Global Kombucha Market Size

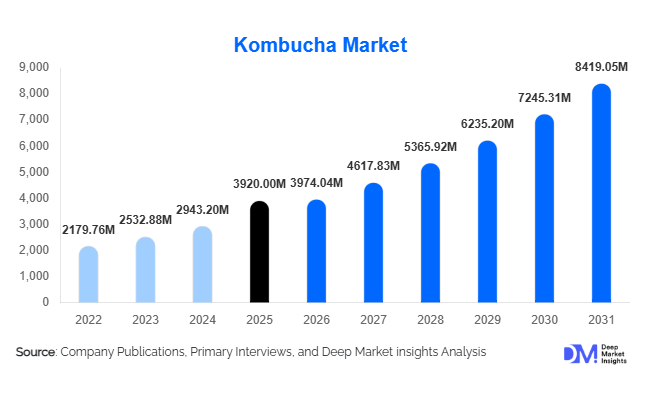

According to Deep Market Insights,the global kombucha market size was valued at USD 3,920 million in 2025 and is projected to grow from USD 3,974.04 million in 2026 to reach USD 8,419.05 million by 2031, expanding at a CAGR of 16.2% during the forecast period (2026–2031). The kombucha market growth is primarily driven by rising health and wellness awareness, increased adoption of functional beverages, and the diversification of flavors and formats catering to premium and mass-market consumers worldwide.

Key Market Insights

- Health-conscious consumers are fueling demand for kombucha, particularly for gut-health benefits, low sugar content, and probiotic-rich functional beverages.

- Hard kombucha and premium craft variants are expanding, offering alcoholic and enhanced formulations that appeal to younger, lifestyle-focused consumers.

- North America dominates the market, led by the U.S., due to early adoption, mature retail channels, and established brand presence.

- Asia-Pacific is the fastest-growing region, driven by urbanization, rising middle-class disposable income, and cultural familiarity with fermented beverages.

- Europe is increasingly adopting functional and organic kombucha products, with Germany, the UK, and France representing key consumption hubs.

- Technological innovation, including e-commerce penetration, direct-to-consumer sales, and cold-chain distribution, is reshaping market accessibility and brand reach.

What are the latest trends in the kombucha market?

Functional and Enhanced Formulations

Manufacturers are increasingly adding functional ingredients such as adaptogens, vitamins, CBD-free botanicals, and clinically backed probiotics to kombucha. These variants appeal to consumers seeking specific health benefits beyond gut wellness, including immunity support and mental health. Functional kombucha commands premium pricing and supports brand differentiation. Product launches emphasizing organic, low-sugar, and therapeutic formulations are rapidly gaining traction across North America and Europe.

Hard Kombucha and Low-Alcohol Innovations

Low-alcohol and hard kombucha products are emerging as a significant growth segment, offering consumers a healthier alternative to beer and spirits. Regulatory easing and growing acceptance of low-ABV beverages in bars, restaurants, and retail outlets have accelerated this trend. Hard kombucha consumption is projected to grow at a CAGR exceeding 20% globally, driven by millennial and Gen Z preference for social, functional beverages.

What are the key drivers in the kombucha market?

Rising Health and Wellness Awareness

Consumers worldwide are increasingly prioritizing digestive health, immunity, and reduced sugar intake. Kombucha, naturally fermented and rich in probiotics, aligns with this shift. Rising incidences of lifestyle-related illnesses and increased awareness of functional foods have directly contributed to market growth. Younger demographics in urban areas show a particular affinity for regular kombucha consumption as a daily health supplement.

Decline in Carbonated Soft Drink Consumption

Government-imposed sugar taxes and health-driven consumer choices are reducing demand for carbonated soft drinks. Kombucha benefits as a low-sugar, natural alternative, driving retail expansion across supermarkets, convenience stores, and e-commerce platforms. The beverage’s positioning as a wellness-oriented substitute supports higher pricing and repeat purchase behavior.

Product Innovation and Premiumization

Innovations in flavor, packaging, and functional ingredients have propelled the premium segment of kombucha. Craft brewing techniques, glass bottle packaging, and limited-edition flavors are attracting discerning consumers willing to pay more. Premium products now account for 44% of the 2025 market, emphasizing both taste and perceived health benefits.

What are the restraints for the global kombucha market?

High Production Costs and Supply Chain Complexity

Fermentation processes, quality consistency requirements, and cold-chain logistics increase production costs, particularly for premium and functional variants. These factors can limit scalability and hinder penetration into price-sensitive regions, restricting market growth.

Regulatory Challenges

Kombucha naturally contains trace alcohol, creating compliance complexities across different countries. Labeling requirements, claims on probiotics, and alcohol limits vary, forcing manufacturers to adapt products for each market, adding operational complexity and potential legal risks.

What are the key opportunities in the kombucha market?

