Men’s Jewelry Market Size

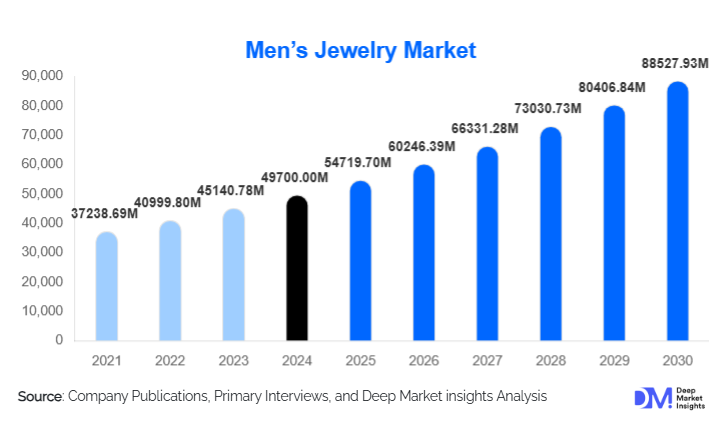

According to Deep Market Insights, the global men's jewelry market size was valued at USD 49,700.00 million in 2024 and is projected to grow from USD 54,719.70 million in 2025 to reach USD 88,527.93 million by 2030, expanding at a CAGR of 10.1% during the forecast period (2025–2030). This sustained growth is driven by shifting fashion norms, rising male adoption of personal accessories, increased digital retail penetration, and growing preferences for premium and personalized jewelry offerings. The men’s jewelry segment is evolving rapidly as consumers seek individuality, status expression, and craftsmanship through rings, bracelets, chains, and modern lifestyle accessories.

Key Market Insights

- Men’s jewelry adoption is rising globally as cultural norms shift toward greater acceptance of personal adornment and style expression among men.

- Gold remains the dominant material segment, driven by cultural affinity, luxury appeal, and investment value across Asia-Pacific and the Middle East.

- North America leads the global market, supported by strong luxury consumption and high fashion awareness among Millennials and Gen Z.

- Asia-Pacific is the fastest-growing region, driven by India and China’s expanding middle class and rapid e-commerce adoption.

- Online retail channels are accelerating market expansion, strengthened by AR/VR try-on tools, influencer marketing, and direct-to-consumer brand strategies.

- Customization and personalization are emerging as key differentiators, with engraved rings, bespoke chains, and tailored bracelets gaining strong traction.

What are the latest trends in the men’s jewelry market?

Rising Demand for Custom and Personalized Jewelry

Customization is one of the most influential trends in the men’s jewelry market. Consumers increasingly prefer rings, pendants, and bracelets that reflect personal identity, heritage, or meaningful symbols. Engraving services, 3D-printed prototypes, and online customization tools are becoming standard features across premium and mid-tier brands. Personalization not only elevates the perceived value of jewelry but also increases customer loyalty and repeat purchase behavior. From monogrammed signet rings to bespoke chains and gemstone combinations, personalized men’s jewelry is reshaping how brands design and market products.

Integration of Technology into Jewelry Design & Shopping

Technology is transforming both the product and its purchasing journey. Retailers are offering AR-based virtual try-ons, AI-driven style recommendations, and interactive 360-degree previews to enhance confidence in online purchases. On the product side, emerging categories such as smart rings that track fitness metrics or offer payment capabilities are attracting tech-savvy consumers. Digital supply-chain transparency tools, such as blockchain-powered gemstone tracking, are also gaining adoption, supporting ethical sourcing initiatives. Technology-driven storytelling and interactive content continue to attract younger consumers seeking premium yet modern jewelry experiences.

What are the key drivers in the men’s jewelry market?

Evolving Masculinity and Fashion Consciousness

A major driver is the cultural reevaluation of masculinity. Global fashion trends, celebrity influence, and social media have normalized men wearing chains, rings, earrings, and bracelets. With Millennials and Gen Z leading this shift, jewelry has become part of everyday styling rather than limited to ceremonial use. This expanding acceptance supports the growth of both fashion and fine jewelry categories.

Growth of Omnichannel and Digital Retail

E-commerce, social commerce, and omnichannel buying journeys have enhanced accessibility for men’s jewelry, especially in urban markets. Brands leverage AI personalization, virtual fitting rooms, and immersive online catalogs to reduce purchase hesitancy. The convenience of online shopping and global visibility of brands significantly accelerates category adoption.

What are the restraints for the global market?

Price Volatility of Precious Metals

Fluctuations in gold, platinum, and gemstone prices pose challenges for manufacturers and retailers. Sudden increases in raw material costs can compress margins, raise retail prices, and reduce demand among price-sensitive consumers. This volatility disrupts long-term planning for premium and luxury segments.

Cultural Barriers in Select Regions

While acceptance of men's jewelry is rising globally, conservative cultural norms in parts of Asia, Africa, and the Middle East may still limit jewelry adoption among men. Traditional views that associate jewelry primarily with women pose demand constraints in certain markets. Brands must invest in targeted marketing and design adaptations to address these challenges.

