Hospitality Market Size

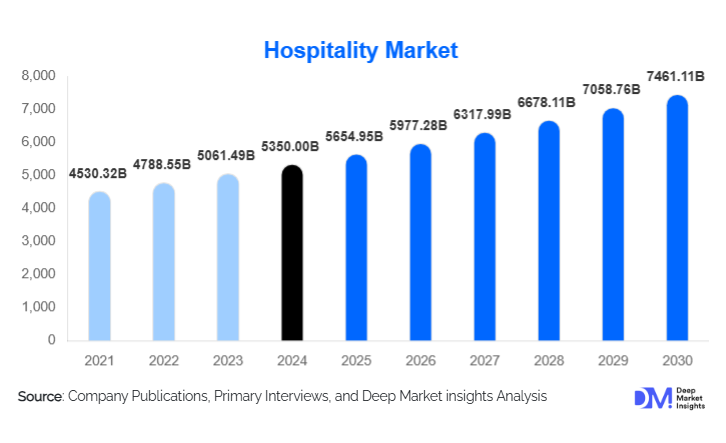

According to Deep Market Insights, the global hospitality market size was valued at USD 5,350.00 billion in 2024 and is projected to grow from USD 5,654.95 billion in 2025 to reach USD 7,461.11 billion by 2030, expanding at a CAGR of 5.7% during the forecast period (2025–2030). The hospitality market growth is primarily driven by the recovery of global travel and tourism, rising disposable incomes, expansion of urban and tourism infrastructure, and increasing demand for premium, experience-led accommodation offerings across both developed and emerging economies.

Key Market Insights

- Hotels remain the dominant property type, accounting for over 60% of global hospitality revenues due to strong leisure and business travel demand.

- Asia-Pacific represents the largest and fastest-growing regional market, supported by rising domestic tourism, infrastructure investments, and government-led tourism initiatives.

- Luxury and upper-upscale hospitality is expanding rapidly, driven by premiumization, experiential travel, and rising high-net-worth populations.

- Chain-operated and branded properties continue to gain share, benefiting from loyalty programs, standardized service quality, and global brand recognition.

- Digitalization and automation, including contactless check-in, AI-driven pricing, and smart rooms, are reshaping operational efficiency and guest experience.

- Sustainability-focused hospitality models are becoming mainstream, influencing consumer preferences and investment decisions.

What are the latest trends in the hospitality market?

Technology-Driven Smart Hospitality

The hospitality industry is undergoing rapid digital transformation, with hotels increasingly adopting AI, IoT, and data analytics to enhance guest experience and operational efficiency. Smart room technologies, mobile-based check-ins, digital concierge services, and predictive maintenance systems are becoming standard across mid-scale and premium properties. Revenue management systems powered by AI are enabling dynamic pricing, improving occupancy rates, and RevPAR. These technologies are particularly attractive to younger, tech-savvy travelers and business guests who value convenience, personalization, and speed.

Rise of Experiential and Lifestyle Hospitality

Travelers are increasingly prioritizing experiences over standardized accommodation, fueling growth in lifestyle hotels, boutique properties, wellness resorts, and themed hospitality offerings. Hotels are integrating local culture, cuisine, wellness programs, and entertainment into their value propositions. Experiential hospitality not only enhances guest satisfaction but also allows operators to command premium pricing and improve customer loyalty. This trend is especially prominent in urban centers and leisure destinations across Europe, Asia-Pacific, and the Middle East.

What are the key drivers in the hospitality market?

Recovery of Global Travel and Tourism

The resurgence of international and domestic travel following pandemic disruptions is a primary driver of hospitality market growth. Increased air connectivity, relaxed visa policies, and pent-up travel demand have significantly improved hotel occupancy rates across major tourism destinations. Leisure travel continues to lead demand, while business travel and MICE activities are steadily recovering, particularly in financial hubs and industrial centers.

Urbanization and Infrastructure Expansion

Rapid urban development, particularly in the Asia-Pacific, the Middle East, and Africa, is driving demand for hotels linked to airports, business districts, convention centers, and industrial corridors. Government investments in smart cities, tourism clusters, and transportation infrastructure are creating long-term hospitality demand and supporting new property development across multiple price segments.

What are the restraints for the global market?

High Capital Intensity and Long Payback Periods

The hospitality industry requires substantial upfront capital for land acquisition, construction, interiors, and regulatory compliance. Returns are highly sensitive to occupancy rates and pricing cycles, making profitability vulnerable during economic slowdowns or travel disruptions. This high capital intensity can deter new entrants and delay expansion plans, particularly in emerging markets.

