Non-Thermal Processing Market Size

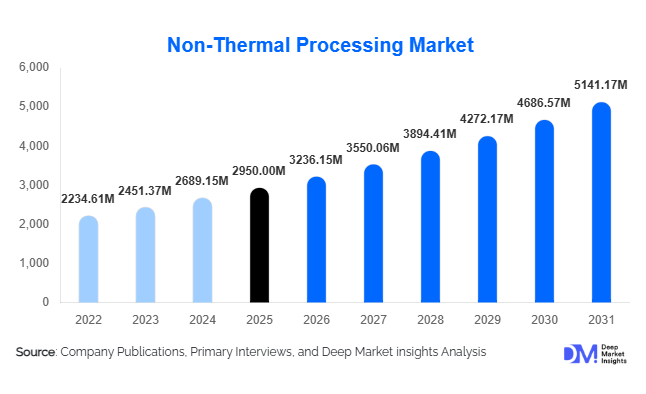

According to Deep Market Insights, the global non-thermal processing market size was valued at USD 2,950 million in 2025 and is projected to grow from USD 3,236.15 million in 2026 to reach USD 5,141.17 million by 2031, expanding at a CAGR of 9.7% during the forecast period (2026–2031). Market growth is primarily driven by rising demand for clean-label and minimally processed food products, increasing food safety regulations across developed economies, and rapid adoption of advanced preservation technologies that retain nutritional quality while extending shelf life.

Key Market Insights

- High Pressure Processing (HPP) dominates the market, accounting for over 40% of global revenue due to its proven safety validation and scalability.

- Liquid foods and beverages remain the largest application segment, driven by demand for cold-pressed juices, dairy alternatives, and functional drinks.

- North America leads global adoption, supported by stringent food safety regulations and early commercialization of HPP systems.

- Asia-Pacific is the fastest-growing region, fueled by export-oriented food processing and rising packaged food consumption.

- Food and beverage manufacturers contribute over two-thirds of total demand, reflecting widespread use across premium and mass-market categories.

- Continuous and semi-continuous processing systems are gaining traction as manufacturers seek higher throughput and operational efficiency.

What are the latest trends in the non-thermal processing market?

Shift Toward Clean-Label and Minimal Processing

One of the most prominent trends in the non-thermal processing market is the accelerating shift toward clean-label food production. Consumers are increasingly avoiding products perceived as over-processed or chemically preserved. Non-thermal technologies such as HPP, pulsed electric field, and UV-C processing enable manufacturers to achieve microbial safety without additives, preservatives, or heat-induced nutrient loss. This trend is particularly strong in premium beverages, ready-to-eat meals, and fresh protein categories, where taste, texture, and nutritional integrity are key purchasing factors.

Integration with Smart Manufacturing Technologies

Non-thermal processing equipment is increasingly being integrated with digital monitoring, automation, and data analytics platforms. Sensors and AI-based control systems allow real-time validation of microbial inactivation, predictive maintenance, and process optimization. These capabilities are enhancing regulatory compliance, reducing downtime, and improving yield consistency, making advanced non-thermal systems more attractive to large-scale food processors and multinational brands.

What are the key drivers in the non-thermal processing market?

Stringent Global Food Safety Regulations

Regulatory agencies across North America and Europe enforce strict microbial safety standards for processed foods, particularly ready-to-eat products and beverages. Non-thermal processing technologies provide validated and repeatable pathogen reduction without altering product formulations, making them a preferred solution for compliance-driven investments.

Rising Demand for Premium and Functional Foods

The global rise in health-conscious consumers has boosted demand for functional foods, probiotic beverages, and nutrient-dense products. Non-thermal processing preserves vitamins, enzymes, and bioactive compounds, supporting the growth of premium food categories and functional nutrition markets.

Improving Technology Economics

Declining system costs, improved throughput capacity, and modular equipment designs have significantly improved return on investment for non-thermal processing systems. Over the past five years, average equipment costs have decreased while operational efficiency has improved, accelerating adoption among mid-sized manufacturers.

What are the restraints for the global market?

High Initial Capital Investment

Despite long-term benefits, non-thermal processing systems require substantial upfront investment. Equipment costs, facility retrofitting, and validation expenses can be prohibitive for small and medium-sized processors, particularly in developing regions.

Limited Technical Expertise in Emerging Markets

The deployment of advanced non-thermal technologies requires specialized technical knowledge and trained personnel. In regions with limited expertise or standardized guidelines, adoption can be slower, constraining market expansion.

What are the key opportunities in the non-thermal processing industry?

Expansion into Nutraceutical and Pharmaceutical Processing

Non-thermal technologies are increasingly being adopted for processing heat-sensitive nutraceuticals, probiotics, and liquid pharmaceutical formulations. As the global nutraceutical market continues to grow at double-digit rates, demand for cold sterilization and preservation methods presents a significant growth opportunity.

Export-Oriented Food Processing in Emerging Economies

Food processors in Asia-Pacific, Latin America, and the Middle East are investing in non-thermal processing to meet export standards set by the U.S. and European Union. This trend is opening new revenue streams for equipment manufacturers and technology providers.

