Pea Grits Market Size

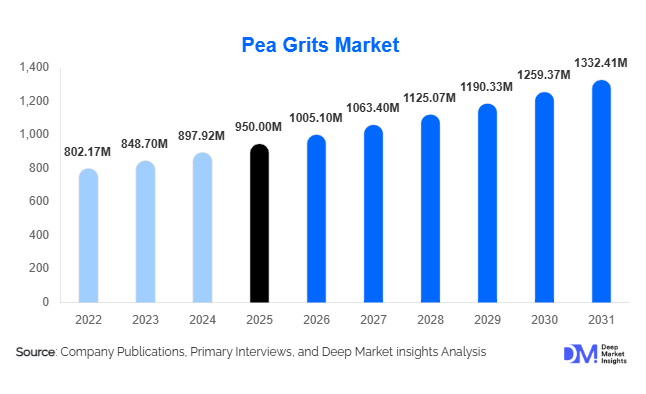

According to Deep Market Insights, the global pea grits market size was valued at USD 950 million in 2025 and is projected to grow from USD 1,005.10 million in 2026 to reach USD 1,332.41 million by 2031, expanding at a CAGR of 5.8% during the forecast period (2026–2031). The market growth is primarily driven by rising demand for plant-based protein ingredients, the expansion of processed and functional food applications, and increasing consumer awareness of sustainable and high-nutrition food options.

Key Market Insights

- Plant-based diets and alternative protein sources are fueling pea grits adoption, particularly in bakery, snacks, and meat analog products.

- North America dominates the pea grits market, supported by a mature food processing industry and strong consumer preference for high-protein and gluten-free foods.

- Europe remains a significant market with increasing demand for organic, non-GMO, and clean-label pea grits across food and beverage sectors.

- Asia-Pacific is emerging as the fastest-growing region due to rising urbanization, protein-focused nutrition awareness, and expanding pulse cultivation in India and China.

- Technological innovations such as advanced milling, functional ingredient enrichment, and AI-enabled quality control are improving product consistency and expanding applications.

- Export demand is rising from North America and Europe to emerging markets in Asia, Africa, and Latin America, further accelerating global growth.

What are the latest trends in the pea grits market?

Rise of Functional and Clean-Label Ingredients

Pea grits are increasingly recognized for their dual role as a functional and high-nutrition ingredient. Manufacturers are integrating pea grits into plant-based protein products, high-protein snacks, gluten-free baked goods, and meat alternatives. The trend towards clean-label formulations is encouraging producers to offer organic and non-GMO varieties, meeting consumer demand for healthful and transparent ingredients. Brands are also leveraging pea grits’ fiber and protein content in functional foods, health bars, and nutraceuticals.

Technology-Driven Product Innovation

Advanced milling techniques, precision moisture control, and functional fortification are enhancing the versatility and nutritional profile of pea grits. Food manufacturers are adopting AI-based quality monitoring and traceability to ensure product consistency and compliance with international standards. These innovations support new applications, including protein beverages, plant-based dairy alternatives, and specialty snacks, appealing to health-conscious and sustainability-focused consumers.

What are the key drivers in the pea grits market?

Growing Plant-Based and Protein-Rich Diets

The global shift toward plant-based nutrition is a primary driver for the pea grits market. Rising awareness of health benefits, sustainability, and environmental impact is encouraging consumers to replace animal protein with pulse-based ingredients. Food manufacturers are responding by incorporating pea grits into meat alternatives, bakery, and functional foods, boosting market demand and encouraging product innovation.

Increased Demand for Sustainable Ingredients

Pea cultivation requires relatively low water and fertilizer inputs compared to other protein sources, making pea grits a sustainable ingredient choice. Governments and regulatory bodies in North America and Europe are promoting eco-friendly agricultural practices and plant-based diets, indirectly supporting pea grits adoption. Sustainability-focused marketing campaigns are helping to position pea grits as a preferred ingredient among conscious consumers.

What are the restraints for the global market?

Price Volatility and Raw Material Supply

Fluctuations in pea crop yields due to weather conditions, pest infestations, and other agricultural variables can lead to price volatility. This impacts the cost of pea grits, potentially affecting margins for manufacturers and limiting wider adoption in cost-sensitive regions.

Limited Awareness in Emerging Markets

In regions where plant-based diets are less established, pea grits face adoption barriers. Lack of consumer awareness and familiarity with pea-based ingredients can slow growth. Education campaigns and marketing initiatives are essential to drive market penetration in these emerging areas.

What are the key opportunities in the pea grits industry?

Expansion into Emerging Protein Markets

Asia-Pacific, Latin America, and parts of Africa represent high-potential markets due to increasing protein demand driven by urbanization, rising income levels, and diet diversification. Countries like India and China are adopting pulse-based ingredients for both food processing and animal feed, creating significant opportunities for market entrants.

Innovation in Processing and Product Development

Technology-driven innovations such as enriched, flavored, or protein-fortified pea grits allow manufacturers to create differentiated products. Applications in plant-based meat alternatives, gluten-free snacks, and functional beverages are expected to expand, attracting both health-conscious consumers and food processors.

Integration with Sustainable Policies

Government initiatives and sustainability-driven policies in North America and Europe support pea cultivation and adoption. Certification programs, clean-label regulations, and nutrition-focused campaigns create an enabling environment for growth, particularly for organic and non-GMO pea grits.

Product Type Insights

Yellow pea grits dominate the global pea grits market, accounting for approximately 62% of total product demand in 2025. Their leadership is primarily driven by their neutral taste profile, superior functional properties, and broad formulation compatibility across processed foods, bakery products, snacks, cereals, and plant-based meat alternatives. Yellow pea grits offer consistent texture, strong binding capacity, and high protein content, making them the preferred choice for large-scale food manufacturers seeking standardized and scalable ingredients.

