Modern Furniture Market Size

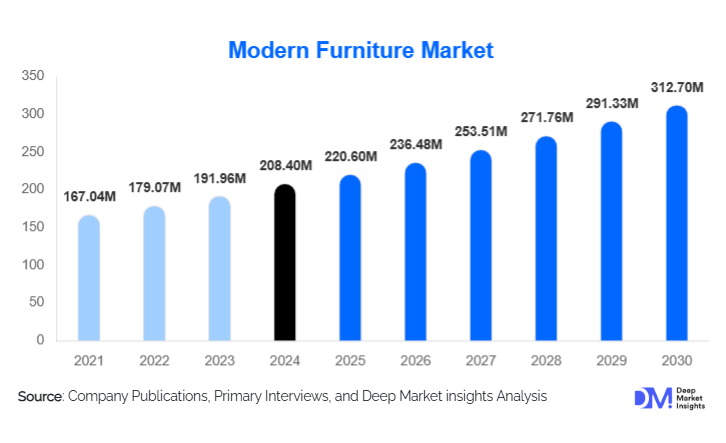

According to Deep Market Insights, the global modern furniture market size was valued at USD 208.4 billion in 2024 and is projected to grow from USD 220.6 billion in 2025 to reach USD 312.7 billion by 2030, expanding at a CAGR of 7.2% during the forecast period (2025–2030). The market growth is driven by rising consumer preference for minimalist interior design, increasing urbanization, and the growing popularity of multifunctional and sustainable furniture solutions across residential and commercial sectors.

Key Market Insights

- Rising demand for sustainable materials such as bamboo, reclaimed wood, and recycled metals is redefining modern furniture aesthetics and manufacturing.

- Smart and modular furniture designs are gaining traction, especially in urban apartments and co-working spaces.

- Asia-Pacific dominates global production, while North America and Europe lead in high-value designer and luxury segments.

- E-commerce is a major growth channel, offering customization, AR-based visualization tools, and competitive pricing.

- Corporate and hospitality sectors are increasingly adopting ergonomic and space-efficient modern furniture to enhance employee productivity and guest comfort.

- Technology integration, including IoT-enabled furniture and 3D-printed components, is reshaping product innovation.

What are the latest trends in the modern furniture market?

Sustainable and Eco-Friendly Furniture on the Rise

Manufacturers are emphasizing eco-friendly production by using renewable, biodegradable, and recycled materials. Consumers, especially millennials and Gen Z, prefer brands with transparent sourcing and carbon-neutral operations. Companies are integrating sustainability into every stage of the product lifecyclefrom material selection to end-of-life recyclability. Furniture made from bamboo, rattan, and reclaimed timber is increasingly favored for its natural aesthetics and low environmental footprint. Leading brands are also adopting water-based finishes, non-toxic adhesives, and modular designs that extend product lifespan.

Smart Furniture and Technology Integration

The fusion of technology and furniture design is transforming modern interiors. Smart desks, beds, and storage units equipped with wireless charging, built-in sensors, and lighting controls are gaining mainstream adoption. IoT-enabled features that allow remote adjustment and usage tracking are appealing to tech-savvy consumers. Companies are experimenting with AI-based ergonomic designs and customizable furniture modules that adapt to users’ posture and preferences, enhancing comfort and health benefits in home and office setups.

What are the key drivers in the modern furniture market?

Rapid Urbanization and Lifestyle Modernization

Rising urban population density and shrinking living spaces are fueling demand for compact, multifunctional furniture. Consumers in metropolitan areas prefer sleek, modular designs that maximize space efficiency without compromising aesthetics. Additionally, the increasing influence of modern interior design trends on social media platforms such as Pinterest and Instagram has significantly boosted consumer interest in contemporary styles.

Growing E-commerce and Digital Customization

The expansion of online furniture retail platforms has democratized access to designer furniture globally. Consumers now leverage AR and VR visualization tools to preview furniture placement, fostering greater confidence in online purchases. Direct-to-consumer (D2C) brands are capitalizing on this trend by offering customizable designs, faster delivery, and flexible financing options. The digital shift is further supported by increasing cross-border e-commerce, making modern furniture accessible in emerging economies.

What are the restraints for the global market?

High Production and Transportation Costs

Volatile raw material prices, particularly for wood, metal, and upholstery materials, significantly impact manufacturing margins. Rising logistics and freight costs due to supply chain disruptions also pose challenges. High-end modern furniture, often reliant on premium materials and craftsmanship, remains unaffordable for a large consumer base, limiting market penetration in price-sensitive regions.

