Global Pulse Ingredients Market Size

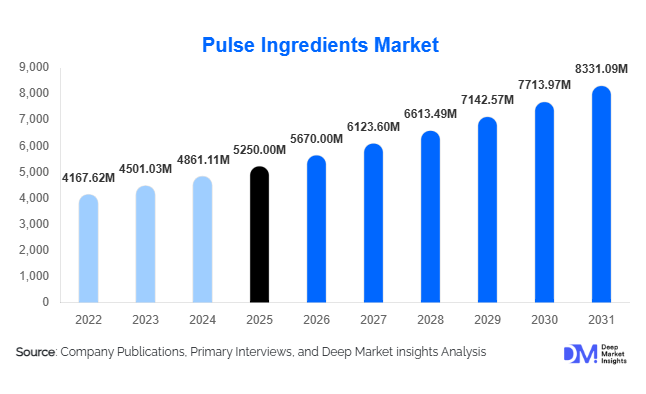

According to Deep Market Insights, the global pulse ingredients market size was valued at USD 5,250 million in 2026 and is projected to grow from USD 5,670.00 million in 2026 to reach USD 8,331.09 million by 2031, expanding at a CAGR of 8.0% during the forecast period (2026–2031). The market growth is primarily driven by the rising demand for plant-based proteins, increasing health and wellness awareness, innovations in functional food applications, and the adoption of pulse-derived ingredients across bakery, dairy alternatives, and meat substitute sectors.

Key Market Insights

- Pulse protein isolates are emerging as the most preferred ingredient, offering high protein content, solubility, and clean-label functionality suitable for diverse applications.

- Plant-based meat and dairy alternatives are fueling global demand, as consumers shift toward vegan, allergen-free, and sustainable food options.

- North America and Europe dominate consumption, led by the U.S., Canada, Germany, and the U.K., driven by strong plant-based food adoption and advanced processing infrastructure.

- Asia-Pacific is the fastest-growing region, led by India and China, with rising urbanization, nutrition awareness, and disposable incomes supporting market expansion.

- Technological innovations, including protein extraction, flavor-masking, and starch modification, are enhancing product versatility and supporting functional food development.

- Export-driven demand, particularly from Europe and North America to Asia-Pacific and LATAM, is strengthening global trade of pulse ingredients.

What are the latest trends in the pulse ingredients market?

Growth of Plant-Based Protein Applications

Pulse ingredients are increasingly being incorporated into plant-based meat alternatives, protein bars, beverages, and dairy substitutes. This trend is driven by consumer preference for vegan diets and the search for allergen-free, sustainable protein sources. Food manufacturers are leveraging pulses for their functional benefits, including water-binding, emulsification, and gelling properties, to create high-protein, clean-label products. Innovations in processing are enabling smoother textures and neutral flavors, broadening pulse adoption across diverse food categories.

Technological Advancements in Pulse Processing

Advancements in extraction and purification technologies have improved protein yield, solubility, and taste, making pulse ingredients more suitable for high-end applications such as beverages and meat analogs. Flavor masking and enzymatic treatments allow manufacturers to overcome bitterness and grainy textures, increasing product acceptance. Additionally, modified starches and fiber-enriched powders from pulses are enabling new functional food formulations, supporting nutritional fortification and innovative product development.

What are the key drivers in the pulse ingredients market?

Rising Health & Nutritional Awareness

Consumers worldwide are increasingly adopting high-protein, low-fat, and gluten-free diets, driving the demand for pulse-based ingredients. Pulse protein powders, flours, and starches are utilized extensively in bakery, beverages, and dietary supplements due to their nutritional profile. This trend is particularly strong in North America and Europe, where functional foods and protein enrichment are key dietary trends, boosting global market growth.

Shift Toward Sustainable and Clean-Label Ingredients

Pulses are environmentally sustainable due to their nitrogen-fixing properties and low water requirements. The growing emphasis on clean-label products is increasing the demand for pulse protein isolates, flours, and starches, as they are non-GMO, allergen-free, and naturally gluten-free. Manufacturers are promoting these attributes to align with consumer preferences for ethical and environmentally responsible food products.

Innovation Across Food & Beverage Applications

Pulse ingredients are penetrating multiple end-use sectors, including plant-based meat alternatives, dairy substitutes, infant nutrition, and functional beverages. Product innovations, such as pea-based protein drinks and chickpea-enriched baked goods, have increased adoption in mainstream and premium food products. This innovation-driven approach supports new revenue streams and reinforces pulse ingredients as versatile functional components in global food manufacturing.

What are the restraints for the global market?

High Processing Costs

Extracting high-purity protein isolates and modifying starches involve complex and energy-intensive processes. This increases production costs compared to traditional soy or whey proteins, limiting adoption in price-sensitive markets. Scaling operations in emerging regions requires significant capital investment, which can act as a barrier for smaller manufacturers.

Allergen & Sensory Challenges

Certain pulses may impart off-flavors or grainy textures in end-products. Companies must invest in flavor-masking and processing technologies to ensure acceptable taste and consistency, especially in beverages and dairy alternatives. Without these innovations, consumer acceptance can be hindered, restraining market growth.

What are the key opportunities in the pulse ingredients market?

Expansion in Plant-Based Protein Products

With plant-based diets gaining popularity globally, pulse proteins offer a sustainable and allergen-free alternative to soy and dairy proteins. Opportunities exist to expand into **vegan meat analogs, protein bars, beverages, and snacks**, particularly in North America, Europe, and emerging APAC markets. Collaborations with food brands to co-develop innovative products can further strengthen market presence.

