High-Protein Bakery Products Market Size

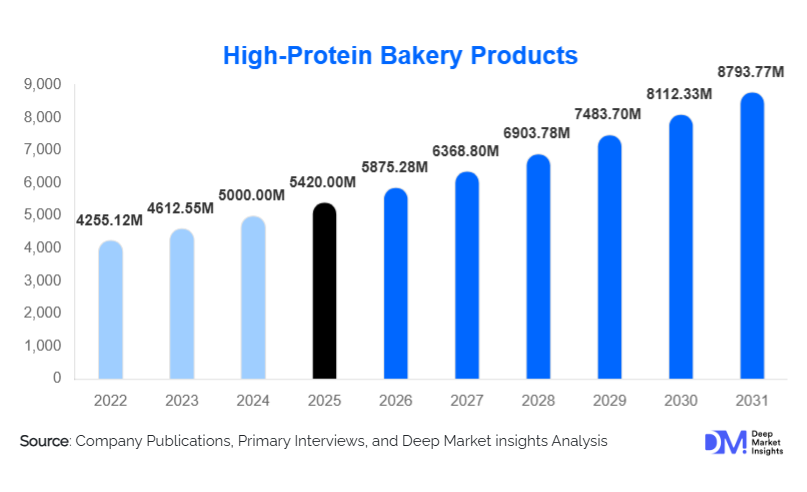

According to Deep Market Insights, the global high-protein bakery products market size was valued at USD 5,420.00 million in 2025 and is projected to grow from USD 5,875.28 million in 2026 to reach USD 8,793.77 million by 2031, expanding at a CAGR of 8.4% during the forecast period (2026–2031). The market growth is primarily driven by increasing health-consciousness among consumers, rising demand for functional and protein-enriched foods, and the expansion of retail and e-commerce channels that make high-protein bakery products more accessible globally.

Key Market Insights

- High-protein bakery products are increasingly being consumed as daily staples, with breads, cookies, and premixes forming a large part of consumer diets due to their convenience and nutritional value.

- Plant-based protein formulations are gaining popularity, appealing to flexitarian, vegetarian, and eco-conscious consumers while driving innovation in functional bakery products.

- North America dominates the market, with the U.S. and Canada leading demand due to established wellness trends and strong retail penetration.

- Asia-Pacific is the fastest-growing region, driven by rising middle-class income, increasing urbanization, and growing awareness of protein-enriched diets in countries like India and China.

- Modern retail and e-commerce platforms are expanding reach, enabling niche brands to capture new customer segments and improve market penetration in both developed and emerging regions.

- Technological innovations in protein fortification and baking processes are enhancing product quality, sensory appeal, and shelf life, supporting broader consumer adoption.

What are the latest trends in the high-protein bakery products market?

Functional Nutrition Integration

Manufacturers are increasingly emphasizing protein fortification and functional ingredients such as fiber, vitamins, and plant-based protein blends in bakery products. These products appeal to consumers seeking both taste and nutritional benefits, including muscle maintenance, weight management, and metabolic support. Clean-label and allergen-friendly formulations are particularly in demand, reflecting a shift toward healthier, convenient eating habits.

Expansion of E-Commerce and Digital Retail

High-protein bakery brands are leveraging e-commerce platforms to reach consumers in previously underserved regions. Online retail offers opportunities for subscription models, personalized recommendations, and targeted promotions, enhancing customer loyalty and repeat purchases. The growing digital footprint allows small and niche brands to compete alongside established multinational players, expanding overall market accessibility and growth.

What are the key drivers in the high-protein bakery products market?

Rising Health and Wellness Awareness

Consumers worldwide are increasingly seeking nutritious alternatives to traditional baked goods. High-protein bakery products are seen as functional foods that support muscle health, satiety, and metabolic balance. This trend spans across fitness enthusiasts, weight management consumers, and everyday health-conscious individuals, providing a broad target audience for product innovation and consumption.

