Lactase Enzyme Supplement Market Size

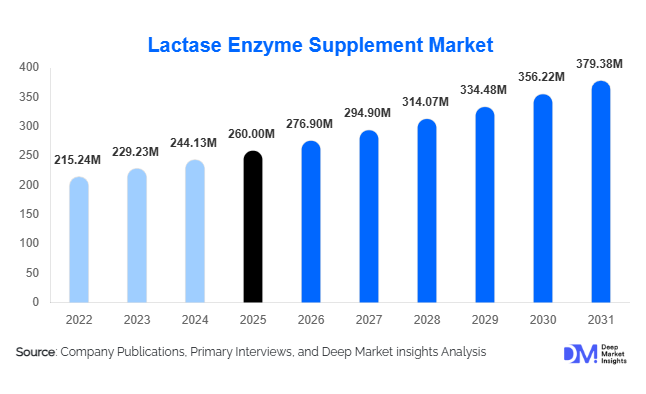

According to Deep Market Insights, the global lactase enzyme supplement market size was valued at USD 260 million in 2025 and is projected to grow from USD 276.90 million in 2026 to reach USD 379.38 million by 2031, expanding at a CAGR of 6.5% during the forecast period (2026–2031). The market growth is primarily driven by the rising prevalence of lactose intolerance, increasing consumer awareness of digestive health, and the growing adoption of convenient, clinically validated enzyme supplement formats such as tablets, capsules, and liquid drops.

Key Market Insights

- Tablets and capsules dominate the product type segment, favored for their ease of use, precise dosing, and strong pharmacy and modern retail presence.

- Yeast-derived lactase is the leading enzyme source, accounting for over 55% of global supply due to its broad pH tolerance, effectiveness, and widespread industry adoption.

- E-commerce channels are expanding rapidly, representing 35–40% of global sales, driven by subscription models, D2C platforms, and online health awareness campaigns.

- Asia-Pacific is the fastest-growing regional market, fueled by rising lactose intolerance awareness, increasing disposable income, and expanding e-commerce penetration.

- North America holds the largest market share, driven by high consumer health literacy, established retail infrastructure, and strong adoption of OTC enzyme supplements.

- Technological innovation in formulations, including enzyme stabilization, enteric-coated tablets, and hybrid lactase-probiotic combinations, is enhancing product differentiation and market growth.

What are the latest trends in the lactase enzyme supplement market?

Integration with Probiotics and Multi-Enzyme Formulations

Manufacturers are increasingly introducing lactase supplements combined with probiotics and other digestive enzymes to address multiple gut health concerns simultaneously. These hybrid formulations improve overall digestive wellness and appeal to health-conscious consumers seeking comprehensive digestive solutions. Premium offerings emphasize clinically validated efficacy, higher enzyme stability, and gut microbiome benefits, allowing companies to differentiate their products and command premium pricing.

E-commerce and Direct-to-Consumer Growth

Online sales are increasingly driving market growth, enabling consumers to conveniently access lactase supplements with transparent pricing, subscription models, and real-time reviews. Digital health platforms and mobile apps now recommend enzyme supplements based on personalized symptom tracking, boosting consumer confidence and encouraging repeat purchases. The rise of social media awareness campaigns and influencer endorsements further expands product visibility, particularly among younger demographics and first-time buyers.

What are the key drivers in the lactase enzyme supplement market?

Rising Lactose Intolerance Awareness

Increasing diagnosis of lactose intolerance worldwide is a primary driver for market expansion. As consumers seek ways to manage digestive discomfort while maintaining dairy consumption, lactase supplements become the preferred choice for non-prescription management. Healthcare providers and online education campaigns are further promoting awareness, supporting adoption across age groups and regions.

Focus on Digestive Health and Personalized Nutrition

The growing global emphasis on digestive wellness, gut health, and personalized nutrition has led to higher demand for targeted enzyme supplements. Consumers are proactively seeking solutions that alleviate bloating, gas, and other lactose-related discomforts. Integration with dietary supplements, probiotics, and functional foods reinforces lactase enzymes as part of a holistic digestive health regimen.

