Sports Supplements Market Size

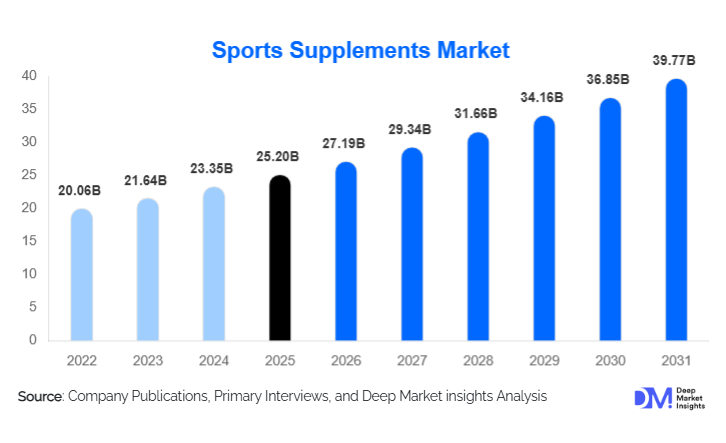

According to Deep Market Insights, the global sports supplements market size was valued at USD 25.2 billion in 2025 and is projected to grow from USD 27.19 billion in 2026 to reach USD 39.77 billion by 2031, expanding at a CAGR of 7.9% during the forecast period (2026–2031). The growth of the sports supplements market is primarily driven by rising health and fitness awareness, increasing adoption of protein and performance-focused nutrition, and rapid penetration of e-commerce and digital retail channels, enabling direct-to-consumer sales worldwide.

Key Market Insights

- Protein supplements dominate the market, with whey and plant-based proteins capturing the largest share due to strong consumer demand for muscle recovery and endurance support.

- Powder formulations are the most preferred, accounting for the majority of market revenues, as they provide versatility, cost-effectiveness, and ease of use across multiple fitness routines.

- North America holds the largest regional market, driven by high fitness participation, professional sports consumption, and strong e-commerce penetration in the U.S. and Canada.

- Asia Pacific is the fastest-growing region, led by China, India, Japan, and Southeast Asia, due to rising disposable incomes, urbanization, and growing fitness culture.

- Online retail channels are rapidly expanding, offering direct-to-consumer sales, subscription models, and personalized nutrition plans, reshaping the distribution landscape.

- Innovation in plant-based and personalized supplements, including AI-driven formulations and wearable integration, is creating new growth opportunities in emerging and developed markets alike.

What are the latest trends in the sports supplements market?

Rise of Plant-Based and Clean-Label Products

Consumer demand for plant-based proteins, vegan supplements, and clean-label formulations is reshaping the sports supplements market. Ingredients such as pea, soy, and rice proteins are gaining traction due to sustainability concerns and dietary preferences. Brands are reformulating products to eliminate artificial additives, promote transparency, and highlight natural ingredients. This trend is particularly strong in Europe, North America, and APAC urban centers, where wellness-conscious consumers prioritize both health benefits and environmental sustainability. Companies are also marketing hybrid blends combining plant-based proteins with functional nutrients, supporting muscle recovery and overall wellness.

Integration of Technology for Personalized Nutrition

Advances in wearable fitness devices, health apps, and AI-based nutrition platforms are enabling personalized supplement recommendations. Brands are leveraging data from activity trackers, biometrics, and dietary patterns to tailor supplements for individual goals, from endurance to recovery. Subscription-based D2C models now offer auto-replenishment and curated nutrition plans, enhancing engagement and customer retention. Consumers increasingly seek online tools that combine performance tracking with supplement guidance, creating opportunities for tech-driven differentiation and higher-value product offerings.

What are the key drivers in the sports supplements market?

Growing Fitness and Health Awareness

Increasing global interest in fitness, preventive health, and lifestyle-driven wellness is a major driver. Both recreational and professional athletes are seeking supplements to enhance performance, recovery, and overall health. This trend extends to general consumers aiming to maintain active lifestyles, fueling demand for protein powders, energy drinks, and functional health supplements.

Product Innovation and Format Diversification

Innovation in formats—such as powders, ready-to-drink beverages, chews, and liquid concentrates—is increasing convenience and accessibility for consumers. Novel formulations including BCAAs, collagen peptides, and functional blends for joint, gut, or immune health are expanding market relevance beyond bodybuilding, appealing to a broader audience.

Expansion of E-Commerce and Digital Channels

Online platforms enable global reach, direct-to-consumer engagement, and cost-effective marketing. Influencer partnerships, social media campaigns, and AI-powered personalization enhance visibility and consumer loyalty, further boosting market growth and reducing dependence on traditional retail.

