Vitamin D Gummies Market Size

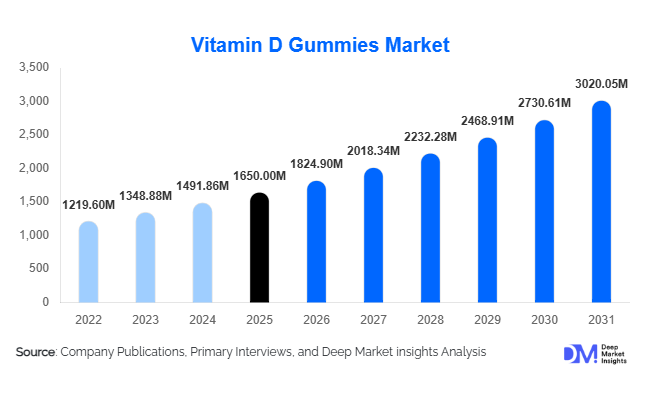

According to Deep Market Insights,the global vitamin D gummies market size was valued at USD 1,650 million in 2025 and is projected to grow from USD 1,824.90 million in 2026 to reach USD 3,020.05 million by 2031, expanding at a CAGR of 10.6% during the forecast period (2026–2031). The vitamin D gummies market growth is primarily driven by rising global vitamin D deficiency rates, increasing consumer preference for convenient and palatable supplement formats, and growing awareness around bone health and immune system support. The transition from traditional tablets and capsules to chewable, flavored gummy supplements has significantly enhanced compliance rates among children, adults, and geriatric populations. Rapid expansion of e-commerce platforms and direct-to-consumer nutraceutical brands is further accelerating global penetration.

Key Market Insights

- Vitamin D3 gummies dominate the market, accounting for over 80% of total demand due to higher bioavailability compared to Vitamin D2 formulations.

- Adults aged 19–50 years represent the largest consumer segment, contributing nearly 38% of total global demand in 2025.

- North America leads the global market, holding approximately 36% share in 2025, driven by strong supplement awareness and retail penetration.

- Asia-Pacific is the fastest-growing region, expanding at over 12% CAGR due to rising urban deficiency rates and e-commerce adoption.

- Sugar-free and clean-label formulations are gaining rapid traction, supported by growing health-conscious consumer behavior.

- Online retail channels account for nearly 28% of total sales, reflecting digital health purchasing trends.

What are the latest trends in the vitamin D gummies market?

Shift Toward Sugar-Free and Clean-Label Formulations

Consumer concerns around sugar consumption and metabolic health are driving innovation in sugar-free and low-calorie vitamin D gummies. Manufacturers are increasingly using natural sweeteners and plant-based pectin instead of gelatin, catering to vegan and vegetarian populations. Organic certification, non-GMO labeling, and allergen-free claims are strengthening premium positioning. Clean-label demand is particularly strong in North America and Europe, where transparency and ingredient sourcing influence purchase decisions. This trend is pushing brands to reformulate legacy products while maintaining taste and texture stability.

Growth of Personalized and Subscription-Based Supplements

The integration of digital health platforms with supplement manufacturing is reshaping the market landscape. Consumers are increasingly opting for personalized vitamin D gummy regimens based on blood test results, lifestyle factors, and age-specific requirements. Subscription-based direct-to-consumer models are enhancing customer retention and recurring revenue streams. AI-driven dosage recommendations and bundled wellness packs combining vitamin D with calcium, zinc, or magnesium are emerging as major differentiators in competitive markets.

What are the key drivers in the vitamin D gummies market?

Rising Global Vitamin D Deficiency

Urbanization, limited sun exposure, indoor lifestyles, and pollution have contributed to widespread vitamin D insufficiency across developed and developing nations. Health organizations increasingly recommend supplementation, especially for elderly and indoor-working populations. This has significantly expanded the addressable consumer base for vitamin D gummies.

Preventive Healthcare and Immunity Awareness

Consumers are proactively investing in preventive healthcare solutions, particularly after heightened awareness of immune resilience. Vitamin D’s association with immune modulation and bone density maintenance continues to strengthen consumer trust. Rising healthcare costs globally are also encouraging self-care supplementation.

