Sustainable Jewelry Market Size

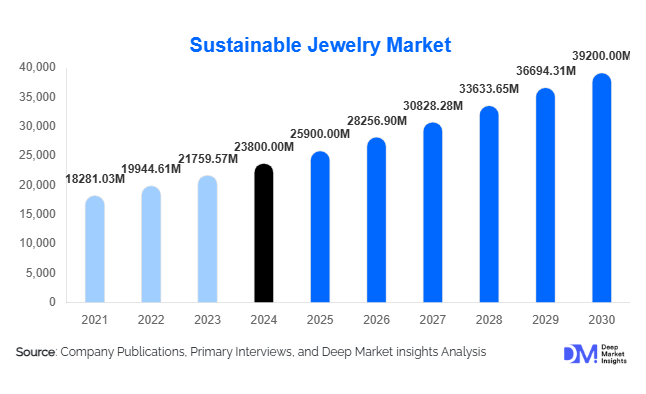

According to Deep Market Insights, the global sustainable jewelry market size was valued at USD 23,800 million in 2024 and is projected to grow from USD 25,900 million in 2025 to reach USD 39,200 million by 2030, expanding at a CAGR of 9.1% during the forecast period (2025–2030). The sustainable jewelry market growth is primarily driven by increasing consumer preference for ethically sourced and environmentally responsible jewelry, rapid adoption of lab-grown gemstones, and expansion of online retail platforms facilitating global access to eco-friendly luxury products.

Key Market Insights

- Consumer preference is shifting toward ethically sourced and environmentally responsible jewelry, with lab-grown diamonds, recycled metals, and upcycled gemstones gaining traction.

- Mid-range sustainable jewelry dominates, offering an ideal balance between affordability and premium quality, particularly in North America and Europe.

- North America leads global demand, with the U.S. accounting for the majority of consumption due to strong ethical consumerism and disposable income.

- APAC is the fastest-growing region, led by India and China, driven by rising urban middle-class income and increasing awareness of sustainable alternatives.

- Technological adoption in e-commerce, AR/VR try-on tools, and blockchain provenance tracking is reshaping consumer trust and engagement with sustainable jewelry brands.

- Government initiatives and certifications, including Fairtrade and Responsible Jewelry Council (RJC) compliance, are enhancing market credibility and encouraging ethical sourcing.

Latest Market Trends

Lab-Grown and Recycled Material Adoption

Jewelry manufacturers are increasingly integrating lab-grown gemstones and recycled precious metals into their offerings. Lab-grown diamonds provide an ethical alternative to mined stones, while recycled gold and silver reduce environmental impact. Consumers, particularly millennials and Gen Z, are driving this demand, as they prioritize sustainability alongside design and quality. Partnerships with responsible suppliers, blockchain-enabled provenance tracking, and transparent sourcing practices are now central to brand positioning, attracting eco-conscious buyers globally.

Digital and E-Commerce Transformation

Online retail is becoming the dominant channel, with platforms offering direct-to-consumer models, virtual try-on features, and personalized jewelry customization. AR/VR tools allow consumers to visualize rings, necklaces, and bracelets before purchase, while AI-powered recommendation engines enhance conversion. E-commerce enables small and mid-sized sustainable jewelry brands to access global markets, reducing reliance on physical stores and enabling inventory optimization. Social media campaigns and influencer collaborations further accelerate brand visibility and adoption, particularly among younger consumers seeking sustainable luxury.

Sustainable Jewelry Market Drivers

Rising Ethical Consumerism

Global consumers are increasingly aware of the environmental and social implications of traditional mining practices. This has driven a strong preference for lab-grown diamonds, recycled metals, and responsibly sourced gemstones. Brands that adopt transparent supply chains and fair-trade practices are seeing higher willingness-to-pay from environmentally conscious buyers, particularly in North America and Europe.

Technological Innovation in Materials and Design

Advancements in lab-grown gemstone synthesis and recycling technologies have lowered production costs, making sustainable jewelry more accessible. 3D printing, computer-aided design (CAD), and precision casting enable intricate, sustainable designs at scale. These innovations are particularly significant for mid-range and luxury segments, allowing brands to combine eco-friendly materials with high-end craftsmanship.

Expansion of Digital Retail Channels

The proliferation of e-commerce platforms and D2C models allows sustainable jewelry brands to reach global audiences. Interactive online experiences, AR/VR try-ons, and blockchain-verified provenance enhance consumer trust. This trend also supports smaller brands in establishing a niche presence, particularly in emerging markets.

Market Restraints

High Production Costs

Manufacturing sustainable jewelry involves higher costs due to lab-grown gemstones, recycled metals, and ethical sourcing certifications. This can limit profit margins and pose barriers for smaller players seeking to compete with established brands in mid-range and luxury segments.

Limited Awareness in Emerging Markets

While demand is growing globally, awareness of sustainable jewelry practices remains limited in regions like Africa and parts of LATAM. Targeted consumer education and marketing campaigns are required to expand adoption beyond mature markets.

