Smart Refrigerator Market Size

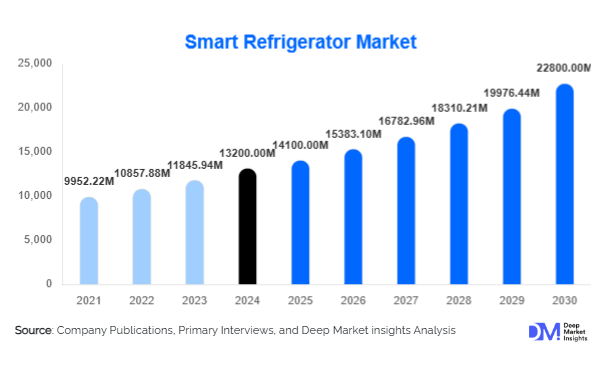

According to Deep Market Insights, the global smart refrigerator market size was valued at USD 13,200 million in 2024 and is projected to grow from USD 14,100 million in 2025 to reach USD 22,800 million by 2030, expanding at a CAGR of 9.1% during the forecast period (2025–2030). The market growth is primarily driven by rising consumer demand for connected home appliances, increasing adoption of energy-efficient technologies, and the integration of AI and IoT-enabled features for enhanced kitchen automation and food management.

Key Market Insights

- Smart refrigerators are increasingly incorporating AI-driven features, such as automatic inventory tracking, predictive maintenance, and personalized temperature control, improving user convenience and reducing food waste.

- Energy-efficient and eco-friendly designs are driving consumer adoption, particularly in regions with stringent energy regulations and rising electricity costs.

- North America and Europe dominate the smart refrigerator market, supported by high disposable incomes, tech-savvy consumers, and advanced retail and e-commerce networks.

- Asia-Pacific is emerging as the fastest-growing region, with increasing urbanization, rising middle-class populations, and growing awareness of connected home technologies.

- Technological integration, including voice control, IoT connectivity, and smart home ecosystem compatibility, is reshaping consumer preferences and influencing purchase decisions globally.

- OEMs are focusing on design innovation, such as flexible storage options, touchscreens, and multi-door models, enhancing product differentiation in a competitive market.

What are the prevailing trends currently influencing the global smart refrigerator market?

AI-Enabled Food Management

Smart refrigerators are increasingly integrating AI to optimize food storage and minimize waste. Features such as automatic expiration alerts, grocery list generation, and recipe recommendations based on available items are becoming standard. AI-powered sensors also monitor temperature fluctuations, humidity levels, and door usage patterns, ensuring food freshness. This trend is particularly appealing to urban consumers and working professionals who value convenience, efficiency, and sustainability. Retailers and manufacturers are also using these insights to enhance predictive maintenance services and improve product lifecycle management.

IoT and Smart Home Integration

Integration with IoT-enabled smart home systems is a defining trend in the smart refrigerator market. Appliances can now communicate with smartphones, tablets, and other connected devices for remote monitoring and control. Voice assistants like Amazon Alexa, Google Assistant, and Samsung Bixby allow users to manage inventory, adjust settings, and receive alerts hands-free. This level of integration not only enhances consumer convenience but also promotes energy efficiency and seamless interaction within connected households.

What are the primary growth drivers impacting the smart refrigerator market?

Rising Consumer Preference for Smart Homes

Urbanization and digital adoption are driving demand for smart home appliances, including smart refrigerators. Consumers are increasingly seeking products that offer convenience, energy efficiency, and integration with other home devices. The shift toward connected living spaces, especially in developed regions, is motivating manufacturers to innovate with AI and IoT-enabled functionalities, such as remote monitoring, automated inventory tracking, and personalized alerts.

Energy Efficiency and Sustainability Regulations

Global initiatives to reduce energy consumption and carbon emissions are positively impacting the smart refrigerator market. Energy Star ratings and government-led efficiency incentives encourage consumers to adopt energy-saving appliances. Refrigerators with inverter compressors, smart temperature management, and eco-friendly refrigerants are gaining traction. These innovations not only reduce operational costs but also align with growing environmental consciousness, making energy-efficient smart refrigerators a preferred choice for eco-aware households.

Growing Demand for Premium and Multi-Door Refrigerators

Consumers are increasingly investing in premium smart refrigerators featuring multi-door designs, customizable storage options, and advanced functionalities such as touchscreen panels, cameras, and automated ice makers. These high-end features improve convenience, enhance kitchen aesthetics, and cater to affluent buyers willing to pay a premium for innovation and style. The rising influence of e-commerce platforms also facilitates access to these advanced models globally.

What are the key challenges and restraints affecting the global smart refrigerator market?

High Initial Purchase Cost

Despite declining prices, smart refrigerators remain costlier than traditional models, which limits adoption in price-sensitive markets. The integration of advanced features such as AI, IoT connectivity, and touchscreen interfaces adds to the upfront cost. While operational savings through energy efficiency partially offset this expense, the high initial investment continues to act as a barrier for middle-income households, especially in developing regions.

Data Privacy and Cybersecurity Concerns

Connected appliances are vulnerable to data breaches and unauthorized access. Consumers are increasingly aware of privacy risks associated with smart refrigerators that track household usage and connect to the internet. Security vulnerabilities can undermine trust in smart home devices, posing a significant challenge for manufacturers to implement robust cybersecurity measures and reassure buyers about data protection.

Which strategic opportunities exist for stakeholders in the smart refrigerator market?

