Humectant Market Size

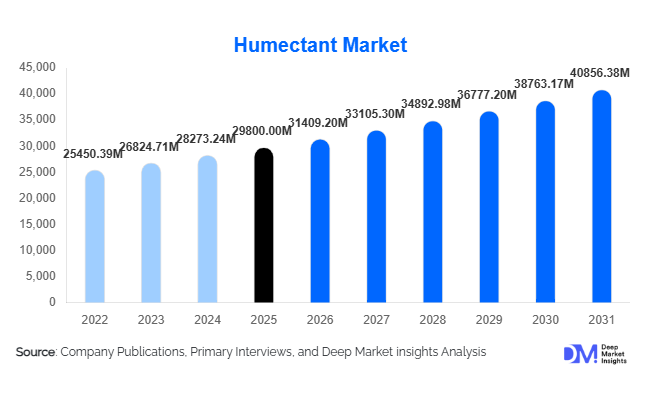

According to Deep Market Insights, the global humectant market size was valued at USD 29,800 million in 2025 and is projected to grow from USD 31,409.20 million in 2026 to reach USD 40,856.38 million by 2031, expanding at a CAGR of 5.4% during the forecast period (2026–2031). Market growth is primarily driven by rising demand for moisture-retention ingredients in personal care products, expanding pharmaceutical excipient consumption, and steady growth in processed food manufacturing worldwide.

Humectants are hygroscopic substances that attract and retain moisture, playing a critical functional role in cosmetics, food preservation, pharmaceuticals, tobacco processing, and industrial applications. Increasing consumer awareness regarding skincare hydration, clean-label formulations, and product stability has strengthened demand across both developed and emerging economies. Additionally, the shift toward bio-based and plant-derived humectants such as vegetable glycerin and fermentation-derived sorbitol is reshaping global supply chains and investment patterns. Asia-Pacific remains the leading production hub, while North America and Europe account for significant high-value consumption in cosmetic and pharmaceutical applications.

Key Market Insights

- Bio-based humectants account for over 60% of total demand, reflecting growing regulatory and consumer preference for sustainable and renewable ingredients.

- Glycerol (glycerin) dominates with nearly 38% market share in 2025, supported by extensive use in food, cosmetics, and pharmaceutical formulations.

- Personal care & cosmetics represent the largest application segment, contributing approximately 34% of global revenue.

- Asia-Pacific holds around 41% of the global market share, led by China and India’s production and pharmaceutical exports.

- Pharmaceutical applications are the fastest-growing segment, expanding at over 6% CAGR due to rising generic drug manufacturing.

- The top five companies collectively account for nearly 42% of the global market share, indicating moderate consolidation with strong multinational participation.

What are the latest trends in the humectant market?

Shift Toward Bio-Based and Sustainable Ingredients

Sustainability has emerged as a defining trend in the humectant market. Manufacturers are increasingly investing in plant-derived glycerin, sorbitol from corn and tapioca starch, and fermentation-based polyols. Regulatory encouragement in Europe and North America, combined with consumer demand for clean-label cosmetics and natural food additives, is accelerating the transition from petrochemical-derived glycols to renewable alternatives. Major producers are expanding vegetable oil refining and biodiesel-linked glycerin purification capacities, ensuring supply stability while improving environmental credentials.

Premiumization in Personal Care Formulations

The personal care sector is driving innovation in specialty humectants such as hyaluronic acid, sodium PCA, and advanced glycols. High-performance moisturizers, anti-aging serums, and dermaceutical products are incorporating multifunctional humectants that combine hydration with barrier repair and stabilization properties. The growing popularity of K-beauty and medical-grade skincare is elevating demand for pharmaceutical-grade purity standards in cosmetic ingredients. This premiumization trend is increasing average selling prices and enhancing margins in specialty segments.

What are the key drivers in the humectant market?

