Rare Sugar Market Size

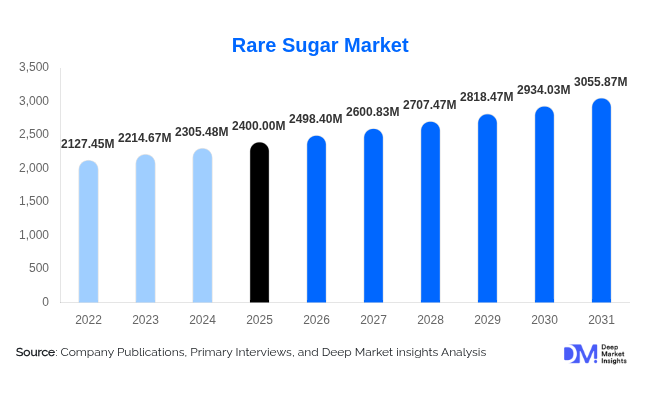

According to Deep Market Insights, the global rare sugar market size was valued at USD 2,400.00 million in 2025 and is projected to grow from USD 2,498.40 million in 2026 to reach USD 3,055.87 million by 2031, expanding at a CAGR of 4.1% during the forecast period (2026–2031). The rare sugar market growth is primarily driven by increasing consumer demand for low-calorie, low-glycemic natural sweeteners, rising health-consciousness among populations globally, and the expansion of biotechnological production methods that improve scalability and cost-efficiency.

Key Market Insights

- Allulose and tagatose are leading product types, offering sweetness similar to sucrose with minimal caloric impact, driving food and beverage reformulations.

- Synthetic and biotechnologically produced rare sugars dominate due to scalability, cost-efficiency, and high purity compared to natural sources.

- North America holds the largest market share (~35%), supported by health-focused consumers, early regulatory acceptance, and strong R&D in functional food applications.

- Asia-Pacific is the fastest-growing region, fueled by rising middle-class income, urbanization, and increasing adoption of functional foods in China, Japan, and India.

- Food and beverages remain the primary application, with industrial food manufacturers being the largest end-users due to large-scale reformulations for sugar reduction.

- Technological advancements, including enzymatic production and fermentation innovations, are increasing efficiency, lowering costs, and enabling new rare sugar variants.

What are the latest trends in the rare sugar market?

Health-Driven Reformulation in Food & Beverages

Manufacturers are increasingly reformulating products to reduce added sugar content while maintaining taste and texture. Rare sugars such as allulose and tagatose are being used in bakery, confectionery, dairy, and beverages to provide sweetness with low glycemic response. Functional benefits such as prebiotic activity, weight management, and metabolic health further drive consumer preference. Brands are leveraging rare sugars to meet clean-label and “better-for-you” positioning, especially in developed markets where health awareness is high.

Technological Innovation in Production

Enzymatic synthesis and fermentation processes are emerging as key trends in rare sugar production. Companies are adopting biotechnological approaches to improve yield, purity, and scalability. This enables a consistent supply for industrial food manufacturers and reduces production costs. Innovations also allow tailored formulations for dietary supplements and pharmaceuticals. The focus on R&D and process optimization is expected to increase global availability and adoption of rare sugars across multiple applications.

What are the key drivers in the rare sugar market?

Rising Health Consciousness

Growing awareness of diabetes, obesity, and metabolic disorders is pushing consumers toward low-calorie and low-glycemic sweeteners. Rare sugars offer sweetness similar to traditional sugar but with minimal impact on blood glucose, making them highly attractive for functional food, beverages, and nutraceutical products. This trend is particularly strong in North America and Europe, where health and wellness drive purchasing decisions.

Expansion Across Multiple End-Use Industries

Rare sugars are no longer limited to food and beverages; applications in dietary supplements, pharmaceuticals, and cosmetics are increasing. In pharmaceuticals, rare sugars are used in drug delivery and excipients, while nutraceuticals leverage metabolic benefits. This diversification widens the revenue base and mitigates dependency on a single industry.

