Rice Crackers Market Size

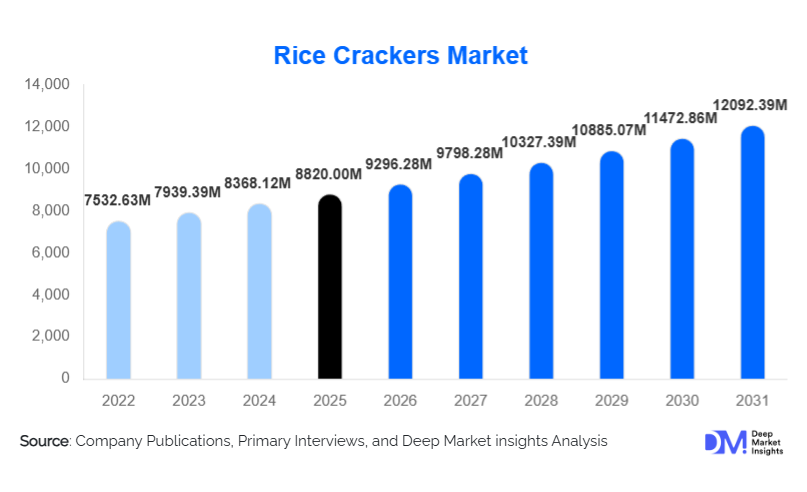

According to Deep Market Insights, the global rice crackers market size was valued at USD 8,820.00 million in 2025 and is projected to grow from USD 9,296.28 million in 2026 to reach USD 12,092.39 million by 2031, expanding at a CAGR of 5.4% during the forecast period (2026–2031). The rice crackers market growth is primarily driven by rising demand for gluten-free and plant-based snacks, increasing global adoption of Asian food formats, and strong innovation in flavors, premium products, and health-oriented formulations.

Key Market Insights

- Rice crackers are increasingly positioned as healthier snack alternatives, benefiting from low-fat profiles, gluten-free composition, and clean-label formulations.

- Asia-Pacific dominates global consumption, supported by strong domestic demand in China, Japan, and South Korea, along with export-led growth.

- Flavored rice crackers lead product demand, driven by consumer preference for savory, umami, and fusion flavor profiles.

- North America and Europe are witnessing accelerated adoption, supported by growing Asian diaspora populations and health-conscious snack consumers.

- E-commerce and D2C channels are expanding rapidly, supported by the long shelf life and strong suitability of rice crackers for online grocery sales.

- Premiumization and organic variants are emerging as key growth levers, particularly in urban and developed markets.

What are the latest trends in the rice crackers market?

Premiumization and Health-Focused Innovation

Manufacturers are increasingly focusing on premium rice crackers formulated with organic rice, ancient grains, seeds, and reduced sodium content. These products cater to consumers seeking clean-label, functional snacks and are often priced 20–35% higher than mass-market alternatives. Premium packaging, gourmet flavor combinations, and smaller batch production are strengthening brand differentiation and margins. This trend is particularly strong in North America, Europe, and urban Asia, where consumers associate premium snacks with quality, health, and sustainability.

Flavor Diversification and Fusion Profiles

Flavor innovation remains a central trend shaping market competitiveness. Beyond traditional soy sauce and seaweed flavors, companies are introducing spicy, sweet-savory, cheese-infused, and global fusion flavors to attract younger demographics. Umami-based and spicy variants are gaining traction across Western markets, while sweet and coated rice crackers are expanding appeal among family and child consumers. Limited-edition and region-specific flavors are increasingly used as tools to boost engagement and repeat purchases.

What are the key drivers in the rice crackers market?

Rising Demand for Gluten-Free and Plant-Based Snacks

Rice crackers naturally align with gluten-free and vegan dietary trends, making them a preferred snack choice among health-conscious consumers and individuals with food intolerances. The growing prevalence of lifestyle-driven dietary restrictions has significantly expanded the consumer base for rice crackers, especially in North America and Europe. This driver alone accounts for a substantial share of incremental market demand in developed regions.

