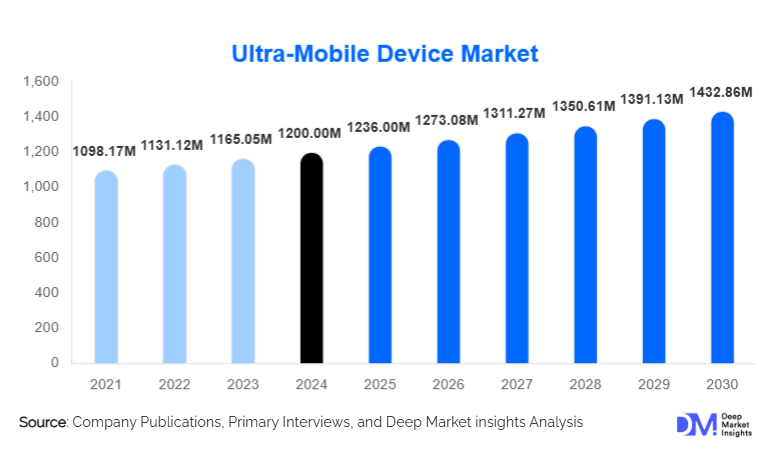

Ultra-Mobile Device Market Size

According to Deep Market Insights, the global ultra-mobile device market size was valued at USD 1,200.00 million in 2024 and is projected to grow from USD 1,236.00 million in 2025 to reach USD 1,432.86 million by 2030, expanding at a CAGR of 3.0% during the forecast period (2025–2030). Market growth is primarily driven by increasing enterprise mobility adoption, rising demand for hybrid-work computing devices, rapid advancements in low-power high-performance processors, and accelerating consumer upgrades toward premium ultra-portable laptops, convertibles, and 5G-enabled mobile devices.

Key Market Insights

- Ultra-portable laptops and premium convertibles dominate value share, driven by enterprise procurement and hybrid-work deployment models.

- 5G-enabled ultra-mobile devices are accelerating due to real-time collaboration needs, cloud-native workflows, and remote productivity.

- Asia-Pacific is the fastest-growing regional market, supported by large-scale digital transformation initiatives and expanding middle-class demand.

- North America remains the largest revenue market, led by high enterprise ASPs and strong premium device upgrade cycles.

- On-device AI and foldable form factors are reshaping product innovation, improving performance, usability, and differentiation.

- Rugged and industrial ultra-mobile devices are emerging as essential tools for logistics, field service, and healthcare operations.

What are the latest trends in the ultra-mobile device market?

AI-Integrated Ultra-Mobile Devices

On-device AI processing is rapidly becoming a defining capability of next-generation ultra-mobile devices. Chipmakers are embedding dedicated neural accelerators that enable advanced features such as real-time translation, predictive text, intelligent power management, privacy-centric AI models, and enhanced computational photography. These capabilities allow ultra-mobile devices to operate efficiently without relying on cloud connectivity. Enterprises benefit from improved data security, while consumers experience richer, low-latency applications. This trend is expanding across premium laptops, 2-in-1s, and high-end tablets, solidifying AI as a long-term innovation vector in the market.

Foldable, Detachable & Hybrid Form Factors

Foldable displays and detachable keyboards are driving a new wave of form-factor innovation. Foldable laptops and tablets provide larger display real estate without increasing device footprint, appealing to mobile professionals, content creators, and multi-taskers. Meanwhile, detachable 2-in-1s are gaining traction in education and enterprise fleets for their versatility and cost-efficiency. Manufacturers are also launching multi-hinge, dual-screen, and ultra-light variants that blur the boundaries between laptops and tablets. These flexible form factors support hybrid work workflows and offer competitive differentiation in an increasingly commoditized device landscape.

What are the key drivers in the ultra-mobile device market?

Enterprise Digital Transformation & Hybrid Work Adoption

Organizations across industries are prioritizing mobility-first strategies as employees split time between office, home, and field environments. Enterprises are investing in secure, high-performance ultra-mobile devices that support collaboration tools, remote device management, and cloud platforms. This shift significantly boosts demand for premium laptops, detachable tablets, and 5G-enabled devices. Large-scale fleet refresh cycles, cybersecurity modernization, and virtual desktop adoption further amplify enterprise demand, particularly in North America and Western Europe.

