major opportunities for platforms, content owners, and OEMs.

Smart Home & AI Integration

The convergence of CTVs with IoT ecosystems, voice assistants, and AI recommendation engines offers a huge emerging market. Brands that combine entertainment, automation, and personalized content into a unified TV interface are well-positioned to shape the next era of home digital ecosystems.

Product Type Insights

Smart TVs remain the dominant product category, capturing over 70% of CTV revenue thanks to their integrated operating systems, seamless app ecosystems, and falling price points. Streaming sticks and dongles serve as strong secondary segments, particularly in markets with high replacement cycles, enabling older TVs to become “smart.” Premium display technologies such as OLED, QLED, and 8K panels are experiencing rising demand among high-income households, while LED TVs continue to dominate volume sales due to affordability. Set-top boxes and IPTV devices maintain relevance in households transitioning from cable, but remain a declining segment overall.

Application Insights

Home entertainment is the leading application, driven by OTT streaming, sports viewing, and family-oriented content consumption. Advertising-focused applications, especially AVOD and FAST channels, are rapidly growing as brands leverage CTV for precision marketing. Cloud gaming is emerging as a major application, supported by low-latency networks and growing partnerships between game-streaming platforms and TV manufacturers. Commercial deployments, including hotels, corporate offices, and educational institutions, represent a rising application sector as organizations adopt CTVs for digital signage, guest entertainment, and hybrid event solutions.

Distribution Channel Insights

Online sales, through e-commerce platforms and brand D2C websites, dominate global CTV distribution, benefiting from transparent comparisons, competitive pricing, and strong promotional cycles. Offline electronics retailers remain essential for high-value purchases, allowing consumers to interact with display technologies before buying. OEM/B2B channels are growing steadily, especially within hospitality and institutional sectors. Subscription-based device bundles and telecom partnerships (broadband + Smart TV packages) are expanding as strategic channels for accelerating adoption in developing markets.

End-User Insights

Households represent the largest end-user segment, fueled by widespread streaming consumption. Younger demographics prioritize affordable Smart TVs and gaming-compatible screens, while high-income families increasingly choose large-format 4K and 8K displays. Hospitality and corporate sectors are adopting CTVs for enhanced customer engagement, digital signage, and in-room entertainment solutions. Educational institutions are also integrating CTVs as versatile learning and presentation tools, supporting segment expansion beyond consumer households.

| By Device Type | By Screen Size | By Operating System / Platform | By Distribution Channel | By Application |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America remains one of the most mature CTV markets, driven by strong OTT services adoption, high disposable incomes, and widespread fiber broadband coverage. The U.S. leads in CTV advertising expenditure, with brands heavily investing in programmatic CTV campaigns. Premium Smart TV penetration is high, and consumers frequently upgrade to larger 4K/8K models. The region held approximately 32% of global CTV revenue in 2024.

Europe

Europe exhibits strong Smart TV adoption with rising preference for energy-efficient technologies and ad-supported streaming. The U.K., Germany, and France dominate regional demand, driven by broadband expansion and new AVOD services. Regulatory emphasis on data privacy and sustainability is shaping platform strategies. Europe remains the fastest-growing mature market for CTV.

Asia-Pacific

Asia-Pacific leads global revenue with nearly 39% market share in 2024. China, India, Japan, and South Korea are major growth engines, fueled by affordable Smart TVs, expanding mobile-to-TV casting habits, and aggressive OTT platform expansion. Rapid urbanization and rising middle-class income continue to push CTV penetration deeper into tier-2 and tier-3 cities. APAC is also the fastest-growing region globally.

Latin America

CTV adoption is rising across Brazil, Mexico, and Argentina as consumers shift away from traditional pay TV. Low-cost Smart TV models and increasing availability of local-language OTT platforms are accelerating growth. Telecom operators are bundling Smart TVs with broadband services, further boosting penetration.

Middle East & Africa

MEA is an emerging but promising CTV region. The Middle East (UAE, Saudi Arabia, Qatar) shows strong demand for premium Smart TVs and global streaming content. Africa’s growth is driven by improving broadband infrastructure and rising smartphone-to-TV upgrade patterns. Government-led digitalization efforts are expanding long-term market potential.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Connected TV Market

- Roku

- Samsung Electronics

- LG Electronics

- Amazon

- Apple

- Sony Corporation

- TCL Technology

- Hisense

- Vizio

- Panasonic

- Philips (TP Vision)

- Google (Android TV / Google TV)

- Xiaomi

- Sharp Corporation

- Skyworth

Recent Developments

- In March 2025, Samsung announced a new AI-powered Smart TV lineup integrating advanced 8K upscaling and personalized content algorithms.

- In February 2025, Roku expanded its global ad-tech capabilities with new programmatic features designed to improve real-time targeting in CTV advertising.

- In January 2025, LG revealed its next-generation WebOS platform, introducing enhanced gaming features and deeper smart home integration.