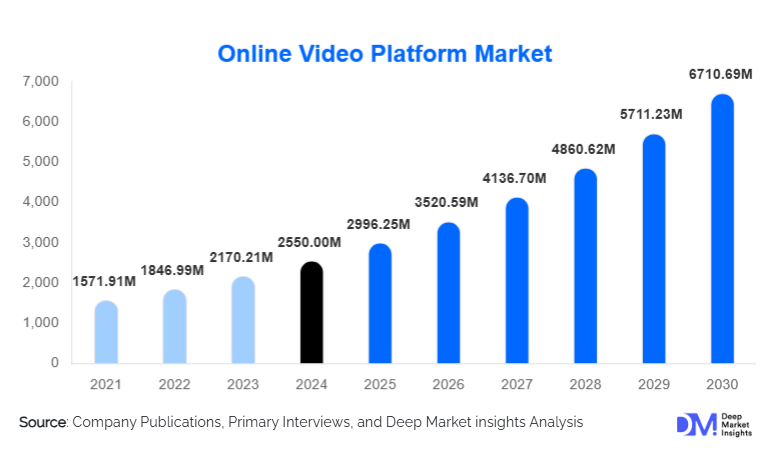

Online Video Platform Market Size

According to Deep Market Insights, the global online video platform market size was valued at USD 2,550.00 million in 2024 and is projected to grow from USD 2,996.25 million in 2025 to reach USD 6,710.69 million by 2030, expanding at a CAGR of 17.5% during the forecast period (2025–2030). Market growth is driven by the rapid adoption of cloud-based video delivery, rising global consumption of on-demand and live-streamed content, and increasing enterprise and educational use cases requiring scalable, secure, and analytics-driven video platforms.

Key Market Insights

- Cloud-based video delivery models dominate the market, fueled by scalability, global reach, and reduced infrastructure costs for enterprises and media companies.

- Video-on-demand (VOD) remains the leading content type, supported by consumer preference for flexible, anytime access across multiple devices.

- Subscription-based (SVOD) models drive over half of global revenue, though hybrid and ad-supported models are rapidly growing due to subscription fatigue.

- Asia-Pacific is the fastest-growing region, driven by rising smartphone penetration, affordable high-speed internet, and demand for localized content.

- Enterprise and educational video usage is surging globally, as organizations adopt video for training, communication, and virtual learning.

- AI, advanced analytics, low-latency streaming, and personalization tools are redefining user experience and platform differentiation.

What are the latest trends in the Online Video Platform Market?

AI-Driven Personalization and Advanced Video Analytics

Online video platforms increasingly integrate artificial intelligence to enhance user experience, content recommendations, and operational efficiency. AI-powered engines now optimize content delivery, improve search relevance, and personalize feeds to increase user engagement and retention. Real-time analytics allow content creators and enterprises to track viewer behavior, attention span, and conversion metrics, enabling data-led video strategies. Predictive analytics assist advertisers in targeting more effectively, while automation tools streamline transcoding, tagging, and content moderation. This shift toward intelligence-led video management is accelerating platform competitiveness and supporting large-scale growth for content-centric businesses.

Surge in Live Streaming and Interactive Video Experiences

Live streaming is experiencing rapid adoption across entertainment, enterprise events, e-learning, gaming, and creator-driven content. Advances in low-latency streaming, real-time chat, polls, and interactive overlays are enabling immersive viewer participation. Corporations increasingly broadcast product launches, town halls, and training sessions using OVPs, while creators leverage live engagement tools to build communities. Hybrid live + on-demand models are gaining traction, allowing viewers to revisit recorded content. This shift toward two-way, interactive streaming reflects the growing demand for real-time digital experiences across consumer and business segments.

What are the key drivers in the Online Video Platform Market?

Expansion of High-Speed Internet and Mobile Penetration

Global increases in broadband coverage, mobile internet adoption, and affordable data plans are enabling widespread video consumption. Consumers across both developed and emerging regions rely on smartphones, smart TVs, and connected devices for entertainment and learning. As mobile networks upgrade to 5G, video streaming quality and accessibility significantly improve, fueling global demand for scalable online video platforms.

Rising Shift Toward On-Demand and Cross-Device Content Consumption

Consumers increasingly prefer personalized, flexible, and device-agnostic viewing experiences. The move away from traditional broadcast toward VOD libraries, binge-watching formats, and multi-device access is a major growth catalyst. Enterprises and educational institutions similarly seek on-demand video capabilities for training, internal communication, and remote learning. This shift creates long-term structural demand for high-quality OVP infrastructure.

Rapid Technological Advancements in Cloud, Streaming, and AI

Cloud-native architectures, AI-driven content workflows, and improvements in video compression and delivery are accelerating platform adoption. Modern OVPs support adaptive bitrate streaming, automated transcoding, DRM security, and global delivery through integrated CDNs. These innovations reduce operational costs for content providers while enhancing user experience, making OVP solutions attractive across sectors.

What are the restraints for the global market?

Intense Market Competition and High Customer Acquisition Costs

The OVP market is crowded with global giants, niche providers, enterprise-focused platforms, and region-specific entrants. High competition pressures pricing and increases churn, making profitability difficult for smaller or new platforms. Content licensing, subscriber acquisition, and retention require significant marketing investments, creating a persistent challenge for sustainable margins.

