Leather Furniture Market Size

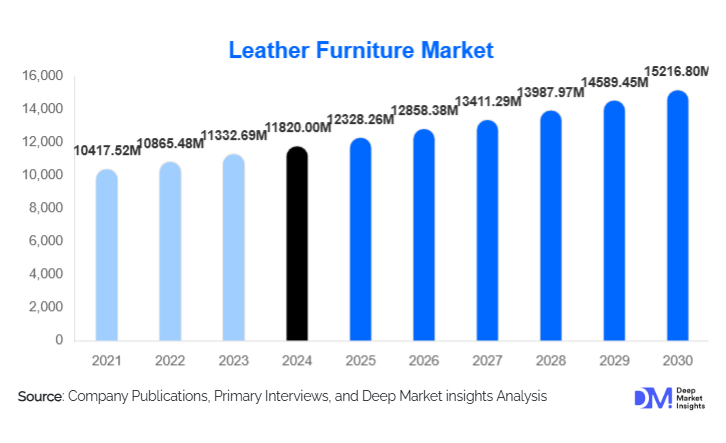

According to Deep Market Insights, the global leather furniture market size was valued at USD 11820 million in 2024 and is projected to grow from USD 12328.26 million in 2025 to reach USD 15216.8 million by 2030, expanding at a CAGR of 4.3% during the forecast period (2025–2030). The growing preference for premium décor, expansion of the hospitality and real estate sectors, and rising demand for ergonomic and smart leather furniture solutions continue to propel market growth worldwide.

Key Market Insights

- Sofas and recliners dominate the product category, driven by high residential and commercial adoption owing to comfort, durability, and aesthetic appeal.

- Genuine leather holds the largest material share, supported by its premium quality and luxury positioning in high-income markets.

- North America leads the global market in terms of revenue share, while Asia-Pacific emerges as the fastest-growing region due to rising urbanization and purchasing power.

- Online distribution channels are rapidly expanding, driven by virtual visualization, AR/VR tools, and growing preference for digital furniture shopping.

- Smart leather furniture equipped with recliners, IoT, massage features, and automation is gaining traction in luxury and premium residential demand.

- Eco-friendly and vegan leather alternatives are witnessing strong growth due to rising environmental awareness and regulatory changes.

What are the latest trends in the leather furniture market?

Rise of Eco-Friendly and Vegan Leather Alternatives

Environmental and ethical concerns are reshaping the leather furniture industry as manufacturers integrate vegan, plant-based, and recycled leather alternatives. Material innovations such as pineapple leather, mycelium-based leather, and recycled polyurethane are increasingly used to replace traditional animal-derived leather. This trend is particularly strong in Europe and North America, where sustainability metrics and carbon footprint transparency influence buyer decisions. Major brands are expanding eco-certified collections to align with global green regulations.

Smart and Automated Leather Furniture

Smart recliners, massage chairs, and IoT-integrated leather seating solutions are gaining popularity among consumers seeking comfort and luxury. Features such as voice-activated reclining, smartphone-controlled adjustments, built-in speakers, USB charging, and posture support systems are redefining modern furniture. This trend is strongest in the U.S., Japan, Germany, and UAE. The category is expected to capture significant premium market share over the next five years.

What are the key drivers in the leather furniture market?

Growing Demand for Luxury Lifestyle and Premium Home Décor

Rising disposable incomes, increasing urbanization, and lifestyle upgrades have boosted consumption of leather furniture, especially in residential and hospitality sectors. Consumers associate leather furniture with durability, prestige, and elegance, driving demand for premium leather sofas, recliners, and executive seating. In North America and Europe, 38–44% of high-income homebuyers demand leather-based interior furnishing solutions.

Expansion of Hospitality, Corporate, and Real Estate Sectors

Luxury hotels, lounges, premium restaurants, and corporate offices are major adopters of leather furniture due to brand positioning, durability, and customer experience value. Global hospitality infrastructure spending continues to rise, especially in UAE, Saudi Arabia, and Southeast Asia, leading to high procurement of leather seating solutions through contract-based bulk purchasing.

Growth of E-Commerce and Visual Furniture Customization

Augmented reality (AR), virtual room visualizers, and 3D modeling tools allow consumers to preview furniture in their home environments, boosting online sales. E-commerce platforms are witnessing double-digit growth, helping brands reach global buyers with custom-made leather furniture products.

What are the key challanges faced by the global market?

High Manufacturing and Raw Material Costs

Volatile raw leather prices, stringent tanning regulations, and high manufacturing costs increase product pricing, limiting accessibility for middle-income consumers. Additionally, prices of full-grain leather fluctuate due to supply chain disruptions, affecting both production and export margins.

