Cufflinks Market Size

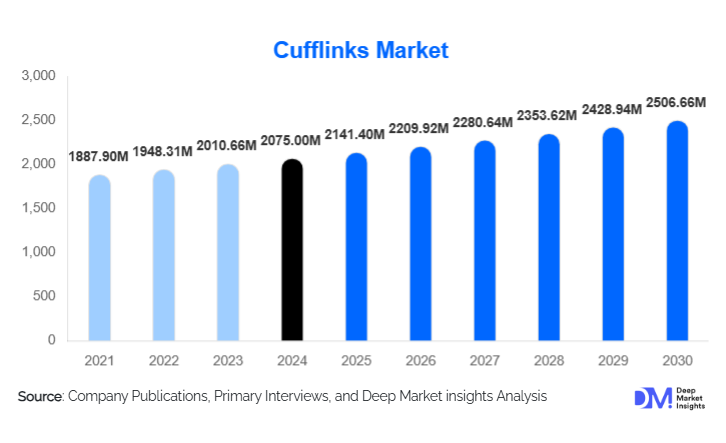

According to Deep Market Insights, the global cufflinks market size was valued at USD 2,075 million in 2024 and is projected to grow from USD 2,141.4 million in 2025 to reach USD 2,506.66 million by 2030, expanding at a CAGR of 3.2% during the forecast period (2025–2030). The cufflinks market growth is primarily driven by rising demand for premium men’s accessories, increasing consumer preference for personalized and designer products, and the expansion of e-commerce channels that are making luxury accessories more accessible worldwide.

Key Market Insights

- Precious-metal cufflinks dominate market value, supported by luxury appeal, material durability, and rising affluent consumer spending.

- Customization and personalization are transforming demand, with monogrammed, engraved, and bespoke designs becoming top-selling categories.

- Asia-Pacific is the fastest-growing region, fueled by rising middle-class wealth in India and China and an expanding corporate gifting culture.

- North America and Europe jointly account for over 60% of global value, driven by strong luxury retail presence and established formalwear traditions.

- E-commerce now contributes 30–40% of global revenue, with consumers increasingly purchasing accessories through D2C platforms and online luxury stores.

- Technology integration, including laser engraving, 3D prototyping, AR-enabled personalization, and smart/NFC cufflink designs, is reshaping product innovation.

Latest Market Trends

Personalized & Bespoke Cufflinks Surging in Popularity

Customization has emerged as one of the most significant trends in the cufflinks industry. Consumers increasingly seek monogrammed, engraved, or uniquely designed pieces that reflect personal identity or serve as meaningful gifts. Brands are responding by offering online configurators, AR-based previews, and rapid laser engraving services. Corporate gifting is also accelerating the adoption of bespoke cufflinks, with companies ordering branded or commemorative designs for executives and special events. This shift is elevating average selling prices while deepening customer engagement across premium and mid-range segments.

Sustainable & Ethical Materials Entering Mainstream

Eco-conscious consumers are influencing product design as brands adopt recycled metals, lab-grown gemstones, and low-impact manufacturing processes. Sustainable cufflinks, once a niche, are becoming mainstream, especially in Europe and North America. Transparent sourcing, fair-mined precious metals, and environmentally-friendly packaging are becoming competitive differentiators. Some brands are launching limited-edition sustainable collections, combining luxury craftsmanship with reduced environmental footprint, appealing to both premium buyers and eco-oriented professionals.

Cufflinks Market Drivers

Growing Formalwear Adoption Among Professionals

Corporate and business environments continue to drive cufflink demand, especially in finance, law, consulting, real estate, and executive roles. As professional dress codes stabilize after a period of casualization, cufflinks have regained importance as symbols of status and refined style. Rising participation in international business events, conferences, and formal corporate gatherings further supports the growth of premium cufflinks.

Expansion of E-commerce & Digital Luxury Retail

Online luxury retailing is transforming the cufflinks industry by allowing brands to reach global consumers without extensive physical-store networks. E-commerce platforms offer broader design varieties, easy customization options, and competitive pricing models. Digital experiences such as AR try-ons, virtual boutiques, and AI-powered recommendation engines are helping brands boost conversion rates, while D2C channels enable higher margins and personalized shopping experiences.

Market Restraints

High Price Sensitivity in Emerging Markets

Premium cufflinks, especially those made from gold, platinum, and gemstone settings, remain accessible primarily to high-income consumers. In cost-sensitive regions, customers often opt for inexpensive fashion accessories or avoid cufflinks altogether due to limited formalwear adoption. Additionally, import duties on luxury goods in countries like India and Brazil further elevate retail prices, restricting market penetration.

Raw Material & Supply Chain Volatility

Fluctuations in the prices of precious metals and gemstones directly affect production costs and retail prices. Supply chain disruptions, craftsmanship shortages, and quality-control inconsistencies can also hinder product availability, particularly for small-scale artisan brands. These challenges impair pricing stability and can reduce customer willingness to purchase high-end cufflinks.

Cufflinks Market Opportunities

Digital Customization Platforms

The growing interest in monogrammed and engraved cufflinks presents a major opportunity for brands to invest in advanced online customization tools. AR configurators, real-time 3D previews, and instant engraving services enable brands to capture premium margins and build strong customer loyalty. Corporate gifting platforms are also increasingly partnering with cufflink brands to offer bulk customizations for business events and executive milestones.

Expansion into Emerging Economies

Rapid economic growth in Asia-Pacific, the Middle East, and select parts of Latin America is creating new demand for premium accessories. Weddings, corporate gifting, and rising luxury consumption in countries like China, India, the UAE, and Saudi Arabia present high-growth opportunities. Localization of manufacturing, region-specific designs, and strategic retail partnerships can help brands scale quickly in these markets.