Growth in Functional and Plant-Based Foods

The surge in functional and plant-based nutrition drives demand for high-protein bakery products formulated with whey, pea, soy, and blended protein sources. Flexitarian and vegetarian consumers are particularly attracted to plant-derived proteins, supporting the adoption of innovative bakery formulations and driving faster growth in Europe and Asia-Pacific.

Retail Expansion and Omnichannel Distribution

The widespread availability of modern retail outlets and e-commerce channels facilitates broader consumer access to high-protein bakery products. Hypermarkets, supermarkets, specialty stores, and online marketplaces together enhance visibility and trial, accelerating adoption across demographic segments.

What are the restraints for the global market?

Premium Pricing of High-Protein Products

Compared to conventional bakery items, high-protein products often carry a price premium due to specialty ingredients, protein fortification, and smaller-scale production. In price-sensitive regions, this limits consumer adoption and may slow market growth.

Technical Formulation Challenges

High protein content can affect the taste, texture, and shelf life of bakery products. Manufacturers must invest in R&D to ensure that products remain palatable and appealing to consumers, which can be a barrier for smaller or emerging brands.

What are the key opportunities in the high-protein bakery products market?

Innovation in Plant-Based Protein Bakery Products

With rising interest in vegetarian and flexitarian diets, plant-based proteins such as pea, lentil, and soy are creating opportunities for differentiated bakery products. These formulations appeal to health-conscious and eco-conscious consumers while enabling brands to create allergen-friendly and gluten-free offerings.

Expansion via E-Commerce and Digital Marketing

The growth of online retail channels allows brands to directly reach niche audiences, offer subscription-based protein bakery products, and implement personalized marketing campaigns. Digital platforms enable new entrants to expand without heavy investment in physical retail infrastructure.

Government Nutrition and Health Initiatives

Public campaigns promoting protein intake and healthier diets, particularly in emerging markets like India, create opportunities for fortified bakery products to reach schools, institutions, and urban consumers. Regulatory support for nutrient-enriched foods encourages adoption and market expansion.

Product Type Insights

High-protein breads dominate the market, accounting for approximately 52–54% of the 2025 market share, primarily due to their status as a daily staple and their ability to deliver protein without requiring consumers to change eating habits. Breads serve as a convenient and versatile vehicle for fortification, allowing manufacturers to enhance nutritional profiles with minimal impact on taste and texture. The segment’s growth is further driven by increasing awareness of protein’s role in satiety, muscle maintenance, and weight management, making breads an ideal functional food for health-conscious consumers.

Cookies and biscuits are rapidly gaining traction as on-the-go protein snacks, appealing to younger consumers and urban professionals seeking convenient, high-protein options. Premium muffins and cakes, along with high-protein premixes, offer opportunities for product innovation in both retail and foodservice channels, as brands experiment with plant-based proteins, clean-label ingredients, and functional additives such as fiber, vitamins, or ancient grains. These products cater to consumers seeking indulgence without compromising nutrition, supporting broader portfolio growth.

Application Insights

The largest application segment remains health-conscious consumers, who incorporate high-protein bakery products into daily meals for overall nutrition, wellness, and diet management. This includes individuals focused on general health, weight control, or age-related nutritional needs.

The fitness and sports nutrition segment represents a significant secondary market, using protein-enriched breads, cookies, and premixes as post-workout recovery and energy-sustaining foods. Institutional demand, including hospitals, schools, and corporate foodservice programs, is growing as organizations increasingly prioritize protein-enriched offerings to meet dietary guidelines and enhance overall nutritional quality. Export-driven demand is expanding as global brands enter emerging markets, particularly in Asia-Pacific and Latin America, where increasing health awareness and urbanization drive adoption. International trade also supports premium bakery launches in markets where functional food penetration is nascent, creating new revenue channels for manufacturers.

Distribution Channel Insights

Modern retail channels, including hypermarkets, supermarkets, and specialty stores, dominate with a 37–39% share of the global distribution network. These channels offer high visibility, structured merchandising, and promotional capabilities that support trial and repeat purchases. E-commerce and direct-to-consumer channels are growing rapidly, enabling brands to leverage subscription models, targeted promotions, and direct feedback loops from health-focused consumers.

