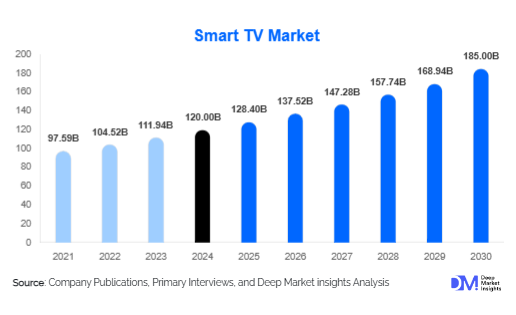

According to Deep Market Insights, the global Smart TV market size was valued at USD 120 billion in 2024 and is projected to grow from USD 128.4 billion in 2025 to reach USD 185 billion by 2030, expanding at a CAGR of 7.1% during the forecast period (2025-2030). The market growth is primarily driven by increasing adoption of connected entertainment systems, integration of AI and IoT in households, rising demand for high-resolution displays, and the expansion of streaming platforms and digital content consumption globally.

Smart TV Market Size

Key Market Insights

- LED Smart TVs remain the dominant type globally, due to affordability, energy efficiency, and mass-market availability, capturing 45% of the market in 2024.

- Large-screen TVs (50-69 inches) are increasingly preferred in residential households for immersive entertainment experiences, holding 38% market share.

- 4K UHD displays dominate the display technology segment, accounting for 50% of Smart TV shipments, driven by widespread availability of 4K content and decreasing panel costs.

- Wi-Fi-enabled connectivity is the leading standard, enabling seamless streaming and smart integration, representing 70% of all Smart TVs globally.

- Android TV operating system leads adoption with 40% market share, supported by app ecosystem, Google integration, and ease of content access.

- Residential applications represent the largest end-use segment, 65% of the market, while commercial and public display segments are emerging as high-growth areas.

What are the latest trends in the Smart TV market?

Integration of AI and IoT Ecosystems

Smart TV manufacturers are increasingly embedding AI and IoT features, including voice assistants, personalized content recommendations, and home automation integration. AI-powered platforms analyze viewer preferences to suggest shows and optimize picture and sound settings. This trend enhances user engagement and positions Smart TVs as central smart-home hubs, creating opportunities for software upgrades and subscription-based services.

Expansion in Emerging Markets

Markets such as India, Southeast Asia, and Latin America are witnessing rapid Smart TV adoption due to rising disposable incomes, increasing internet penetration, and supportive government initiatives. Affordable Smart TV models and financing options have made these products accessible to a wider consumer base. Urbanization and expanding middle-class households are key drivers, while local manufacturing and import incentives support regional growth.

Premium Display Adoption

Consumers are increasingly opting for OLED, QLED, and 8K panels for superior picture quality and immersive viewing experiences. The premium segment is growing faster than the overall market due to higher disposable incomes in North America, Europe, and select Asia-Pacific markets. Innovations such as HDR support, curved screens, and anti-reflection coatings are driving consumer interest in high-end models.

What are the key drivers in the Smart TV market?

Rising Demand for Smart Entertainment

The global shift toward streaming platforms and on-demand content consumption has significantly boosted Smart TV adoption. Consumers prefer integrated applications, wireless connectivity, and access to multiple content sources. This trend is particularly strong among households with high internet connectivity and tech-savvy users seeking interactive features.

Advancements in Display Technology

High-quality display innovations such as OLED, QLED, and 8K UHD panels are driving market growth. These technologies provide improved contrast, higher resolution, and enhanced color accuracy, which appeals to consumers willing to invest in premium products. Adoption of these displays in residential and commercial sectors fuels incremental revenue opportunities for manufacturers.

Growing Smart Home Ecosystems

Smart TVs are becoming central hubs in connected homes, integrating with IoT devices such as lights, thermostats, and speakers. The increasing trend of smart home adoption encourages consumers to upgrade existing TV setups to Smart TVs that support seamless ecosystem connectivity. This also enables additional service revenue streams, such as subscription-based apps and AI-driven recommendations.

What are the restraints for the global market?

High Cost of Premium Models

Despite rising demand, the higher price points of OLED, QLED, and 8K TVs limit adoption in price-sensitive markets. Affordability remains a barrier for large-scale penetration in emerging regions, where mid-range and budget models dominate.

Bandwidth and Connectivity Limitations

High-resolution content streaming requires stable and fast internet, which is still limited in several developing regions. Limited broadband infrastructure and variable network speeds constrain the utility of Smart TVs, slowing adoption in rural and semi-urban areas.

What are the key opportunities in the Smart TV market?

AI and IoT Integration

There is a significant opportunity for manufacturers to integrate AI-driven content recommendations, voice assistants, and smart home compatibility. Enhanced interactivity and connected home functionality allow brands to differentiate products, increase user engagement, and generate recurring revenue through subscriptions and app-based services.

