Smart Tourism Market Size

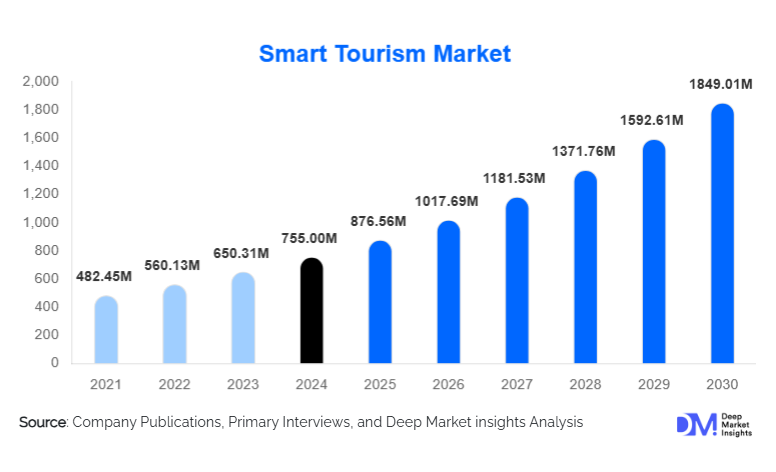

According to Deep Market Insights, the global smart tourism market size was valued at USD 755.00 million in 2024 and is projected to grow from USD 876.56 million in 2025 to reach USD 1849.01 million by 2030, expanding at a CAGR of 16.10% during the forecast period (2025–2030). The smart tourism market growth is primarily driven by the accelerating digital transformation across cities and tourism destinations, rising traveler demand for seamless digital experiences, and increasing investment in AI-driven personalization, IoT-enabled infrastructure, and mobile-first engagement platforms that enhance pre-travel, on-site, and post-travel experiences.

Key Market Insights

- Smart tourism solutions are becoming core components of smart city initiatives, integrating real-time mobility data, IoT sensors, and visitor analytics to optimize traveler flow and enhance safety.

- AI- and big data-powered personalization is reshaping travel behavior, enabling dynamic itinerary planning, automated recommendations, and real-time multilingual support.

- Cloud-based platforms dominate deployment, providing scalable and cost-efficient infrastructure for tourism authorities, hotels, mobility providers, and attractions.

- North America holds the largest market share due to mature digital infrastructure, widespread mobile adoption, and strong investment from airports, hotels, and tech companies.

- Asia-Pacific is the fastest-growing regional market, driven by rapid urbanization, rising smartphone penetration, and government-backed smart city programs in China, India, Japan, and South Korea.

- AR/VR and immersive content are becoming central to destination marketing, allowing travelers to preview locations and enhancing on-site engagement.

What are the latest trends in the smart tourism market?

AI-Powered Personalization and Predictive Travel Services

Smart tourism operators are integrating AI and machine learning across the traveler journey, from trip planning to on-ground navigation. Platforms now generate hyper-personalized itineraries, predict congestion at attractions, translate languages instantly, and deliver real-time mobility updates. AI-driven chatbots and virtual assistants are replacing traditional visitor centers, while predictive analytics help destinations allocate resources, manage crowds, and enhance traveler safety. As younger, digitally native travelers dominate the global tourism base, demand for intelligent, context-aware travel recommendations continues to surge. AI is also enabling more accurate forecasting of travel patterns, optimizing marketing spend, and improving the profitability of tourism operators.

IoT-Enabled Smart Destinations

Destinations are implementing IoT sensors, smart kiosks, NFC-enabled ticketing, and location-aware services to create connected and responsive tourism ecosystems. Real-time monitoring of visitor flows helps reduce congestion, improve sustainability, and enhance the visitor experience. GPS-enabled navigation tools, automated queue management, and smart mobility services (e-scooters, autonomous shuttles, smart parking) are transforming urban exploration. Museums, theme parks, and cultural sites are increasingly using IoT to track visitor engagement, personalize exhibits, and deliver interactive experiences. Governments' investments in 5G networks further accelerate this trend, enabling faster data exchange and richer mobile-based traveler interactions.

What are the key drivers in the smart tourism market?

Rising Traveler Demand for Seamless Digital Experiences

Modern travelers expect frictionless experiences across planning, booking, transit, and exploration. The shift toward mobile-based interactions, contactless payments, e-tickets, and automated check-ins is driving rapid adoption of smart tourism platforms. As tourism volumes rebound post-pandemic, both private operators and government bodies are upgrading digital interfaces to enhance traveler satisfaction, reduce operational bottlenecks, and improve safety.

Expansion of Smart City Initiatives Worldwide

The growth of smart city programs is directly propelling smart tourism adoption. Cities worldwide are integrating tourism layers into broader digital ecosystems, including IoT networks, big data platforms, public Wi-Fi grids, and digital signage. These improvements allow destinations to offer more personalized, safe, and sustainable experiences. Governments consider smart tourism a strategic lever for competitiveness, leading to increased public–private partnerships and infrastructure investment.

Growth of AR/VR and Immersive Destination Marketing

The demand for immersive digital experiences is rising, with AR-powered landmark overlays, VR destination previews, and interactive cultural storytelling becoming standard in tourism campaigns. These technologies enhance engagement, help travelers plan better, and support tourism boards in differentiating their destinations in crowded markets.

What are the restraints for the global market?

High Infrastructure and Technology Integration Costs

Deploying IoT sensors, AR systems, AI engines, and cloud-based management platforms involves significant capital investment. Many small destinations, municipalities, and tourism operators face budget constraints, slowing large-scale implementation. Integration across legacy systems, digital signage, transport networks, and hospitality platforms adds further complexity and cost.

