Pancake Lenses Market Size

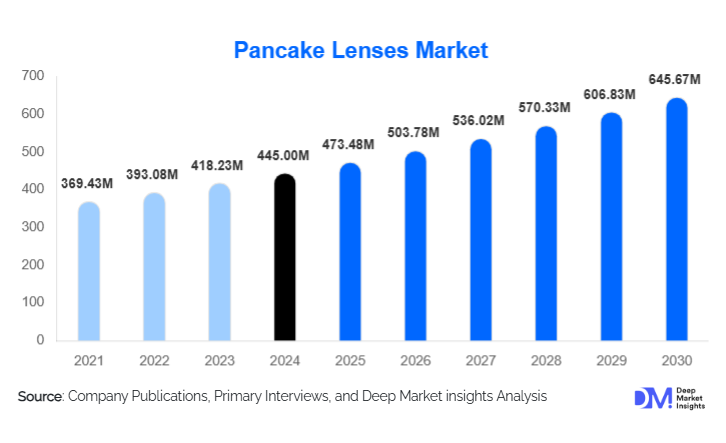

According to Deep Market Insights, the global pancake lenses market size was valued at USD 445 million in 2024 and is projected to grow to USD 473.48 million in 2025 and reach USD 645.67million by 2030, expanding at a CAGR of 6.4% during the forecast period (2025–2030). The market growth is driven by the booming mirrorless camera ecosystem, rising adoption of compact photography equipment, and increasing demand for lightweight lenses among content creators, travel photographers, and professional videographers.

Key Market Insights

- Pancake lenses are increasingly preferred for their ultra-compact design, enabling lightweight camera setups ideal for travel, street, and everyday photography.

- Mirrorless cameras dominate pancake lens compatibility, with short flange distances enabling slimmer lens designs and enhanced optical performance.

- Asia-Pacific is the fastest-growing regional market due to rising disposable income, expanding creator economies, and rapid adoption of mirrorless cameras in China, India, and Japan.

- Third-party lens manufacturers are gaining traction by offering high-quality, affordable pancake lenses that compete with OEM offerings.

- Technological advancements in optical coatings and autofocus motors are improving image quality and driving interest among professional photographers.

- E-commerce channels now account for over half of total pancake lens sales, supported by competitive pricing, user reviews, and global distribution capabilities.

Latest Market Trends

Rise of Compact & Travel-Friendly Photography Kits

Pancake lenses are benefiting from a rising global shift toward minimalistic camera setups optimised for portability. Travel photographers, vloggers, and social media influencers increasingly prefer camera kits that are lightweight yet capable of producing high-quality images. Pancake lenses, with their slim profiles and practical focal lengths, allow creators to carry full-frame or APS-C cameras discreetly. This trend is further reinforced by growing demand for street photography and on-the-go video content, where compactness and ease of handling significantly influence buyers’ decisions. Brands are responding by introducing new pancake primes with improved optical coatings, silent autofocus motors, and weather sealing, expanding appeal to both amateur and pro-level users.

Technological Advancements Enabling Higher Optical Performance

Technological innovation is reshaping the pancake lenses market. Manufacturers are integrating advanced aspherical elements, high-precision glass molding, and multi-layer nano-coating technologies to enhance sharpness, reduce distortion, and improve low-light performance despite compact form factors. Autofocus systems are also evolving, with linear motors and stepping motors delivering quieter and faster focusing, ideal for hybrid photo-video shooters. AI-enhanced lens correction through camera firmware and in-lens microprocessor upgrades further boosts image quality. These advancements are making pancake lenses increasingly competitive with larger prime lenses, expanding adoption across professional and enthusiast segments.

Pancake Lenses Market Drivers

Growing Adoption of Mirrorless Cameras

The mirrorless camera segment continues to expand rapidly, driven by its compact design, enhanced user experience, and superior video capabilities. Pancake lenses pair exceptionally well with mirrorless bodies due to their short flange distance and lightweight construction. As major manufacturers such as Sony, Canon, Fujifilm, and Nikon expand their mirrorless lineups, lens makers are increasing production of pancake lenses tailored for full-frame and APS-C formats. This synergy between mirrorless bodies and slim-profile lenses is a primary growth catalyst for the market.

