Virtual Reality Headset Market Size

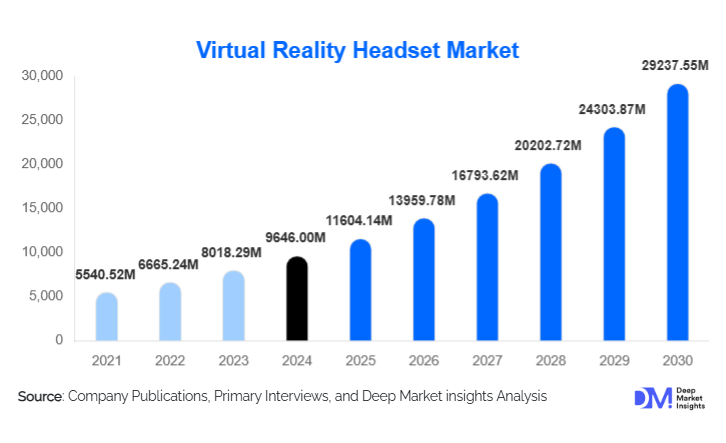

According to Deep Market Insights, the global virtual reality headset market size was valued at USD 9646.00 million in 2024 and is projected to grow from USD 11604.14 million in 2025 to reach USD 29237.55 million by 2030, expanding at a CAGR of 20.30% during the forecast period (2025–2030). The VR headset market growth is primarily driven by rapid advancements in display technologies, expanding enterprise use cases, rising consumer adoption for immersive gaming, and increasing integration of VR into healthcare, training, and education ecosystems.

Key Market Insights

- Standalone VR headsets dominate global adoption, supported by ease of use, lower cost of ownership, and high processing capabilities.

- Enterprise and industrial VR solutions are accelerating due to strong ROI in employee training, simulation, and design visualization.

- North America leads the market with the highest consumer spending and advanced enterprise deployment of VR technologies.

- Asia-Pacific is the fastest-growing region, driven by manufacturing expansion, government tech initiatives, and rising consumer demand in China, Japan, and India.

- Healthcare-focused VR applications are expanding rapidly, particularly in surgical simulation, therapy, and rehabilitation.

- Mixed reality (MR) and AI-enhanced VR solutions are redefining next-generation headsets with improved optics, real-time spatial mapping, and cloud rendering.

What are the latest trends in the virtual reality headset market?

Enterprise VR Adoption for Training & Simulation Surges

Businesses across manufacturing, energy, automotive, and aerospace are rapidly expanding the use of VR for technical training, safety instruction, and operational simulations. VR-based programs enable employees to practice hazardous or complex tasks in a controlled environment, significantly reducing training time and improving skill retention. As companies measure tangible productivity gains and reduced on-site accidents, VR adoption is becoming a standard component of digital transformation. Enterprise-grade headsets with precise tracking and high-resolution displays are witnessing strong demand, pushing hardware vendors to design rugged, ergonomically optimized devices suited for extended professional use.

AI, Cloud Rendering & Mixed Reality Transforming User Experience

Next-generation VR headsets are increasingly integrating artificial intelligence, real-time cloud rendering, and mixed-reality passthrough capabilities. AI-driven eye-tracking enables dynamic foveated rendering, enhancing performance while reducing GPU load. Cloud VR solutions allow high-fidelity experiences without expensive local hardware, expanding adoption in price-sensitive regions. Mixed-reality features, combining real and virtual environments, are becoming mainstream, enabling new applications in design, collaboration, education, retail, and healthcare. These innovations are attracting both consumers and enterprises seeking immersive yet versatile experiences.

What are the key drivers in the virtual reality headset market?

Advancements in Optics & Display Technologies

Major technological improvements, such as micro-OLED displays, pancake lenses, and 4K+ resolution per eye, are transforming visual immersion and reducing motion sickness. These enhancements have led to lighter, more compact devices with superior clarity, fueling wider acceptance across both consumer and enterprise markets. Better visuals directly influence content development, accelerating ecosystem growth.

