Transglutaminase Meat Market Size

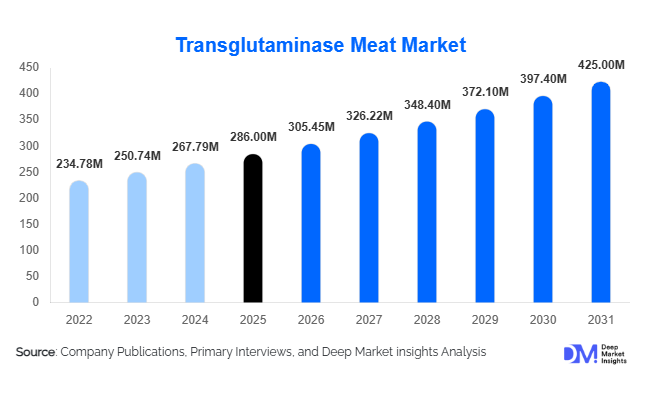

According to Deep Market Insights, the global transglutaminase meat market size was valued at USD 286 million in 2025 and is projected to grow from USD 305.45 million in 2026 to reach USD 425 million by 2031, expanding at a CAGR of 6.8% during the forecast period (2026–2031). The market growth is primarily driven by rising consumption of processed and restructured meat products, increasing pressure on meat processors to improve yield efficiency, and the expanding global trade of poultry and red meat products.

Key Market Insights

- Microbial transglutaminase dominates global demand, owing to its scalability, regulatory acceptance, and cost efficiency compared to animal-derived alternatives.

- Poultry-based applications account for the largest share of enzyme usage, supported by high global poultry consumption and suitability for restructuring.

- Asia-Pacific leads global demand, driven by rapid industrialization of meat processing in China, Thailand, and India.

- Industrial meat processors remain the primary end users, accounting for the majority of consumption due to export-oriented and private-label production.

- Yield optimization and cost control are key adoption drivers as processors face rising raw material and labor costs.

- Technological advancements in enzyme formulation are enabling lower dosages, improved performance, and clean-label positioning.

What are the latest trends in the transglutaminase meat market?

Rising Adoption in Restructured and Portion-Controlled Meats

Meat processors are increasingly using transglutaminase to manufacture restructured and portion-controlled meat products such as formed poultry fillets, sliced deli meats, and standardized beef cuts. This trend is driven by demand from quick-service restaurants, institutional catering, and export markets that require consistent size, texture, and appearance. By enabling binding of smaller meat pieces into uniform portions, transglutaminase helps processors reduce trim loss and improve profitability while maintaining product quality.

Clean-Label Positioning and Processing-Aid Classification

Manufacturers are increasingly positioning transglutaminase as a processing aid rather than a traditional additive. Advances in microbial fermentation and enzyme purification have enabled lower usage levels, helping processors comply with clean-label expectations in North America and Europe. Transparent labeling strategies and regulatory clarity are allowing broader adoption in premium processed meat products without compromising consumer trust.

What are the key drivers in the transglutaminase meat market?

Growth of Processed and Export-Oriented Meat Production

The expansion of global meat exports, particularly from the U.S., Brazil, Thailand, and China, is driving demand for transglutaminase. Export markets require standardized cuts, improved shelf stability, and minimal waste, all of which are supported by enzymatic binding solutions. As international trade volumes grow, adoption of transglutaminase continues to rise across industrial processing facilities.

Need for Yield Improvement and Cost Optimization

Rising livestock prices, feed costs, and energy expenses are pushing meat processors to maximize yield. Transglutaminase improves protein binding and water retention, increasing finished product yield by 5–10% in many applications. This direct economic benefit makes the enzyme a strategic input for processors aiming to protect margins.

What are the restraints for the global market?

Consumer Perception and Labeling Concerns

Negative perceptions surrounding the term “meat glue” have created reputational risks for processors in certain markets. Although scientifically safe, misinterpretation by consumers and advocacy groups has led to cautious adoption in Europe and select North American segments.

Regulatory Variability Across Regions

Differences in labeling requirements, usage limits, and regulatory classification across countries increase compliance complexity for global suppliers. This variability raises operational costs and slows product approvals in certain regions.

What are the key opportunities in the transglutaminase meat industry?

Emerging Market Industrialization of Meat Processing

Rapid urbanization and cold-chain expansion in India, Southeast Asia, Africa, and Latin America are accelerating the shift from informal slaughtering to organized meat processing. This transition creates strong long-term demand for functional enzymes such as transglutaminase.

Sustainability and Food Waste Reduction Initiatives

Transglutaminase supports sustainability goals by enabling full utilization of meat trimmings and lower-value cuts. As governments and corporations prioritize waste reduction, enzyme-based solutions are becoming integral to sustainable meat production strategies.

