Business Travel Market Size

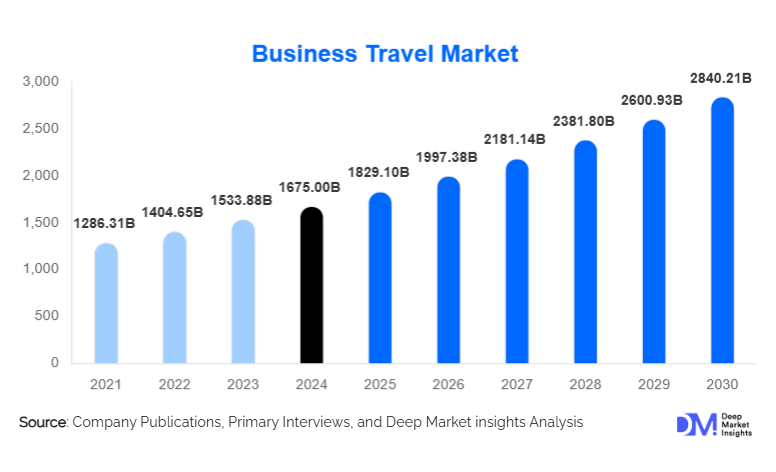

According to Deep Market Insights, the global business travel market size was valued at USD 1,675.00 billion in 2024 and is projected to grow from USD 1,829.10 billion in 2025 to reach USD 2,840.21 billion by 2030, expanding at a CAGR of 9.20% during the forecast period (2025–2030). Growth in the business travel market is primarily driven by the resurgence of in-person corporate engagement, the expansion of MICE (Meetings, Incentives, Conferences & Exhibitions) tourism, and the rapid digital transformation of travel management platforms leveraging AI, automation, and integrated mobility tools.

Key Market Insights

- Corporate travel for internal operations remains the dominant purpose category, driven by global enterprise expansion and recurring inter-office collaboration.

- TMCs (Travel Management Companies) hold the largest share of bookings, driven by strong adoption of end-to-end compliance, analytics, and duty-of-care capabilities.

- Asia-Pacific is the fastest-growing region, supported by industrial growth, FDI inflows, and increasing multinational presence in India, China, and Southeast Asia.

- North America leads global market share, driven by a high concentration of multinational headquarters and strong MICE demand.

- AI-driven travel management tools, real-time risk analytics, and sustainability scoring are transforming corporate travel planning globally.

- Sustainability-linked policies and ESG compliance frameworks are becoming mandatory for enterprise travel decisions, influencing vendor selection and route optimization.

What are the latest trends in the business travel market?

AI-Integrated Travel Ecosystems

AI adoption is reshaping corporate travel planning through predictive budgeting, automated itinerary creation, dynamic pricing insights, and real-time compliance monitoring. Enterprises increasingly prefer platforms that integrate policy enforcement, risk alerts, carbon footprint scoring, and expense reconciliation within a single dashboard. Predictive AI models assist organizations in forecasting travel demand, optimizing employee routing, and minimizing costs. Advanced duty-of-care tools now use geolocation and real-time global event monitoring to enhance traveler safety. These features have significantly elevated expectations for digital travel ecosystems, accelerating vendor adoption across large enterprises.

Sustainable Corporate Travel & ESG Footprint Reduction

Global corporations are aligning business travel policies with their sustainability and net-zero commitments. This trend is driving the adoption of low-emission air travel options, carbon offset programs, eco-certified hotel partnerships, and route optimization for reduced fuel consumption. Booking platforms have begun integrating sustainability ratings and carbon calculators within the selection process, allowing employees and managers to make eco-conscious travel decisions. As ESG reporting becomes more stringent across Europe, North America, and APAC, sustainability-centric travel solutions are becoming a core competitive differentiator for travel service providers.

What are the key drivers in the business travel market?