Technology Type Insights

High-pressure processing (HPP) remains the dominant technology in the non-thermal processing market, accounting for approximately 42% of the total market value in 2025. The leadership of HPP is primarily driven by its broad regulatory acceptance across major markets, proven efficacy in microbial inactivation, and versatility across a wide range of food categories, including beverages, processed meats, seafood, and ready-to-eat meals. Unlike emerging non-thermal methods, HPP has well-established validation protocols, making it the preferred choice for large-scale commercial deployment among multinational food manufacturers.

Pulsed electric field (PEF) technology is gaining strong traction, particularly in liquid food and beverage applications, due to its ability to improve extraction yields, enhance microbial safety, and maintain sensory attributes with lower energy consumption. PEF adoption is accelerating in juice processing, dairy alternatives, and functional beverages, where continuous processing capability provides operational advantages. Cold plasma and UV-C light processing technologies are emerging as niche but strategically important solutions. These technologies are increasingly used for surface decontamination, packaging sterilization, and fresh produce treatment, where minimal penetration depth is sufficient. Their growth is driven by demand for non-chemical sanitation methods and increasing interest in combination processing systems that integrate multiple non-thermal technologies to enhance overall food safety outcomes.

Application Insights

Liquid foods and beverages represent the largest application segment, contributing nearly 31% of global market revenue. This leadership is driven by rapid growth in cold-pressed juices, dairy alternatives, functional beverages, and ready-to-drink nutritional products, where thermal processing negatively impacts flavor, vitamins, and bioactive compounds. Non-thermal processing enables extended shelf life while preserving freshness, making it the preferred solution for premium and clean-label beverage brands.

Ready-to-eat meals and processed meats form another significant application area, supported by rising consumption of convenience foods and stringent pathogen control requirements. Non-thermal processing, particularly HPP, is widely adopted in these segments to eliminate post-packaging contamination risks and ensure compliance with zero-tolerance food safety regulations, especially in North America and Europe. Fruits and vegetables processed using non-thermal technologies are gaining momentum due to reduced spoilage rates, improved export viability, and enhanced retention of texture and nutrients. This trend is particularly strong in export-oriented supply chains, where extended shelf life and minimal quality degradation are critical for long-distance transportation.

End-Use Industry Insights

Food and beverage manufacturers dominate end-use demand, accounting for approximately 67% of the global non-thermal processing market. This dominance is driven by widespread adoption across beverages, meats, dairy alternatives, and ready-to-eat foods, where manufacturers prioritize safety, quality retention, and regulatory compliance. Large food brands are increasingly integrating non-thermal technologies into their processing lines as a strategic investment to support premium product positioning and global market access.

Nutraceutical and pharmaceutical companies represent the fastest-growing end-use segment, supported by rising demand for functional ingredients, probiotics, enzymes, and liquid dietary supplements. Non-thermal processing enables cold sterilization of heat-sensitive bioactives, preserving potency and efficacy, an essential requirement in these industries. Pet food manufacturers are emerging as a niche but high-growth end-use segment, particularly in the fresh and raw pet food category. Growing pet humanization trends and increasing regulatory scrutiny on pet food safety are driving the adoption of non-thermal processing to extend shelf life and ensure microbial safety without compromising nutritional value.

| By Technology Type | By Application | By End-Use Industry | By Equipment Configuration | By Functionality |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 38% of the global non-thermal processing market, led by the United States. Regional dominance is driven by stringent food safety regulations, including zero-tolerance policies for pathogens in ready-to-eat foods, which strongly favor validated non-thermal technologies such as HPP. High consumer demand for premium, clean-label, and minimally processed foods further accelerates adoption. Additionally, the presence of advanced food processing infrastructure, early technology commercialization, and strong capital investment capabilities among manufacturers continues to reinforce North America’s leadership position.

Europe

Europe holds around 27% of the global market, with Germany, France, Spain, and the U.K. driving demand. Growth in the region is supported by robust sustainability initiatives, strict regulatory frameworks, and strong consumer preference for high-quality and environmentally responsible food products. European manufacturers are actively adopting non-thermal processing to reduce food waste, improve energy efficiency, and meet clean-label expectations. High penetration of advanced food processing technologies and strong export-oriented food industries further support market expansion.

Asia-Pacific

Asia-Pacific represents approximately 24% of global revenue and is the fastest-growing region, expanding at over 11% CAGR. China, Japan, South Korea, and India are key growth markets, driven by rapid industrialization of food processing, rising packaged food consumption, and strong export demand. Governments across the region are investing heavily in modernizing food infrastructure to meet international safety standards, which is accelerating the adoption of non-thermal technologies. Growing middle-class populations and increasing awareness of food safety are additional demand drivers.

Latin America

Latin America accounts for roughly 7% of the global market, led by Brazil and Mexico. Regional growth is primarily driven by export-oriented meat and seafood processing industries, which require advanced pathogen control to access North American and European markets. Rising consumption of packaged and convenience foods within the region is also supporting demand for non-thermal processing technologies.

Middle East & Africa

The Middle East & Africa region holds approximately 4% of global demand, with growth driven by food security initiatives, increasing reliance on food imports, and investments in modern processing facilities. Countries such as the UAE and Saudi Arabia are prioritizing advanced food processing technologies to reduce spoilage, improve shelf life, and strengthen domestic food supply chains. Growing adoption of premium and functional food products is further supporting market growth in the region.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|