Data Privacy and Cybersecurity Challenges

Smart tourism relies heavily on personal and behavioral data to deliver personalized experiences. This raises concerns related to data privacy, security breaches, and compliance with regulations such as GDPR. Destinations and service providers must invest in secure data architectures, encryption protocols, and compliance frameworks, which may delay adoption.

What are the key opportunities in the smart tourism industry?

Integration with Sustainability and Responsible Tourism Programs

As sustainability becomes central to tourism strategies, smart tourism platforms can help monitor carbon footprints, manage crowds, and optimize resource usage. Tools that direct travelers toward eco-friendly attractions, track environmental impact, and support regenerative tourism present major opportunities. Governments increasingly prioritize technology to manage carrying capacities and preserve heritage sites.

Public–Private Partnerships for Smart Destination Development

Governments are collaborating with tech companies, telecom providers, and tourism operators to co-develop smart destination platforms. These partnerships unlock funding, accelerate innovation, and create new revenue streams. For technology companies, this offers access to long-term citywide contracts, while destinations gain access to advanced analytics, mobility solutions, AR/VR capabilities, and cybersecurity frameworks.

Product Type Insights

Smart tourism solutions are led by digital platforms and analytics systems, which support booking, navigation, personalization, and real-time information delivery. AR/VR solutions are rapidly gaining adoption across heritage sites, museums, and themed attractions. IoT-enabled systems, including sensors, smart ticketing, and beacon-based navigation, are increasingly used in airports, hotels, transportation hubs, and city centers, enabling automated, data-driven visitor management.

Application Insights

Booking and reservation platforms remain the largest application segment, supported by high global penetration of OTAs, mobile apps, and integrated travel platforms. Navigation and destination guidance tools are growing rapidly due to demand for real-time multimodal transport data, language translation, and personalized routing. AR-driven engagement applications, smart ticketing systems, and analytics dashboards for destination management are seeing strong adoption as cities modernize tourism infrastructure.

Distribution Channel Insights

Online platforms dominate the smart tourism ecosystem, including mobile apps, OTAs, and cloud-based travel portals. Direct-to-consumer digital channels operated by hotels, airlines, theme parks, and city tourism boards are expanding due to improved user experience and loyalty programs. Integration with social media, influencer-driven discovery, and dynamic content platforms further strengthens online distribution. Traditional offline travel agencies are adopting hybrid digital models to remain competitive.

Traveler Type Insights

Individual travelers represent the largest segment, driven by the widespread adoption of mobile apps for personalized planning and on-the-go decision-making. Business travelers rely heavily on smart mobility, automated check-ins, and seamless booking tools, making them high-value users. Group and family travelers increasingly use smart tourism apps for itinerary coordination, guided tours, and multilingual navigation, strengthening their share of the market.

Age Group Insights

Travelers aged 25–45 dominate smart tourism adoption due to strong digital affinity and high smartphone usage. Younger demographics (18–30) are key drivers for immersive content, AR navigation, and mobile-first interactions, while older segments (50–65) adopt smart tourism features for convenience, accessibility, and safety. The above-65 age group shows growing interest in AI-driven travel assistance and digital concierge services.

| By Component | By Technology Enabler | By Application | By Traveler Type | By End Use |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds the largest share of the global market due to advanced mobile infrastructure, strong investment in tourism digitization, and widespread adoption of smart mobility and contactless services. The U.S. leads with major airports, hotels, and theme parks deploying AI, IoT, and AR systems to enhance visitor engagement. Canada continues to invest in smart destination initiatives, particularly in urban centers.

Europe

Europe is a major smart tourism hub, supported by the EU’s digitalization programs and strong preference for sustainable, tech-enabled travel. Destinations such as France, Italy, Spain, and Germany integrate IoT sensors, AR experiences, and digital passes to manage visitor flows in heritage sites. Tourism boards across the region are prioritizing data-driven management and immersive cultural experiences.

Asia-Pacific

Asia-Pacific is the fastest-growing region, driven by rapid smartphone penetration, urban development, and government-backed smart city strategies. China, Japan, South Korea, and India are key contributors, with significant investments in smart mobility, AI platforms, and digital visitor services. Southeast Asian destinations are leveraging smart tourism to enhance competitiveness and attract global travelers.

Latin America

Latin America is gradually adopting smart tourism technologies, with Brazil, Mexico, and Argentina leading investments in digital ticketing, mobile-based destination guides, and IoT-enhanced attractions. The region’s tourism boards increasingly prioritize immersive digital content and real-time visitor analytics to modernize travel experiences.

Middle East & Africa

The Middle East is emerging as a high-value market for smart tourism, driven by luxury travel investments and visionary smart city projects in the UAE, Saudi Arabia, and Qatar. Africa is adopting smart tourism solutions to enhance visitor satisfaction in national parks, cultural sites, and urban centers, supported by growing digital infrastructure and government tourism initiatives.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Smart Tourism Market

- Booking Holdings Inc.

- Expedia Group

- Amadeus IT Group

- Sabre Corporation

- Trip.com Group

- Airbnb Inc.

- Google Travel

- Microsoft (Travel AI Solutions)

- Samsung SDS (Smart City & Tourism Solutions)

- Huawei Technologies (Smart Destination Platforms)

- TUI Group (Digital Tourism Services)

- Travelport

- NEC Corporation

- Siemens Smart Infrastructure

- Accenture Travel Technology Services

Recent Developments

- In March 2025, Amadeus launched an AI-driven smart destination platform enabling real-time visitor flow optimization for tourism boards.

- In January 2025, Booking Holdings introduced immersive AR-powered city guides integrated into its mobile app for major global destinations.

- In November 2024, Trip.com Group partnered with several Asian governments to develop multilingual smart tourism services supporting inbound travelers.