Convenient Delivery Forms and Premium Product Offerings

Consumer preference for tablets, capsules, and liquid drops provides convenience and portability, supporting frequent usage. Innovative formulations, including enteric-coated tablets and enzyme-probiotic blends, are commanding higher market value and enhancing consumer trust. Premium product offerings targeting efficacy and stability are driving revenue growth alongside broader mainstream adoption.

What are the restraints for the global market?

Competition from Dairy Alternatives

The rise of plant-based and lactose-free dairy products reduces the need for lactase enzyme supplements among consumers who avoid dairy entirely. While occasional dairy consumers still rely on supplements, sustained market expansion may require repositioning products for broader digestive health applications beyond lactose intolerance.

Regulatory Complexity and Quality Concerns

Variations in global supplement regulations regarding labeling, claims, and enzyme activity create barriers to international expansion. Additionally, consumer skepticism due to substandard or unverified products can limit adoption, necessitating strict quality controls, transparent labeling, and clinically validated formulations.

What are the key opportunities in the lactase enzyme supplement market?

Emerging Markets in Asia-Pacific

Rising disposable incomes, increased awareness of lactose intolerance, and growing e-commerce penetration in China, India, and Japan are creating high-growth opportunities. Local production and distribution partnerships allow both regional and global players to expand reach while addressing unmet demand in these populous markets.

Integration with Digital Health Platforms

Lactase supplements can capitalize on telehealth, personalized nutrition apps, and AI-driven dietary guidance to boost consumer engagement. Digital platforms recommending enzyme intake based on symptoms and meal patterns provide recurring demand and enhance customer loyalty.

Product Innovation in Formulations

Developing high-stability, multi-enzyme, and probiotic-enriched lactase supplements allows companies to differentiate their offerings and cater to broader digestive health needs. Clinical validation and premium positioning also enable higher margins and consumer trust, fostering long-term brand loyalty.

Product Type Insights

Tablets and capsules dominate the global lactase enzyme supplement market, accounting for the largest revenue share due to their convenience, accurate dosing, long shelf life, and widespread availability across pharmacies, supermarkets, and online retail platforms. These formats are particularly favored by adult consumers and frequent dairy users, as they allow on-the-go consumption immediately before meals. The dominance of tablets and capsules is further reinforced by pharmaceutical-grade manufacturing standards, consistent enzyme activity, and the ease of incorporating advanced technologies such as enteric coating, which improves enzyme stability and effectiveness in the digestive tract.

Powder formulations and liquid drops serve niche but growing segments, particularly among pediatric users, elderly consumers, and individuals requiring flexible or weight-based dosing. Liquid drops are commonly used for infant nutrition and clinical settings, where precise control over enzyme intake is critical. Powders are increasingly adopted by consumers, integrating lactase enzymes into beverages or functional foods at home. Multi-enzyme and probiotic-integrated lactase supplements are emerging as a premium and high-growth segment, driven by rising consumer demand for comprehensive digestive health solutions. These formulations address broader gut health concerns such as bloating, indigestion, and microbiome balance, allowing manufacturers to command higher price points and improve margins. This segment is particularly popular in North America, Europe, and urban Asia-Pacific markets, where consumer awareness of gut microbiome science is high.

Application Insights

Personal management of lactose intolerance remains the primary application, accounting for the majority of global demand. Individual consumers rely on lactase supplements to continue consuming dairy products without discomfort, making this application highly recurrent and volume-driven. Rising self-diagnosis, physician recommendations, and online health education platforms continue to reinforce this segment’s dominance. Secondary applications include functional food and beverage integration, where lactase enzymes are used to produce lactose-reduced or lactose-free dairy products. While this application overlaps with the broader industrial enzyme market, it indirectly supports supplement demand by increasing consumer familiarity with enzyme-based digestive solutions.

Clinical nutrition and sports nutrition are emerging application areas. In clinical settings, lactase supplements are increasingly incorporated into dietary protocols for pediatric, geriatric, and post-operative patients. In sports nutrition, rising protein and dairy consumption among athletes and fitness-focused consumers is driving demand for digestive enzyme support, positioning lactase as part of broader performance nutrition regimens.