Growing Demand for Immersive Gaming & Entertainment

Gaming remains the largest demand generator, accounting for more than half of VR headset usage. Popular VR titles, improved motion tracking, and robust gaming hardware ecosystems have pushed VR gaming into mainstream adoption. Subscriptions and VR-native content libraries are further expanding engagement, especially among younger demographics. The growth of VR esports and live virtual events also supports market expansion.

Digital Transformation Across Industries

From remote collaboration and architectural visualization to healthcare simulation and defense training, VR is now a core component of enterprise modernization strategies. Organizations are integrating VR into learning & development, product prototyping, simulation modeling, and customer engagement. This broadening use-case spectrum is fueling stable, long-term demand for high-end headsets globally.

What are the restraints for the global market?

High Cost of Premium VR Systems

Despite progress in affordability, advanced VR headsets remain expensive for average consumers and small businesses. High-end enterprise systems can cost USD 1,500–3,000 or more, particularly when bundled with controllers, sensors, or compatible computing hardware. This limits penetration in emerging markets and among cost-sensitive organizations. Subscription-based XR-as-a-service models are beginning to address this challenge but are still in early adoption stages.

Limited Non-Gaming Content & Slow Content Development Cycles

While gaming offers abundant content, non-entertainment sectors still experience fragmented or insufficient VR libraries. Education, healthcare, and industrial training require tailored content, which is resource-intensive to build and validate. The absence of standardized VR content frameworks further prolongs development timelines, restraining faster adoption outside entertainment and professional simulation environments.

What are the key opportunities in the virtual reality headset industry?

Enterprise Upskilling & Workforce Training

Industries facing labor shortages and rising safety requirements are actively adopting VR-based learning solutions. Manufacturing, logistics, energy, and construction sectors are increasingly turning to immersive simulations for employee upskilling, technical training, and remote collaboration. As return-on-investment becomes clearer, demand for enterprise-grade VR devices is expected to surge, creating multi-billion-dollar opportunities for hardware, software, and content providers.

Healthcare & Medical Simulation Expansion

Hospitals and medical institutions are integrating VR into surgical planning, anatomy education, mental health therapy, and patient rehabilitation. The ability to simulate complex procedures without risk makes VR a transformative tool for medical training. Mental health applications, such as phobia treatment, PTSD therapy, and anxiety management, are emerging as high-potential growth avenues. As regulatory standards improve and medical-grade headsets evolve, healthcare VR adoption is set to accelerate sharply.

AI-Powered Mixed Reality & Cloud-Based VR Experiences

Next-generation VR headsets leveraging AI-enhanced rendering, spatial computing, and mixed-reality interfaces represent major growth potential. Cloud VR enables high-definition immersive experiences using low-cost devices, widening global accessibility. Governments across APAC, the Middle East, and Europe are funding metaverse and immersive technology ecosystems, creating strong opportunities for headset manufacturers and VR solution providers.

Product Type Insights

Standalone VR headsets dominate the global market, accounting for nearly 46% of total 2024 sales. Their independence from PCs or consoles, combined with ease of setup and affordability, has made them the preferred choice for consumers and enterprises. Tethered headsets continue to serve high-end gaming and design users, benefiting from superior graphics driven by external computing systems. Smartphone-based VR has sharply declined due to lower immersion and limited compatibility, and now represents only a small portion of global demand.

Application Insights

Gaming & entertainment remain the largest application segment, representing approximately 53% of the 2024 market demand. Expanding VR gaming libraries, improved motion tracking, and the growth of VR fitness apps continue to strengthen this segment. Enterprise and industrial training applications are growing rapidly as companies adopt VR for simulation-based learning. Healthcare applications, including surgical rehearsal, therapy, and rehabilitation, are among the fastest-growing categories. Education and research segments are also gaining traction as institutions increasingly adopt immersive learning methods.

