Tablet Market Size

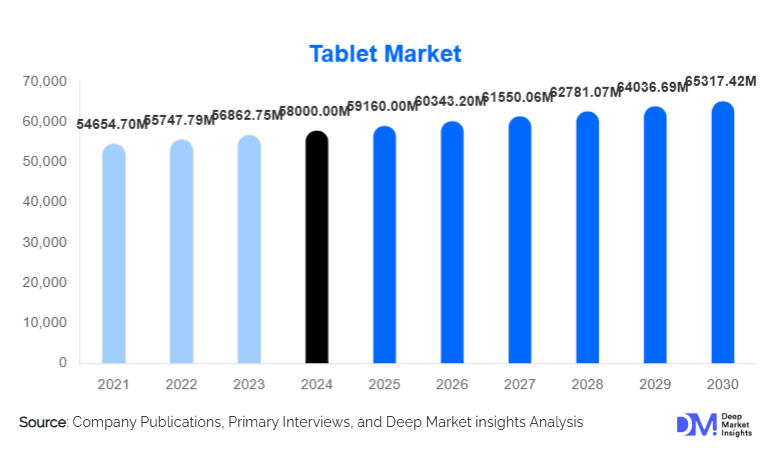

According to Deep Market Insights, the global tablet market size was valued at USD 58,000.00 million in 2024 and is projected to grow from USD 59,160.00 million in 2025 to reach USD 65,317.42 million by 2030, expanding at a CAGR of 2.0% during the forecast period (2025–2030). The market is experiencing steady expansion driven by rising demand for hybrid mobility devices, the integration of AI-enabled chipsets, growing digital education investments, and increasing enterprise deployments across logistics, healthcare, and retail sectors.

Key Market Insights

- Slate tablets remain the dominant product category globally, accounting for nearly 58% of total shipments due to their affordability and widespread consumer usage.

- Android leads the tablet OS landscape with approximately 49% share, while iPadOS continues to dominate the premium revenue-driven segment.

- Asia-Pacific holds the largest regional share (34%) and is also the fastest-growing region, driven by education-sector digitisation and strong consumer electronics adoption.

- Digital education programs across India, China, Africa, and Southeast Asia are accelerating demand for low- and mid-range tablets.

- Enterprises are rapidly adopting tablets for field operations, PoS systems, warehouse management, and healthcare documentation.

- Technological advancements, including OLED displays, 5G tablets, and AI-powered processors, are redefining productivity, gaming, and creative workflows.

What are the latest trends in the tablet market?

AI-Integrated and Performance-Optimised Tablets

Tablet manufacturers are increasingly integrating advanced AI capabilities into their chipsets to boost on-device processing, energy optimisation, and productivity applications. New processors are designed to support generative AI tasks, real-time translation, advanced photo/video editing, and intelligent multitasking. Professional users such as designers and content creators are adopting AI-ready tablets that rival laptop-level performance. Ecosystem integrations, such as seamless workflows between smartphones, PCs, and wearables, are becoming a key differentiating factor, especially in premium models.

Growing Adoption of Tablets in Education, Healthcare & Enterprise

Digitisation across public and private institutions is fueling large-scale adoption of tablets. Education ministries worldwide are distributing tablets for e-learning, digital exams, and hybrid classrooms. Healthcare providers are deploying tablets for telemedicine, patient data entry, and bedside monitoring. Enterprises are implementing rugged tablets for warehouse management, mobility workflows, and workforce automation. These trends are promoting steady volume growth across mid-range and enterprise-grade product segments.

What are the key drivers in the tablet market?

Rise of Remote Work & Digital Learning

Remote and hybrid work models have made tablets essential devices for communication, productivity, and learning. Their lightweight form factor, combined with keyboard compatibility and improved multitasking tools, enables users to work and learn from anywhere. Educational institutions are adopting tablets at scale for lesson delivery, assessments, and content management. Governments in emerging regions are subsidising device access, accelerating mass adoption.

Advancements in Display, Connectivity & Creative Tools

High refresh-rate OLED displays, 5G connectivity, and enhanced stylus precision are transforming the user experience. Tablets are increasingly used for professional design, digital art, gaming, and high-resolution content consumption. These technological advances allow tablets to compete with laptops in performance-driven segments. Expanding 5G networks further strengthens their utility for cloud gaming, remote diagnostics, and low-latency work applications.

What are the restraints for the global market?

Competition from Laptops & Large-Screen Smartphones

The growing popularity of foldable smartphones, ultralight laptops, and hybrid PCs creates overlapping use cases that challenge tablet differentiation. Many consumers opt for multifunctional smartphones or productivity-focused laptops, reducing upgrade cycles for tablets. This competition puts pressure on manufacturers to innovate and justify the value proposition of tablets across price segments.

Supply Chain Instability & Rising Component Costs

Fluctuations in semiconductor availability, logistics disruptions, and rising costs of advanced displays and chipsets can constrain production volumes. These challenges particularly affect mid- and entry-level tablets, where margins are thin, and cost sensitivity is high. Such supply chain pressures may result in delays, price increases, and inconsistent availability across markets.

What are the key opportunities in the tablet industry?

Government Digitisation & National Education Programs

Governments across Asia, Africa, Europe, and Latin America are investing heavily in digital learning infrastructure, creating large procurement opportunities for OEMs. Education-focused tablets with preloaded content, rugged designs, and long battery life are seeing rapid demand. Programs aimed at bridging digital divides, through subsidised student tablets or public-sector modernisation, are creating long-term, recurring opportunities.