Advancements in Processor Efficiency & Battery Life

The introduction of ARM-based architectures, Apple Silicon, and next-generation x86 processors has transformed portable computing performance. Ultra-mobile devices now deliver near-desktop capabilities with dramatically lower power consumption, enabling all-day battery life, fanless designs, and thinner form factors. These improvements are a strong driver of consumer upgrades and enterprise fleet modernization efforts. High-efficiency processors also enable advanced workloads such as video editing, AI applications, and immersive content creation on mobile devices.

5G Expansion & Always-Connected Computing

The global rollout of 5G networks is catalyzing demand for always-connected devices. Low-latency connectivity supports real-time collaboration, high-resolution streaming, AR/VR applications, and cloud-native workflows. Sectors such as logistics, field service, emergency response, and healthcare are rapidly adopting 5G tablets, rugged ultra-mobile devices, and connected laptops. Consumers similarly benefit from enhanced mobility, making 5G laptops and tablets increasingly desirable across premium price tiers.

What are the restraints for the global market?

High Component Costs & Supply Chain Volatility

Fluctuations in semiconductor pricing, memory modules, and advanced display panels, especially foldable OLEDs, continue to pressure OEM margins. Supply chain disruptions create production delays and limit the availability of high-demand models. This challenge disproportionately affects value-tier and mid-range devices, where manufacturers operate under tight cost constraints. Persistent component inflation can reduce affordability, slow refresh cycles, and impact profitability for both OEMs and channel partners.

Fragmented Software Ecosystems for Emerging Form Factors

While hardware innovation is accelerating, software optimization for foldables, dual-screens, and detachable devices lags. Many applications are not yet adapted for multi-window workflows or flexible-screen layouts, leading to suboptimal user experiences. Inconsistent OS support and limited developer adoption hinder wider consumer and enterprise acceptance of novel form factors. This fragmentation slows market penetration and reduces the perceived value of next-generation ultra-mobile devices.

What are the key opportunities in the ultra-mobile device industry?

Verticalized Enterprise Mobility Solutions

Healthcare, retail, logistics, field service, and public safety are rapidly adopting rugged tablets, lightweight laptops, and detachable 2-in-1s. These industries require secure, durable, and purpose-built devices that support specialized applications such as telemedicine, warehouse management, digital POS, and fleet coordination. OEMs can unlock high-margin opportunities by offering integrated hardware-software solutions, device-as-a-service models, and industry-specific accessories. Long lifecycle support and mobile device management (MDM) services further strengthen enterprise value propositions.

Emerging Market Expansion Through Telco Bundling & Local Manufacturing

South Asia, Southeast Asia, and Sub-Saharan Africa present significant high-volume opportunities. Telco-subsidized device financing and government-backed digital learning initiatives are accelerating the adoption of low-cost and mid-range ultra-mobile devices. Local manufacturing incentives, especially in India and Vietnam, enable new entrants to reduce costs and scale production efficiently. This environment opens the door for rapid expansion into value-driven markets with long-term growth potential.

AI-Driven User Experiences & Next-Gen Human-Machine Interfaces

Integrated AI capabilities, voice-first interfaces, gesture controls, and contextual computing features are creating differentiated user experiences. Devices that leverage AI for productivity (summaries, speech-to-text, automated workflows), security (biometric authentication, anomaly detection), and content creation (smart editing) are commanding premium prices. OEMs investing in AI ecosystems, SDKs, developer tools, and on-device machine learning frameworks stand to gain competitive advantages as computing shifts toward intelligent mobility.

Product Type Insights

Ultra-portable laptops dominate the market owing to their superior performance, enterprise-ready security, and high ASPs. These devices serve as the primary workhorse for business travelers, hybrid employees, and students who require a balance of mobility and computing power. Premium variants equipped with advanced processors, extended battery life, and high-resolution displays continue to lead revenue generation. Convertibles and detachable 2-in-1 devices are rapidly growing as flexible productivity tools across education and enterprise environments. Their versatility, functioning both as a laptop and a tablet, makes them ideal for fieldwork, classrooms, and mobile sales operations.

