Residential Washing Machine Market Size

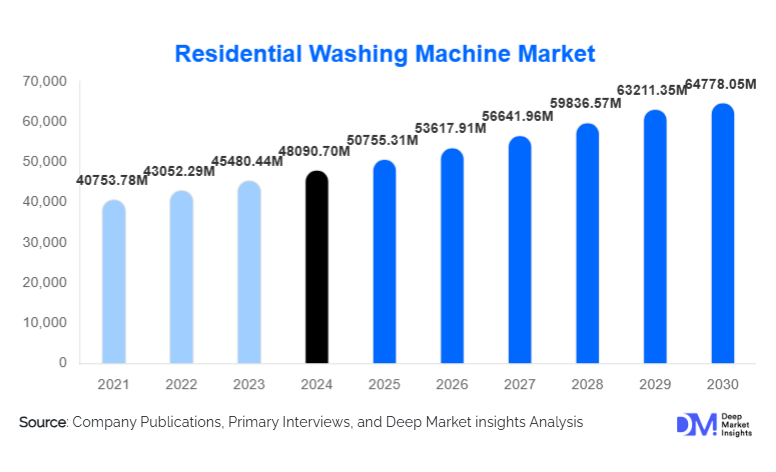

According to Deep Market Insights, the global residential washing machine market size was valued at USD 48,090.70 Million in 2024 and is projected to grow from USD 50,755.31 Million in 2025 to reach USD 64,778.05 Million by 2030, expanding at a CAGR of 5.64% during the forecast period (2025–2030). This steady growth is driven by rapid urbanisation, rising middle-class purchasing power in emerging economies, increasing adoption of smart and fully automatic washing machines, and a growing preference for energy- and water-efficient home appliances.

Key Market Insights

- Front-load and fully automatic machines dominate global product demand, supported by higher energy efficiency, lower water usage, and premium wash performance.

- Asia-Pacific accounts for the largest market share (≈ 34%) due to population growth, rising urban incomes, and fast-paced home appliance penetration.

- Smart/IoT-enabled washing machines are gaining rapid traction, especially among tech-savvy households in urban regions worldwide.

- Medium-capacity (5–8 kg) machines remain the most adopted category, driven by nuclear family structures and increased affordability.

- E-commerce and omnichannel retailing are reshaping distribution dynamics, offering price transparency and wider product availability.

- Government initiatives promoting local manufacturing (e.g., “Make in India”) and energy-efficiency regulations are influencing product innovation.

What are the latest trends in the residential washing machine market?

Smart and Connected Washing Machines Driving Innovation

Technological evolution remains a central trend, with smart and connected washing machines steadily becoming mainstream. Consumers now expect app-controlled operations, AI-powered fabric detection, remote diagnostics, and customised wash cycles. As homes become digitally integrated, washing machines increasingly connect with broader smart-home ecosystems. Real-time monitoring, predictive maintenance alerts, and energy optimisation features are attracting both premium consumers and tech-forward households. Manufacturers are heavily investing in IoT platforms, voice-assistant integration, and machine-learning algorithms to meet this rising demand.

Shift Toward Energy- & Water-Efficient Appliances

With rising utility costs and environmental concerns, energy-efficient and water-saving washing machines are becoming a global priority. Innovations such as inverter motors, eco-wash modes, low-water consumption drums, and smart load sensors are gaining popularity. Governments in Europe, Asia, and North America are tightening energy-labelling and water-efficiency standards, prompting companies to redesign products for compliance. Consumers, especially in urban areas with water scarcity, are increasingly choosing high-efficiency front-load machines. Sustainability is also influencing brand perception, pushing companies to highlight eco-friendly technologies in their marketing strategies.

What are the key drivers in the residential washing machine market?

Rapid Urbanisation and Expanding Middle-Class Population

As millions of households transition into urban centres across Asia-Pacific, Latin America, and parts of Africa, the demand for essential home appliances is surging. Increased disposable income, lifestyle upgrades, and the need for efficient household management are driving first-time purchases of washing machines. Urban nuclear families and working professionals prioritise convenience, accelerating the shift from manual washing to automated solutions.

Technological Advancements and Smart-Home Integration

The proliferation of connected devices and the rising adoption of AI-enabled home ecosystems are boosting demand for modern washing machines. Consumers increasingly prefer fully automatic front-load models offering efficiency, automation, and digital control. Manufacturers are focusing on innovations such as adaptive wash programs, vibration reduction technologies, remote diagnostics, and smart sensors that improve performance while reducing resource consumption.

Growing Hygiene Awareness and Time-Saving Lifestyle Needs

Post-pandemic lifestyle changes have heightened hygiene awareness globally. More consumers prefer in-home laundry instead of laundromats, particularly in densely populated cities. Faster, deeper, and fabric-friendly cleaning cycles appeal to busy families who value convenience and time savings. This shift has significantly boosted demand for premium models with advanced sanitation features, such as steam wash and allergen-removal cycles.

What are the restraints for the global market?

High Initial Cost and Affordability Challenges

Despite market growth, high upfront costs of modern washing machines, especially fully automatic and smart-connected models, remain a constraint for lower-income households. Rural regions and developing markets still face significant affordability barriers. Even with financing options, premium models remain out of reach for many consumers.

