Digital Video Content Market Size

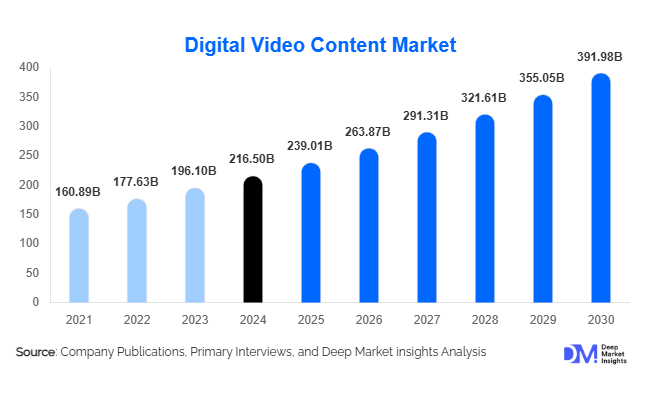

According to Deep Market Insights, the global digital video content market size was valued at USD 216.5 billion in 2024 and is projected to grow from USD 239.01 billion in 2025 to reach USD 391.98 billion by 2030, expanding at a CAGR of 10.4% during the forecast period (2025–2030). This growth is fueled by rising global video streaming consumption, 5G proliferation, rapid smart device adoption, and expanding monetization models across subscription, advertising, and hybrid ecosystems.

Key Market Insights

- Subscription Video-on-Demand (SVOD) remains the dominant revenue model, accounting for approximately 40% of the global market in 2024, driven by exclusive content and loyal subscriber bases.

- Mobile devices lead video consumption, representing nearly 62% of total global viewing hours as users increasingly access streaming platforms on smartphones and tablets.

- North America leads the market with around 35% of total revenue, supported by mature OTT ecosystems and high consumer spending.

- Asia-Pacific is the fastest-growing region, projected to expand at a CAGR of over 13% between 2025 and 2030 due to affordable mobile data and regional content proliferation.

- Ad-supported and hybrid monetization models are gaining traction as cost-sensitive users seek flexible access to premium content.

- Technology integration of AI, AR/VR, and interactive video is reshaping engagement, enhancing personalization, and improving ad targeting.

Latest Market Trends

Rise of Ad-Supported and Hybrid Streaming Models

The global streaming landscape is shifting toward ad-supported video-on-demand (AVOD) and Free Ad-Supported Streaming TV (FAST) models. Consumers in price-sensitive markets are increasingly choosing platforms that offer free or low-cost access to premium content supported by advertising. Global players like Disney+, Netflix, and Amazon Prime have introduced ad tiers to attract budget-conscious viewers, while advertisers leverage advanced targeting and real-time bidding technologies to improve campaign ROI. This trend is expected to drive diversified monetization and improve profitability margins across the digital video ecosystem.

Localization and Original Content Expansion

Streaming platforms are investing heavily in local-language production and regional storytelling to attract new audiences. Markets such as India, Indonesia, and Latin America are witnessing rapid growth in regional content, boosting subscriber acquisition and engagement. The surge of local creators on platforms like YouTube and TikTok further amplifies short-form content consumption. Original content in non-English languages has become a strategic differentiator, with localized marketing and culturally resonant storylines enhancing brand loyalty and viewer retention.

Digital Video Content Market Drivers

Rapid Broadband and Smartphone Penetration

Global internet accessibility, driven by affordable smartphones and the rollout of 4G and 5G networks, has dramatically expanded the video content consumer base. Mobile-first consumption dominates, with billions of users accessing short-form and long-form video daily. This structural shift is reinforcing continuous content engagement and driving ad revenues in emerging regions.

Shift from Traditional Television to On-Demand Streaming

The migration from linear television to on-demand, personalized streaming experiences has transformed viewing behavior. Consumers prefer flexibility, ad-free experiences, and access to global content libraries. This transition has propelled OTT platforms into mainstream entertainment, challenging traditional broadcasters and driving a new wave of content innovation.

Growing Advertising and Hybrid Monetization

As subscription fatigue emerges, hybrid and ad-supported models are unlocking new revenue streams. Advertisers are allocating higher budgets to digital video because of precise targeting, interactive ad formats, and measurable performance. This dynamic supports long-term sustainability for streaming platforms beyond subscription revenues alone.

Market Restraints

High Content Production and Licensing Costs

Producing and licensing premium video content remains capital-intensive. The competition for exclusive rights to blockbuster films, live sports, and original series drives up operational costs and compresses margins. Smaller platforms struggle to compete with established players possessing vast content libraries and higher budgets.

Piracy and Regulatory Complexities

Unauthorized content distribution and piracy continue to challenge profitability, especially in developing regions with weak IP enforcement. Regulatory constraints, including data protection laws, censorship rules, and local content mandates, add compliance burdens and restrict operational flexibility across multiple markets.

