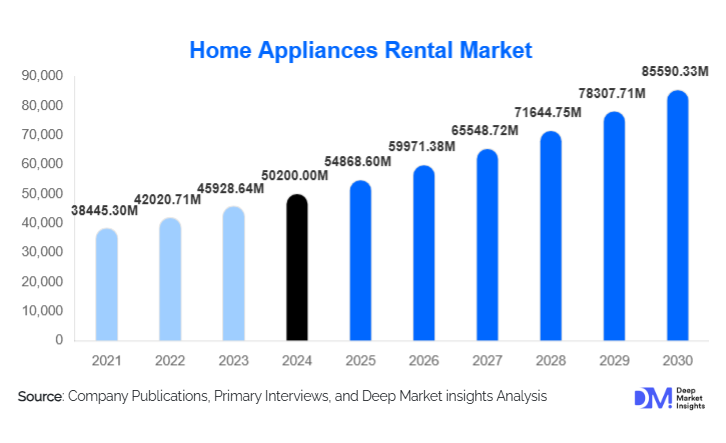

Home Appliances Rental Market Size

According to Deep Market Insights, the global home appliances rental market size was valued at USD 50,200.00 million in 2024 and is projected to grow from USD 54,868.60 million in 2025 to reach USD 85,590.33 million by 2030, expanding at a CAGR of 9.3% during the forecast period (2025–2030). The market growth is driven by rising urban mobility, the rapid expansion of digital rental platforms, the growing popularity of subscription-based consumption, and increasing demand for flexible, low-capex appliance access among residential and commercial users worldwide.

Key Market Insights

- Residential consumers dominate demand, supported by rising millennial and Gen Z preferences for rental-based, asset-light lifestyles.

- Long-term rentals (>12 months) lead the industry, accounting for over 40% of the global market due to stable recurring revenue and lower logistics cycles.

- Asia-Pacific is the fastest-growing regional market driven by rapid urbanization, co-living adoption, and expanding digital rental ecosystems.

- North America remains the largest market, supported by mature rental platforms and a mobile workforce.

- IoT integration and predictive maintenance are transforming asset management, reducing downtime and operating costs for rental providers.

- Premium smart appliances are gaining traction, with consumers renting high-cost devices such as smart TVs, IoT refrigerators, and AI-enabled washers.

What are the latest trends in the Home Appliances Rental Market?

IoT-Enabled Rental Appliances and Smart Fleet Management

Rental operators are increasingly incorporating IoT into refrigerators, AC units, washers, and entertainment appliances to monitor usage, predict failures, and optimize maintenance schedules. This transition toward smart rentals enhances asset life, reduces service downtime, and improves customer satisfaction. Real-time analytics allow companies to track consumption patterns, optimize pricing, and tailor subscription plans. IoT integration is especially influencing B2B rental models, where uptime and performance reliability are mission-critical for hospitality and co-living operators.

Shift Toward Subscription-Based “Appliance-as-a-Service” Models

Inspired by the success of subscription models in entertainment and mobility, rental platforms are offering bundled services including upgrades, doorstep servicing, installation, and flexible contract durations. Consumers increasingly prefer predictable monthly payments over high upfront costs. This trend is particularly strong in urban centers where lifestyle flexibility is valued. OEMs are also entering the market with direct-to-consumer rental programs, transforming traditional sales-focused business structures into recurring revenue ecosystems.

What are the key drivers in the Home Appliances Rental Market?

Urban Mobility and Rise of Short-Term Housing

Increasing workforce relocation, student mobility, and the rise of remote workers have sharply accelerated demand for rental appliances. Consumers moving between cities or temporary residences prefer renting essentials like refrigerators, washing machines, and AC units rather than purchasing and transporting them. This has resulted in a consistent surge in residential rental subscriptions, especially in regions experiencing strong urbanization such as India, Southeast Asia, and Europe.

Growing Cost of Premium and Smart Appliances

With prices of high-end smart appliances rising, consumers are opting for rentals to access advanced features at affordable monthly fees. Smart refrigerators, AI-enabled washers, and 4K/8K smart TVs are seeing high rental penetration. This shift enables rental companies to expand margins while offering users an accessible, flexible pathway to premium technologies traditionally reserved for high-income households.

What are the restraints for the global market?

High Logistics, Repair, and Maintenance Costs

Unlike product ownership, rental companies must manage the entire lifecycle, including transportation, installation, repairs, refurbishment, and returns. Rising logistics costs and skilled labor shortages significantly impact profitability. Managing large, geographically dispersed fleets also presents operational challenges, especially for bulky appliances such as refrigerators and washing machines.

Uncertain Regulatory Environment and Depreciation Risks

Variability in rental taxation laws, warranty regulations, and consumer protection policies across regions complicates compliance for market players. Appliances also depreciate rapidly under heavy usage, and poorly managed refurbishment cycles can diminish asset value, impacting long-term profitability for rental operators.

What are the key opportunities in the Home Appliances Rental Industry?

