Urban Tourism Market Size

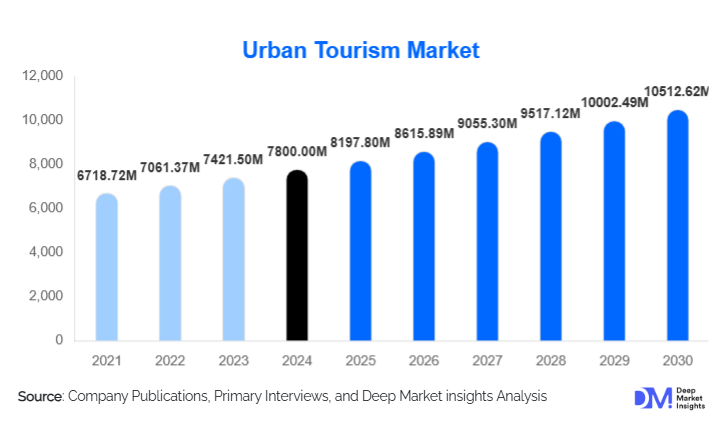

According to Deep Market Insights, the global urban tourism market size was valued at USD 7,800.00 million in 2024 and is projected to grow from USD 8,197.80 million in 2025 to reach USD 10,512.62 million by 2030, expanding at a CAGR of 5.1% during the forecast period (2025–2030). Urban tourism market growth is primarily driven by rising global urbanization, increasing traveler preference for immersive city-based experiences, digital platform adoption, and expanding cultural, culinary, and entertainment offerings in major metropolitan areas.

Key Market Insights

- Urban tourism is shifting toward hyper-personalized, experience-driven travel, with visitors prioritizing authentic cultural immersion, local dining, and on-foot city exploration.

- Digital platforms and smart-city technologies are becoming essential, enabling AI-based itinerary planning, AR-supported landmark tours, and seamless app-enabled navigation.

- Asia-Pacific is the fastest-growing region, driven by rapid urbanization, rising middle-class populations, and strong investment in tourism infrastructure.

- Domestic city tourism dominates in most geographies as travelers increasingly choose short, frequent “micro-cations” to urban destinations.

- Europe and North America remain top-performing urban tourism markets, supported by strong cultural assets, business-travel flows, and extensive transportation networks.

- Sustainability and low-impact urban tourism, including cycling tours, green roofs, and eco-urban circuits, is becoming a major traveler preference, influencing city planning and tour design.

What are the latest trends in the urban tourism market?

Smart-City Tourism and Digital Integration

Cities worldwide are deploying smart technologies that enhance convenience, safety, and engagement for tourists. Mobile apps offering real-time transit updates, digital museum passes, and AI-powered guides are now central to the urban tourism experience. Augmented reality (AR) overlays are allowing travelers to explore historical narratives layered onto modern city streets, while digital ticketing solutions streamline access to attractions. Additionally, predictive analytics are being used by tourism boards to distribute visitor traffic and reduce overcrowding at popular sites. This digital-first shift, accelerated by consumer expectations for frictionless travel, is redefining how tourists interact with city environments.

Sustainable and Low-Impact Urban Exploration

Urban tourists are increasingly seeking sustainable experiences, bike-friendly city tours, pedestrian-only cultural routes, and eco-initiatives such as rooftop farms and nature-integrated architecture. Many cities are implementing environmental management strategies, including low-emission zones, green transit systems, and large-scale urban park revitalization projects. Travelers are gravitating toward eco-certified hotels, carbon-neutral activities, and locally sourced culinary experiences. The shift toward sustainability is also prompting municipal authorities to develop regenerative-tourism frameworks, balancing economic growth with environmental protection.

What are the key drivers in the urban tourism market?

Rising Preference for Experiential City Travel

Global travelers, especially Millennials and Gen Z, are increasingly prioritizing immersive city experiences over traditional sightseeing. This includes local food exploration, cultural festivals, creative districts, nightlife, street art tours, and community-led micro-experiences. Urban destinations are responding with curated itineraries that highlight authentic, hyper-local experiences. The demand for short, frequent urban getaways is also rising due to flexible work arrangements and the popularity of "bleisure" travel, where business trips are extended for leisure activities.

Growth of Digital Booking Channels and Mobile Travel Ecosystems

The expansion of online travel agencies (OTAs), meta-search engines, and city-specific travel apps has dramatically improved accessibility and visibility for urban tourism. Travelers rely heavily on mobile-first platforms for accommodation, transportation, and activity bookings, fueling demand for digital convenience. Dynamic pricing, real-time reviews, and instant-booking capabilities make it easier for tourists to plan trips efficiently. Increased smartphone penetration and digital payments adoption have further accelerated this shift, making digital integration a critical growth driver.

What are the restraints for the global market?

Overcrowding and Infrastructure Pressure

Major cities face growing challenges related to overcrowding, particularly at iconic sites and during peak seasons. Congested transportation networks, limited public spaces, and pressure on city services reduce visitor satisfaction and can trigger pushback from residents. Some cities are introducing tourist caps, congestion pricing, or regulatory restrictions, which may limit short-term growth. Without sustainable visitor management, many urban destinations risk environmental degradation and community resistance.

Regulatory Constraints and Rising Operational Costs

Urban tourism operations, particularly accommodations such as short-term rentals, face complex and frequently changing regulations. Restrictions on Airbnb-style rentals, zoning rules, and tourist taxes impact both operators and travelers. Additionally, rising urban labour costs, real estate prices, and service expenses reduce margins for hotels, attractions, and tour operators. Economic fluctuations, visa complexities, and high intra-city travel costs further challenge industry expansion.

What are the key opportunities in the urban tourism industry?