Market Opportunities

Growth in Lab-Grown Diamond and Recycled Metal Offerings

Increasing adoption of lab-grown diamonds and recycled precious metals provides a significant growth opportunity. These materials reduce environmental impact, lower carbon footprint, and cater to consumer demand for ethical alternatives. Jewelry brands investing in R&D for sustainable designs are likely to capture premium segments and attract younger, eco-conscious buyers.

Expansion Through E-Commerce and Digital Platforms

Digital adoption enables brands to reach global audiences efficiently, particularly in emerging APAC and LATAM markets. E-commerce allows personalization, virtual try-ons, and streamlined logistics, enhancing both accessibility and consumer engagement. Integration of blockchain for provenance verification and sustainable packaging solutions further differentiates products in competitive markets.

Product Type Insights

Rings dominate the sustainable jewelry market, accounting for 32% of 2024 sales, primarily driven by engagement and wedding rings made from lab-grown diamonds. Necklaces and pendants hold a strong position in fashion-conscious demographics, while bracelets and earrings are gaining popularity due to their versatility. Sustainable watches and multifunctional jewelry are emerging niches, particularly in premium segments. Consumer preference for ethical materials combined with modern design aesthetics is shaping product portfolios across all categories.

Material Insights

Lab-grown diamonds hold the largest market share (28%) within materials, driven by their ethical appeal and comparable quality to mined diamonds. Recycled gold and silver are increasingly popular among eco-conscious buyers, while upcycled gemstones and bio-based alternatives are gaining traction in niche, fashion-focused markets. Market trends indicate sustained growth for materials that minimize environmental impact while maintaining premium appeal.

Distribution Channel Insights

Online retail represents 40% of the sustainable jewelry market, driven by the convenience of digital shopping, AR/VR try-on features, and D2C platforms. Offline retail remains significant in luxury segments, offering tactile experiences and premium service. Hybrid models combining online ordering with in-store collection are gaining popularity, especially in North America and Europe. Social media marketing and influencer collaborations are increasingly shaping consumer purchase behavior in digital channels.

End-Use Insights

Personal use accounts for 55% of sustainable jewelry demand, reflecting rising awareness of ethical consumption among fashion-conscious consumers. Gifting is also significant, particularly for weddings and anniversaries, while corporate and institutional adoption is emerging for awards and recognition programs. Export-driven demand is rising from Europe and North America to APAC and LATAM, with high-value shipments in lab-grown diamond and recycled metal jewelry segments. New applications include eco-luxury watches and multifunctional jewelry targeting millennials and Gen Z.

| By Product Type | By Material | By Price Range | By Distribution Channel | By End-Use |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds 35% of the market, with the U.S. leading in lab-grown diamond adoption and recycled metal usage. Ethical consumerism, high disposable income, and digital adoption drive growth. Demand is concentrated in engagement rings, fashion jewelry, and luxury sustainable watches, with continued expansion into mid-range products.

Europe

Europe accounts for 30% of the market, with Germany, the U.K., and France as leading consumers. Sustainability certifications and regulations enhance consumer confidence, while e-commerce penetration drives accessibility. Mid-range and luxury jewelry, particularly rings and necklaces, dominate sales. Carbon-neutral operations and ethical sourcing are key decision factors for buyers.

Asia-Pacific

APAC is the fastest-growing region, led by India and China, experiencing a 10–12% CAGR. Rising middle-class income, increasing awareness of lab-grown diamonds, and digital adoption fuel demand. India favors mid-range sustainable rings and necklaces, while China emphasizes the luxury and gifting segments. E-commerce platforms are crucial for market expansion in both countries.

Latin America

Brazil and Mexico are emerging markets, with growing interest in eco-friendly jewelry and outbound luxury purchases. Affluent consumers are increasingly exploring mid-range and premium sustainable products, particularly engagement and fashion jewelry.

Middle East & Africa

UAE and Saudi Arabia are driving high-income demand for luxury sustainable jewelry, while South Africa and Kenya focus on export-driven production of recycled metals and lab-grown gemstones. Ethical luxury products and corporate gifting are expanding in these regions.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Sustainable Jewelry Market

- Tiffany & Co.

- Pandora A/S

- Chopard

- Cartier

- De Beers Group

- Signet Jewelers

- Boodles

- Bulgari

- Swarovski

- Piaget

- Graff

- Van Cleef & Arpels

- Chow Tai Fook

- Damiani

- Mikimoto

Recent Developments

- In March 2025, Tiffany & Co. expanded its lab-grown diamond collection, focusing on engagement rings with traceable provenance and recycled gold settings.

- In February 2025, Pandora launched an online-only sustainable jewelry line targeting eco-conscious millennials in Europe and North America.

- In January 2025, De Beers Group announced the expansion of its recycled metal sourcing program, increasing partnerships with certified responsible mining and recycling initiatives globally.