What are the key opportunities in the men’s jewelry industry?

Expansion in Emerging Markets

Urbanization and rising disposable incomes across India, China, the Middle East, and Latin America provide significant opportunities for brands. These regions show strong demand for gold jewelry, fashion accessories, and premium lifestyle products. Companies entering these markets with culturally aligned design collections stand to capture substantial growth.

Sustainable and Ethical Jewelry

Consumers are increasingly prioritizing sustainability, making ethically sourced metals, recycled materials, and transparent manufacturing practices attractive differentiators. Brands investing in carbon-neutral production, recycled gold programs, and conflict-free gemstone certification can strengthen trust and attract environmentally conscious buyers.

Product Type Insights

Rings dominate the men’s jewelry market, accounting for approximately 30% of 2024 revenue. Demand stems from both traditional uses, such as wedding bands, and fashion-driven segments, including signet rings and gemstone rings. Chains and necklaces represent a fast-growing category, supported by influencer culture, streetwear trends, and layered styling aesthetics. Bracelets, particularly leather, stainless steel, and beaded variants, are increasingly popular among younger consumers. Earrings continue to expand, driven by celebrity endorsements and broader cultural acceptance. Cufflinks remain strong in corporate and ceremonial markets, though smaller in overall share.

Application Insights

The primary applications of men’s jewelry span fashion jewelry, ceremonial jewelry, corporate wear, and personalized gifting. Fashion-oriented jewelry is the largest and fastest-growing segment, fueled by social media, lifestyle influencers, and casual luxury trends. Ceremonial and wedding jewelry remains stable, particularly in South Asia and the Middle East, where cultural traditions emphasize precious metal adornment. Gifting applications, such as engraved rings, bracelets, and premium accessories, are expanding as brands introduce curated gift collections targeting milestone events and festive seasons.

Distribution Channel Insights

Offline retail channels currently hold the largest share, supported by brand-owned stores and jewelry specialists where consumers value tactile evaluation and authenticity. However, online channels are growing fastest, powered by AR try-ons, influencer collaborations, and improved product visualization. Direct-to-consumer (D2C) jewelry brands have particularly benefited from lower operating costs and targeted digital marketing. Omni-channel strategies, such as click-and-collect and showrooming, are further enhancing consumer convenience and conversion rates.

End-User Insights

Millennials and Gen Z represent the most influential consumer groups, driving trends in personalization, contemporary styling, and sustainable jewelry. Gen X consumers contribute significantly to luxury jewelry sales due to their higher purchasing power. Professional men continue to show steady demand for cufflinks, premium bracelets, and subtle accessories suited for corporate environments. Younger audiences increasingly experiment with expressive pieces such as layered chains, bold rings, and earrings, fueling diversification within product portfolios.

| By Product Type | By Material | By Price Tier | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America leads the global men’s jewelry market with roughly 30–32% share. High purchasing power, fashion-forward consumers, and strong adoption of premium and luxury jewelry support the region’s growth. The U.S. especially shows strong demand for rings, personalized jewelry, and designer collaborations. Digital penetration and omnichannel experiences continue to shape consumer behavior.

Europe

Europe holds around 20–22% of the market, with strong demand in the U.K., France, Italy, and Germany. European consumers value craftsmanship, heritage, and design authenticity. Fashion houses and designer brands drive trends toward minimalist and contemporary men’s jewelry. Sustainability-driven purchases are particularly strong in this region.

Asia-Pacific

The fastest-growing region, Asia-Pacific, accounts for approximately 28–30% of global demand. India’s gold-dominant culture and China’s expanding luxury consumption significantly boost sales. Japan and Southeast Asia show rising interest in mid-tier fashion jewelry. E-commerce growth and rising middle-class spending accelerate adoption across the region.

Latin America

Latin America is witnessing increasing demand, particularly in Brazil and Mexico, supported by urban lifestyle shifts and rising interest in men’s fashion accessories. Mid-range jewelry and personalized gifting segments are expanding as digital retail improves accessibility.

Middle East & Africa

The region demonstrates a strong affinity for gold and gemstone jewelry. High-income consumers in the UAE, Saudi Arabia, and Qatar drive luxury purchases, while African markets show growing demand for both traditional and fashion jewelry. Cultural traditions and gifting occasions ensure consistent revenue streams.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Men’s Jewelry Market

- Tiffany & Co.

- Cartier

- Bulgari

- David Yurman

- Signet Jewelers

- Chopard

- Swarovski

- Louis Vuitton

- Tanishq

- Rolex

- Harry Winston

- Piaget

- Van Cleef & Arpels

- Buccellati

- Graff

Recent Developments

- In March 2025, Cartier expanded its men’s jewelry line featuring modern chain designs and sustainable material sourcing.

- In January 2025, Tiffany & Co. launched a new personalization platform for men’s rings and pendants using AI-assisted customization.

- In 2024, David Yurman introduced a men’s collection using recycled gold and ethically sourced gemstones.