Labor Shortages and Rising Operating Costs

Hospitality is a labor-intensive industry, and operators globally face challenges related to workforce shortages, rising wages, and skill gaps. Increasing energy costs, sustainability compliance requirements, and maintenance expenses further pressure operating margins, particularly for full-service and luxury properties.

What are the key opportunities in the hospitality industry?

Government-Led Tourism and Infrastructure Initiatives

Governments worldwide are prioritizing tourism as a key economic growth engine, offering tax incentives, investment subsidies, and relaxed FDI norms. Large-scale tourism programs and destination branding initiatives in the Asia-Pacific and the Middle East are creating attractive opportunities for hotel developers and global brands to expand their footprint.

Expansion into Secondary Cities and Emerging Destinations

Hospitality demand is increasingly shifting toward tier-2 and tier-3 cities as urban congestion rises and connectivity improves. These locations offer lower development costs, growing domestic tourism, and long-term scalability, making them attractive for mid-scale and budget hotel expansion.

Property Type Insights

Hotels dominate the hospitality market, accounting for approximately 62% of global revenue in 2024, supported by diversified demand from leisure, business, and MICE travel. Resorts represent a high-growth segment, particularly in coastal and destination-driven markets, benefiting from experiential and wellness tourism. Serviced apartments and vacation rentals are expanding rapidly due to demand for long-stay accommodation, remote work trends, and family travel. Hostels and budget lodging continue to gain traction among younger travelers and backpackers, particularly in Europe and Southeast Asia.

Service Model Insights

Full-service hospitality leads the market with nearly 48% share, driven by higher average daily rates and value-added offerings such as dining, events, and wellness facilities. Limited-service hotels are growing steadily due to cost efficiency and strong demand from domestic and business travelers. Self-service and automated hospitality models are emerging as a disruptive segment, leveraging technology to reduce operational costs and improve scalability.

Price Positioning Insights

The mid-scale segment holds the largest share of the market at approximately 37%, benefiting from affordability, standardized quality, and strong domestic travel demand. Luxury and upper-upscale hospitality is expanding faster than the overall market, driven by premiumization and experiential travel. Economy and budget accommodation continues to see consistent demand, particularly in high-volume urban and transit locations.

End-Use Insights

Leisure and tourism remain the largest end-use segment, accounting for nearly 60% of total hospitality demand in 2024. Business travel continues to provide a stable baseline occupancy, particularly in North America and Europe. The MICE segment is witnessing renewed growth as global events and exhibitions return. Long-stay accommodation is expanding due to expatriate movement, infrastructure projects, and remote working trends.

| By Property Type | By Service Model | By Price Positioning | By Ownership & Operating Model | By End-Use Purpose |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounted for approximately 29% of the global hospitality market share in 2024, led by the United States. High room rates, extensive hotel inventory, and strong domestic travel underpin regional dominance. Canada and Mexico contribute significantly through tourism and business travel demand.

Europe

Europe represents nearly 22% of global market share, driven by France, the U.K., Germany, Italy, and Spain. Cultural tourism, international arrivals, and business travel support steady growth, while sustainability-led hospitality models are gaining traction.

Asia-Pacific

Asia-Pacific is the largest and fastest-growing region, accounting for approximately 34% of global hospitality revenue. China, India, Japan, and Southeast Asia are key demand centers, supported by rising middle-class populations, domestic tourism, and government tourism initiatives. India is the fastest-growing country, with hospitality demand expanding at over 8% CAGR.

Latin America

Latin America continues to experience moderate growth, led by Brazil and Mexico. Rising domestic tourism and improving infrastructure are supporting the steady expansion of hotel capacity across urban and leisure destinations.

Middle East & Africa

The Middle East & Africa region is witnessing strong growth, driven by large-scale tourism investments in the UAE and Saudi Arabia. Africa benefits from natural attractions and rising international tourism, while intra-regional travel is also increasing.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Hospitality Market

- Marriott International

- Hilton Worldwide

- InterContinental Hotels Group (IHG)

- Accor

- Hyatt Hotels Corporation

- Wyndham Hotels & Resorts

- Choice Hotels International

- Radisson Hotel Group

- Jin Jiang International

- Melia Hotels International

- Shangri-La Group

- Minor Hotels

- NH Hotel Group

- OYO Hotels

- Mandarin Oriental Hotel Group