Regulatory Support and Policy Initiatives

Government policies promoting sugar reduction and functional ingredients, coupled with regulatory approval for sugars like allulose in major markets, are facilitating broader adoption. Supportive regulations reduce barriers for market entry and encourage reformulation by food manufacturers globally.

What are the restraints for the global market?

High Production Costs

Although technological advances are improving efficiency, rare sugar production remains more expensive than conventional sugar. High capital investment, raw material costs, and complex enzymatic processes limit widespread adoption, especially in cost-sensitive emerging markets.

Regulatory Complexities

Different approval requirements across regions can slow product launches and create compliance challenges. While some rare sugars are approved in one market, additional safety and labeling standards may be required elsewhere, increasing costs and timelines for manufacturers.

What are the key opportunities in the rare sugar market?

Functional Food and Beverage Innovation

The growing demand for low-sugar, health-oriented food products presents significant opportunities. Manufacturers can innovate with rare sugar blends to create low-calorie snacks, beverages, bakery, and dairy products with functional health benefits. This trend supports product differentiation and clean-label positioning.

Technological Advancements in Production

Enzymatic and fermentation-based production methods allow higher yield and reduced costs, enabling entry into emerging markets. Companies can also develop tailored formulations for specific applications in nutraceuticals and pharmaceuticals, increasing product versatility.

Emerging Regional Demand

Asia-Pacific and Latin America are fast-growing regions for rare sugars. Rising middle-class income, urbanization, and increasing functional food adoption in countries like China, India, and Brazil create new markets for both local and export-oriented manufacturers.

Product Type Insights

Within the rare sugar market, Allulose and D‑Mannose continue to dominate, representing approximately 30–32% of the global market in 2025. Their dominance is primarily driven by their low-calorie profile, sugar-like taste, and metabolic benefits, which make them highly suitable for reformulation in food and beverages as well as functional nutrition products. These sugars enable manufacturers to develop products that cater to health-conscious consumers seeking sugar reduction without compromising taste or texture. Emerging rare sugars such as tagatose and D-psicose are gaining traction due to growing consumer awareness, increased regulatory acceptance, and ongoing innovations in enzymatic and fermentation production processes. Overall, product innovation, regulatory approvals, and functional health benefits serve as key drivers for growth in the product type segment, allowing Allulose and D‑Mannose to maintain their leading position globally.

Application Insights

The food and beverage sector accounts for the largest share of the rare sugar market, approximately 60–62% in 2025. This dominance is primarily due to the extensive use of rare sugars in bakery, confectionery, dairy, and beverage reformulations, particularly in products targeting low-calorie, low-glycemic, or functional nutrition claims. Nutraceuticals and dietary supplements represent a rapidly growing application segment, driven by rising interest in prebiotic and metabolic health benefits. Pharmaceuticals are increasingly exploring rare sugars for functional excipients and therapeutic formulations, contributing to market diversification and higher value applications. The primary driver for growth in this segment is the increasing consumer demand for healthier food options and the trend toward functional, clean-label, and sugar-reduced products, which is fostering innovation across multiple application domains.

Distribution Channel Insights

Industrial food manufacturers and B2B ingredient suppliers dominate the distribution landscape, reflecting the large-scale usage of rare sugars in commercial food production. Online procurement platforms are gaining traction for bulk ingredient sourcing, offering convenience, transparency, and real-time order tracking. Retail channels, including supermarkets and e-commerce platforms, are expanding as consumer-facing functional foods containing rare sugars gain popularity. Direct B2B sales from manufacturers continue to ensure quality control, consistency, and scalability for large-scale production. Growth in this segment is driven by the increasing demand from industrial food producers for reliable, high-purity rare sugar sources, alongside the rising adoption of digital procurement platforms enabling faster supply chain access.

