Herbal Nutraceuticals Market Size

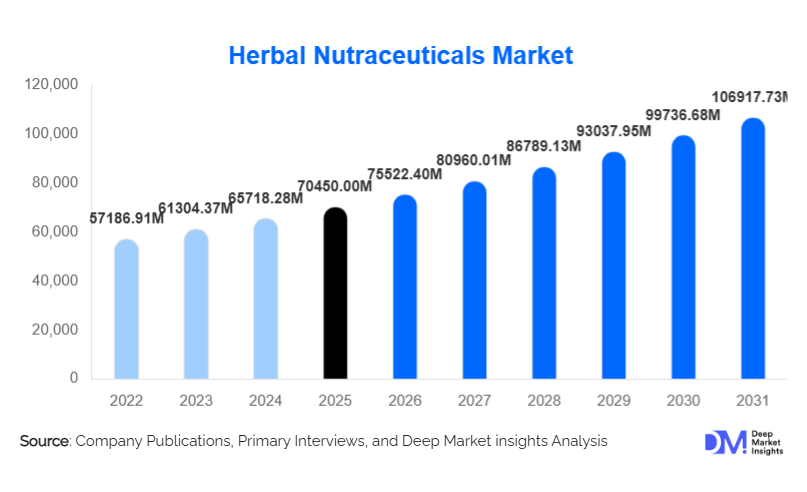

According to Deep Market Insights, the global herbal nutraceuticals market size was valued at USD 70,450.00 million in 2025 and is projected to grow from USD 75,522.40 million in 2026 to reach USD 106,917.73 million by 2031, expanding at a CAGR of 7.2% during the forecast period (2026–2031). The herbal nutraceuticals market growth is primarily driven by rising consumer awareness of preventive healthcare, increasing demand for immune-boosting supplements, and the expansion of functional herbal beverages and fortified foods globally.

Key Market Insights

- Herbal nutraceuticals are gaining preference for preventive and holistic healthcare, with consumers seeking natural alternatives to pharmaceuticals.

- Functional herbal beverages and fortified foods are witnessing strong demand growth, driven by urban populations seeking convenience and health benefits.

- Asia-Pacific dominates production due to rich traditional herbal knowledge, particularly in India, China, and Japan, supplying global markets.

- North America is the fastest-growing consumer market, supported by high disposable incomes and demand for scientifically validated herbal products.

- Online and D2C channels are transforming distribution, enabling brands to educate consumers and expand reach directly.

- Technological integration in product standardization, bioavailability enhancement, and quality testing is enhancing global trust and adoption.

What are the latest trends in the herbal nutraceuticals market?

Integration of Traditional Knowledge with Modern Science

Manufacturers are increasingly combining traditional herbal knowledge with modern extraction technologies and clinical validation. Standardized extracts of turmeric, ashwagandha, ginseng, and other herbs are gaining premium adoption due to proven efficacy and higher bioavailability. Companies investing in R&D for multi-herb formulations are offering targeted health benefits, such as cognitive support, anti-aging, and immune health, which attract health-conscious consumers willing to pay a premium.

Growth of Functional Beverages and Fortified Foods

Functional herbal beverages, including teas, RTD drinks, and herbal tonics, are becoming mainstream as urban populations seek convenient wellness options. Similarly, fortified foods such as snack bars, dairy alternatives, and cereals enriched with herbal extracts are increasingly popular. These segments appeal to younger consumers seeking quick, nutritious, and immunity-enhancing solutions, leading to significant CAGR in both retail and e-commerce channels.

What are the key drivers in the herbal nutraceuticals market?

Increasing Health and Wellness Awareness

Consumers worldwide are proactively seeking natural and preventive healthcare solutions. Herbal nutraceuticals offer antioxidant, adaptogenic, and anti-inflammatory properties that support immunity, cardiovascular health, and cognitive function. This trend is especially pronounced in regions with aging populations and rising lifestyle-related health concerns.

Regulatory Support and Government Initiatives

Governments in Asia-Pacific, including India and China, are actively supporting herbal product standardization and export promotion. Initiatives such as India’s Ayush Mission and China’s modernization programs for traditional medicine help expand production, ensure quality compliance, and boost consumer trust globally.

Rising Demand for Organic and Standardized Products

Premium consumers are increasingly preferring organic-certified and clinically validated herbal nutraceuticals. Brands offering organic turmeric, ashwagandha, and ginseng extracts are commanding higher margins and capturing growing demand in North America and Europe.