Product Form Insights

Powdered transglutaminase dominates the global market, accounting for approximately 62% of total demand in 2025. Its leadership is primarily driven by its long shelf life, ease of storage and transportation, and superior compatibility with dry seasoning and spice blends widely used in industrial meat processing. Powdered formulations also offer precise dosing control, making them ideal for high-volume production environments.

Granular transglutaminase is steadily gaining traction, particularly in automated and continuous processing lines, where reduced dusting, improved flowability, and uniform dispersion are critical. Meanwhile, liquid formulations remain a niche segment due to shorter shelf life, higher logistics costs, and stability challenges, limiting their adoption to specialized applications.Leading Segment Driver: Cost efficiency, extended shelf stability, and compatibility with large-scale industrial processing systems.

Source Type Insights

Microbial transglutaminase represents nearly 88% of the global market, supported by its scalable fermentation-based production, consistent enzymatic performance, and broad regulatory acceptance across major meat-processing regions. Its plant- and microbe-based origin aligns well with clean-label reformulation trends and sustainability goals among global processors.

Animal-derived transglutaminase remains limited to niche applications due to higher production costs, supply constraints, and stricter regulatory and ethical considerations. As a result, its market penetration continues to decline in favor of microbial alternatives.Leading Segment Driver: High scalability, regulatory compliance, and suitability for clean-label and cost-sensitive formulations.

Meat Type Application Insights

Poultry meat applications lead the market with approximately 46% share in 2025, driven by high global consumption, affordability, and the enzyme’s effectiveness in improving binding, texture, and yield in restructured poultry products. Poultry processors increasingly rely on transglutaminase to reduce raw material losses and enhance product uniformity.

Red meat applications follow, particularly in processed beef and pork products, where transglutaminase supports value recovery from lower-grade cuts. Blended and processed meats—including sausages, nuggets, and formed meat products—continue to gain share as manufacturers focus on cost optimization and product innovation.Leading Segment Driver: High poultry consumption and increasing demand for yield optimization in restructured meat products.

End-Use Industry Insights

Industrial meat processors account for nearly 70% of total consumption, driven by large-scale production, export-oriented operations, and the need for consistent product quality. These processors utilize transglutaminase to enhance product appearance, texture, and profitability.

The foodservice and HoReCa segment represents the fastest-growing end-use category, expanding at close to 8% CAGR. Growth is fueled by the rapid expansion of quick-service restaurants (QSRs), cloud kitchens, and ready-to-cook meat offerings, particularly in urban markets.Leading Segment Driver: Large-scale industrial processing requirements and rapid expansion of organized foodservice channels.

| By Product Form | By Source Type | By Meat Type Application | By Functionality | By End-Use Industry |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific leads the global transglutaminase meat market with approximately 34% share in 2025. China remains the largest consumer due to its extensive poultry and pork processing industry and strong demand for processed meat products. India is the fastest-growing market, expanding at over 9% CAGR, as organized meat processing, cold-chain infrastructure, and export-oriented production gain momentum.Regional Growth Drivers: Rising meat consumption, rapid urbanization, expanding processed food sector, and increasing investments in industrial meat processing.

North America

North America accounts for nearly 28% of global demand, led by the United States. The region benefits from early adoption of enzyme technologies, advanced processing infrastructure, and strong private-label and export-oriented meat production. Consistent demand for processed and convenience meat products continues to support market stability.Regional Growth Drivers: Technological maturity, strong regulatory clarity, high demand for processed meats, and efficiency-driven manufacturing.

Europe

Europe represents around 21% of global market share, with Germany, Spain, and the Netherlands emerging as key consumers. While growth remains moderate due to strict labeling regulations and clean-label scrutiny, demand remains stable within large industrial processing facilities focused on export and value-added meat products.Regional Growth Drivers: Established meat processing industry, focus on product consistency, and steady demand for restructured meat applications.

Latin America

Latin America holds approximately 10% share, primarily driven by Brazil’s export-focused beef and poultry industry. Increasing investments in processing automation and compliance with international export standards are strengthening enzyme adoption across the region.Regional Growth Drivers: Expanding meat exports, infrastructure modernization, and rising adoption of efficiency-enhancing processing technologies.

Middle East & Africa

The Middle East & Africa accounts for about 7% of global demand, with growth led by Saudi Arabia, the UAE, and South Africa. Rising meat imports, growing local processing capacity, and increasing demand for halal-compliant and value-added meat products are supporting market expansion.Regional Growth Drivers: Increasing meat consumption, investments in local processing, and rising demand for processed and imported meat products.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Transglutaminase Meat Market

- Ajinomoto Co., Inc.

- DSM-Firmenich

- Kerry Group

- Nagase & Co., Ltd.

- Amano Enzyme Inc.

- BDF Natural Ingredients

- Jiangsu Boli Bioproducts

- Shenzhen Sunway Biotech

- Yiming Biological Products

- Huadong Medicine

- Shandong Freda Biochem

- Wuhan Yuancheng

- Henan Tailijie

- Enzyme Development Corporation

- AB Enzymes