What are the restraints for the global market?

Sugar Content and Dental Health Concerns

Traditional gummy supplements contain added sugars, which may discourage diabetic or calorie-conscious consumers. Regulatory scrutiny regarding sugar levels in nutraceutical confectionery may impact certain product lines unless reformulated.

Regulatory Variability Across Regions

Differences in dosage caps, labeling standards, and health claims across North America, Europe, and Asia create compliance challenges for multinational brands. Strict regulatory frameworks can slow product launches and innovation cycles.

What are the key opportunities in the vitamin D gummies industry?

Expansion into Emerging Economies

Asia-Pacific and Latin America present strong untapped potential due to rising middle-class income and increasing awareness of micronutrient deficiencies. Countries such as China, India, Brazil, and Indonesia are experiencing growing retail penetration of nutraceuticals. Government-backed health campaigns focusing on deficiency reduction are expected to create sustained demand growth.

Fortified and Combination Gummies

Combining vitamin D with complementary nutrients such as calcium, omega-3, magnesium, and zinc offers differentiation and value-added positioning. Multi-functional gummies targeting bone health, prenatal nutrition, and sports recovery are expanding product portfolios and increasing average selling prices.

Dosage Strength Insights

Gummies containing 1,001–2,000 IU lead the market with approximately 41% share in 2025, primarily driven by physician-recommended daily supplementation levels for adults and geriatric populations managing mild to moderate vitamin D deficiency. This dosage range aligns with preventive healthcare guidelines and is widely prescribed for maintaining optimal serum vitamin D levels, particularly in regions with limited sun exposure and indoor lifestyle patterns. The strong clinical acceptance of this dosage band has reinforced its dominance across pharmacy and online channels. Higher dosage variants above 2,000 IU are gaining traction in therapeutic and deficiency management applications, especially among aging consumers and individuals diagnosed with osteoporosis or chronic insufficiency. Meanwhile, lower-dose gummies continue to maintain stable demand in pediatric nutrition, where safety, palatability, and precise dosing remain key purchasing considerations.

Consumer Age Group Insights

Adults aged 19–50 years account for nearly 38% of total market demand in 2025, supported by growing preventive wellness adoption, higher disposable income, and increased awareness of immune and bone health maintenance. This demographic actively integrates dietary supplements into daily routines, particularly in urban populations with sedentary work patterns and limited sunlight exposure. The geriatric segment represents the fastest-growing consumer base due to rising osteoporosis prevalence, bone mineral density concerns, and physician-led supplementation programs. Increased life expectancy and proactive aging strategies are further strengthening demand within this group. Pediatric consumption remains steady, driven by parental focus on early nutritional support and the preference for flavored, chewable gummy formats that enhance compliance among children.

Vitamin Type Insights

Vitamin D3 dominates the market with approximately 82% share in 2025, owing to its superior bioavailability, enhanced efficacy in raising serum 25(OH)D levels, and strong clinical validation compared to vitamin D2 formulations. Healthcare professionals increasingly recommend D3-based supplementation, reinforcing consumer confidence and regulatory alignment. Manufacturers continue to prioritize D3 formulations in product innovation pipelines, integrating clean-label ingredients and fortified combinations to strengthen competitive positioning. Although D2 retains niche relevance in specific dietary or prescription-based contexts, its overall adoption remains comparatively limited.

Formulation Insights

Sugar-based gummies hold 63% of global revenue share in 2025, largely driven by superior taste appeal, established manufacturing processes, and strong consumer acceptance across adult and pediatric categories. Their sensory profile enhances adherence to daily supplementation, particularly among first-time supplement users. However, sugar-free variants are expanding at a faster pace due to increasing metabolic health concerns, diabetes prevalence, and weight management awareness. The shift toward reduced-calorie and low-glycemic alternatives is accelerating product reformulation strategies. Additionally, pectin-based vegan gummies are emerging as a premium sub-segment, benefiting from plant-based dietary trends, clean-label positioning, and gelatin-free formulations that cater to vegetarian and religious dietary requirements.