End-Use Insights

Industrial food and beverage manufacturers represent the largest end-user segment, accounting for approximately 58–60% of global demand in 2025. Their demand is driven by large-scale reformulations in response to sugar reduction initiatives, functional food trends, and regulatory pressures to offer low-calorie products. Nutraceuticals and dietary supplements are emerging as high-growth end-use segments, leveraging the metabolic and prebiotic benefits of rare sugars. Export-driven demand is significant, particularly from production hubs in North America and Asia-Pacific, where manufacturers supply global markets, especially Europe and Latin America. Key growth drivers in end-use segments include rising consumer health awareness, product innovation requirements, and expanding functional food and supplement industries globally.

| By Product Type | By Application | By Distribution Channel | By End-Use |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America holds the largest share of the rare sugar market at approximately 35% in 2025. The region’s growth is driven by strong consumer health awareness, early regulatory acceptance of rare sugars such as allulose and tagatose, and high adoption in food and beverage reformulations. The U.S. leads in both consumption and R&D investment, focusing on large-scale industrial reformulation and functional food innovation, while Canada follows closely due to rising health-conscious consumption. Other drivers include high disposable income, supportive government initiatives for sugar reduction, and advanced biotechnological capabilities that enable high-volume, consistent production of rare sugars for industrial applications.

Europe

Europe accounts for approximately 20–22% of the global market. Growth in this region is fueled by stringent sugar reduction regulations, widespread consumer preference for clean-label products, and strong functional food adoption in countries like Germany, France, and the U.K. Additional drivers include growing eco-conscious consumption, regulatory harmonization across the EU, and ongoing innovation by leading food manufacturers to meet sugar reduction and metabolic health trends. Functional food, nutraceuticals, and fortified beverages are key application areas, supported by high awareness of prebiotic and low-glycemic ingredients.

Asia-Pacific

Asia-Pacific is the fastest-growing region, expanding at a CAGR of approximately 6-7%. China, India, and Japan lead demand, with rising middle-class income, rapid urbanization, and increasing functional food adoption fueling market growth. China shows strong demand for luxury and group-oriented products, India focuses on mid-range formulations, and Japan maintains steady adoption in premium nutraceuticals. Growth drivers include government initiatives promoting healthier diets, increasing awareness of diabetes and obesity prevention, expanding e-commerce and modern retail infrastructure, and ongoing industrial-scale production of rare sugars enabling regional supply to meet domestic and export demand.

Latin America

Latin America represents approximately 8–10% of the market, led by Brazil and Argentina. Urbanization, rising health-conscious populations, and growing outbound travel contribute to increasing awareness of low-sugar and functional products. Growth drivers include rising disposable income, adoption of global food trends, and increasing investment in functional food and beverage sectors. Brazilian manufacturers are increasingly exploring export opportunities to meet demand in North America and Europe, further strengthening market potential.

Middle East & Africa

This region accounts for approximately 5–7% of the market, with the UAE, Saudi Arabia, and South Africa leading adoption. Africa continues to serve as a source of natural, rare sugars, while high-income Middle Eastern consumers drive premium product adoption. Growth is supported by increasing urbanization, rising health awareness, expanding modern retail and e-commerce infrastructure, and government support for local functional food initiatives. Additionally, the region is benefiting from cross-border exports, particularly to Europe and Asia, with manufacturers leveraging Africa’s natural sugar resources and Middle Eastern investment in high-end food and nutraceutical products.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Rare Sugar Market

- Tate & Lyle PLC

- Cargill, Incorporated

- Bonumose Inc.

- Matsutani Chemical Industry Co., Ltd.

- Daesang Corporation

- Roquette Frères

- Anderson Global Group, LLC

- Shandong Bailong Chuangyuan Bio-tech Co., Ltd.

- Shandong Fuyang Bio-tech Co., Ltd.

- CJ CheilJedang Corporation

- Samyang Corporation

- Ardilla Technologies

- Symrise AG

- Specom Biochemical

- DuPont de Nemours Inc.