Integration of Advanced Sensors and Predictive Analytics

Manufacturers have an opportunity to differentiate products by incorporating advanced sensors and predictive analytics for superior food management. Smart refrigerators can track consumption patterns, suggest optimal storage conditions, and even reorder groceries automatically. These features not only enhance user experience but also open possibilities for partnerships with grocery retailers and e-commerce platforms, creating a connected ecosystem for consumers.

Expansion in Emerging Markets

Emerging economies in Asia-Pacific, Latin America, and the Middle East represent significant growth potential due to rising disposable incomes, urbanization, and increasing awareness of smart home technologies. Companies entering these regions can leverage local distribution networks, government incentives, and affordable financing options to expand their consumer base. Urban centers in India, China, Brazil, and Mexico are likely to see accelerated adoption due to increasing demand for modern kitchen appliances among the growing middle class.

Customization and Product Innovation

Smart refrigerators that offer modular storage, flexible designs, and personalized interfaces present a significant opportunity. Consumers are seeking appliances that fit their lifestyle preferences, including multi-door configurations, energy-efficient compressors, and customizable cooling zones. Manufacturers investing in R&D for innovative designs and differentiated features can capture premium market segments, increase brand loyalty, and maintain a competitive advantage globally.

Product Type Insights

French-door smart refrigerators dominate the market, accounting for nearly 35% of the 2024 market share. These models offer large storage capacity, separate compartments for different food types, and advanced cooling technologies, making them ideal for family households and premium consumers. Side-by-side refrigerators follow closely, favored for their organizational efficiency and energy-saving features. Single-door and bottom-freezer models are gaining traction in emerging markets due to affordability and compact design, supporting adoption among middle-income households. Overall, product differentiation and multi-door designs continue to shape consumer preferences globally.

Application Insights

Household usage remains the primary application segment, accounting for over 70% of the market in 2024. Growing urban populations, nuclear families, and rising disposable incomes are driving this trend. Commercial applications, such as smart refrigerators in hotels, restaurants, and supermarkets, are expanding due to the need for temperature monitoring, inventory management, and energy efficiency. Additionally, corporate offices and co-living spaces are adopting smart refrigeration for employee convenience and operational optimization, representing emerging growth opportunities.

Distribution Channel Insights

Online platforms, including e-commerce marketplaces and D2C websites, dominate smart refrigerator sales due to convenience, transparent pricing, and wide product selection. Electronics and appliance retail chains continue to account for a substantial share, particularly for premium models, where in-store demonstrations influence purchase decisions. Emerging distribution channels include subscription-based appliance rentals and smart home bundles, which are gaining traction in price-sensitive segments. Retailers are increasingly integrating AR/VR experiences to allow consumers to visualize smart refrigerators in their kitchens before purchase, enhancing engagement and driving conversions.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America holds the largest share, accounting for approximately 32% of the 2024 smart refrigerator market. The U.S. and Canada lead demand due to high disposable incomes, urbanization, and a preference for connected home technologies. Consumers increasingly favor energy-efficient, AI-enabled refrigerators with advanced features. E-commerce platforms and retail chains in the region facilitate the wide availability of premium models, driving growth. North America is expected to maintain steady growth at a 7–8% CAGR during 2025–2030.

Europe

Europe represents nearly 28% of the 2024 market, with Germany, France, and the U.K. leading demand. Consumers are highly receptive to energy-efficient appliances and smart home integration. Incentives for energy-saving appliances and increasing environmental awareness further stimulate adoption. The European market is witnessing rising demand for premium French-door and multi-door smart refrigerators, complemented by technological innovations and IoT integration, driving a CAGR of 8–9% over the forecast period.

Asia-Pacific

Asia-Pacific is the fastest-growing region, driven by rising urbanization, growing middle-class populations, and expanding e-commerce infrastructure. China, India, Japan, and Australia are key contributors. Adoption is fueled by increasing awareness of connected appliances, government incentives for energy-efficient products, and rising disposable incomes. The region is expected to witness double-digit growth, with China alone accounting for 12–13% of global market demand by 2030.

Latin America

Brazil, Mexico, and Argentina are gradually adopting smart refrigerators, primarily driven by urban households and premium appliance consumers. Market growth remains moderate due to price sensitivity and limited high-end appliance penetration, but expansion in e-commerce and urban centers is expected to accelerate adoption.

Middle East & Africa

Demand is concentrated in the UAE, Saudi Arabia, and South Africa, supported by affluent consumers, modern retail infrastructure, and interest in premium home appliances. Smart refrigerators in the Middle East often feature advanced connectivity, energy-saving options, and luxury designs, catering to high-income buyers. The region is expected to witness steady growth due to ongoing urbanization and increasing consumer awareness of connected home appliances.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Smart Refrigerator Market

- Samsung Electronics

- LG Electronics

- Whirlpool Corporation

- Haier Group

- Panasonic Corporation

- Bosch

- GE Appliances

- Electrolux

- Sharp Corporation

- Siemens

- Hisense

- TCL Corporation

- Hitachi

- Fujitsu General

- Midea Group

Recent Developments

- In March 2025, Samsung launched a new AI-enabled smart refrigerator series with enhanced food inventory tracking and remote monitoring capabilities, aimed at premium households in North America and Europe.

- In January 2025, LG introduced energy-efficient, Wi-Fi-connected refrigerators in India and Southeast Asia, targeting the rapidly growing urban middle-class segment.

- In February 2025, Whirlpool unveiled smart refrigerators with modular storage solutions and predictive maintenance analytics, catering to both residential and commercial applications globally.