Global Expansion of Multinational Operations

Corporations are rapidly expanding footprints across Asia-Pacific, the Middle East, and Africa, creating strong demand for cross-border mobility. Project-based deployments, market-entry evaluations, facility commissioning, and supply chain expansion initiatives require frequent employee travel. As companies diversify manufacturing locations and nearshore/backshore operations, international and long-haul business travel continues to rise, supporting sustained market growth.

Strong Revival in MICE Events

MICE tourism has rebounded faster than anticipated, with global trade shows, corporate off-sites, incentive programs, and conventions driving significant travel demand. Government-backed event strategies in the UAE, Saudi Arabia, Singapore, Spain, and the U.S. have amplified international attendance. Premium corporate events, particularly in technology, pharmaceuticals, finance, and manufacturing, now represent one of the fastest-growing components of business travel spending.

Increasing Demand for High-Value, In-Person Collaboration

Enterprises recognize that virtual interactions cannot fully replace relationship-driven engagements such as client negotiations, consulting assignments, and on-site project delivery. High-stakes industries, including BFSI, IT, engineering, and healthcare, rely on physical presence for credibility, regulatory compliance, and operational efficiency. This behavioral shift continues to reinforce sustained demand for business travel.

What are the restraints for the global market?

Corporate Budget Optimization & Virtual Collaboration Substitution

Many organizations continue to reduce non-essential travel by prioritizing digital collaboration tools. Routine internal meetings and training sessions increasingly shift to hybrid or virtual formats, limiting volume in certain travel categories. Cost-control mandates, particularly during economic uncertainty, lead firms to impose stricter travel approval processes, reducing discretionary travel spending.

Geopolitical Uncertainty & Travel Risk Exposure

Political instability, conflicts, shifting visa regulations, and health-related travel advisories can disrupt travel plans, increase insurance premiums, and raise overall risk exposure for businesses. Companies may avoid travel to high-risk regions, impacting demand in affected geographies. Uncertain global conditions remain a structural challenge for long-term travel planning.

What are the key opportunities in the business travel industry?

AI-Driven Corporate Travel Platforms

Digital transformation creates substantial opportunities for travel management companies and SaaS providers. AI capabilities, such as automated policy enforcement, traveler sentiment analysis, cost prediction models, and real-time duty-of-care mapping, enable vendors to deliver measurable ROI to corporate clients. Integrated tech ecosystems are also creating new revenue opportunities through premium analytics services, carbon tracking modules, and enterprise-grade mobility applications.

Expansion into Emerging Corporate Markets

Countries such as India, Vietnam, Kenya, the UAE, and Saudi Arabia are witnessing accelerated economic growth supported by FDI, infrastructure modernization, and multinational expansion. These markets offer significant untapped potential for corporate travel providers to establish long-term partnerships with enterprises across manufacturing, IT, energy, and logistics. Early market entry can yield a strong competitive advantage as these regions scale up international business activities.

ESG-Aligned Travel Programs & Green Business Travel Solutions

Corporations are seeking vendors that provide transparent sustainability metrics, eco-friendly travel options, and carbon offset mechanisms. Providers offering green-certified accommodations, sustainable aviation fuel (SAF)-linked itineraries, and low-carbon route optimization stand to benefit from surging global ESG adoption. This opportunity is expected to expand sharply as environmental reporting standards tighten globally.

Product Type Insights

Transportation services dominate global spending, accounting for the largest portion of travel budgets due to the prevalence of international air travel. Within transportation, premium economy and business class options are increasingly favored for long-haul corporate routes. Accommodation services follow closely, supported by rising demand for extended-stay facilities, business hotels, and MICE-focused hospitality offerings. Event management services continue expanding due to the resurgence of conferences and incentive programs. Travel insurance and ancillary services represent smaller but rapidly growing categories as companies prioritize safety, risk mitigation, and duty-of-care compliance.

Application Insights

Client-related travel and project-based deployments form the core of business travel applications, driven by the need for direct client servicing, on-site delivery, and project supervision. MICE applications are recovering strongly, supported by large-scale exhibitions, product launches, and global summits. Government and institutional travel maintains steady demand due to diplomatic missions, intergovernmental conferences, and administrative coordination. Internal corporate collaboration remains essential but is increasingly optimized through hybrid travel strategies, balancing physical and virtual engagement.