Product Type Insights

Precious-metal cufflinks remain the dominant product category, capturing the largest share of global revenue due to their exceptional durability, premium aesthetic appeal, and strong preference among affluent consumers. Gold, platinum, and sterling-silver cufflinks are especially favored in luxury retail channels and high-profile corporate gifting. Stainless-steel and base-metal cufflinks continue to perform well in the mainstream segment, supported by affordability, diverse design options, and suitability for everyday professional use.

Personalized cufflinks represent the fastest-growing product type, driven by rising demand for customized gifting, wedding accessories, and corporate-branded memorabilia. Advancements in engraving, 3D-printing, and modular design are further accelerating adoption. Designer and artisanal cufflinks are increasingly sought after as craftsmanship, heritage branding, and exclusivity become essential decision factors among high-income buyers seeking unique statement pieces.

Application Insights

Business and corporate usage remains the largest application segment, reflecting a strong association between cufflinks and professional attire across global markets. Demand is further reinforced by corporate gifting programs, brand-customized accessories, and increasing emphasis on formal dressing in executive environments. Formalwear applications, including black-tie events, galas, and ceremonial occasions, continue to boost sales of premium and precious-metal cufflinks.

Weddings and celebratory gifting are among the fastest-growing applications, particularly in Asia-Pacific and the Middle East, where large-scale wedding cultures and premium gifting traditions are accelerating adoption. Collectible and high-jewelry cufflinks are emerging as niche luxury subsegments, commanding high margins and generating recurring purchases among collectors, luxury enthusiasts, and connoisseurs of fine accessories.

Distribution Channel Insights

Online platforms, including luxury e-commerce portals and direct-to-consumer (D2C) brand stores, now contribute an estimated 30–40% of global cufflink sales. These channels benefit from product customization capabilities, broad design accessibility, and customer reliance on digital reviews and virtual try-on features. E-commerce is particularly influential among younger consumers seeking novelty and personalized designs.

Specialty jewelry stores and luxury boutiques remain indispensable for premium purchases, as consumers in this segment value tactile inspection, brand assurance, and personalized in-store service. Department stores and multi-brand retailers continue to support strong mid-market sales. Corporate gifting distributors are an expanding channel, especially for bulk orders involving customized and branded cufflink designs.

End-User Insights

Men aged 36–55 constitute the largest end-user demographic, driven by higher disposable incomes, frequent professional engagements, and a preference for premium accessories that complement business attire. Younger professionals aged 20–35 are increasingly purchasing cufflinks through online channels, favoring modern, novelty, and personalized designs suited to contemporary fashion trends.

Female consumers play a pivotal role in the gifting segment, although actual end-use remains predominantly male. High-income individuals primarily drive demand in the premium and luxury categories, while mid-income professionals contribute significantly to volume growth within the mass and mid-market segments.

Age Group Insights

The 31–50 age group holds the largest market share, representing consumers with established careers, frequent participation in corporate events, and a greater inclination toward premium lifestyle products. The 20–30 demographic shows increasing interest in trendy, fashionable, and novelty cufflinks, with purchases largely concentrated on e-commerce platforms.

Consumers aged 51–65 and above tend to favor classic, timeless designs, including precious-metal cufflinks. This segment represents a stable, high-value market, characterized by brand loyalty and consistent demand for luxury accessories aligned with formal occasions and professional commitments.

| By Product Type | By Application | By Distribution Channel | By End User | By Age Group |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for roughly one-third of global cufflink revenue, supported by a mature luxury retail ecosystem and a strong formalwear culture. The U.S. leads regional demand due to a sizeable professional workforce, corporate gifting traditions, and strong penetration of luxury brands across metropolitan markets. High-income consumers and business professionals are major contributors to premium segment growth.

Europe

Europe is a major global market characterized by long-standing traditions in formal dressing, heritage luxury craftsmanship, and deep-rooted appreciation for fine accessories. Countries such as the U.K., Germany, France, Italy, and Switzerland drive regional demand. Precious-metal and classic heritage-inspired cufflinks maintain strong momentum, while sustainability-focused collections are gaining traction in Western Europe.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market, fueled by rising middle-class incomes, expanding corporate sectors, and robust wedding-related demand. China and India dominate volume growth due to cultural traditions that emphasize gifting and formal dressing during celebrations. Japan and South Korea generate significant demand for designer and limited-edition cufflinks, supported by a strong luxury fashion culture. Digital gifting platforms and e-commerce adoption are accelerating regional expansion.

Latin America

Latin America is gradually expanding in the cufflinks market, with Brazil, Mexico, and Argentina leading demand. Growth is underpinned by increasing participation in corporate and social events, a rising affluent consumer base, and growing interest in imported luxury accessories. Mid-range and novelty cufflinks are particularly favored among younger consumers seeking affordable fashion-forward options.

Middle East & Africa

The Middle East demonstrates strong demand for luxury and precious-metal cufflinks, driven by high disposable incomes, cultural significance of premium gifting, and strong luxury shopping ecosystems in markets such as the UAE, Saudi Arabia, and Qatar. Africa’s demand is led by South Africa, where weddings, corporate events, and expanding luxury retail infrastructure continue to drive sales.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Cufflinks Market

- Tiffany & Co.

- Cartier

- Montblanc

- Louis Vuitton

- Gucci

- Burberry

- Tateossian

- Deakin & Francis

- Paul Smith

- Hugo Boss

Recent Developments

- In June 2024, Montblanc launched a new collection of customizable cufflinks featuring AR-enabled design previews for online shoppers.

- In March 2025, Tiffany & Co. introduced a sustainable cufflink line made from recycled silver and lab-grown gemstones.

- In January 2025, Deakin & Francis unveiled a limited-edition precious-metal cufflink series designed for corporate gifting and high-profile events.