Matcha Perfume Market Size

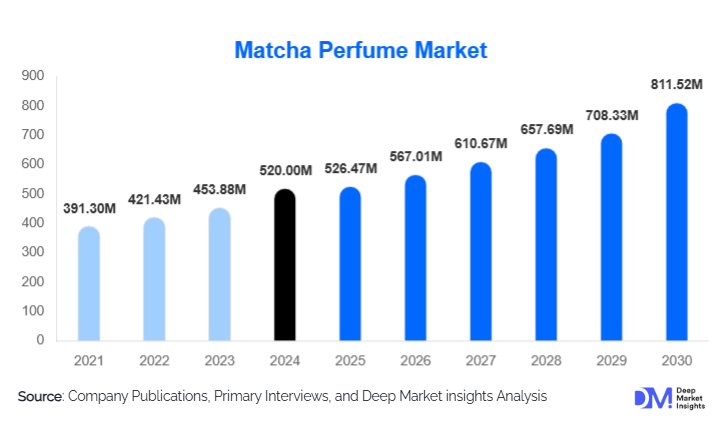

According to Deep Market Insights, the global matcha perfume market size was valued at USD 520.00 million in 2024 and is projected to grow from USD 560.04 million in 2025 to reach USD 811.52 million by 2030, expanding at a CAGR of 7.7% during the forecast period (2025–2030). The matcha perfume market growth is primarily driven by increasing consumer preference for natural, plant-based fragrances, the rising influence of Japanese minimalism in luxury perfumery, and the growing adoption of wellness-oriented scent formulations featuring antioxidant-rich matcha extracts.

Key Market Insights

- Rising consumer demand for clean and green fragrances is accelerating innovation in botanical and tea-based perfume formulations.

- Premium and niche perfume houses are introducing matcha-inspired scents that blend earthy, fresh, and umami notes for distinctive olfactory profiles.

- Asia-Pacific dominates production and early adoption of matcha perfumes, leveraging Japan’s cultural association with matcha and green tea rituals.

- Europe remains the fastest-growing market, driven by the rising preference for artisanal, sustainable, and minimalist fragrances.

- North America is witnessing surging demand among millennials and Gen Z consumers seeking holistic and eco-conscious lifestyle products.

- Digital-first perfume brands are leveraging AI scent personalization and direct-to-consumer e-commerce to expand matcha perfume accessibility.

Latest Market Trends

Natural and Wellness-Infused Fragrances on the Rise

Consumers are increasingly drawn to perfumes that align with wellness lifestyles. Matcha, known for its antioxidant and calming properties, is being incorporated not only for its scent but also for its perceived wellness benefits. Brands are highlighting matcha’s natural origins, low environmental footprint, and holistic connection to mindfulness and balance. Perfume formulations now often include other tea extracts, botanical waters, and essential oils to create wellness-oriented scent lines that appeal to health-conscious consumers.

Japanese Minimalism Inspiring Global Fragrance Design

Japanese-inspired aesthetics are shaping global perfume trends, with matcha perfumes positioned as a reflection of purity, harmony, and simplicity. Packaging design emphasizes minimalist elegance, using eco-friendly materials and soft color palettes inspired by green tea and nature. Brands are leveraging the cultural narrative of the Japanese tea ceremony, creating immersive storytelling around mindfulness, tranquility, and ritualized scent experiences that resonate with luxury consumers worldwide.

Matcha Perfume Market Drivers

Growing Demand for Natural and Sustainable Ingredients

As consumers move away from synthetic chemicals and artificial fragrances, matcha-based perfumes are gaining traction for their natural, plant-derived origins. The global shift toward sustainable beauty has spurred investment in green chemistry and eco-friendly extraction techniques. Matcha, being biodegradable and ethically sourced, fits perfectly within the clean beauty movement, driving strong growth across both premium and mass fragrance categories.

