Global Tofu Coagulant Market Size

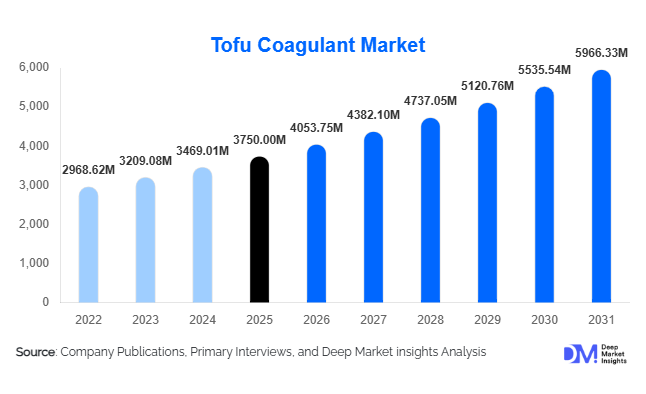

According to Deep Market Insights, the global tofu coagulant market size was valued at USD 3,750.00 million in 2025 and is projected to grow from USD 4,053.75 million in 2026 to reach USD 5,966.33 million by 2031, expanding at a CAGR of 8.1% during the forecast period (2026–2031). The market growth is primarily driven by rising global adoption of plant-based diets, increasing industrial-scale tofu production, and technological innovations in coagulant formulations that enhance yield, texture, and clean-label compliance.

Key Market Insights

- Calcium sulfate remains the dominant coagulant type, preferred for its cost efficiency, neutral taste, and suitability for firm and extra-firm tofu.

- Asia-Pacific leads global consumption, driven by China, Japan, South Korea, and Indonesia, while North America and Europe are emerging as high-growth regions due to increasing plant-based protein adoption.

- Fermentation-based and enzyme-derived coagulants are gaining traction, catering to clean-label and natural product trends in premium and export markets.

- Commercial tofu manufacturers dominate end-use demand, representing over 68% of the market, fueled by industrial production and growing retail and foodservice requirements.

- Direct B2B supply is the leading distribution channel, reflecting long-term contracts between coagulant suppliers and tofu processors for consistent quality and bulk delivery.

- Technological adoption, including automated liquid dosing, granular formulations for industrial lines, and AI-assisted yield optimization, is reshaping efficiency and product consistency.

What are the latest trends in the tofu coagulant market?

Shift Toward Clean-Label and Natural Coagulants

Consumer preference is increasingly focused on natural, minimally processed ingredients. Fermentation-derived, enzyme-based, and non-synthetic coagulants are seeing rising adoption due to their alignment with clean-label, vegan, and organic requirements. These alternatives not only appeal to health-conscious consumers but also allow manufacturers to differentiate their products in competitive retail and foodservice markets. Innovation in natural coagulants is also enabling higher protein retention, improved texture, and reduced coagulation time for industrial-scale tofu production.

Industrialization and Automation of Tofu Production

Tofu manufacturing is shifting from artisanal and small-scale methods toward automated production lines. Powdered and liquid coagulants compatible with industrial equipment are increasingly preferred to improve yield, maintain texture consistency, and reduce labor intensity. Automation-friendly formulations allow for integration with digital dosing systems and quality control monitoring, appealing to large-scale producers and export-oriented facilities. This trend is especially strong in Asia-Pacific, North America, and Europe.

What are the key drivers in the tofu coagulant market?

Rising Adoption of Plant-Based Diets

The global increase in vegetarian, vegan, and flexitarian diets is directly boosting tofu consumption, particularly in North America, Europe, and Asia-Pacific. This trend fuels demand for all types of tofu coagulants, as manufacturers seek to scale up production to meet growing retail, foodservice, and export requirements. Health, sustainability, and environmental considerations are key motivators driving consumer adoption.

Technological Innovations in Coagulant Formulations

Advancements in enzyme-based, fermentation-derived, and industrial-grade liquid coagulants are enhancing yield, texture, and consistency in tofu production. Technology integration, such as AI-assisted dosing and automation-ready formulations, reduces production costs and improves product uniformity. This innovation is particularly attractive for large-scale commercial tofu producers looking to optimize operational efficiency.

Government Support and Regulatory Endorsement

Regulatory approvals and nutritional promotion of soy-based proteins by governments worldwide are positively impacting market growth. Programs promoting plant-based proteins in school meals, hospitals, and public institutions encourage higher tofu consumption, indirectly driving coagulant demand.

What are the restraints for the global tofu coagulant market?

