Pea Flour Market Size

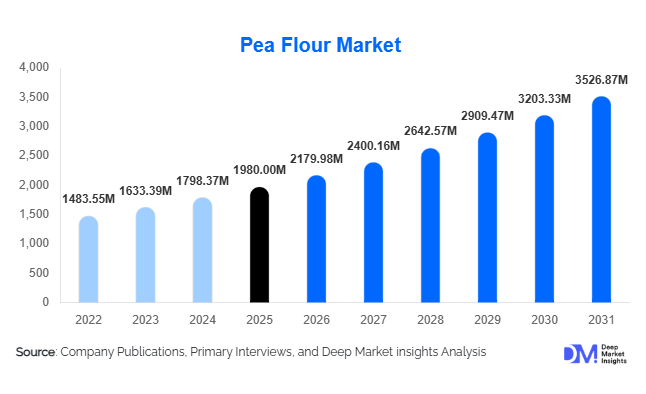

According to Deep Market Insights,the global pea flour market size was valued at USD 1,980 million in 2025 and is projected to grow from USD 2,179.98 million in 2026 to reach USD 3,526.87 million by 2031, expanding at a CAGR of 10.1% during the forecast period (2026–2031). The pea flour market growth is primarily driven by the accelerating shift toward plant-based protein consumption, rising demand for gluten-free ingredients, and increasing adoption of pulse-based functional flours in bakery, snacks, and meat alternatives. Growing consumer preference for clean-label, allergen-friendly, and sustainable food formulations is further strengthening demand across both developed and emerging markets.

Key Market Insights

- Plant-based protein demand is the primary growth engine, with pea flour increasingly used in meat analogues, dairy alternatives, and high-protein snacks.

- Yellow pea flour dominates globally, supported by strong production volumes in Canada and Russia and its neutral flavor profile.

- North America leads the market, driven by strong adoption in plant-based foods and a well-established pulse processing industry.

- Asia-Pacific is the fastest-growing region, fueled by expanding processed food sectors in China and India.

- Dry milling remains the dominant processing method, owing to cost efficiency and large-scale industrial applicability.

- Bakery and snack applications account for the largest demand share, particularly in gluten-free and fortified product formulations.

What are the latest trends in the pea flour market?

Integration into Plant-Based Meat and Dairy Alternatives

Pea flour is increasingly being incorporated into plant-based burgers, sausages, nuggets, and dairy-free beverages as a cost-effective protein source. While pea protein isolates dominate premium formulations, manufacturers are shifting toward pea flour blends to optimize cost structures while maintaining nutritional claims. This trend is especially strong in North America and Europe, where retail shelf space for plant-based foods continues expanding. Hybrid formulations combining pea flour with chickpea or lentil flours are also gaining traction, improving texture and amino acid balance in processed foods.

Clean-Label and Gluten-Free Product Innovation

As consumers seek shorter ingredient lists and allergen-friendly foods, pea flour has emerged as a preferred alternative to wheat and soy. Its naturally gluten-free and non-GMO positioning aligns with regulatory and labeling requirements across the U.S. and EU. Bakery brands are increasingly substituting 10–25% of wheat flour with pea flour to enhance protein content without compromising texture. Additionally, air-classified and protein-enriched pea flours are being introduced for specialized applications such as infant nutrition and clinical dietary supplements.

What are the key drivers in the pea flour market?

Expansion of Plant-Based Diet Adoption

The global rise of vegan and flexitarian diets is accelerating pea flour consumption. Food manufacturers are reformulating product portfolios to meet protein fortification and sustainability goals. Pea flour offers favorable amino acid composition and lower environmental impact compared to soy and animal-based proteins, positioning it as a strategic ingredient in plant-based product development.

Rising Demand for Gluten-Free and Functional Foods

Increasing diagnosis of celiac disease and lifestyle-driven gluten avoidance are boosting demand for gluten-free bakery and snacks. Pea flour enhances fiber and protein content while maintaining product structure when blended appropriately. The global gluten-free packaged food industry continues expanding steadily, directly influencing pea flour uptake.

What are the restraints for the global market?