Distribution Channel Insights

Pharmacies and drug stores account for 34% of global sales in 2025, maintaining strong consumer trust, professional recommendation alignment, and credibility in therapeutic supplementation. Pharmacist guidance and prescription-linked purchasing behavior significantly contribute to this channel’s leadership. Online retail follows closely with a 28% share, reflecting rapid digital adoption, subscription-based supplement purchasing models, and wider product assortment availability. E-commerce platforms are particularly influential among younger demographics and urban consumers seeking convenience and competitive pricing. Supermarkets and specialty health stores continue to generate stable volumes, supported by impulse purchases, in-store promotions, and expanding functional nutrition sections.

Application Insights

Bone and joint health applications account for 46% of total demand in 2025, driven primarily by the increasing global burden of osteoporosis, calcium absorption synergy benefits, and aging population demographics. Vitamin D gummies are widely incorporated into bone density management protocols and preventive healthcare regimens, reinforcing this segment’s dominance. Immunity support represents the fastest-growing application area, reflecting evolving consumer priorities toward immune resilience and overall wellness. Heightened awareness following global health disruptions has further amplified demand for multifunctional supplements that support both skeletal and immune health outcomes.

| By Consumer Age Group | By Vitamin Type | By Formulation | By Nature | By Distribution Channel | By Application |

|---|---|---|---|---|---|

|

|

|

|

|

|

Regional Insights

North America

North America leads the global market with approximately 36% share in 2025, with the United States contributing nearly 29% alone. Growth in this region is driven by high dietary supplement penetration rates, strong consumer awareness regarding vitamin D deficiency, and advanced healthcare infrastructure supporting preventive supplementation. Increasing geriatric population size, rising indoor lifestyles, and strong e-commerce ecosystems further sustain demand momentum. In Canada, steady expansion is supported by public health recommendations addressing widespread seasonal vitamin D insufficiency and growing clean-label supplement preferences.

Europe

Europe holds around 27% market share in 2025, led by Germany, the United Kingdom, France, and Italy. Regional growth is supported by heightened awareness of limited sunlight exposure in northern countries, strong regulatory quality standards, and growing demand for premium, clean-label, and plant-based formulations. Government-backed nutritional guidelines and preventive health campaigns further stimulate supplementation uptake. Additionally, increasing aging demographics and pharmacy-led distribution networks contribute to consistent market expansion across both Western and Northern Europe.

Asia-Pacific

Asia-Pacific represents the fastest-growing regional market, projected to expand at over 12% CAGR during the forecast period. Rapid urbanization, high prevalence of vitamin D deficiency due to indoor lifestyles, and rising middle-class income levels are major growth drivers. China and India are experiencing strong demand growth supported by expanding e-commerce penetration, increasing healthcare awareness, and growing preventive nutrition trends. Japan and Australia remain comparatively mature markets, characterized by high product quality standards and stable supplementation adoption rates, particularly among aging populations.

Latin America

Latin America accounts for approximately 6–7% of global market share, with Brazil and Mexico leading regional demand. Growth is supported by increasing health awareness initiatives, pharmacy retail expansion, and improving access to dietary supplements in urban centers. Rising disposable income levels and greater exposure to global wellness trends are gradually accelerating adoption rates. While price sensitivity remains a moderating factor, affordable gummy formulations are helping expand penetration across middle-income consumer segments.

Middle East & Africa

The Middle East & Africa region represents nearly 5% of the global market, with GCC countries demonstrating particularly strong uptake. High prevalence of vitamin D deficiency, despite abundant sunlight exposure, is driven by lifestyle patterns, indoor occupations, and cultural clothing practices that limit sun exposure. Government-led health awareness programs and expanding pharmacy networks are supporting regional growth. In parts of Africa, gradual improvements in healthcare access and urban retail infrastructure are contributing to steady, albeit moderate, market development.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Vitamin D Gummies Market

- Church & Dwight Co., Inc.

- Haleon plc

- Nestlé S.A.

- Bayer AG

- Amway Corp.

- Nature’s Way Products, LLC

- SmartyPants Vitamins

- Pharmavite LLC

- Jamieson Wellness Inc.

- NOW Health Group, Inc.

- OLLY Public Benefit Corporation

- Garden of Life LLC

- GNC Holdings, LLC

- Herbaland Naturals Inc.

- Blackmores Limited