Distribution Channel Insights

E-commerce is the leading distribution channel, accounting for approximately 35–40% of global sales. The dominance of online channels is driven by convenience, subscription-based purchasing models, wider product selection, transparent pricing, and access to consumer reviews. Direct-to-consumer (D2C) platforms allow brands to build loyalty through personalized recommendations, bundled digestive health solutions, and recurring purchase programs. Pharmacies and modern trade retailers maintain a strong presence, particularly in developed markets, due to consumer trust, professional guidance, and impulse purchases. These channels are especially important for first-time buyers and clinically positioned products.

Healthcare channels, including hospitals, clinics, and dietitian-led nutrition centers, are gradually increasing adoption. Lactase supplements are being recommended as part of dietary management plans for lactose intolerance, supporting steady growth in institutional and prescription-adjacent sales.

End-User Insights

Individual consumers represent the largest end-user segment, driven by widespread lactose intolerance and growing awareness of digestive health. Repeat usage, meal-linked consumption patterns, and OTC accessibility make this segment the core revenue contributor. Healthcare and clinical nutrition users are growing steadily as lactase supplements are increasingly recommended by healthcare professionals. Pediatric nutrition, geriatric care, and hospital dietary planning are key contributors to this segment’s expansion.

Emerging end-users include sports nutrition brands, wellness programs, and functional food manufacturers, integrating lactase enzymes to improve digestibility and consumer comfort. Export-driven demand is rising in Asia-Pacific, Europe, and North America as regulatory approvals expand and health-conscious populations adopt enzyme supplementation as part of daily nutrition routines.

| By Product Type | By Application | By Distribution Channel | By End User |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 30–35% of the global lactase enzyme supplement market, led by the United States and Canada. Growth in this region is driven by high awareness of lactose intolerance, a well-established dietary supplement culture, and strong over-the-counter (OTC) adoption. Advanced retail infrastructure, widespread e-commerce penetration, and the popularity of premium, multi-enzyme, and probiotic-integrated formulations further support regional dominance. Additionally, strong physician and dietitian recommendations reinforce consumer trust and repeat usage.

Europe

Europe holds around 25–28% of the global market share, with Germany, the United Kingdom, and France being the key demand centers. Regional growth is driven by health-conscious consumers, high dairy consumption levels, and regulatory clarity around dietary supplements. Europe also shows strong demand for clean-label, non-GMO, and clinically validated enzyme products. While the market is relatively mature, steady growth is supported by aging populations, rising digestive health awareness, and expanding adoption of premium and combination formulations.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market, expanding at an estimated CAGR of 8–10%, driven by China, India, and Japan. The region’s growth is supported by a high prevalence of lactose intolerance, rapid urbanization, increasing disposable incomes, and expanding access to e-commerce platforms. Growing awareness of digestive wellness, the influence of Western dietary patterns, and rising consumption of dairy and protein-rich foods are further accelerating demand. Multi-enzyme and premium formulations are gaining traction among urban consumers seeking holistic gut health solutions.

Latin America

Latin America accounts for approximately 8–10% of the global market share, with Brazil and Mexico as the primary contributors. Regional growth is driven by increasing health literacy, rising middle-class purchasing power, and gradual adoption of dietary supplements. Expansion of international brands, improved retail penetration, and growing awareness of lactose intolerance are supporting market development, although demand remains more niche compared to developed regions.

Middle East & Africa

The Middle East & Africa region represents around 5–7% of the global market. Growth is concentrated in urban centers such as the UAE, Saudi Arabia, and South Africa, supported by rising disposable incomes, increasing exposure to Western diets, and growing interest in digestive wellness. However, slower growth persists due to lower overall awareness, limited retail penetration in rural areas, and uneven regulatory frameworks across countries.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Lactase Enzyme Supplement Market

- Chr. Hansen Holding A/S

- DuPont de Nemours, Inc.

- DSM (Royal DSM)

- Novozymes A/S

- Advanced Enzyme Technologies Ltd.

- Kerry Group

- BASF SE

- Enzymedica

- Amano Enzyme

- Südzucker

- Kerry Ingredients

- Gnosis by Lesaffre

- Biocatalysts Ltd.

- Lactaid

- Other regional/niche players