Raw Material Price Volatility and Infrastructure Limitations

Fluctuating prices of steel, plastic resin, electronic chips, and motors significantly impact manufacturing costs. When these costs are passed to consumers, demand softens, particularly in price-sensitive markets. Additionally, inadequate electricity and water infrastructure in some regions constrain the adoption of fully automatic, large-capacity appliances.

What are the key opportunities in the residential washing machine industry?

Expansion of Smart & AI-Integrated Appliances

The rapid rise of the smart-home ecosystem provides manufacturers with a sizable opportunity to introduce AI-powered washing machines. Demand for remote-controlled operations, customised wash cycles, and predictive maintenance is driving innovation. Integrating machine-learning algorithms that optimise detergent usage, water levels, and fabric protection is expected to create new revenue streams and premium product categories.

Growth Potential in Emerging Markets

Massive opportunities lie in emerging economies, including India, Indonesia, Vietnam, the Philippines, and several African nations. Growing young populations, expanding middle-class segments, and rising female workforce participation are accelerating washing machine penetration. First-time buyers represent a high-volume opportunity for entry-level and mid-range models. As urbanisation intensifies, demand for compact and affordable machines is expected to rise sharply.

Eco-Friendly and Low-Water Technology Innovation

Water scarcity in many regions is encouraging the development of ultra-efficient washing machines that use significantly less water. Features like recirculation systems, high-efficiency front loaders, greywater compatibility, and improved drum designs are increasingly relevant. Manufacturers focusing on sustainability-oriented technology will gain a competitive advantage, especially in regions where environmental regulations are tightening.

Product Type Insights

Front-load washing machines dominate the global market, accounting for approximately 52% of total revenue in 2024. Consumers prefer their superior wash quality, energy efficiency, and lower water consumption compared to top-load models. Fully automatic washing machines also lead in technology-based segmentation with nearly 70% market share, reflecting a shift toward convenience-driven purchasing behaviour. Medium-capacity machines (5–8 kg) remain the most widely adopted segment globally, aligning with urban nuclear family structures.

Application Insights

Residential households form the core application segment, with urban apartments and multi-family complexes showing the fastest adoption. Smart-home-enabled washers are increasingly used in premium residential complexes, while portable and compact washers are gaining traction in rental housing and small apartments. New applications are emerging in serviced apartments, co-living spaces, and student housing, where shared laundry facilities or in-unit compact washers are becoming standard.

Distribution Channel Insights

Online platforms and omnichannel retailers dominate sales growth due to price transparency, wider product availability, and home delivery services. E-commerce portals offer easy comparison of features, warranties, and energy ratings, influencing purchasing decisions. Offline retail, especially appliance-focused speciality stores, continues to hold a significant share in developing economies where consumers prefer in-store demonstrations and after-sales support. Modern big-box retailers are also expanding their appliance sections to capture mid-range and premium consumers.

| By Product Type | By Technology | By Capacity | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America remains a mature market driven by replacement purchases and demand for high-efficiency, smart washers. The U.S. leads the region due to high disposable income and a strong preference for premium appliances. Energy-efficiency regulations and the popularity of large-capacity machines further support market growth.

Europe

Europe has a strong demand for eco-friendly and front-load washing machines driven by stringent energy and water-use regulations. Countries such as Germany, France, and the U.K. lead in the adoption of high-efficiency models. European consumers are highly responsive to sustainability labels, pushing manufacturers to innovate rapidly in low-energy appliances.

Asia-Pacific

Asia-Pacific accounts for about 34% of the global market share, led by China, India, Japan, and South Korea. Rising urbanization and expanding middle-class incomes are stimulating large-scale adoption. India represents one of the fastest-growing markets, while China continues to dominate in both consumption and production. Increasing female workforce participation and smaller households are accelerating the shift toward fully automatic machines.

Latin America

The region is experiencing rising demand due to improving economic stability in countries like Brazil, Mexico, and Chile. Despite price sensitivity, mid-range and fully automatic models are gaining traction. Urbanization and growing access to modern retail formats support market expansion.

Middle East & Africa

MEA shows promising growth potential driven by rising household incomes, expanding expatriate communities, and increasing urban development. The Gulf countries, such as the UAE, Saudi Arabia, and Qatar, are major consumers of premium appliances. Africa, led by South Africa, Kenya, and Nigeria, is witnessing rising adoption of entry-level models supported by urbanisation and improved electrification.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Residential Washing Machine Market

- LG Electronics

- Samsung Electronics

- Whirlpool Corporation

- Haier Group Corporation

- Bosch (BSH Hausgeräte)

- Electrolux AB

- Midea Group

- Panasonic Corporation

- Miele

- IFB Industries

- Toshiba Corporation

- Hitachi Ltd.

- Godrej Appliances

- Sharp Corporation

- Vestel

Recent Developments

- In March 2025, LG Electronics launched its next-generation AI Wash™ platform in Europe, introducing enhanced load-sensing and energy optimisation features.

- In January 2025, Samsung announced the expansion of its smart-appliance manufacturing facility in India under the “Make in India” scheme to boost local production capacity.

- In April 2025, Bosch introduced a new line of ultra-efficient front-load washing machines featuring water-recycling technology in select Asia-Pacific markets.