Regulatory Complexities and Infrastructure Limitations in Emerging Markets

Data privacy laws, content censorship, copyright compliance, and regional content quotas impose operational hurdles for OVP expansion. In emerging regions, inconsistent network quality and bandwidth constraints can impact streaming performance. These factors limit platform scalability and require extensive localization, compliance investment, and partnership networks to overcome.

What are the key opportunities in the Online Video Platform Industry?

Enterprise and Educational Video Transformation

The surge in remote work, hybrid learning, and digital-first corporate communication is creating substantial opportunities for OVP providers. Enterprises require secure, scalable platforms for training, webinars, onboarding, and internal communication, while educational institutions adopt OVPs for lectures, virtual classrooms, and student collaboration. These segments offer high-margin, long-term contracts that diversify revenue beyond consumer streaming.

Hybrid Monetization Models and Ad-Supported Video Growth

With global subscription fatigue rising, ad-supported video (AVOD) and hybrid tiers are expanding rapidly. OVPs can capitalize by offering targeted advertising, programmatic ad insertion, and freemium access models tailored to price-sensitive markets. Diversified monetization strategies increase platform revenue resilience and enable broader global penetration.

Product Type Insights

Software platforms dominate the global OVP market, accounting for approximately 60% of 2024 revenue. Cloud-native video management systems, encoding/transcoding engines, player SDKs, and analytics tools form the backbone of modern streaming services. The demand for scalable, customizable software solutions continues to grow across entertainment, enterprise, and educational sectors. Services, such as hosting, CDN delivery, and managed support, complement software adoption but represent a smaller share. Software-led deployments offer higher margins, rapid scalability, and strong recurring revenue streams, reinforcing their leadership within the market.

Application Insights

Video-on-demand (VOD) is the leading application segment, representing around 60–65% of global consumption in 2024. Consumers prefer flexible access to movies, series, tutorials, and user-generated content across devices. Live streaming, while smaller in share, is rapidly expanding due to gaming, virtual events, sports broadcasts, and enterprise livestream adoption. Hybrid formats that merge VOD archives with real-time engagement are emerging as a key driver of user retention and revenue growth.

Distribution Channel Insights

Direct-to-consumer (D2C) apps and web platforms dominate OVP distribution, enabling creators and companies to engage audiences without intermediaries. Enterprise sales channels play a major role in B2B deployments, with organizations procuring licenses for internal video communication. Telecom operator partnerships are increasingly influential in emerging markets, where bundled data + streaming packages accelerate OVP penetration. Social platforms drive significant traffic to video content, enhancing discoverability and subscription funnels.

End-User Insights

Consumer users represent the largest end-user segment, contributing 50–55% of market revenue in 2024. Entertainment consumption remains the biggest driver. Enterprise users are among the fastest-growing groups, adopting OVPs for training, communication, and virtual events. Educational institutions are rapidly increasing the usage of hybrid learning models, digital classrooms, and remote course delivery. Emerging sectors such as healthcare (teleconsultations), fitness (online classes), and government (public communication) are expanding their overall market reach.

Age Group Insights

Users aged 18–35 remain the largest consumers of digital video content due to high smartphone usage and preference for streaming platforms. The 36–55 age group drives enterprise and educational video usage, representing significant value for B2B deployments. Older demographics increasingly adopt streaming for entertainment and learning, supported by improved digital literacy and simplified platform interfaces.

| By Product Type | By Application / Streaming Type | By Revenue Model | By Deployment | By End-User |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America is the largest regional market, accounting for roughly 35–40% of global revenue in 2024. High broadband penetration, strong device adoption, and the presence of major streaming companies support continued dominance. Enterprises in the U.S. and Canada widely implement video for training and communication, enhancing B2B OVP demand.

Europe

Europe contributes 15–20% of global revenue, driven by mature streaming adoption and strict data privacy regulations, prompting enterprise OVP adoption. Key markets include the U.K., Germany, France, and the Nordics. The region increasingly prefers localized content and privacy-compliant OVP solutions, driving competitive differentiation.

Asia-Pacific

APAC is the fastest-growing market, holding a 25–30% share in 2024 but expanding rapidly due to mobile-first video consumption. India, China, Indonesia, and Southeast Asia are major growth engines. Demand for localized content, low-cost ad-supported models, and mobile streaming platforms continues to rise, making APAC central to future market expansion.

Latin America

Latin America represents 5–8% of global OVP revenue, with Brazil and Mexico leading adoption. Growth is supported by increasing internet access, young demographics, and rising consumption of entertainment video across smartphones and connected TVs. Ad-supported models are particularly effective in price-sensitive markets.

Middle East & Africa

MEA accounts for 5–7% of global revenue and is growing steadily. The Middle East shows strong demand for premium video content, while Africa benefits from expanding mobile internet infrastructure. Government-led digital transformation and e-learning initiatives are increasing enterprise and educational OVP adoption across the region.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Online Video Platform Market

- YouTube (Google)

- Vimeo

- Brightcove

- Kaltura

- IBM Cloud Video

- Panopto

- JW Player

- Dacast

- Wowza Media Systems

- Muvi

- StreamAMG

- BrightRoll

- StreamGuys

- Wistia

- Ooyala

Recent Developments

- In March 2025, Brightcove launched an upgraded AI-driven analytics suite offering predictive viewer behavior models and automated ad optimization.

- In January 2025, Vimeo introduced a new enterprise collaboration toolkit with enhanced security, live-streaming scalability, and workflow automation features.

- In February 2025, Kaltura expanded its education-focused OVP solutions, integrating virtual classroom enhancements and multilingual AI captioning.