Increase in Content Creation & Social Media Photography

Content creators, ranging from travel vloggers and lifestyle influencers to mobile filmmakers, are driving strong demand for portable, high-quality optics. Pancake lenses enable handheld shooting, compact rigs, and everyday carry setups ideal for spontaneous content capture. Their affordability compared to premium prime lenses also makes them attractive for entry-level creators. As global social media usage rises and platforms like TikTok, Instagram Reels, and YouTube Shorts continue gaining traction, demand for compact prime lenses suitable for both photo and video is expected to surge.

Shift Toward Lightweight Professional Gear

Professional photographers and videographers are increasingly prioritizing lightweight equipment for long shooting sessions, travel assignments, and documentary-style work. Pancake lenses offer a balance of optical quality and reduced weight, making them an appealing addition to professional gear kits. Improvements in autofocus reliability and optical sharpness have made modern pancake lenses viable for commercial photography, weddings, events, and film production. This transition to lighter gear ecosystems is accelerating pancake lens adoption in high-end market tiers.

Market Restraints

Optical Limitations Compared to Larger Prime Lenses

Despite technological advances, pancake lenses still face physical constraints due to their extremely compact design. Challenges such as lower maximum apertures, potential vignetting, and limited low-light performance persist, discouraging some professionals who require superior optical precision. These optical trade-offs remain a key barrier to widespread adoption in premium photography and cinematography segments.

High Manufacturing Costs and Price Sensitivity

Producing compact lenses with high-precision glass and advanced coatings requires sophisticated manufacturing processes. As a result, high-quality pancake lenses can be relatively costly for consumers. This price sensitivity is particularly evident in developing markets where affordable alternatives, such as standard kit lenses, remain more popular. Additionally, competition from third-party lens makers exerts pressure on OEMs to reduce margins, creating profitability challenges.

Pancake Lenses Market Opportunities

Expansion Into Embedded Imaging & Industrial Applications

Beyond traditional photography, pancake lenses are gaining relevance in industrial imaging, drone optics, robotics vision systems, and compact surveillance devices. Their slim design makes them suitable for embedded systems where space constraints are critical. As industries increasingly adopt automation, smart monitoring, and compact machine-vision modules, demand for pancake-format lenses is expected to grow substantially. This emerging cross-industry application segment presents one of the most promising long-term opportunities for lens manufacturers.

Affordable Pancake Lenses for Growing Creator Economies

Countries across Asia-Pacific, Latin America, and Africa are witnessing rapid expansion in creator communities. Affordable pancake lenses provide accessible entry points for budding photographers and videographers. Third-party manufacturers, such as Viltrox, Samyang, TTArtisan, and Sigma, are well-positioned to address this expanding demand through competitively priced lenses offering strong optical value. OEM partnerships and localized manufacturing also present opportunities to reduce cost barriers and accelerate adoption.

Product Type Insights

Interchangeable pancake lenses dominate the market, accounting for nearly 70% of global sales in 2024. Their ability to be used across different camera bodies, combined with wide availability in multiple mounts (E-mount, RF-mount, Z-mount, X-mount, MFT), makes them highly versatile. Fixed pancake lenses embedded in compact cameras appeal to travel and street photographers but represent a smaller market share. Demand for wide-angle and standard-focal-length pancake primes continues to grow as brands release next-generation APS-C and full-frame variants optimized for mirrorless platforms.

Application Insights

Consumer photography is the largest application segment, supported by growing global interest in travel, lifestyle, and street photography. Professional photographers increasingly integrate pancake lenses into their secondary kits for documentary and event work. Video content creation is another fast-growing application, driven by vloggers and hybrid creators who favor lightweight camera rigs. Industrial and surveillance applications—though smaller—are expanding due to rising demand for compact imaging modules in security, automation, and drone technologies.