Urbanization and Changing Snacking Habits

Rapid urbanization and evolving work-life patterns are increasing the demand for convenient, ready-to-eat snacks. Rice crackers benefit from portability, long shelf life, and versatility across consumption occasions. The growing penetration of modern retail and convenience stores in emerging economies is further supporting volume growth, particularly in Asia-Pacific and Latin America.

What are the restraints for the global market?

Volatility in Raw Material Prices

Rice price fluctuations driven by climate conditions, export restrictions, and input cost volatility directly impact production economics. Manufacturers operating in mass-market segments face margin pressure during periods of rising raw material prices, limiting pricing flexibility and profitability.

Perception of High Sodium Content

Traditional rice crackers are often associated with high sodium levels, which can restrict consumption among health-sensitive consumers. Regulatory pressure and evolving nutritional guidelines are pushing manufacturers toward reformulation, increasing R&D and production complexity.

What are the key opportunities in the rice crackers industry?

Export-Led Growth from Asia

Asia-Pacific manufacturers are increasingly leveraging export demand from North America and Europe, where Asian snacks are gaining mainstream acceptance. Localization of flavors, compliance with international food safety standards, and private-label partnerships with global retailers are opening new revenue streams for producers.

Expansion of Online and Direct-to-Consumer Channels

The rapid growth of online grocery and brand-owned D2C platforms presents a strong opportunity for rice cracker manufacturers. Digital channels enable direct consumer engagement, personalized offerings, and higher margins. Online sales of rice crackers are growing at a faster pace than traditional retail, particularly among younger and urban consumers.

Product Type Insights

Flavored rice crackers dominate the global rice crackers market, accounting for approximately 42% of total revenue in 2025. This segment’s leadership is primarily driven by strong consumer preference for savory, umami-rich, and regionally inspired flavor profiles such as soy sauce, seaweed, chili, and sweet–savory combinations. Flavor diversification enables manufacturers to cater to both traditional Asian palates and Western consumers seeking novel snack experiences, making flavored variants the most commercially scalable product category. Additionally, continuous innovation through limited-edition flavors, fusion seasonings, and premium ingredient blends has significantly increased repeat purchases and brand loyalty.

Traditional plain rice crackers continue to maintain relevance, particularly in the Asia-Pacific region, where they are deeply embedded in cultural consumption habits and daily snacking routines. These products benefit from minimal ingredient formulations and strong price competitiveness. Meanwhile, stuffed and coated rice crackers—including cheese-filled, nut-filled, and chocolate-coated variants—are emerging as niche premium offerings. These products appeal to younger consumers and gifting occasions, commanding higher price points and margins. Rice cracker mixes are also gaining traction, especially in family packs and festive assortments, as they offer variety, portion flexibility, and increased perceived value, supporting incremental volume growth.

Nature Insights

Conventional rice crackers account for nearly 78% of total market demand, supported by their affordability, mass production scalability, and extensive availability across modern retail, convenience stores, and traditional trade channels. This segment remains the backbone of the global market, particularly in price-sensitive regions such as Asia-Pacific and Latin America, where high-volume consumption drives steady demand.

Organic rice crackers, while currently representing a smaller share, are the fastest-growing sub-segment, expanding at over 10% CAGR. Growth is driven by increasing health awareness, rising demand for clean-label and chemical-free foods, and stronger purchasing power in developed economies. Consumers in North America and Europe are increasingly willing to pay premium prices for organic certifications, non-GMO claims, and sustainably sourced rice. This trend is encouraging manufacturers to expand organic product lines and invest in certified supply chains, positioning organic rice crackers as a key long-term growth driver despite their higher cost structure.

Distribution Channel Insights

Modern retail channels, including supermarkets and hypermarkets, lead rice cracker distribution with nearly 48% market share in 2025. Their dominance is driven by strong shelf visibility, impulse-driven purchases, and the ability to stock a wide variety of flavors, pack sizes, and price points. Promotional activities, in-store sampling, and private-label offerings further enhance sales volumes in this channel.

Convenience stores remain a critical distribution channel, particularly in Asia-Pacific, where high store density, frequent footfall, and preference for single-serve packs support consistent demand. Online retail and direct-to-consumer (D2C) platforms are witnessing double-digit growth, supported by increasing digital grocery adoption, the long shelf life of rice crackers, and growing consumer preference for home delivery. Specialty and health food stores play an important role in premium and organic rice cracker sales, acting as key touchpoints for health-conscious consumers and supporting brand positioning in the high-value segment.