Emerging Markets in Asia-Pacific and LATAM

Growing urbanization, rising disposable incomes, and increased awareness of protein deficiency in India, China, and Brazil provide fertile ground for market expansion. Establishing local processing hubs and leveraging government nutrition initiatives can reduce costs, increase accessibility, and drive adoption in emerging regions.

Technological Innovation and Functional Product Development

Advances in protein extraction, starch modification, and fiber enrichment enable pulse ingredients to meet the growing demand for functional foods and beverages. Products with enhanced solubility, neutral taste, and high nutritional value offer manufacturers opportunities to capture high-value market segments and strengthen brand differentiation.

Product Type Insights

Pulse protein isolates dominate the market, accounting for approximately 40% of global consumption in 2025. These isolates are widely preferred in plant-based meat, dairy alternatives, and high-protein beverages due to their high protein content (>80%), clean-label status, and functional versatility. Pulse flours are extensively used in bakery and snack products, providing texture and nutritional enhancement, while starches and fibers are increasingly incorporated into functional foods and dietary supplements for their digestive and stabilizing properties. Among sources, pea-derived ingredients remain the most popular, representing around 30–35% of total market share, attributed to their neutral flavor, high protein solubility, and suitability for allergen-friendly formulations.

Application Insights

Plant-based protein and meat alternatives are the leading applications, accounting for 35% of the market in 2025. Bakery and confectionery products follow closely, driven by the rising inclusion of pulse flours and protein powders for enhanced nutrition and texture. Emerging applications such as functional beverages, infant and clinical nutrition, and high-protein snacks are witnessing strong growth. The overall market is being fueled by the global trend toward protein-enriched, clean-label, and sustainable products, as consumers increasingly seek nutritious and health-oriented food options.

Distribution Channel Insights

Food ingredient manufacturers and direct-to-consumer (D2C) platforms dominate distribution. B2B supply to food and beverage manufacturers continues to be the largest channel, particularly for large-scale production of plant-based and functional foods. Online ingredient sales for small-scale bakeries, start-ups, and specialty product creators are gaining traction. Export-driven demand from North America and Europe to APAC and LATAM is strengthening international trade, while the expansion of local processing hubs in India, China, and other emerging markets is reducing reliance on imports and enabling regional supply chain resilience.

End-Use Insights

The demand for pulse-based ingredients is highest in plant-based protein and meat alternatives, followed by bakery, beverages, and functional foods. Rapid growth is observed in sports nutrition, infant foods, and clinical nutrition segments, driven by heightened consumer focus on health, protein enrichment, and convenience. Export-driven demand is significant, particularly from North America and Europe to APAC and LATAM, where emerging consumer markets are increasingly adopting protein-enriched and functional foods. Continuous innovation in formulation and taste masking is further enabling adoption across diverse end-use applications.

| By Product Type | By Application | By Form | By Source |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America leads the global market with a 28% share in 2025. The U.S. and Canada are the primary consumers, driven by strong adoption of plant-based proteins, advanced food processing infrastructure, and high awareness of health, wellness, and sustainable nutrition. Growth is further supported by significant R&D investments in functional foods, protein bars, beverages, and dairy alternatives. Government initiatives promoting protein-enriched diets and clean-label foods, along with rising demand for allergen-friendly ingredients, continue to propel market expansion.

Europe

Europe holds a 25% market share in 2025, with Germany, U.K., and France as key markets. Consumers increasingly demand organic, sustainable, and allergen-free ingredients. Rising interest in vegan diets, functional foods, and protein-enriched formulations, combined with well-established food manufacturing infrastructure, supports continued adoption of pulse ingredients. Regional drivers include regulatory incentives for plant-based and clean-label foods, as well as growing consumer preference for environmentally sustainable products.

Asia-Pacific

APAC is the fastest-growing region, projected to expand at a CAGR of ~9–10%, led by India, China, and Japan. Urbanization, rising disposable incomes, growing middle-class populations, government nutrition programs, and increased awareness of protein deficiency are major growth drivers. Expansion of local processing units, coupled with government support for domestic food manufacturing, is reducing import dependency and boosting regional availability. Rising demand for plant-based and functional foods among health-conscious urban consumers is accelerating market adoption.

Latin America

Brazil and Argentina are major contributors to the Latin American market, reflecting growing demand for export-oriented processing hubs and protein-enriched food applications. Rising disposable income, increasing functional food adoption, and awareness of protein supplementation are driving regional growth. Additionally, favorable agricultural conditions for pulses and legumes strengthen the supply chain, supporting both domestic consumption and exports to North America and Europe.

Middle East & Africa

MEA accounts for approximately 8% of the global market, with South Africa as a key consumer of functional foods and supplements. The UAE and Saudi Arabia represent high-income markets exploring health and wellness trends, supporting niche adoption of pulse-based products. Drivers include growing urban populations, rising health awareness, and increased investment in food fortification and functional nutrition programs. Regional imports and partnerships with global ingredient suppliers further enhance market availability.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Pulse Ingredients Market

- Ingredion Inc.

- Cargill, Inc.

- Roquette Frères

- Agrana Beteiligungs-AG

- Archer Daniels Midland Company

- Burcon NutraScience Corporation

- Puris Proteins

- Olam International

- Tate & Lyle PLC

- Glanbia PLC

- AGT Food and Ingredients

- FutureCeuticals, Inc.

- Farbest Brands

- Supreme Petfoods Ltd.

- SunOpta Inc.