Enterprise Mobility & Industry 4.0 Deployments

Rugged tablets, enterprise software bundles, and device-as-a-service (DaaS) models are gaining traction as companies digitalise field operations. Tablets enable faster workflows in logistics, healthcare, construction, and retail, where mobility and real-time data are critical. As companies adopt IoT and automation technologies, tablets serve as the interface layer for diagnostics, analytics, and remote operations, creating sustained demand.

Product Type Insights

Slate tablets dominate the 2024 market with around 58% share, driven by affordability, design simplicity, and diverse consumer applications ranging from entertainment to education. Detachable 2-in-1 tablets are gaining traction among professionals seeking versatility, while rugged tablets are expanding within industrial and field-service environments. Kids’ tablets continue to grow due to parental controls and educational content integration. Enterprise-grade tablets, designed for secure, mission-critical workflows, are becoming an important niche with high margins and stable long-term contracts.

Application Insights

Tablets are widely used for entertainment, education, productivity, creative design, retail PoS, and enterprise mobility workflows. Educational applications are the fastest-growing category, supported by national digital classroom initiatives and hybrid learning. Enterprise applications, including warehouse scanning, field diagnostics, and telehealth, are gaining prominence. Creative applications such as digital illustration and video editing are expanding due to improved stylus precision and advanced GPU performance. Retailers increasingly rely on tablets for PoS and inventory systems, while healthcare applications benefit from real-time patient monitoring and digital recordkeeping.

Distribution Channel Insights

Online channels lead with around 52% share, driven by aggressive pricing, exclusive online model launches, and the convenience of home delivery. E-commerce platforms and OEM websites dominate consumer sales, especially during promotional events. Offline retail continues to play a significant role in premium tablet purchases, where customers prefer device trials and personalised guidance. Enterprise-direct sales channels are expanding as organisations procure customised, large-volume tablet solutions with integrated software and warranty packages.

User Type Insights

Consumers represent the largest user segment, accounting for more than 54% of the market. Students and educators form a rapidly growing group due to e-learning adoption. Enterprise users, particularly in logistics, retail, construction, and healthcare, are increasingly shifting toward rugged and high-dependability tablets. Creative professionals value tablets for illustration, video editing, and music production. Families represent a key segment for kids’ tablets, with parental controls and educational ecosystems driving demand.

Age Group Insights

Younger users (18–30) drive demand for entertainment, gaming, and social connectivity, often choosing affordable Android tablets. Adults aged 31–50 represent the largest revenue group, purchasing mid-range and premium tablets for productivity and family use. Older demographics (51–65 and above) prefer larger displays and simplified interfaces for reading, telehealth, and video communication. Education-oriented devices typically target early childhood to teenage age groups, with durable designs and curated learning content.

| By Product Type | By Operating System | By Display Size | By End User | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 28% of global tablet demand, led by the U.S., where premium devices dominate sales. Strong adoption among enterprises, educational institutions, and creative professionals drives regional growth. Government programs focused on digital healthcare and school modernisation also support rising procurement volumes. Canada experiences consistent demand for mid-range and productivity-oriented tablets as hybrid work becomes entrenched.

Europe

Europe holds around 23% of the global market, with significant adoption in Germany, the U.K., France, and Nordic countries. Digital transformation initiatives and strong consumer preference for premium technology fuel sales. Enterprises and public sectors increasingly deploy tablets for public administration, transportation, and educational modernisation. Sustainability-focused consumers in Europe also influence demand for longer-lasting, repairable, and energy-efficient devices.

Asia-Pacific

Asia-Pacific is both the largest (34% share) and fastest-growing region, propelled by mass education deployments, affordable device accessibility, and strong consumer electronics manufacturing bases in China, India, Vietnam, and South Korea. China leads in both consumption and production, while India represents the highest growth rate due to national digital education missions. Japan and South Korea contribute significant demand from tech-savvy consumers and enterprise buyers.

Latin America

Latin America accounts for around 8% of global demand, driven primarily by Brazil and Mexico. Educational tablet programs and improving digital infrastructure are expanding market penetration. Price sensitivity drives strong demand for mid-range and entry-level tablets, while enterprises in retail and logistics increasingly adopt mobility solutions to improve operational efficiency.

Middle East & Africa

This region holds approximately 7% of the market and is experiencing rising adoption due to government modernisation efforts, expanding internet access, and a growing young population. GCC countries such as the UAE and Saudi Arabia show strong demand for premium tablets, while African nations prioritise educational deployments and affordable models. Public-sector mobile initiatives are helping fuel early-stage enterprise adoption across the region.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Company Market Share

The tablet market is moderately concentrated, with the top five players, Apple, Samsung, Lenovo, Huawei, and Amazon, collectively holding approximately 72% of global market share in 2024. Apple leads the premium category, Samsung remains strong across price tiers, Lenovo dominates enterprise and education segments, Huawei excels in APAC markets, and Amazon leads entry-level consumer tablets. The remaining market share is distributed among emerging Asian brands and specialized rugged tablet manufacturers.

Key Players in the Tablet Market

- Apple

- Samsung

- Lenovo

- Huawei

- Amazon

- Xiaomi

- Microsoft

- Dell

- ASUS

- Acer

- Panasonic

- TCL

- Realme

- HP

- Zebra Technologies

Recent Developments

- In 2025, Apple expanded its iPad lineup with AI-optimised chipsets designed to enhance creative workflows and productivity tools.

- In 2025, Samsung introduced new rugged enterprise tablets equipped with advanced durability and 5G capabilities for industrial applications.

- In 2024, Lenovo launched education-focused tablets with reinforced casings and long-life batteries tailored for large school deployments.

- In 2024, Huawei enhanced its HarmonyOS tablet ecosystem to improve cross-device synergy with smartphones and wearables.