Distribution Channel Insights

Travel Management Companies (TMCs) account for the largest share of enterprise bookings, providing integrated solutions that include policy compliance, reporting analytics, negotiated fares, and traveler safety features. Online Travel Agencies (OTAs) are widely used by SMEs, offering flexible pricing and wide supplier access. Corporate self-booking tools (SBTs) are gaining traction as organizations seek to centralize travel data, automate approvals, and integrate expense management workflows. Direct booking via airline and hotel portals remains significant but is declining as companies shift toward unified travel ecosystems.

Traveler Type Insights

Operational and mid-level employees represent the largest traveler segment, driven by frequent sales trips, project deployments, and field operations. Executive travelers contribute a smaller share but generate higher per-trip spending due to premium service use. Technical and field personnel form a critical segment for industries such as energy, telecom, and manufacturing. Government delegates account for consistent travel volumes tied to administrative functions and cross-border policy coordination.

Age Group Insights

Travelers aged 31–50 constitute the largest share of corporate travel, combining career mobility with strong involvement in client-facing and operational roles. Younger employees (22–30) represent a growing segment as globalized industries demand early-career mobility. Senior professionals (51–65) largely dominate high-value travel in consulting, engineering, and leadership functions, often using premium travel accommodations. Travelers above 65 are limited but represent specialized roles in consulting, advisory services, and retired executive engagements.

| By Travel Purpose | By Booking Channel | By Service Type | By Industry Vertical |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America leads the global business travel market, supported by the U.S., which alone accounts for nearly 28% of global spending. High corporate density, extensive MICE activity, and rapid adoption of digital travel technologies support the region’s dominance. Canada contributes additional growth through strong financial, energy, and government travel demand.

Europe

Europe holds the second-largest market share, driven by Germany, the U.K., France, Spain, and the Netherlands. Manufacturing, finance, and technology hubs fuel constant travel flows, while EU inter-country mobility supports high-frequency short-haul trips. Europe is also a leader in sustainable travel policies, influencing corporate procurement behavior across the region.

Asia-Pacific

Asia-Pacific is the fastest-growing region, expanding at over 7% annually. China dominates spending, while India, Vietnam, Singapore, and Australia show rapid growth driven by IT, manufacturing, and multinational expansion. Rising middle-class corporate employment and increasing outbound participation from SMEs further accelerate APAC adoption.

Latin America

Brazil and Mexico lead business travel in LATAM, supported by manufacturing, banking, and energy sectors. Political volatility and cost pressures exist, but long-term growth is supported by nearshoring activities and international investment in automotive and infrastructure industries.

Middle East & Africa

The Middle East is emerging as a major hub for MICE and corporate events, led by Saudi Arabia’s Vision 2030 initiatives and the UAE’s world-class convention infrastructure. Africa’s demand is expanding steadily across South Africa, Kenya, and Nigeria, driven by energy, telecom, and development-sector travel.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Business Travel Market

- American Express Global Business Travel (Amex GBT)

- BCD Travel

- CWT

- Flight Centre Travel Group Corporate Division

- Hogg Robinson Group

- Frosch International Travel

- Expedia for Business

- Booking Holdings Corporate Solutions

- SAP Concur

- Egencia (Amex GBT)

- ATG Travel Worldwide

- Corporate Travel Management (CTM)

- Travel Leaders Corporate

- Direct Travel

- ATPI Group

Recent Developments

- In April 2025, Amex GBT introduced an advanced AI-driven analytics module enabling real-time carbon tracking and predictive travel budgeting for enterprise clients.

- In March 2025, BCD Travel expanded its Asia-Pacific digital operations hub to support rapid enterprise adoption of self-booking tools and live traveler risk dashboards.

- In January 2025, CWT launched an integrated sustainable travel platform offering carbon-optimized itinerary recommendations and SAF-linked flight options.