Tourism Market Size

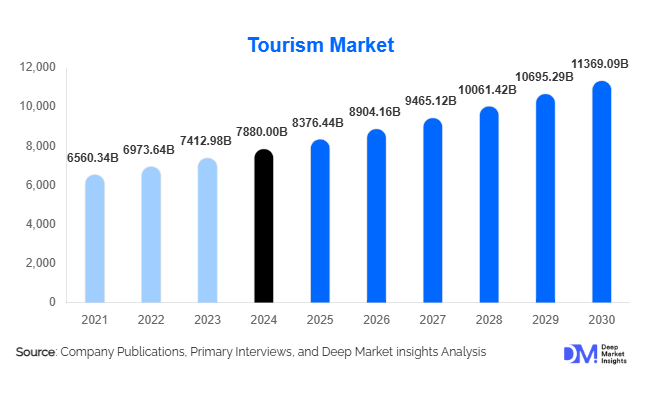

According to Deep Market Insights, the global tourism market size was valued at USD 7,880 billion in 2024 and is projected to grow from USD 8,376.44 billion in 2025 to reach USD 11,369.09 billion by 2030, expanding at a CAGR of 6.3% during the forecast period (2025–2030). Market growth is primarily driven by the rising adoption of digital travel technologies, post-pandemic recovery of international travel, and increasing demand for sustainable and experience-driven tourism worldwide.

Key Market Insights

- Technology-driven tourism experiences are transforming traveler engagement through AI, AR/VR, and personalized digital itineraries.

- Sustainable and responsible travel is becoming a central focus, with eco-friendly accommodations and carbon-neutral trips gaining traction.

- Asia-Pacific dominates the global market due to rapid urbanization, growing disposable incomes, and government-led tourism infrastructure development.

- Europe remains a key destination hub, driven by cultural, heritage, and luxury tourism segments.

- North America leads in outbound spending, supported by a strong preference for international leisure and adventure travel.

- Emerging markets in the Middle East and Africa are witnessing a surge in tourism investments aligned with national diversification agendas such as Saudi Vision 2030.

Latest Market Trends

Rise of Digital and Smart Tourism

Smart tourism initiatives are reshaping how destinations interact with travelers. Governments and private operators are investing in IoT-enabled systems, digital guide platforms, and AI-powered customer service to enhance the overall visitor experience. Mobile booking platforms and AI chatbots are streamlining travel planning, while data analytics enable more personalized marketing. Cities like Dubai, Singapore, and Barcelona are pioneering “smart destination” ecosystems integrating digital payments, virtual guides, and sustainability tracking tools.

Growing Popularity of Sustainable and Regenerative Tourism

Environmental consciousness is redefining tourism choices. Travelers are increasingly prioritizing destinations that minimize ecological impact and promote community welfare. Regenerative tourism models—where visitors contribute positively to local ecosystems—are expanding across Europe, Oceania, and Latin America. Hotels and operators are adopting renewable energy, waste reduction practices, and local sourcing to meet eco-tourism standards. Certifications such as Green Globe and EarthCheck are becoming key differentiators in traveler decision-making.

Tourism Market Drivers

Increasing Global Middle-Class and Disposable Incomes

Economic growth in emerging economies has expanded the global middle-class population, driving international and domestic travel demand. Rising disposable incomes, particularly in Asia-Pacific and Latin America, are enabling more frequent and premium travel experiences. Affordable airfares and expanded visa-free travel agreements further contribute to global mobility, boosting leisure and business tourism alike.

Advancements in Travel Technology

Digital transformation continues to accelerate within the tourism ecosystem. Online travel agencies (OTAs), mobile booking platforms, and real-time language translation apps are enhancing accessibility and convenience. Artificial intelligence, big data, and blockchain applications are improving customer targeting, payment security, and loyalty programs. The rise of immersive experiences through augmented and virtual reality also strengthens destination marketing and traveler engagement.

Market Restraints

Geopolitical Instability and Safety Concerns

Political unrest, regional conflicts, and security concerns can disrupt international travel flows. Tourism-dependent regions often experience sharp downturns during geopolitical crises. Safety perceptions heavily influence traveler confidence, affecting bookings and destination choice, particularly in regions with uncertain political climates.

Environmental and Overtourism Challenges

Overtourism has led to congestion, habitat degradation, and cultural erosion in popular destinations. Cities like Venice and Bali are implementing visitor caps and tourism taxes to mitigate pressure on local environments. Additionally, rising carbon emissions from air travel continue to challenge sustainability goals, pushing the industry toward greener transportation alternatives and carbon-offset programs.

Tourism Market Opportunities

Expansion of Wellness and Experiential Tourism

Wellness tourism is emerging as one of the fastest-growing niches, blending travel with physical and mental well-being. Yoga retreats, meditation tours, and spa getaways are gaining traction among affluent travelers seeking balance and rejuvenation. Destinations are integrating wellness amenities, organic cuisine, and nature-based activities to attract health-conscious consumers.