Environmental Regulations and Supply Chain Constraints

Stringent regulations related to timber sourcing, chemical emissions, and sustainable manufacturing increase operational complexities for producers. Additionally, geopolitical tensions and disruptions in global supply chains can delay raw material procurement and distribution, constraining timely production and delivery cycles.

What are the key opportunities in the modern furniture industry?

Rise of Modular and Customizable Furniture

As flexible living becomes the norm, demand for modular furniture that adapts to changing spatial and lifestyle needs is surging. Manufacturers are investing in lightweight, reconfigurable products suitable for urban apartments and co-living spaces. Customization optionssuch as fabric, finish, and configuration choicesare attracting design-conscious consumers seeking personalization.

Expansion into Emerging Markets

Rising disposable incomes and rapid urban infrastructure development in Asia-Pacific, Latin America, and the Middle East are creating new opportunities for furniture brands. Local manufacturing collaborations, affordable product lines, and localized e-commerce platforms are helping companies penetrate these high-growth regions.

Product Type Insights

Seating furniture, including sofas, chairs, and recliners, accounts for the largest share of the market, driven by high demand in both residential and commercial spaces. Storage furniture, such as wardrobes and modular cabinets, is witnessing growing popularity for its functionality in compact urban homes. Tables and beds are evolving with ergonomic and convertible designs, while outdoor modern furniture is gaining traction among homeowners seeking aesthetic garden and patio arrangements.

Material Insights

Wood remains the dominant material segment due to its durability and timeless appeal, followed by metal and plastic composites used for modern industrial aesthetics. Glass and acrylic are increasingly used for minimalist interiors, while eco-friendly materials such as bamboo and recycled plastics are growing fastest as consumers shift toward sustainable options.

Distribution Channel Insights

Online retail leads the market, supported by increasing smartphone penetration, AR visualization technologies, and easy return policies. Offline channels, including specialty stores and exclusive brand outlets, remain vital for high-end purchases where tactile evaluation is key. Hybrid retail strategies combining digital and physical experiences are becoming the new standard for customer engagement.

End User Insights

The residential sector dominates global demand, driven by urban housing development and renovation trends. Commercial applicationsespecially in corporate offices, hospitality, and co-working spacesare expanding rapidly, emphasizing ergonomic and space-optimized designs. Educational institutions and healthcare facilities are emerging niche segments, focusing on durability, flexibility, and comfort.

| By Product Type | By Material Type | By Distribution Channel | By End User |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America represents a major market for modern furniture, led by high consumer spending, design innovation, and home improvement trends. The U.S. and Canada are witnessing strong demand for modular, ergonomic, and smart furniture solutions. The region’s focus on sustainable materials and domestic manufacturing supports steady long-term growth.

Europe

Europe remains a hub for premium and designer modern furniture, with Italy, Germany, and Scandinavia leading in craftsmanship and innovation. Consumers in this region prioritize quality, sustainability, and minimalist aesthetics. The European Green Deal and circular economy policies are accelerating the adoption of eco-conscious furniture production.

Asia-Pacific

Asia-Pacific dominates global furniture production and is the fastest-growing consumption market, driven by rapid urbanization in China, India, and Southeast Asia. Rising disposable incomes, expanding real estate development, and growing e-commerce infrastructure are key growth catalysts. The region is also seeing a surge in export-oriented manufacturing and localized design trends.

Latin America

Latin America’s modern furniture market is expanding steadily, with Brazil and Mexico leading demand. The region’s growing middle-class population and urban housing projects are boosting the consumption of affordable, contemporary furniture. Increasing local manufacturing capabilities and online retail growth are further supporting market expansion.

Middle East & Africa

The Middle East’s luxury residential developments and Africa’s emerging urban centers present lucrative growth prospects. The UAE, Saudi Arabia, and South Africa are major markets investing in modern infrastructure, hotels, and corporate officesdriving demand for modern furniture with both aesthetic and functional appeal.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Modern Furniture Market

- IKEA

- Herman Miller, Inc.

- HNI Corporation

- Steelcase Inc.

- Haworth Inc.

- Ashley Furniture Industries

- Williams-Sonoma, Inc.

- Okamura Corporation

- La-Z-Boy Incorporated

- Wayfair Inc.

Recent Developments

- In September 2025, IKEA announced plans to expand its circular product line with furniture made from 100% renewable and recycled materials by 2030.

- In June 2025, Herman Miller introduced an AI-powered ergonomic seating collection designed to improve posture and reduce fatigue in hybrid workplaces.

- In April 2025, Steelcase partnered with Microsoft to launch smart office furniture integrated with IoT-based productivity and wellness tracking systems.