Functional Limitations in Standalone Applications

Pea flour lacks gluten elasticity, limiting its use as a complete wheat substitute in bakery applications. Manufacturers must blend it with binding agents or other flours, which increases formulation complexity and R&D costs.

Price Sensitivity in Emerging Markets

Despite being cost-effective compared to isolates, pea flour remains more expensive than staple cereal flours. In price-sensitive regions, adoption depends on value-added applications rather than bulk substitution.

What are the key opportunities in the pea flour industry?

Government Support for Pulse Cultivation

Governments in Canada, India, and parts of Europe are promoting pulse production to enhance soil sustainability and reduce nitrogen fertilizer dependency. Increased cultivation acreage improves raw material availability and stabilizes supply chains, presenting long-term opportunities for processing capacity expansion.

Protein-Enriched and Specialty Flour Development

Air classification and advanced milling technologies are enabling the development of protein-enriched pea flour variants targeting sports nutrition, infant food, and clinical nutrition markets. Premium pricing opportunities exist for specialized formulations tailored to industrial customers.

Source Type Insights

Yellow pea flour dominates the global pea flour market with approximately 62% share in 2025, primarily due to its neutral taste profile, light color, high protein content, and superior functional properties in food processing applications. Its strong cultivation base in major producing countries such as Canada and Russia ensures stable raw material availability, competitive pricing, and consistent export supply. Yellow pea flour is widely preferred in gluten-free bakery formulations, plant-based meat alternatives, protein blends, and snack products because it offers excellent emulsification, water-binding, and texturizing characteristics. In addition, the growing demand for clean-label, allergen-free, and non-GMO ingredients further strengthens the adoption of yellow pea flour across global markets. Green pea flour, while holding a comparatively smaller share, maintains a stable niche presence in specialty foods, traditional recipes, and regional culinary applications where flavor differentiation is valued. Its usage is particularly visible in artisanal and ethnic food categories, contributing to product diversification within the overall market.

Nature Insights

Conventional pea flour accounts for nearly 78% of the total market share, supported by large-scale industrial procurement, cost efficiency, and widespread availability across global supply chains. Food processors favor conventional variants for high-volume applications in bakery, snacks, extruded products, and protein fortification due to lower production costs and stable pricing structures. The segment benefits from established agricultural infrastructure, especially in North America and Europe, where mechanized farming enhances yield efficiency. However, organic pea flour is emerging as a high-growth segment, expanding at over 12% CAGR, driven by rising consumer awareness regarding pesticide-free cultivation, sustainability, and traceability. Demand is particularly strong in Europe and North America, where stringent organic certification standards and clean-label preferences enable manufacturers to command premium pricing. Retail expansion of organic product lines and growing adoption of plant-based diets further accelerate this segment’s growth trajectory.

Processing Type Insights

Dry milling leads the market with around 55% share, owing to its lower capital investment requirements, operational simplicity, and suitability for large-scale production. The process preserves functional attributes required for bakery, confectionery, and snack applications, making it the preferred processing technique among manufacturers. Dry milling supports cost-effective mass production while delivering consistent particle size and stable shelf life, which are critical for industrial food processing. Meanwhile, wet milling and air classification technologies are gaining momentum, particularly for protein-enriched and functional food applications. These advanced processing methods allow for improved protein concentration, enhanced solubility, and better textural properties, which are essential in plant-based meat formulations, high-protein beverages, and nutraceutical applications. The shift toward value-added and protein-fortified food products continues to support technological upgrades within this segment.

Application Insights

Bakery and confectionery applications account for approximately 30% of total demand, making it the leading segment globally. Growth in this segment is driven by increasing demand for gluten-free, high-protein, and clean-label baked goods, including bread, cookies, cakes, and snack bars. Pea flour enhances texture, moisture retention, and nutritional value, enabling manufacturers to reformulate products in line with health-focused consumer trends. Additionally, its compatibility with plant-based formulations makes it a strategic ingredient for egg replacement and protein enrichment. Plant-based meat alternatives represent the fastest-growing application, expanding at over 14% CAGR, supported by rising vegan and flexitarian populations worldwide. Food manufacturers are increasingly incorporating pea flour and pea protein blends to improve texture, structure, and protein density in meat substitutes. The growing global emphasis on sustainable protein sources and reduced environmental impact further accelerates adoption across this segment.