Rising Popularity of Domestic and Rural Tourism

Post-pandemic trends have accelerated domestic travel, with rural, countryside, and heritage destinations gaining appeal for their authenticity and lower crowd density. Governments are promoting rural tourism to support local economies and decentralize travel flows from urban centers. This shift is creating new business opportunities for small-scale operators and community-based tourism enterprises.

Tourism Type Insights

Leisure tourism dominates the market, accounting for the largest revenue share due to increasing global demand for holidays, cultural exploration, and entertainment travel. Business tourism, while recovering post-pandemic, remains significant, driven by MICE (Meetings, Incentives, Conferences, and Exhibitions) activities. Adventure tourism is gaining strong momentum, particularly among millennials, while wellness tourism continues to rise as a premium lifestyle choice. Educational and volunteer tourism are also expanding among socially conscious and younger travelers seeking purposeful experiences.

Booking Channel Insights

Online channels lead the global tourism market, with OTAs and direct hotel and airline websites capturing the majority of bookings. The shift toward digital convenience is reinforced by mobile-first travelers and personalized recommendations powered by AI algorithms. Offline travel agencies continue to hold relevance in the luxury and corporate travel sectors, where tailored services and human expertise remain valuable. Hybrid models combining digital and offline interactions are increasingly popular among multi-generational travelers.

Traveler Type Insights

Solo travelers represent a growing segment, particularly among younger demographics seeking independence and self-exploration. Family tourism remains strong, especially in beach and theme park destinations. Group travel, including corporate and organized leisure tours, continues to drive volume in both budget and mid-range categories. Couples and honeymooners account for a substantial share of luxury tourism, emphasizing privacy and exclusive experiences.

Age Group Insights

Travelers aged 25–44 years dominate the tourism market, representing the core demographic driving experiential and adventure-based travel. The 45–64 age group accounts for substantial luxury and cultural tourism spending, while Generation Z (18–24 years) is driving budget-friendly and social-media-driven travel trends. Older travelers above 65 years are contributing to the rise in wellness and cruise tourism, valuing comfort, health, and slow-paced itineraries.

| By Tourism Type | By Booking Channel | By Traveler Type | By Age Group |

|---|---|---|---|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific leads the global tourism market, driven by robust growth in China, India, Japan, and Southeast Asia. Rapid urbanization, improved infrastructure, and government investment in tourism promotion are accelerating inbound and outbound travel. China remains a powerhouse in outbound tourism, while India is emerging as both a significant source and destination market. Australia and Thailand continue to attract large volumes of regional travelers, supported by advanced air connectivity.

Europe

Europe remains the largest inbound tourism region globally, with iconic destinations such as France, Italy, and Spain leading international arrivals. The region’s strong focus on heritage, gastronomy, and cultural festivals underpins its resilience. Sustainable tourism initiatives and digital transformation programs across EU member states are enhancing traveler experiences and reducing environmental footprints.

North America

North America holds a significant share of global outbound tourism spending, led by the U.S. and Canada. Domestic tourism remains robust, with national parks, road trips, and nature-based experiences gaining popularity. The U.S. continues to attract global travelers for leisure, business, and entertainment, while Mexico and the Caribbean are benefiting from regional travel demand.

Middle East & Africa

The Middle East is undergoing rapid tourism diversification, driven by initiatives such as Saudi Vision 2030 and Dubai’s Tourism Strategy 2031. Mega-projects like NEOM and Red Sea Global are redefining luxury and eco-tourism experiences. Africa, meanwhile, is experiencing a tourism renaissance, with Kenya, South Africa, and Morocco emerging as leading regional destinations combining adventure, culture, and wildlife.

Latin America

Latin America’s tourism market is growing steadily, led by Brazil, Mexico, and Argentina. The region is gaining recognition for eco-tourism, adventure travel, and heritage circuits. Sustainable practices are being increasingly integrated into tourism development, especially across Costa Rica, Peru, and Chile, to appeal to environmentally conscious travelers.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Global Tourism Market

- Booking Holdings Inc.

- Expedia Group, Inc.

- Airbnb, Inc.

- TripAdvisor, Inc.

- Marriott International

- Hilton Worldwide Holdings

- CWT (Carlson Wagonlit Travel)

- TUI Group

Recent Developments

- In September 2025, Booking Holdings announced an AI-driven personalization platform enhancing traveler recommendations and eco-friendly lodging visibility.

- In August 2025, Expedia Group expanded its partnership with major airlines to integrate sustainable flight options and carbon offset features for users.

- In July 2025, Airbnb launched its “Regenerative Stays” initiative, promoting community-based and sustainability-certified accommodations globally.