Distribution Channel Insights

E-commerce dominates pancake lens distribution, with over 55–60% of purchases now made online. Digital platforms enable price comparison, access to international brands, and fast delivery, making them popular among younger consumers. Offline camera stores remain relevant for professional users seeking hands-on evaluation and expert recommendations. Direct-to-consumer websites from OEMs and third-party lens manufacturers are also gaining traction through subscription discounts and bundled kits.

User Type Insights

Enthusiast photographers represent the largest user group, driven by their interest in compact setups and affordable prime lenses. Professional photographers value pancake lenses as lightweight additions to multi-lens kits, especially for travel, weddings, documentary, and low-profile street assignments. Content creators comprise the fastest-growing user group, leveraging pancake lenses for dynamic on-the-go shooting. Tech hobbyists and industrial users represent emerging niches with growing purchasing activity.

Buyer Age Group Insights

Buyers aged 25–40 account for the majority of pancake lens purchases, reflecting strong engagement with digital content creation and travel photography. The 18–25 segment is growing rapidly due to the affordability of entry-level mirrorless cameras and third-party pancake lenses. Customers aged 40–60, including professionals and serious hobbyists, contribute significantly to premium pancake lens sales. Older buyers (60+) represent a niche but stable segment that values lightweight gear for convenience and comfort.

| By Product Type | By Focal Length Type | By Camera Mount Type | By Application | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America commands the largest regional share, accounting for 30–35% of global sales in 2024. High adoption of mirrorless cameras, strong purchasing power, and widespread creator culture drive demand. The U.S. leads consumption, with Canada showing steady growth among travel and landscape photographers. Online retail penetration is especially high in this region, further supporting pancake lens sales.

Europe

Europe represents 20–25% of the global market, supported by a large community of photographers and a strong preference for minimalistic, portable camera gear. Germany, the U.K., France, and Italy are key markets, driven by professional photography segments, travel culture, and rapid adoption of mirrorless bodies. European consumers show strong interest in premium optics and environmentally conscious manufacturing practices.

Asia-Pacific

Asia-Pacific is the fastest-growing region, projected to expand at over 8% annually through 2030. China and India lead the surge in demand due to rising disposable incomes and booming creator economies. Japan and South Korea remain technologically mature markets with a strong interest in high-end mirrorless systems. Increased local manufacturing and expanding e-commerce ecosystems are further accelerating pancake lens adoption across APAC.

Latin America

Latin America is witnessing steady growth, particularly in Brazil, Mexico, and Argentina. Expanding social media influence, improving online retail access, and growing middle-class purchasing power are contributing factors. Budget-friendly pancake lenses and mid-range mirrorless bodies are the primary drivers of demand.

Middle East & Africa

MEA markets are gradually expanding, supported by rising interest in professional videography, wedding photography, and content creation. The UAE, Saudi Arabia, and South Africa are major contributors. While market share remains below 10%, increasing technology adoption and improved retail access signal strong long-term potential.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Pancake Lenses Market

- Sony Corporation

- Canon Inc.

- Nikon Corporation

- Fujifilm Holdings

- Sigma Corporation

- Tamron Co., Ltd.

- Samyang Optics

- Viltrox (Shenzhen JCD)

- OM System (formerly Olympus Imaging)

- TTArtisan

- Panasonic Corporation

- Ricoh Imaging (Pentax)

- Tokina

- Leica Camera AG

- Zeiss (Carl Zeiss AG)

Recent Developments

- In March 2025, Sony introduced a new full-frame 24mm pancake lens featuring advanced linear motors for silent video autofocus and improved corner sharpness.

- In January 2025, Sigma announced an ultra-compact 35mm f/2.8 pancake lens for mirrorless mounts, targeting travel and street photographers seeking premium portability.

- In November 2024, Canon launched its RF-mount pancake prime lens optimised for hybrid creators, accelerating its expansion into lightweight mirrorless optics.