Distribution Channel Insights

Online retail leads VR headset distribution, capturing nearly 57% of global sales in 2024. Consumers prefer online channels for competitive pricing, detailed product reviews, and broader model availability. Offline electronics stores continue to serve premium buyers who prefer physical trials before purchase. Direct-to-consumer sales via brand websites are rising as manufacturers invest in interactive AR/VR product demos, dynamic pricing, and loyalty programs.

End-User Insights

Consumer usage accounts for the largest share (62%) of VR headset demand, driven by gaming, fitness, and entertainment applications. Enterprise usage, spanning industrial training, collaboration, and visualization, is the fastest-growing end-user category, expected to reach over 40% share by 2030. Healthcare institutions, defense organizations, and universities are among the most rapidly expanding adopters, supported by measurable improvements in cost efficiency and training outcomes. New end-user segments such as tourism, architecture, and automotive design are emerging as VR tools become central to customer engagement and product visualization.

Age Group Insights

The 18–35 age group forms the core consumer base for VR headsets, driven by strong interest in gaming, social VR platforms, and fitness apps. Users aged 36–55 represent a growing demographic, particularly in enterprise and professional training use cases. Older demographics are increasingly adopting VR for healthcare applications, cognitive therapy, and low-impact virtual fitness experiences. As headset comfort and usability improve, adoption among all age groups is expected to rise steadily.

| By Product Type | By Display Type | By Application | By Distribution Channel | By End-Use Industry |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds the largest share of global VR headset demand, approximately 38% in 2024. The U.S. leads adoption with a strong gaming culture, high digital infrastructure, and widespread enterprise integration of VR. Corporate training, defense simulation, and medical education represent major growth drivers. Canada demonstrates increasing adoption across the education and healthcare sectors, supported by government innovation grants.

Europe

Europe accounts for nearly 24% of global market share, with Germany, France, and the U.K. serving as key markets. Strong adoption in automotive design, engineering simulation, and enterprise training supports long-term growth. Europe’s emphasis on digital transformation, sustainability, and advanced research infrastructure strengthens its VR ecosystem. Educational institutions across Scandinavia and Western Europe are also expanding immersive classroom adoption.

Asia-Pacific

Asia-Pacific is the fastest-growing region, with an expected CAGR of 24–27% through 2030. China leads manufacturing and consumer adoption, supported by strong government tech investments. Japan and South Korea are major adopters of mixed-reality and enterprise applications, while India is rapidly expanding VR usage in education and corporate training. APAC’s strong electronics manufacturing base provides a significant competitive advantage for hardware scalability.

Latin America

Latin America shows rising demand, particularly in Brazil and Mexico, where gaming and educational VR adoption are growing. Economic constraints limit high-end VR purchases, but demand for affordable standalone headsets is increasing steadily across universities and corporate L&D segments.

Middle East & Africa

MEA is emerging as a promising market, driven by the UAE and Saudi Arabia’s investments in smart cities, digital innovation, and immersive entertainment venues. Africa is seeing growing adoption in medical training and virtual education, particularly in South Africa, Kenya, and Nigeria. Regional tourism and hospitality sectors are beginning to use VR for virtual tours and marketing experiences.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Virtual Reality Headset Market

- Meta Platforms

- Sony Group

- HTC Corporation

- Pico (ByteDance)

- Valve Corporation

- Samsung Electronics

- HP Inc.

- Lenovo Group

- DPVR

- Varjo Technologies

- Xiaomi Corporation

- Acer Inc.

- Panasonic Corporation

- Microsoft

- Qualcomm Technologies

Recent Developments

- In January 2025, Meta announced upgrades to its mixed-reality ecosystem, including AI-enhanced rendering and new enterprise capabilities for training simulations.

- In March 2025, Sony introduced an advanced VR headset optimized for PS6 platforms, offering micro-OLED displays and enhanced passthrough for mixed-reality gaming.

- In April 2025, HTC launched a new enterprise-grade VR headset designed for industrial training and digital twin simulations, featuring improved optical tracking and ruggedized components.