Additionally, the relatively higher availability of yellow peas across major producing regions such as North America and Europe ensures a stable supply and cost competitiveness, further reinforcing their dominance. In contrast, green pea grits are witnessing steady growth in premium and specialty food segments, where flavor differentiation and visual appeal are valued. Organic pea grits represent a fast-growing niche, particularly in Europe and North America, supported by rising consumer demand for clean-label, non-GMO, and sustainably sourced ingredients. Although smaller in volume, organic variants command higher margins and are expected to gain traction over the forecast period.

Application Insights

Food processing applications lead the global pea grits market, capturing nearly 47% of total market share in 2025. This dominance is driven by the increasing use of pea grits in bakery products, extruded snacks, ready meals, breakfast cereals, and plant-based protein formulations. Pea grits enhance nutritional value by increasing protein and fiber content while maintaining desirable texture and mouthfeel, making them highly attractive for health-focused food innovation.

The plant-based meat and dairy alternative segment is a particularly strong growth driver within food processing, as pea grits serve as an effective base ingredient for structure, moisture retention, and protein enrichment. Animal feed represents the second-largest application segment, with strong demand from poultry, aquaculture, and livestock feed producers seeking sustainable, high-protein feed ingredients. Meanwhile, emerging applications in protein beverages, functional foods, and nutraceuticals are expanding the application scope, driven by rising sports nutrition and wellness trends globally.

Distribution Channel Insights

B2B distribution channels dominate the pea grits market, accounting for approximately 72% of total sales. This is largely due to the market’s strong reliance on bulk procurement by food processors, ingredient manufacturers, and animal feed producers. Long-term supply contracts, consistent volume requirements, and customization of granulation and protein specifications make B2B channels the preferred route for major buyers.

However, online retail platforms and specialty health food stores are gaining momentum, particularly for organic and consumer-packaged pea grits. Growth in these channels is supported by increasing consumer interest in plant-based home cooking, clean-label products, and direct-to-consumer purchasing models. E-commerce platforms enable manufacturers to target niche consumer segments and improve brand visibility, while specialty stores cater to health-conscious and allergen-sensitive consumers.

End-Use Insights

Food and beverage manufacturers represent the largest end-use segment in the pea grits market, driven by continuous product innovation in protein-enriched and functional foods. Large-scale adoption in bakery, snacks, cereals, and meat alternatives positions this segment as the primary revenue contributor.

Animal nutrition and feed producers are the fastest-growing end-use segment, particularly in export-oriented regions such as the Asia Pacific and Latin America. Rising demand for sustainable feed ingredients, coupled with efforts to reduce dependency on soy and fishmeal, is accelerating pea grits adoption in feed formulations. Emerging end-use industries such as nutraceuticals, sports nutrition, and plant-based ready-to-drink beverages are expected to further diversify demand and support long-term market growth.

| By Product Type | By Application | By Distribution Channel | By End-Use Industry |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America remains the largest regional market, accounting for approximately 35–40% of global pea grits demand in 2025, led by the United States and Canada. Regional growth is driven by strong consumer adoption of plant-based diets, high demand for gluten-free and protein-rich foods, and a well-established food processing ecosystem. Advanced milling technologies, widespread availability of yellow peas, and significant investment in alternative protein manufacturing further strengthen the region’s leadership. Additionally, supportive government policies promoting sustainable agriculture and pulse cultivation contribute to long-term supply stability.

Europe

Europe holds the second-largest market share (30%), with Germany, the UK, and France leading demand. Growth in the region is primarily fueled by stringent clean-label regulations, strong sustainability mandates, and high consumer awareness of nutrition and environmental impact. Demand for organic and non-GMO pea grits is particularly strong, supported by premium food brands and functional food manufacturers. Government support for plant-based food innovation and reduced carbon footprints further accelerates market expansion.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market, driven by rapid urbanization, rising middle-class income, increasing protein consumption, and expanding food processing industries. China and India are the key growth engines, supported by large-scale pulse cultivation, growing adoption of plant-based proteins, and increasing export-oriented feed production. Rising health awareness and government initiatives promoting nutritional security are also contributing to accelerated market growth.

Latin America

Latin America is experiencing gradual but steady growth, with Brazil and Argentina leading regional demand. Growth drivers include expanding livestock and aquaculture industries, increasing use of pea-based ingredients in animal feed, and modernization of food processing infrastructure. The region’s strong agricultural base supports raw material availability, positioning Latin America as both a consumer and exporter of pea grits over the long term.

Middle East & Africa

The Middle East & Africa currently account for a smaller share of the global market but represent emerging growth opportunities. Countries such as the UAE, Saudi Arabia, and South Africa are witnessing rising demand due to urbanization, increasing nutrition awareness, and growing reliance on imported high-protein food ingredients. Expansion of food manufacturing capacity and dietary diversification initiatives are expected to support steady market growth across the region.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Pea Grits Market

- Roquette Frères

- Ingredion Inc.

- AGT Food & Ingredients

- Cargill

- The Scoular Company

- EPIC Provisions

- Meridian Foods

- Burcon NutraScience

- ADM

- Kerry Group

- Grain Processing Corporation

- Puris

- Roquette America

- SunOpta

- Glencore Agriculture

Recent Developments

- In March 2025, Roquette expanded its pea protein processing facility in the U.S., improving milling capacity and functional ingredient applications.

- In February 2025, AGT Food & Ingredients launched fortified pea grits for meat alternative formulations targeting North American and European markets.

- In January 2025, Ingredion introduced new organic pea grits lines to meet growing demand for clean-label, high-protein products in Asia-Pacific.