Tablets and phablets maintain strong consumer adoption due to affordability and media consumption use cases, while rugged ultra-mobile devices occupy a crucial niche in industrial sectors needing durable, mission-critical hardware.

Application Insights

Enterprise mobility applications lead the market, including remote work, field service, healthcare diagnostics, logistics coordination, and digital workflows. The shift toward cloud productivity tools, EHR platforms, and real-time collaboration has elevated the need for secure, lightweight devices. Consumer applications remain significant, driven by content consumption, gaming, communication, and personal productivity. Premium smartphone-tablet-laptop ecosystems boost cross-device usage.

Education applications are expanding due to digital classrooms, virtual learning, and government-funded device distribution. Low-cost tablets and detachables dominate this segment, particularly in emerging markets.

Distribution Channel Insights

Online channels, including D2C brand stores and e-commerce platforms, dominate sales due to transparency, product comparison tools, and widespread consumer preference for online purchasing. Enterprise direct sales and channel partners remain critical for bulk procurements, especially for laptops, convertibles, and rugged devices. Telecom operators play a major role in distributing smartphones, tablets, and 5G-enabled laptops through financing plans, bundling, and subscription-based device programs.

End-User Type Insights

Enterprise users account for a substantial share of market revenue, driven by device lifecycle management, security compliance, and deployment of mobile productivity suites. Consumer users fuel demand for entertainment, communication, and general productivity devices, particularly in premium smartphone and tablet categories. Educational institutions represent one of the fastest-growing user categories due to digitization programs and large-scale device procurement.

Age Group Insights

Professionals aged 25–45 years dominate demand for ultra-portable laptops and premium convertibles due to work mobility needs and higher spending power. Younger consumers aged 16–25 drive the adoption of tablets, smartphones, and entry-level laptops for gaming, learning, and social media engagement. Older demographics contribute to steady demand for large-screen tablets and simplified operating system experiences, supporting long-term care and accessibility applications.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America remains the largest regional market, driven by strong enterprise procurement, high disposable incomes, and early adoption of next-generation technologies. The United States leads device consumption with a mature IT infrastructure, robust hybrid-work ecosystem, and dominance in premium laptop purchases. Upgrades to AI-enabled laptops and 5G-ready detachables continue to accelerate regional growth.

Europe

Europe demonstrates stable demand, underpinned by digital transformation initiatives across governments, manufacturing, healthcare, and education. Countries such as Germany, the U.K., and France are major adopters of ultra-portables and rugged devices. Sustainability regulations and energy-efficient computing requirements are influencing OEM design strategies in this region.

Asia-Pacific

Asia-Pacific is the fastest-growing region, fueled by rapidly expanding digital ecosystems, rising middle-class spending, and government-run digital literacy programs. China and India are high-volume markets for smartphones, tablets, and low-cost laptops, while Japan and South Korea lead in premium device adoption. Local manufacturing ecosystems further strengthen regional market momentum.

Latin America

Latin American markets, including Brazil, Mexico, and Argentina, are witnessing rising demand for mid-range smartphones, tablets, and lightweight laptops. Economic recovery, improving broadband penetration, and hybrid educational models are driving adoption. Telco-subsidized devices remain an important distribution pathway in the region.

Middle East & Africa

MEA shows growing demand for premium laptops and enterprise tablets, especially in GCC countries with strong IT modernization agendas. Africa demonstrates significant potential for low-cost tablets and rugged devices in education, logistics, and public sector deployments. Improved internet infrastructure and digital payments adoption are boosting device uptake across emerging African economies.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Ultra-Mobile Device Market

- Apple

- Samsung Electronics

- Lenovo Group

- HP Inc.

- Dell Technologies

- Xiaomi Corporation

- Huawei Technologies

- ASUS

- Acer Inc.

- Microsoft Corporation (Surface)

- Google (Pixel ecosystem)

- Honor

- Amazon Devices

- Panasonic (rugged devices)

- Sonyyab;