Emerging Market Expansion

Rapid urbanization and increasing disposable income in regions such as India, Southeast Asia, and Latin America present untapped growth potential. Affordable Smart TVs, localized content apps, and financing schemes can help manufacturers expand their consumer base and capture share from conventional TV segments.

Commercial and Public Display Applications

Smart TVs are gaining traction in hotels, airports, corporate offices, and retail spaces as interactive displays, digital signage, and conferencing solutions. This B2B segment offers high-margin opportunities, driven by demand for advanced display technologies and customized content solutions.

Product Type Insights

LED Smart TVs dominate the global market, accounting for 45% of total 2024 sales due to affordability and widespread adoption. OLED and QLED TVs are gaining traction in premium segments, offering superior picture quality and immersive features. MicroLED remains niche but is expected to grow as manufacturing costs decline.

Application Insights

Residential applications remain the largest, representing 65% of the market, driven by high adoption in urban households and growing content consumption. Commercial applications, including hospitality, offices, and retail, are expanding rapidly. Public display applications such as airports, stadiums, and malls are emerging as high-growth segments.

Distribution Channel Insights

Online sales channels, including e-commerce platforms and direct manufacturer websites, dominate Smart TV distribution. Retail chains and electronics stores remain important for mid-range and premium segments. Emerging channels include subscription-based offerings and smart home bundle deals, particularly in North America and Asia-Pacific.

End-User Insights

Residential households are the primary end-users, followed by commercial clients such as hotels, offices, and retail chains. Emerging applications in public displays and corporate environments offer new avenues for growth. Export-driven demand is significant, particularly from Asia-Pacific manufacturers supplying North America and Europe.

| By Product Type | By Screen Size | By Display Technology | By Connectivity | By Application / End-Use | By Distribution Channel |

|---|---|---|---|---|---|

|

|

|

|

|

|

Regional Insights

North America

North America holds 25% of the global Smart TV market in 2024, driven by high disposable income, early technology adoption, and strong streaming content penetration. The U.S. is the largest consumer market, while Canada shows steady growth in mid-range and premium segments.

Europe

Europe accounts for 20% of the market, with Germany, the UK, and France leading adoption. Demand is fueled by premium segment preferences, eco-friendly products, and high broadband penetration. The region is a key growth hub for high-resolution and large-screen Smart TVs.

Asia-Pacific

Asia-Pacific is the largest region, 35% share, driven by China, India, and South Korea. Rising middle-class populations, urbanization, and strong manufacturing bases support both domestic demand and exports. The region is the fastest-growing, with emerging markets adopting affordable Smart TVs rapidly.

Latin America

Latin America represents 10% of the market, with Brazil and Mexico leading adoption. Demand is rising among middle-class households and affluent consumers, with a growing preference for mid-range models and digital content streaming.

Middle East & Africa

Middle East & Africa account for 10% of global demand. UAE, Saudi Arabia, and South Africa lead the market with premium and luxury Smart TV adoption. Urbanization and government-led digital initiatives are key growth drivers.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Note: The above countries are part of our standard off-the-shelf report, we can add countries of your interest

Regional Growth Insights Download Free Sample

Key Players in the Smart TV Market

- Samsung Electronics

- LG Electronics

- Sony Corporation

- TCL Corporation

- Hisense Co., Ltd.

- Panasonic Corporation

- Xiaomi Corporation

- Vizio Inc.

- Philips

- Sharp Corporation

- Toshiba Corporation

- Skyworth Digital Holdings

- Haier Group

- Changhong Electric

- Konka Group

Recent Developments

- In January 2025, Samsung Electronics launched its next-generation 8K QLED Smart TV with AI-powered content recommendations and enhanced home automation integration.

- In March 2025, LG Electronics expanded its OLED Smart TV lineup with more affordable models targeting emerging markets in India and Southeast Asia.

- In April 2025, Sony Corporation unveiled a new series of Smart TVs with integrated gaming features and premium display technologies for North American and European markets.

Frequently Asked Questions

How big is the global Smart TV market?

According to Deep Market Insights, the global Smart TV market size was valued at USD 120 billion in 2024 and is projected to grow from USD 128.4 billion in 2025 to reach USD 185 billion by 2030, expanding at a CAGR of 7.1% during the forecast period (2025-2030).

What are the key opportunities in the market?

Key opportunities include AI and IoT integration for smart home ecosystems, expansion in emerging markets, and growth in commercial and public display applications.

Who are the leading players in the market?

Samsung Electronics, LG Electronics, Sony Corporation, TCL Corporation, Hisense Co., Ltd., Panasonic Corporation, Xiaomi Corporation, Vizio Inc., Philips, and Sharp Corporation are the leading global players.

What are the factors driving the growth of the market?

Rising demand for connected entertainment systems, adoption of high-resolution and premium display technologies, and the growth of smart home ecosystems are key growth drivers.

Which are the various segmentation that the market report covers?

The market is segmented as follows: By Product Type, By Screen Size, By Display Technology, By Connectivity, By Operating System, By Application / End-Use, By Distribution Channel.