Convenience stores and foodservice outlets complement these channels, catering to on-the-go consumers in urban environments. The rise of digital platforms and mobile commerce is facilitating access to premium, niche, and plant-based high-protein bakery offerings, driving incremental sales and brand awareness globally.

End-User Insights

Demand is primarily driven by health-conscious consumers, fitness enthusiasts, and weight-management segments. Younger consumers (18–30 years) favor ready-to-eat protein snacks and innovative product formats, while older demographics (31–50 and 51–65 years) gravitate toward breads and bakery products supporting daily nutrition and wellness. Institutional buyers, including schools, hospitals, and corporate cafeterias, are increasingly adopting protein-enriched offerings to meet dietary standards and functional food guidelines, further boosting market penetration.

| By Product Type | By Protein Source | By Distribution Channel | By End-User Group |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America is the largest market, accounting for approximately 36–38% of global revenue in 2025. Growth is primarily driven by strong consumer awareness of health and wellness, high disposable incomes, and mature retail and e-commerce infrastructure. In the U.S. and Canada, breads, cookies, and premixes dominate due to the daily consumption patterns and convenience appeal. Key drivers include rising interest in functional foods, widespread adoption of fitness lifestyles, and increasing demand for plant-based and clean-label bakery products. Retailers are also expanding shelf space for high-protein offerings, which further supports segment growth.

Europe

Europe represents a significant share of the global market, led by Germany, France, and the U.K. Growth is driven by high protein awareness, strong adoption of plant-based diets, functional food trends, and regulatory support for nutrient-fortified products. Clean-label and allergen-free bakery innovations are particularly appealing in Western Europe. Segment drivers include consumer preference for sustainable and health-oriented foods, high urbanization, and established retail distribution networks that facilitate the rapid introduction of protein-enriched bakery items. Bread remains the leading product segment due to its daily consumption and ease of fortification.

Asia-Pacific

Asia-Pacific is the fastest-growing region with a projected CAGR of 8–9% through 2030, particularly in India and China. Growth is fueled by rising incomes, increasing urbanization, growing health awareness, and lifestyle changes among middle-class populations. Bread and premixes are the primary contributors to growth, supported by increased protein consumption in diets, the rising influence of fitness and wellness trends, and expanding modern retail and e-commerce channels. Key drivers include government nutrition campaigns, greater acceptance of functional foods, and rising demand for convenient, protein-enriched snack formats.

Latin America

Brazil, Mexico, and Argentina are the leading markets in Latin America. Growth is supported by rising middle-class disposable incomes, urbanization, and growing consumer awareness of protein-enriched foods. Breads and cookies lead product adoption, while premixes and on-the-go snacks are emerging segments. Drivers for growth include increasing retail penetration, the entry of international high-protein brands, and the rising demand for functional foods that align with health and lifestyle trends.

Middle East & Africa

High-income Gulf countries such as the UAE, Saudi Arabia, and Qatar show strong demand for premium high-protein bakery products, while African markets are gradually emerging, driven by urban adoption and increased awareness of functional foods. Key drivers include rising disposable income, increasing fitness and wellness trends, and growing retail and e-commerce availability. Breads remain the most consumed product type due to their versatility and staple status, while cookies and snacks appeal to younger urban consumers seeking convenient, protein-enriched options. Government initiatives and private investment in modern retail also support market expansion in this region.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the High-Protein Bakery Products Market

- Mondelēz International

- Grupo Bimbo S.A.B. de C.V.

- Kellanova

- Quest Nutrition

- ARYZTA AG

- Kodiak Cakes

- Simple Mills

- Naturell India Pvt. Ltd.

- Modern Bakery LLC

- The Protein Bakery

- Hain Celestial Group

- General Mills, Inc.

- Kellogg Company

- Danone S.A.

- Nestlé S.A.