Rising Popularity of Niche and Artisanal Perfume Brands

Independent fragrance houses are increasingly experimenting with unconventional scent profiles such as matcha, yuzu, and hinoki. These niche brands appeal to consumers seeking authenticity and individuality. The use of matcha provides a unique, fresh, and earthy aroma that differentiates artisanal perfumes from mainstream offerings. Limited-edition matcha scent collections, collaborations with tea brands, and cross-category launches (e.g., skincare perfumes) are fueling creative innovation in the market.

Market Restraints

High Production and Ingredient Costs

Extracting and formulating matcha-based fragrances can be costly due to the premium nature of high-quality matcha powder and the need for delicate blending techniques. Additionally, ensuring ingredient purity and maintaining stable scent performance over time requires specialized production processes, limiting scalability for smaller producers and increasing retail prices for consumers.

Limited Consumer Awareness Outside Asia

While matcha is a well-established cultural element in Japan, awareness of its scent potential remains relatively low in some Western markets. Many consumers associate matcha primarily with beverages and skincare rather than perfumery. This perception challenge slows mass-market adoption, requiring educational marketing and storytelling to communicate matcha’s fragrance appeal and benefits effectively.

Matcha Perfume Market Opportunities

Expansion of Unisex and Gender-Neutral Perfume Segments

Matcha’s earthy and balanced scent profile lends itself naturally to unisex fragrances. With growing global demand for gender-inclusive perfumes, brands have a strong opportunity to position matcha perfumes as neutral, versatile scents. This shift aligns with broader consumer movements toward self-expression, inclusivity, and non-binary product design.

Integration with Wellness and Lifestyle Experiences

Opportunities exist to integrate matcha perfumes into holistic wellness experiences, such as spa treatments, meditation sessions, and aromatherapy rituals. Brands are partnering with wellness resorts, yoga studios, and lifestyle influencers to promote matcha perfumes as mood-enhancing and calming. The rise of “functional fragrances” that combine scent and therapeutic benefits further positions matcha as a key ingredient in the evolving wellness fragrance sector.

Product Type Insights

Eau de Parfum (EDP) remains the leading segment in the matcha perfume market, driven by consumer willingness to pay a premium for long-lasting, matcha-forward fragrances that balance freshness and sophistication. The EDP format is particularly favored among luxury buyers who associate longevity and depth with higher quality. Perfume oils and concentrates are gaining traction due to their intimate, skin-clinging finish and the way matcha’s natural, earthy tones evolve more richly in oil bases. These formats are popular in Middle Eastern and Asian markets, where heat resistance and fragrance endurance are valued. Solid perfumes continue to attract eco-conscious and urban consumers who prioritize sustainability, portability, and alcohol-free formulations, ideal for travel or festival use. Meanwhile, body mists serve as an accessible entry point for younger demographics, capitalizing on layering trends where matcha provides a refreshing top note in daily routines.

Distribution Channel Insights

Online retail platforms lead global matcha perfume distribution, supported by influencer collaborations, subscription sampling programs, and rapid DTC brand scaling. Social commerce and AI-driven scent recommendation tools have transformed digital discovery, allowing niche brands to compete effectively with established perfume houses. Specialty boutiques and concept stores remain crucial for storytelling-driven retail, offering sensory experiences like “tea and scent” rituals and scent bars that align perfectly with matcha’s meditative heritage. Department stores continue to drive visibility for premium and giftable matcha fragrances, especially during seasonal campaigns. Additionally, spas and hotels are emerging as institutional buyers, using matcha perfumes in signature scent programs aligned with wellness and relaxation themes.

| By Product Type | By Price Tier | By Distribution Channel | By Consumer Target / Positioning | By Ingredient / Formulation Source |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific remains the epicenter of matcha perfume innovation, led by Japan, South Korea, and China. Japan’s longstanding cultural familiarity with matcha and its established production ecosystem significantly reduces sourcing and formulation friction for fragrance producers. Premiumization in domestic markets, particularly in Japan and South Korea, is reinforcing consumer demand for heritage-inspired ingredients and minimalist, ritual-based scent experiences. The synergy between K-beauty and J-beauty continues to drive cross-category co-branding, where matcha is featured in hybrid fragrance–skincare lines. In China, growing luxury consumption and sophisticated e-commerce channels are fueling regional expansion, with local brands capitalizing on the “modern wellness luxury” narrative. Collectively, these drivers make Asia-Pacific not only the production hub but also the leading innovation and consumption region for matcha perfumes.