Raw Material Price Volatility

Price fluctuations of magnesium salts, calcium compounds, and fermentation substrates can impact coagulant costs and compress profit margins for manufacturers. Volatility is influenced by energy prices, mining costs, and transportation expenses, creating challenges for pricing stability and procurement planning.

Regional Regulatory Variations

Differences in food additive approvals and standards across regions complicate global product standardization. Compliance costs, reformulation requirements, and approval timelines can slow market entry for new players or expansion for existing manufacturers, limiting growth in some jurisdictions.

What are the key opportunities in the tofu coagulant industry?

Emerging Markets and Export Expansion

Countries in Southeast Asia, Latin America, and Africa are experiencing rising soy consumption. Local production and distribution of coagulants in these emerging markets offer opportunities to reduce import dependency and logistics costs, enabling faster market penetration and increased revenue potential for both established and new players.

Clean-Label and Specialty Coagulant Innovation

Innovation in fermentation-derived, enzyme-based, and natural coagulants enables manufacturers to meet clean-label trends and appeal to premium product segments. These coagulants can command higher pricing while offering improved functional performance, positioning companies strategically in export-oriented and health-conscious markets.

Technology-Integrated Industrial Solutions

Advanced coagulant formulations compatible with automated tofu lines and AI-assisted dosing systems allow for faster coagulation, higher yield, and consistent quality. Industrial-scale producers can leverage these technologies to optimize operations, reduce labor costs, and meet large-volume retail and export demands.

Product Type Insights

Calcium sulfate dominates the global tofu coagulant market due to its low cost, wide acceptance, and suitability for firm and extra-firm tofu applications. Magnesium chloride is gaining traction in silken tofu and specialty products, while enzyme-based coagulants are increasingly adopted in clean-label, premium, and export-oriented tofu production. Powdered forms remain the leading format, preferred for transport and shelf life, while liquid forms are growing in industrial automated production lines.

Application Insights

Firm tofu accounts for the largest application segment, representing over 41% of market demand in 2025, reflecting consumer preference for versatile tofu products in home cooking, retail, and foodservice. Silken tofu is growing rapidly due to plant-based dessert and smoothie applications. Specialty and flavored tofu are emerging niches, particularly in North America and Europe, driven by health-conscious and premium food trends.

Distribution Channel Insights

Direct B2B supply dominates, accounting for approximately 54% of global demand in 2025, as commercial tofu manufacturers rely on consistent quality and bulk delivery contracts. Distributors serve smaller manufacturers and artisanal producers, while online and e-commerce channels are gaining traction for specialty coagulants targeting SMEs and boutique tofu brands.

End-Use Insights

Commercial tofu manufacturing represents the largest end-use segment, with over 68% of market demand in 2025. Foodservice and HORECA segments are growing steadily, driven by plant-based menu expansion. Plant-based food processors incorporating tofu into ready meals and meat analogs present new demand avenues. Household consumption remains a stable, but smaller, market segment.

| By Coagulant Type | By Source | By Form | By Application | By End Use | By Distribution Channel |

|---|---|---|---|---|---|

|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific holds a dominant 58% market share in 2025, with China (28%), Japan (9%), South Korea (6%), and Indonesia (5%) leading demand. High tofu consumption, industrial production, and export-oriented manufacturing drive growth. APAC is also the fastest-growing region due to rising plant-based diet adoption and investment in food processing infrastructure.

North America

North America represents 16% of global demand, with the U.S. at 12%. Growth is driven by increasing vegan and flexitarian populations, industrial tofu production, and export demand. North America is the fastest-growing individual country market, with CAGR exceeding 11%.

Europe

Europe accounts for 14% of the market, led by Germany, the UK, and France. Clean-label trends and premium tofu products are driving growth, with younger demographics and sustainability-focused consumers leading demand.

Latin America

Latin America contributes about 7% of the global market, with Brazil and Argentina emerging as growth markets due to rising consumer awareness and exports of industrial tofu.

Middle East & Africa

This region accounts for roughly 5% of the global market, with South Africa leading in intra-regional production. High-income Middle Eastern countries are driving premium import demand.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Global Tofu Coagulant Market

- Jungbunzlauer

- Tate & Lyle

- Corbion

- Fufeng Group

- RZBC Group

- Gadot Biochemical

- Shandong Jiejing Group

- Fengchen Group

- Niacet Corporation

- Foodchem International

- Shandong Baisheng Biotechnology

- Anhui BBCA Group

- Weifang Ensign Industry

- Shandong Xiwang Sugar

- Henan Jindan Lactic Acid