Functional Beverage Expansion

Adding adaptogens, nootropics, and targeted probiotics enables brands to capture health-conscious consumers looking for tailored wellness benefits. Functional kombucha products also support premium pricing and foster consumer loyalty, particularly in North America and Europe.

Emerging Market Expansion

Asia-Pacific and Latin America offer untapped growth potential. Rising urban populations, higher disposable incomes, and growing interest in wellness beverages provide opportunities for localized flavors, affordable packaging, and tailored marketing campaigns. Asia-Pacific is projected to grow at over 18% CAGR, making it the fastest-growing region.

Low-Alcohol and Hard Kombucha Innovation

The popularity of low-ABV and hard kombucha presents opportunities in social and lifestyle consumption occasions. Regulatory liberalization, bar adoption, and the appeal of healthier alternatives to traditional alcohol enable new entrants to capture incremental market share.

Product Type Insights

Traditional kombucha continues to dominate the global market, accounting for 62% of sales in 2025. Its leadership is supported by high consumer familiarity, non-alcoholic positioning, and strong repeat purchase behavior. Hard kombucha and functional variants, however, are experiencing rapid growth, particularly in North America and Europe, fueled by lifestyle adoption, premium positioning, and increasing consumer interest in functional beverages that support health and wellness.

Flavor Insights

Fruit-based kombucha leads with a 48% share of the global market. Fruity flavors effectively mask the natural acidity of fermentation, attracting first-time consumers and encouraging trial. Herbal and botanical variants are gaining traction due to their perceived functional benefits, including anti-inflammatory, immunity-boosting, and digestive health properties, aligning with the rising wellness-focused consumer trend.

Packaging Insights

Glass bottles account for 54% of global kombucha sales, driven by premium perception, environmental consciousness, and the preservation of flavor and probiotic quality. Aluminum cans are increasingly popular in convenience and foodservice channels, offering advantages such as portability, shelf stability, and suitability for on-the-go consumption.

Distribution Channel Insights

Supermarkets and hypermarkets remain the primary distribution channels, representing 46% of global sales due to their mainstream retail penetration. Online and direct-to-consumer (DTC) channels are growing rapidly at over 22% CAGR, providing access to niche flavors, subscription-based offerings, and personalized consumer experiences. Foodservice adoption, including kombucha on tap in cafés and bars, is emerging as a significant growth avenue, targeting wellness-conscious consumers seeking premium beverage experiences.

| By Product Type | By Flavor Profile | By Packaging Format | By Distribution Channel | By Price Positioning |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America is the largest kombucha market, holding a 38% share in 2025, with the U.S. leading at 32%. Market growth is driven by high consumer awareness, strong retail presence, and the dominance of established brands. Premium and functional variants are particularly popular in urban areas. Key growth drivers include increasing health-consciousness among consumers, lifestyle adoption of functional beverages, and the proliferation of specialty health and wellness stores.

Europe

Europe accounts for 26% of the global market, with Germany, the UK, and France as major contributors. Market expansion is supported by high consumer receptivity to organic and functional kombucha, regulatory clarity, and an increasing number of retail channels offering premium beverages. Growth drivers include rising interest in natural and organic ingredients, lifestyle-driven consumption patterns, and increasing awareness of gut health and immunity benefits.

Asia-Pacific

Asia-Pacific is the fastest-growing kombucha market, with a CAGR exceeding 18%. Key markets include China, India, Japan, and South Korea. Growth is propelled by urban wellness trends, strong influence of social media and digital marketing, rising disposable incomes, and a growing middle class seeking premium and functional beverages. Increasing health consciousness, modern retail expansion, and the emergence of domestic kombucha brands also contribute significantly to regional growth.

Latin America

Latin America accounts for 9% of the market, led by Brazil and Mexico. Growth is driven by emerging health awareness, premium beverage adoption, and an increasing trend of functional drinks consumption in urban centers. Rising disposable incomes, expansion of modern retail formats, and exposure to global wellness trends are accelerating market adoption.

Middle East & Africa

The Middle East & Africa hold a 5% share of the global kombucha market. Early adoption in high-income GCC countries and urban African centers supports gradual expansion. Growth is primarily driven by increasing health-consciousness among urban consumers, adoption of premium beverages in hospitality and wellness-focused establishments, and rising availability of imported and niche kombucha brands. The region also benefits from rising social media influence and exposure to global health and wellness trends.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Kombucha Market

- GT’s Living Foods

- KeVita

- Health-Ade

- Brew Dr. Kombucha

- Humm Kombucha

- The Hain Celestial Group

- Reed’s Inc.

- Buchi Kombucha

- Kosmic Kombucha

- Captain Kombucha

- Remedy Drinks

- Equinox Kombucha

- Rise Kombucha

- Jarr Kombucha

- Love Kombucha