End-Use Industry Insights

The food and beverage processing industry contributes nearly 68% of overall demand, positioning it as the dominant end-use sector. Growth in this segment is fueled by rapid innovation in plant-based foods, gluten-free product lines, and protein-fortified processed foods. Large-scale manufacturers are increasingly integrating pea flour into mainstream food portfolios to enhance nutritional profiles while meeting regulatory labeling standards. The nutraceutical sector is among the fastest-growing end-use industries, supported by expanding protein supplement innovation, sports nutrition products, and functional health formulations. Rising consumer focus on muscle health, weight management, and plant-based protein supplementation supports sustained demand growth. Animal nutrition applications are also expanding gradually, particularly in sustainable feed formulations. Export-driven demand remains strong, especially from Canada to the United States, China, and Europe, reinforcing global trade volumes and strengthening supply chain integration.

| By Product Type | By Application | By Distribution Channel | By End-Use Industry |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America holds approximately 34% of the global market share in 2025, led by the United States and Canada. The region benefits from strong agricultural infrastructure, technological advancements in milling processes, and a well-established plant-based food industry. Canada remains the world’s largest producer and exporter of yellow peas, ensuring raw material security and competitive pricing. The United States drives demand through rapid expansion of plant-based meat manufacturers, gluten-free bakery producers, and protein supplement brands. Increasing health awareness, rising vegan and flexitarian populations, and strong retail penetration of clean-label products act as primary drivers for regional growth. Government support for pulse cultivation and sustainability initiatives further strengthens market expansion.

Europe

Europe accounts for nearly 28% of the global market, with Germany, France, and the United Kingdom leading consumption. Regional growth is strongly supported by EU protein diversification strategies aimed at reducing reliance on imported soy protein and promoting locally sourced pulse ingredients. Sustainability regulations, carbon footprint reduction goals, and plant-based dietary transitions significantly contribute to pea flour adoption. The region’s advanced food processing sector, combined with strong organic product penetration, supports premium product development. Rising demand for allergen-free and clean-label foods, along with favorable regulatory frameworks for plant-based labeling, continues to drive steady expansion across European markets.

Asia-Pacific

Asia-Pacific is the fastest-growing region, expanding at approximately 12.5% CAGR. China and India represent key growth engines, supported by expanding processed food industries, rising urbanization, and increasing disposable incomes. Growing demand for protein fortification in snacks, bakery, and ready-to-eat meals drives consumption across the region. Additionally, increasing awareness of plant-based nutrition and government initiatives promoting pulse production enhance supply chain development. The rapid growth of modern retail formats and e-commerce distribution channels further accelerates market penetration. Cost-effective manufacturing capabilities in the region also attract global food brands seeking localized production strategies.

Latin America

Latin America is emerging as a promising market, with Brazil and Argentina serving as key demand centers. Regional growth is supported by expanding plant-based food innovation, increasing snack production, and gradual diversification of protein sources in food processing industries. Agricultural expansion and improving pulse cultivation practices enhance domestic supply potential. Rising health consciousness among urban consumers and growing adoption of functional foods contribute to incremental demand growth. Trade partnerships and improving export infrastructure further support long-term market development in the region.

Middle East & Africa

The Middle East & Africa region demonstrates moderate yet steady growth, driven by food import substitution initiatives, rising urban populations, and increasing investments in local food processing industries. Governments across the region are encouraging pulse-based ingredient adoption to enhance food security and reduce dependence on imported wheat and soy products. Growing bakery and snack manufacturing sectors, particularly in the Gulf countries and South Africa, support demand expansion. Additionally, increasing awareness of plant-based nutrition and expanding retail networks contribute to gradual market penetration across emerging economies in the region.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Pea Flour Market

- Roquette Frères

- Ingredion Incorporated

- AGT Food and Ingredients

- The Scoular Company

- Cosucra Groupe Warcoing

- Puris Holdings

- Axiom Foods

- Vestkorn Milling

- Parrish & Heimbecker

- Emsland Group

- Shandong Jianyuan Foods

- ET Chem

- Nutri-Pea Limited

- A&B Ingredients

- Diefenbaker Spice & Pulse