Digital Video Content Market Opportunities

Emerging Market Expansion and Localization

Rapid digitization in emerging economies presents immense untapped potential. Platforms that localize interfaces, language options, and cultural narratives can scale rapidly. Strategic partnerships with telecom operators for bundled data-video offerings can extend reach to new user bases in tier-2 and tier-3 cities. As disposable incomes rise, local-language original content will fuel long-term subscriber growth and engagement.

Technological Integration: AI, AR/VR, and Interactive Video

AI-driven personalization, voice-based navigation, and interactive storytelling are redefining the viewing experience. Immersive formats such as 360° videos and virtual concerts enable deeper engagement and new monetization channels. The convergence of video and commerce through “shoppable videos” creates cross-industry opportunities, especially in fashion, retail, and live entertainment.

Corporate, Educational, and Government Applications

Beyond entertainment, enterprises and educational institutions are increasingly leveraging video for training, communication, and e-learning. The rise of virtual classrooms and enterprise video platforms enhances engagement and knowledge retention, positioning B2B and institutional video as a high-growth sub-segment of the market.

Product Type Insights

Among business models, SVOD (Subscription Video-on-Demand) leads with about 40% of global revenue in 2024, propelled by recurring subscriptions and consumer loyalty to premium content. AVOD and hybrid models are expanding quickly as advertising budgets shift to digital. TVOD serves niche audiences seeking flexibility for high-value titles. The industry trend toward multi-tier pricing and ad-supported packages ensures broader reach and revenue optimization.

Application Insights

Long-form video-on-demand (VOD) dominates, contributing nearly 60% of global content revenue. It remains the preferred format for movies and series, while short-form and user-generated videos drive massive engagement on social platforms. Live streaming of sports, concerts, and e-sports is rapidly expanding, benefiting from low latency and interactive viewer tools. Interactive and immersive video formats are emerging as the next frontier for digital engagement.

Device Insights

Mobile devices account for approximately 62% of total viewing share in 2024, driven by the ubiquity of smartphones and affordable data plans. Smart TVs represent the second-largest device segment, particularly in developed markets where home viewing and 4K content dominate. PCs and gaming consoles continue to serve niche audiences for desktop streaming and interactive gaming-video integrations.

End-Use Insights

Individual consumers remain the dominant end-user group, accounting for most digital video demand globally. Enterprises and educational institutions are expanding usage for corporate training, product marketing, and e-learning. Government agencies are increasingly adopting digital video for citizen awareness campaigns and e-governance communication. Export-driven content such as Korean dramas and Indian originals has strengthened cross-border consumption, boosting global revenue streams.

| By Content Type | By Platform Type | By Device Type | By End User | By Revenue Model |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds about 35% of the global market in 2024, supported by high ARPU, advanced broadband networks, and strong content ecosystems. The United States is home to global leaders such as Netflix, Disney+, and Amazon Prime, whose international expansions anchor market maturity. Although growth rates are stabilizing, innovation in ad-supported tiers continues to drive profitability.

Europe

Europe contributes roughly 20–25% of the global market, led by the U.K., Germany, and France. Regulatory frameworks emphasizing data privacy and local content quotas shape platform strategies. Viewers show high adoption of smart TVs and multi-language content, supporting stable regional revenue growth.

Asia-Pacific

Asia-Pacific is the fastest-growing region, expected to record double-digit growth through 2030. With current shares near 25–30%, the region’s trajectory is powered by mobile-first consumption and regional content production. India, China, Japan, and South Korea are driving both consumption and export of original programming to global audiences.

Latin America

Latin America represents 8–10% of global revenue in 2024, with Brazil and Mexico as leading contributors. The region’s mobile-centric audience and increasing affordability of streaming plans make it one of the most promising emerging markets for OTT expansion.

Middle East & Africa

MEA currently accounts for 5–8% of market value but offers significant upside potential. Rapid digitization, youth demographics, and government-backed digital transformation initiatives are spurring adoption. GCC nations and South Africa are leading markets for premium content, while local Arabic-language productions are gaining traction.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Digital Video Content Market

- Netflix, Inc.

- Amazon.com, Inc.

- Apple Inc.

- The Walt Disney Company

- Google LLC (YouTube)

- Comcast Corporation

- AT&T Inc.

- Warner Bros. Discovery, Inc.

- ViacomCBS Inc.

- Roku, Inc.

- Tencent Holdings Ltd.

- ByteDance Ltd.

- Alibaba Group Holding Ltd.

- Sony Group Corporation

- Liberty Global plc

Recent Developments

- In August 2025, Netflix expanded its ad-supported tier to 20 additional markets, targeting new price-sensitive demographics across Asia and Latin America.

- In July 2025, Disney+ announced the launch of 50 new regional-language originals across Asia-Pacific as part of its global localization strategy.

- In May 2025, Amazon Prime Video integrated AI-driven personalization for video recommendations, boosting engagement by over 15% in early trials.