End-Use Insights

Household consumption represents over 70% of total demand, driven by everyday snacking habits, family consumption, and the suitability of rice crackers across age groups. Their versatility as standalone snacks, accompaniments, or meal add-ons supports frequent household purchases, particularly in urban markets.

The foodservice and HoReCa segment is growing at a faster pace, driven by the rising use of rice crackers in airline catering, cafés, hotels, and Asian quick-service restaurants. These establishments increasingly prefer rice crackers as portion-controlled, shelf-stable snack options that align with health-oriented menus. Export-oriented snack manufacturing and private-label production for global retailers are also emerging as important demand drivers, particularly as international retailers expand Asian and gluten-free snack assortments across global markets.

| By Product Type | By Nature | By Flavor Profile | By Distribution Channel | By Price Positioning |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific accounts for approximately 46% of the global market share in 2025, making it the largest and most mature regional market. China, Japan, and South Korea lead consumption, supported by strong cultural integration of rice crackers into daily diets, traditional snack customs, and gifting practices. The region also benefits from large-scale manufacturing capacity, cost-efficient production, and well-established domestic distribution networks.

Export-driven growth is a key regional driver, with Asia-Pacific manufacturers supplying rice crackers to North America, Europe, and the Middle East. Emerging markets such as India, Indonesia, Thailand, and Vietnam are witnessing rapid growth due to urbanization, rising disposable incomes, and expanding modern retail infrastructure. Increased exposure to packaged snacks and growing demand for affordable, healthier alternatives are accelerating regional consumption.

North America

North America holds around 21% of the global rice crackers market, with the United States accounting for the majority of regional demand. Growth is driven by rising adoption of gluten-free and plant-based diets, increasing popularity of Asian cuisine, and strong demand for premium and flavored snack products. Rice crackers are increasingly positioned as better-for-you alternatives to traditional chips and crackers.

Canada is witnessing steady growth, particularly in organic and specialty rice crackers, supported by high health awareness and strong penetration of specialty grocery chains. The rapid expansion of e-commerce grocery platforms and private-label offerings by large retailers is further supporting market growth across the region.

Europe

Europe represents approximately 18% of global demand, led by the U.K., Germany, and France. Regional growth is driven by strong consumer preference for clean-label, organic, and sustainably packaged snacks. European consumers show high sensitivity to ingredient transparency, sodium reduction, and environmental impact, which is pushing manufacturers toward reformulation and premium positioning.

The growing popularity of Asian food culture, combined with rising snack consumption between meals, is supporting demand across both Western and Northern Europe. Expansion of health food stores and organic retail chains further strengthens the premium rice crackers segment.

Latin America

Latin America is the fastest-growing regional market, expanding at over 8% CAGR, led by Brazil and Mexico. Growth is supported by rising middle-class income levels, increasing urbanization, and growing exposure to global snack trends. Consumers are increasingly shifting from unpackaged snacks to branded, packaged alternatives, benefiting rice cracker adoption.

Expansion of modern retail formats and increasing availability of imported Asian snack products are key drivers. Manufacturers are also introducing localized flavors to improve market penetration and acceptance across the region.

Middle East & Africa

The Middle East & Africa region is witnessing gradual but steady growth, driven by rising demand for premium and imported snack products in countries such as the UAE and Saudi Arabia. High purchasing power, strong tourism activity, and growing expatriate populations are supporting demand for Asian snack formats, including rice crackers.

South Africa remains a key consumption hub within Africa, supported by developed retail infrastructure and increasing health awareness. Growth across the region is further supported by rising imports, expanding specialty food retail, and increasing demand for halal-certified and better-for-you snack options.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Rice Crackers Market

- Kameda Seika

- Want Want China

- Bourbon Corporation

- Amanoya

- Sanko Seika

- Nongshim

- Master Kong

- Three Squirrels

- Orion Corporation

- Lotte Confectionery

- Hapi Foods

- JFC International

- Bin Bin Rice Cracker

- Tsingtao Food

- Senbei Co. Ltd