Emerging Digital Experiences and Virtual Urban Tourism

Augmented and virtual reality technologies present new opportunities for creating immersive digital city tours, historical reconstructions, and interactive museum content. Virtual tourism also allows cities to promote lesser-known or under-visited attractions, helping to disperse visitor traffic. Operators can develop subscription-based or on-demand virtual experiences that generate additional revenue streams while enhancing pre-trip planning for travelers.

Expansion of Eco-Urban Tourism and Community-Led Initiatives

Urban farms, green architecture, community markets, and artisan-led experiences are gaining traction as travelers seek authentic, sustainable, and socially conscious tourism alternatives. Cities have opportunities to partner with local communities to create tourism circuits that promote small businesses, cultural preservation, and environmental stewardship. Community-guided tours, neighborhood storytelling walks, and indigenous craft hubs offer differentiation in a competitive market.

Product Type Insights

Accommodation-based offerings remain central to urban tourism. Hotels, especially mid-range and upscale categories, dominate due to demand from business travelers and leisure tourists seeking comfort and convenience. Hostels and short-term rentals attract younger demographics seeking affordability and social experiences, while serviced apartments appeal to long-stay corporate travelers and families. Experience-based tourism products such as food tours, cultural workshops, night markets, and smart-city tours are expanding rapidly, driven by the shift toward experiential travel.

Application Insights

Leisure tourism leads the market, supported by sightseeing, cultural exploration, shopping, dining, and nightlife activities. Business tourism also holds a significant share due to conferences, meetings, exhibitions, and corporate travel. Cultural and heritage tourism is expanding as cities invest in museums, arts festivals, and heritage-site restoration. Culinary tourism, centered on food districts, street markets, and chef-led tours, is emerging as a major application, particularly among younger travelers. Urban eco-tourism, including cycling tours and nature-integrated urban developments, is growing as sustainability becomes a core priority.

Distribution Channel Insights

Online travel agencies (OTAs) and digital booking platforms dominate the distribution landscape, driven by convenience and wide selection. Direct booking via hotel websites and city tourism portals is rising due to personalized offers and loyalty programs. Mobile apps, featuring city passes, attraction bundles, and real-time navigation, are becoming essential. Offline travel agents maintain relevance for luxury city travel and corporate bookings, while influencer-driven social media channels increasingly shape traveler decision-making, especially for younger demographics.

Traveler Type Insights

Domestic travelers constitute the largest segment, driven by short-haul urban breaks and regional mobility. International travelers contribute significant revenue through longer stays and higher spending patterns. Solo travelers and digital nomads prioritize flexible, experience-rich itineraries, while couples focus on romantic dining, cultural activities, and premium stays. Families are increasingly seeking child-friendly city attractions and urban parks. Group travelers remain important for corporate retreats, school travel, and organized tours.

Age Group Insights

Travelers aged 25–45 years represent the largest share, driven by urban lifestyle preferences, flexible work models, and disposable income. Younger travelers (18–30 years) drive demand for budget-friendly accommodations, nightlife, and social experiences. Middle-aged groups (45–60 years) focus on cultural, culinary, and premium city experiences. Older tourists (60+) prefer guided tours, accessible attractions, and comfort-oriented accommodations, contributing to strong growth in premium urban tourism.

| By Purpose of Visit | By Type of Activities | By Tourist Type | By Booking & Distribution Channel | By Accommodation Type |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds a major share of the global urban tourism market due to high domestic travel volumes and iconic cities such as New York, Los Angeles, and Chicago. Strong cultural institutions, vibrant dining scenes, and large-scale events fuel demand. Business tourism is highly developed, while growing interest in sustainable, walkable city experiences is reshaping tourism strategies.

Europe

Europe is one of the most mature and culturally rich urban tourism regions. Cities like Paris, London, Berlin, and Barcelona attract travelers seeking historical heritage, architectural landmarks, and renowned museums. Europe’s compact geography, efficient transport networks, and emphasis on sustainability make it a stronghold for both leisure and cultural tourism.

Asia-Pacific

Asia-Pacific is the fastest-growing region, driven by rapid urbanization, expanding middle-class populations, and heavy investment in modern tourism infrastructure. Leading destinations include Tokyo, Shanghai, Seoul, Singapore, Bangkok, and Mumbai. APAC cities are experiencing strong demand for both luxury and mid-range travel products, with social media significantly influencing traveler preferences.

Latin America

Latin American urban tourism is growing steadily, led by cities such as São Paulo, Mexico City, Rio de Janeiro, and Buenos Aires. Travelers are attracted to cultural festivals, culinary tourism, and creative districts. Constraints include infrastructure challenges, but increasing international connectivity is boosting market potential.

Middle East & Africa

The Middle East, particularly Dubai, Abu Dhabi, and Riyadh, continues to invest heavily in city tourism through mega-projects, luxury hospitality, and world-class events. Africa’s urban tourism is growing in cities like Cape Town, Johannesburg, Nairobi, and Marrakech, supported by strong cultural diversity and rising intra-regional travel.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Urban Tourism Market

- Booking Holdings

- Airbnb, Inc.

- Expedia Group

- Accor S.A.

- Marriott International

- Hilton Worldwide

- Trip.com Group

- TripAdvisor (Experiences)

- TUI Group

- Go City

Recent Developments

- In 2024, several major cities launched smart-tourism platforms integrating AI itineraries, contactless city passes, and augmented reality museum guides.

- In 2025, global hotel chains expanded their urban lifestyle brands, targeting Millennials and Gen Z with design-focused, experience-driven micro-hotels.

- In late 2024, digital travel platforms introduced enhanced “eco-urban” filters, enabling users to book sustainable city experiences and low-emission accommodations.