Expansion of the Global Personal Care Industry

The global skincare and haircare markets continue to expand due to rising disposable incomes, urbanization, and growing beauty consciousness. Humectants are foundational components in moisturizers, conditioners, toothpaste, and color cosmetics. The hydration-focused product trend has significantly boosted demand for glycerin and hyaluronic acid, particularly in Asia-Pacific and North America.

Growth in Processed and Packaged Food Consumption

Humectants play a crucial role in moisture control, texture enhancement, and shelf-life extension in bakery, confectionery, dairy, and beverage products. The continued growth of packaged food industries in emerging markets, coupled with rising export-oriented food manufacturing, has strengthened industrial demand for sorbitol and glycerol.

What are the restraints for the global market?

Raw Material Price Volatility

Vegetable oil price fluctuations, particularly palm and soybean oil, directly impact glycerin production economics. As crude glycerin is a by-product of biodiesel manufacturing, variability in biofuel policies and feedstock pricing can create supply-demand imbalances, affecting margins.

Stringent Regulatory Compliance

Pharmaceutical- and food-grade humectants must comply with strict pharmacopeia and food safety standards. Regulatory approvals, documentation, and quality audits increase operational costs, particularly for small and mid-sized manufacturers operating in export markets.

What are the key opportunities in the humectant industry?

Pharmaceutical Manufacturing Expansion in Emerging Markets

India and China are strengthening their positions as global generic drug exporters. Humectants used as excipients in syrups, tablets, and topical formulations are benefiting from rising production volumes. Long-term supply contracts and compliance with international pharmacopeial standards offer strong growth prospects for manufacturers.

New Applications in Plant-Based and Nutraceutical Products

The rapid growth of plant-based meat substitutes and nutraceutical supplements is generating new demand for moisture-stabilizing and texture-enhancing agents. Humectants are increasingly used in protein bars, alternative dairy products, and fortified beverages to maintain consistency and product stability.

Product Type Insights

Glycerol (glycerin) remains the leading product segment, accounting for approximately 38% of the global humectant market in 2025. The dominance of glycerol is primarily driven by its multi-industry applicability, cost-effectiveness, and abundant availability as a by-product of biodiesel production. Its compatibility with food-grade, pharmaceutical-grade, and cosmetic-grade formulations makes it a preferred moisture-retention agent globally. Additionally, the expansion of bio-based glycerin production from vegetable oils has strengthened supply stability and supported regulatory compliance in developed markets. Strong demand from skincare hydration products, toothpaste formulations, syrups, and bakery applications continues to reinforce its leadership position.

Sorbitol represents the second-largest segment, supported by widespread use in sugar-free confectionery, chewing gums, diabetic-friendly foods, and oral care products. Growth in low-calorie and functional food consumption is directly supporting sorbitol demand. Meanwhile, specialty humectants such as hyaluronic acid and polyethylene glycol (PEG) account for a smaller volume share but generate significantly higher margins due to their applications in dermaceuticals, injectables, and advanced pharmaceutical formulations. The rising global demand for anti-aging skincare and drug delivery systems is accelerating growth in these specialty categories. By form, liquid humectants dominate with nearly 70% share, driven by ease of blending, formulation flexibility, and suitability for large-scale manufacturing in food, cosmetics, and pharmaceutical industries. Powder and gel forms serve niche applications, particularly in dry formulations and controlled-release drug systems.

Application Insights

Personal care & cosmetics account for around 34% of global demand in 2025, making it the leading application segment. The primary growth driver is the global shift toward hydration-focused skincare, anti-aging formulations, and clean-label beauty products. Rising disposable incomes in the Asia-Pacific and increased product premiumization in North America and Europe are supporting sustained demand. The influence of dermatologically tested and medical-grade skincare products has also increased the use of high-purity humectants. Food & beverages follow with approximately 30% share, driven by growth in packaged foods, bakery products, dairy items, and sugar-free confectionery. Humectants play a vital role in moisture retention, texture stabilization, and shelf-life extension, making them indispensable in processed food manufacturing. Expansion of export-oriented food processing in emerging markets further strengthens this segment.