What are the restraints for the global market?

Regulatory and Quality Concerns

Inconsistent regulations across regions can impede market growth. Consumers are increasingly cautious about product safety, efficacy, and authenticity, making high-quality certifications and third-party testing essential. Recalls or adverse events negatively impact market perception, especially in professional sports.

Price Sensitivity in Emerging Economies

High costs for premium supplements can limit adoption in emerging markets. Without affordable alternatives, price-sensitive consumers may rely on local substitutes, reducing the potential for full market penetration. Trade barriers and supply chain constraints further exacerbate pricing challenges in these regions.

What are the key opportunities in the sports supplements industry?

Expansion in Emerging Economies

Rising urbanization, disposable incomes, and health consciousness in markets such as India, Southeast Asia, and Latin America are creating opportunities for both international and local brands. Customizing products to local tastes, pricing, and cultural preferences can capture untapped demand.

Personalized and AI-Driven Nutrition

Personalized supplement solutions leveraging wearable data, digital health insights, and AI algorithms are expanding the consumer base. Subscription models offering tailored protein blends, pre-workout formulations, or functional supplements can strengthen brand loyalty and drive higher margins.

Regulatory Harmonization and Quality Certification

Global alignment on safety standards, clean-label transparency, and third-party testing can build consumer trust, especially for premium supplements. Endorsements by sports federations and inclusion in institutional nutrition programs offer additional growth potential.

Product Type Insights

Protein supplements lead the market, representing 47% of total revenues in 2025. Whey protein remains dominant due to bioavailability and established consumer preference, while plant-based alternatives are rapidly gaining share. Performance and energy products, including pre-workout formulations and BCAAs, are expanding due to growing interest in endurance and recovery-focused nutrition. Weight management and functional health supplements are witnessing steady growth as lifestyle and preventive health trends accelerate adoption.

Application Insights

Muscle recovery and performance enhancement remain the primary applications, particularly among professional athletes and recreational fitness enthusiasts. Weight management and general wellness applications are growing rapidly, reflecting increased interest in holistic health. Ready-to-drink formulations and multi-functional supplements are gaining traction for convenience and versatility across various fitness routines.

Distribution Channel Insights

Offline retail accounts for 52% of the 2025 market share, with specialty health stores, pharmacies, and supermarkets being key contributors. Online retail is expanding rapidly due to direct-to-consumer models, e-commerce marketplaces, and subscription-based delivery. Social media, influencer marketing, and digital content are increasingly driving brand discovery and purchase decisions, particularly among younger consumers.

End-User Insights

Recreational athletes and fitness enthusiasts constitute the largest end-user group, contributing 60% of demand. Professional athletes remain high-value consumers, particularly for specialized recovery and performance products. Growth is also observed in the weight management and general wellness segments, highlighting opportunities beyond traditional sports-focused consumers.

| By Product Type | By Formulation / Form | By Distribution Channel | By End User | By Source |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds the largest share (36%) of the global market, driven by high gym participation, professional sports consumption, and widespread e-commerce adoption. U.S. and Canadian consumers favor high-quality proteins, ready-to-drink formulations, and premium functional supplements.

Europe

Europe accounts for 26% of global revenues, led by Germany, the U.K., and France. Consumers prefer clean-label, plant-based, and scientifically validated products. The region is also characterized by a high demand for personalized nutrition and functional health supplements.

Asia Pacific

Asia Pacific is the fastest-growing region, led by China, India, Japan, and Southeast Asia, with a double-digit CAGR projected through 2030. Rising disposable incomes, urbanization, and fitness adoption are driving strong demand for protein powders, energy drinks, and functional supplements.

Latin America

Latin America represents 9% of the market, with Brazil and Mexico driving growth. Demand is increasing for performance and weight management supplements, particularly in urban centers. Market penetration is supported by local manufacturing and retail partnerships.

Middle East & Africa

MEA holds 6% of the market. The UAE, Saudi Arabia, and South Africa are leading consumers, driven by fitness awareness and rising wellness initiatives. Africa is also witnessing emerging intra-regional demand for protein and recovery products.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Sports Supplements Market

- Glanbia plc

- PepsiCo, Inc.

- The Coca-Cola Company

- Abbott Laboratories

- Herbalife Nutrition

- Amway Corporation

- Nestlé S.A.

- NOW Foods

- GNC Holdings, LLC

- BellRing Brands

- Nutrabolt

- MyProtein (THG plc)

- Dymatize (Post Holdings)