IoT-Driven Predictive Maintenance and Smart Rental Models

IoT-enabled appliances present opportunities for predictive maintenance, automated fleet management, and real-time customer support. By reducing downtime and repair costs, companies can significantly improve asset utilization rates and expand into premium rental tiers with higher margins.

Expansion into Emerging Urban Centers and Co-Living Markets

Rapidly growing co-living spaces, student housing complexes, migrant worker accommodations, and short-term rentals in emerging markets are creating multimillion-dollar opportunities. Partnerships with property developers, universities, and hospitality groups can unlock stable, large-scale B2B demand.

Product Type Insights

Refrigerators dominate the rental market, representing nearly 24% of total demand in 2024 due to their essential nature in households and commercial spaces. Washing machines and air conditioners follow, driven by growing urban apartment living and climate-driven cooling needs. Premium smart appliances, smart refrigerators, IoT air purifiers, and smart TVs are rapidly growing as consumers seek high-end features without capital investment. Small appliances such as vacuum cleaners, air purifiers, and induction cooktops are gaining traction in subscription bundles targeted at students and young professionals. Entertainment appliances, particularly smart TVs and soundbars, remain strong contributors as content consumption shifts toward in-home digital streaming.

Application Insights

The residential segment accounts for nearly 63% of global demand, driven by young professionals, mobile workers, expat populations, and students seeking flexible, low-commitment appliance access. In commercial applications, co-living operators, hotels, PG accommodations, retail outlets, and office spaces rely on appliance rentals to manage costs and enable rapid scalability. Student housing and co-living are the fastest-growing applications, with demand projected to expand at 12–14% annually through 2030. Temporary worker accommodations and remote-office setups are emerging as new growth niches, particularly in Asia-Pacific and the Middle East.

Distribution Channel Insights

Online rental platforms dominate the distribution landscape, representing 58% of global demand thanks to transparent pricing, seamless subscription management, doorstep delivery, and automated billing. Offline rental stores maintain relevance in small cities, but digital-first models are growing significantly faster. OEM-led subscription platforms are an emerging trend, as appliance manufacturers shift toward recurring revenue models through direct-to-consumer rentals. B2B commercial rental portals are also rising, offering enterprise leasing solutions for hotels, offices, and large housing projects.

Customer Type Insights

Residential customers represent the largest share of the market due to rising urban mobility, smaller household sizes, and lifestyle-driven consumption habits. Commercial customers, including co-living operators, student housing providers, hospitality companies, and corporate offices, contribute significantly to long-term rental contracts. The commercial segment is expanding as businesses seek to avoid the high capex of purchasing appliances, instead preferring bundled rental solutions that include maintenance and periodic upgrades.

Pricing Tier Insights

Mid-range appliances hold the largest market share at 46%, offering the best balance of durability, cost, and rental viability. Economy appliances remain popular among budget-focused customers, such as students and shared accommodations. The premium and smart appliance segment is the fastest-growing, supported by rising consumer interest in IoT-enabled devices and high-end features accessible through affordable monthly subscriptions.

| By Appliance Type | By Rental Model | By Customer Type | By Distribution Channel | By Pricing Tier |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for 26% of the global market, driven by high urban mobility, widespread digital platform adoption, and strong demand from students and remote workers. The U.S. leads the region, with significant growth in premium appliance rentals and corporate leasing models.

Europe

Europe holds a 23% share of the global market, supported by sustainability-driven consumer behavior, rental-friendly regulations, and strong subscription economy adoption. The U.K., Germany, and France are the leading markets, with rising demand for energy-efficient and refurbished rental appliances.

Asia-Pacific

Asia-Pacific is the fastest-growing region, projected to expand at a CAGR of 12.5% through 2030. Key drivers include rapid urbanization, affordable rental pricing, and strong demand from India, China, Indonesia, and Vietnam. India is the fastest-growing country market, supported by booming co-living and student housing sectors.

Latin America

Demand is gradually rising in Brazil, Mexico, and Colombia due to increased urban migration and growing interest in subscription services. Budget-friendly rental options are especially popular in price-sensitive markets.

Middle East & Africa

Growth is supported by strong expat populations, seasonal housing demand, and expanding tourism-related accommodations. The UAE and Saudi Arabia are key markets, with rising adoption of appliance rentals in both residential and hospitality sectors.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Home Appliances Rental Market

- Whirlpool Corporation

- LG Electronics

- Samsung Electronics

- Haier Group

- Electrolux AB

- Bosch (BSH Hausgeräte)

- Panasonic Corporation

- Godrej Appliances

- Midea Group

- Sharp Corporation

- TCL Technology

- Hisense Group

- Rent-A-Center Inc.

- Furlenco

- RentoMojo

Recent Developments

- In March 2025, LG Electronics expanded its appliance subscription platform across Southeast Asia, integrating IoT diagnostics and doorstep service plans.

- In January 2025, Whirlpool launched a rental-focused product line optimized for durability and extended lifecycle performance, targeting co-living operators.

- In April 2025, Furlenco announced investments in smart fleet management systems to reduce refurbishment cycles and improve asset utilization across India.