Pharmaceutical applications contribute nearly 25% of market revenue and represent the fastest-growing segment, expanding at over 6% CAGR. Rising generic drug production, increasing global healthcare expenditure, and growing demand for excipients in syrups, tablets, and injectables are the primary drivers. Industrial applications, including paints, adhesives, textiles, and tobacco, collectively account for the remaining share, offering stable yet moderate growth.

End-Use Industry Insights

FMCG manufacturers represent the largest end-use segment, contributing approximately 45% of global demand in 2025. Growth in skincare, oral care, processed food, and beverage industries underpins this segment’s leadership. Large multinational FMCG companies are increasingly sourcing bio-based and high-purity humectants to align with sustainability and regulatory requirements.

Pharmaceutical manufacturers account for roughly 25% and are expanding rapidly due to export-driven generic drug production, particularly from India and China. Increasing compliance with international pharmacopeia standards has boosted demand for pharmaceutical-grade humectants. Industrial chemical producers and specialty chemical companies form a stable demand base, especially in coatings, textiles, and adhesives. Additionally, rising nutraceutical and plant-based food manufacturers are emerging as new end-use contributors, strengthening diversified demand across global markets.

| By Product Type | By Application | By End-Use Industry | By Form | By Source |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific leads the global humectant market with approximately 41% share in 2025 and remains the fastest-growing region at over 6% CAGR. China dominates global production due to large-scale glycerin and sorbitol manufacturing facilities integrated with oleochemical and starch-processing industries. Government support for bio-based chemical manufacturing and export-oriented industrial policies further enhances competitiveness. India is a key growth engine, driven by its rapidly expanding pharmaceutical exports and robust generic drug manufacturing sector. Japan and South Korea contribute significantly to high-value cosmetic demand, particularly in premium skincare and dermaceutical applications. Rapid urbanization, rising disposable incomes, and expanding processed food industries continue to fuel regional growth.

North America

North America accounts for around 24% of global demand, led primarily by the United States. Strong consumption from advanced personal care, processed food, and pharmaceutical industries drives stable market expansion. The region benefits from high demand for clean-label and bio-based ingredients, supported by stringent regulatory standards and sustainability commitments. Technological innovation in specialty humectants and strong R&D investments by chemical manufacturers further support premium product demand. Additionally, increasing nutraceutical and functional food consumption is reinforcing regional growth momentum.

Europe

Europe holds nearly 22% share of the global market, with Germany, France, and the UK serving as key demand centers. Strict environmental and sustainability regulations are accelerating the adoption of bio-based humectants. The region’s well-established cosmetic and pharmaceutical industries support steady consumption of high-purity grades. Growing demand for vegan and clean-label products in the food and beauty segments further strengthens growth. Government policies promoting circular economy models and green chemistry investments also provide structural support for market expansion.

Latin America

Latin America contributes approximately 8% of global demand, led by Brazil and Mexico. Expanding food processing, sugar-free confectionery production, and rising personal care manufacturing capacity are key growth drivers. Brazil’s strong biodiesel industry supports regional glycerin availability, improving supply economics. Increasing foreign direct investment in pharmaceutical production and improving export capabilities are gradually strengthening demand across the region.

Middle East & Africa

The Middle East & Africa account for about 5% of global demand, with growth concentrated in GCC countries and South Africa. Rising consumer goods manufacturing, increasing pharmaceutical imports, and diversification efforts away from oil-dependent economies are supporting demand for specialty chemicals, including humectants. Infrastructure development, urban population growth, and expanding packaged food consumption are contributing to gradual but steady regional expansion.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Humectant Market

- Archer Daniels Midland Company

- Cargill Incorporated

- Dow Inc.

- BASF SE

- DuPont de Nemours, Inc.

- Roquette Frères

- Ingredion Incorporated

- Ashland Inc.

- Evonik Industries AG

- Croda International Plc

- KLK OLEO

- Wilmar International Limited

- Mitsubishi Chemical Group Corporation

- IOI Oleochemical Industries

- Godrej Industries Limited