Regulatory and Environmental Limitations

Animal-based leather production faces growing scrutiny due to environmental impact, cruelty concerns, and carbon emissions. Stricter regulations across the EU and North America are affecting leather sourcing and supply chain stability, pushing manufacturers towards compliant and eco-conscious alternatives.

What are the emerging opportunities in the leather furniture industry?

Smart Technology and Automation Integration

Automated recliners, massaging chairs, and tech-enhanced leather seating are redefining premium furniture categories. Integration of IoT, temperature control, voice commands, and AI-based posture support are opening new opportunities for manufacturers targeting luxury and ergonomic furniture segments.

Expansion in Hospitality and Commercial Real Estate

The growth of luxury resorts, co-working spaces, airports, and boutiques creates strong demand for commercial-grade leather furniture. The Middle East and Asia-Pacific regions are expected to invest heavily in leather furnishings for premium commercial spaces.

Vegan and Bio-Based Leather Furniture

Manufacturers can tap into growing interest for sustainable furniture through plant-based vegan leather, recycled PU leather, and biodegradable alternatives. These materials align with ESG goals and appeal to environmentally conscious consumers, particularly in Europe and North America.

Product Type Insights

Sofas & Recliners hold the largest market share at 38% in 2024, driven by their wide usage in both residential and commercial spaces. Recliner sofas and sectional leather seating are increasingly preferred in urban households due to comfort, ergonomic features, and luxury appeal. In corporate settings, leather seating represents sophistication and professionalism, further boosting its adoption.

Material Type Insights

Genuine leather accounts for approximately 45% of total revenue due to its premium positioning, durability, and luxury perception. Full-grain and top-grain leather dominate the category, especially in luxury hospitality and executive office settings. However, faux and vegan leather categories are projected to grow faster due to sustainability concerns and cost advantages.

Distribution Channel Insights

Offline retail channels hold 52% market share, driven by buyers’ preference for physical inspection, tactile quality assessment, and customized purchasing experiences. Specialty furniture stores and design studios maintain strong dominance, although online channels are rapidly growing with 10.5% CAGR as AR-based furniture visualization improves buyer experience.

End-User Insights

Residential users account for 56% of total leather furniture consumption, driven by home renovation trends, rising homeownership, and demand for stylish recliners and sectional sofas. Commercial demand, particularly from hospitality, offices, and premium lounges, is growing at 7.2% CAGR due to expanding infrastructure, brand positioning, and comfort-focused workplace trends.

| Product Type | Material Type | Distribution Channel | End-User |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounts for 31% of the global leather furniture market, with the United States leading in premium residential furniture consumption and commercial procurement. High consumer purchasing power, strong demand for luxury interiors, and widespread adoption of smart leather furniture drive this region’s dominance.

Europe

Europe captures 27% of market share, led by Germany, Italy, France, and the UK. The region has strong demand for sustainable and vegan leather alternatives, and Italy remains a major manufacturing hub for designer leather furniture. EU regulations promote ethical sourcing and eco-certified production.

Asia-Pacific

Asia-Pacific is the fastest-growing region, expanding at 7.8% CAGR. China is both the manufacturing and consumption leader, while India and Japan are emerging as major demand centers for both premium and mid-range leather furniture. Hospitality and residential real estate expansion is driving bulk procurement in the region.

Middle East & Africa

High-end luxury hospitality projects in UAE, Saudi Arabia, and Qatar are driving strong demand for premium leather furnishings. Africa also acts as both a consumption and raw material hub, with South Africa and Kenya showing growing import demand.

Latin America

Brazil and Mexico lead the Latin American market, focusing on value-based leather furniture and export manufacturing. Increasing real estate developments and rising interior décor trends are expanding market presence.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Company Market Share

The leather furniture market is moderately fragmented, with top players accounting for approximately 25% of the global market. These companies dominate premium and branded furniture retail segments across North America and Europe, while Asia-Pacific is increasingly led by regional manufacturers.

Key Players in the Leather Furniture Market

- Ashley Furniture Industries

- La-Z-Boy Incorporated

- IKEA Group

- Natuzzi S.p.A.

- Herman Miller, Inc.

- Flexsteel Industries

- DFS Furniture PLC

- Williams-Sonoma, Inc.

- Kuka Home

- Ethan Allen Interiors

Recent Developments

- In September 2024, Natuzzi S.p.A. announced its expansion into eco-friendly vegan leather collections for European markets.

- In July 2024, Ashley Furniture launched its smart recliner leather sofa with integrated charging docks and motion sensors across U.S. retail outlets.

- In May 2024, IKEA introduced recycled PU-based leather furniture solutions aimed at cost-effective and sustainable categories.