Europe

Europe is the fastest-growing market for matcha perfumes, propelled by a mature niche perfumery scene that values craftsmanship, provenance, and storytelling. The region’s stringent fragrance regulations (e.g., IFRA and EU cosmetics directives) shape product formulation and authenticity claims, compelling brands to emphasize clean-label ingredients and responsible sourcing. Sustainability and eco-certifications such as COSMOS and Ecocert play a decisive role in purchase decisions, making matcha’s natural and traceable origins a strong differentiator. Growth is particularly robust in France, Germany, and the U.K., where consumers seek artisanal and nature-inspired scent compositions that reflect mindfulness and modern minimalism. This convergence of regulation, sustainability, and artisanal expertise positions Europe as a vital hub for premium and ethically aligned matcha perfume development.

North America

North America is witnessing the rapid adoption of matcha perfumes, driven by a “novelty plus wellness” consumer mindset that embraces new scent experiences linked to health and mindfulness. The region’s strong DTC and social commerce ecosystem accelerates the discovery of niche matcha fragrances through influencer storytelling, subscription boxes, and digital-first marketing. U.S. and Canadian consumers display higher tolerance for hybrid formulations, where synthetic and natural matcha notes are combined to enhance performance and scent stability, provided the innovation is framed transparently. Millennials and Gen Z demographics continue to power demand, drawn to eco-conscious branding, refillable packaging, and versatile unisex formulations. This dynamic, digital, and wellness-oriented environment positions North America as a key incubator for experimental, lifestyle-driven matcha perfume brands.

Middle East & Africa

The Middle East and Africa region offers strong potential for matcha perfumes, underpinned by one of the world’s highest per-capita fragrance spends. A deeply ingrained gift culture and preference for rich, long-lasting scents create a receptive market for matcha-based fragrances with adapted compositions, often reformulated with concentrated oils or heavier base notes to suit regional climates and olfactory preferences. The UAE and Saudi Arabia are leading adopters, with premium consumers seeking novel yet sophisticated scent profiles that blend tradition with contemporary wellness themes. The region’s growing demand for sustainable and alcohol-free formulations further enhances the appeal of matcha perfumes positioned as both luxurious and health-conscious.

Latin America

Latin America is an emerging growth market for matcha perfumes, propelled by its youthful population, rising disposable incomes, and expanding e-commerce reach. Consumers in Brazil and Mexico are particularly receptive to influencer-driven fragrance trends and are showing enthusiasm for affordable premiumization, where accessible pricing meets elevated sensory storytelling. The region’s dynamic social media landscape and beauty influencer ecosystem help popularize matcha perfumes as aspirational yet attainable lifestyle products. Moreover, local brands are beginning to integrate botanical and tea-inspired ingredients to align with the global clean beauty movement. These trends collectively support strong regional growth through a mix of affordability, novelty, and social-media-fueled desirability.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Matcha Perfume Market

- Le Labo

- Diptyque

- Shiseido

- Maison Margiela

- Jo Malone London

- Parfums de Marly

- BYREDO

- Kyoto Tea Fragrance Co.

Recent Developments

- In August 2025, Jo Malone London launched its limited-edition “Matcha Meditation” fragrance across Europe, emphasizing tranquility and mindful living.

- In June 2025, Le Labo introduced an eco-refill initiative for its tea-based perfume range, including its matcha variant, supporting zero-waste goals.

- In March 2025, Shiseido unveiled a matcha-infused fragrance collection in Japan, combining skincare-grade ingredients with luxury scent profiles under its Future Aroma line.