What are the restraints for the global market?

Lack of Standardization and Quality Control

Variability in raw material quality and inconsistent concentrations of active compounds can undermine consumer confidence and restrict market expansion. Global harmonization of regulatory standards remains a challenge.

High Product Pricing

Premium herbal extracts and organic-certified nutraceuticals are significantly more expensive than conventional alternatives. This limits adoption in price-sensitive regions such as Latin America and parts of Asia, restricting volume growth in these markets.

What are the key opportunities in the herbal nutraceuticals market?

Expansion via E-Commerce and D2C Models

Digital channels allow direct access to health-conscious consumers, providing personalized recommendations and subscription-based offerings. Brands integrating AI-powered wellness apps and personalized health solutions can tap into growing millennial and Gen Z markets.

Emerging Applications in Sports and Cognitive Nutrition

The growing sports nutrition and cognitive health segments represent lucrative opportunities. Herbal nutraceuticals supporting endurance, recovery, and mental performance are increasingly being incorporated into beverages, supplements, and functional foods targeted at athletes and knowledge workers.

Export-Led Growth from Asia-Pacific

Asia-Pacific producers are leveraging low-cost raw materials and traditional medicinal expertise to supply global markets. Exporting standardized and organic-certified herbal products to North America, Europe, and Middle East is creating high-margin opportunities for manufacturers.

Product Type Insights

Herbal dietary supplements dominate the market, particularly capsules and tablets, due to convenience and dosage standardization. Functional herbal beverages are rapidly growing, with teas, tonics, and RTD products appealing to urban consumers seeking quick wellness solutions. Fortified foods such as cereals and snack bars are emerging as high-value additions, particularly in developed markets where consumers prefer holistic nutrition alongside lifestyle convenience.

Application Insights

Immune health and wellness applications dominate the herbal nutraceuticals market, followed by cognitive function, cardiovascular support, and anti-aging applications. Sports nutrition and digestive health applications are emerging rapidly. Multi-herb formulations targeting specific health outcomes are gaining popularity in premium segments, while single-herb products such as turmeric and ashwagandha remain mainstream favorites.

Distribution Channel Insights

E-commerce and D2C platforms are growing fastest, enabling brands to communicate product benefits and traceability directly to consumers. Traditional retail channels such as pharmacies, supermarkets, and health stores remain important, particularly in regions with low digital penetration. Subscription-based models, health apps, and influencer-led marketing are increasingly shaping purchasing decisions among younger consumers.

End-User Insights

Household consumption accounts for the largest share of the herbal nutraceuticals market. Sports nutrition, cognitive enhancement, and beauty & anti-aging segments are witnessing double-digit growth, driving premium product adoption. Export demand, particularly from Asia-Pacific to North America and Europe, is increasing, with standardized and organic products commanding high prices.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific accounts for approximately 43% of the global herbal nutraceuticals market in 2025. India, China, and Japan dominate production due to rich herbal traditions, abundant raw materials, and government support. India is the fastest-growing market with a CAGR of 9.5%, driven by export opportunities and domestic consumption.

North America

North America holds around 25% of global market share, with the U.S. and Canada leading premium consumption. High disposable income, health-conscious urban populations, and demand for organic-certified products fuel growth. Immune and cognitive health supplements are particularly popular.

Europe

Europe accounts for 22% of the market, led by Germany, U.K., and France. Consumers favor scientifically validated, organic-certified products. Regulatory compliance and strong wellness culture support high-value adoption.

Latin America

Latin America contributes 6% of global market share, with Brazil and Mexico leading demand. Awareness is rising, but adoption is constrained by pricing and regulatory barriers.

Middle East & Africa

Combined share is approximately 4%, with UAE, Saudi Arabia, and South Africa emerging as premium consumers. Demand is driven by imported organic and standardized herbal products.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Herbal Nutraceuticals Market

- Himalaya Global Holdings Ltd.

- Dabur India Ltd.

- Amway Corporation

- Nature’s Bounty Co.

- Herbalife Nutrition Ltd.

- Swisse Wellness Pty Ltd.

- Pukka Herbs Ltd.

- NOW Foods, Inc.

- Gaia Herbs, Inc.

- Solgar, Inc.

- Nestlé Health Science

- Baidyanath Ayurved Bhawan Pvt Ltd.

- Planet Ayurveda

- Yakult Honsha Co., Ltd.

- Vitabiotics Ltd.