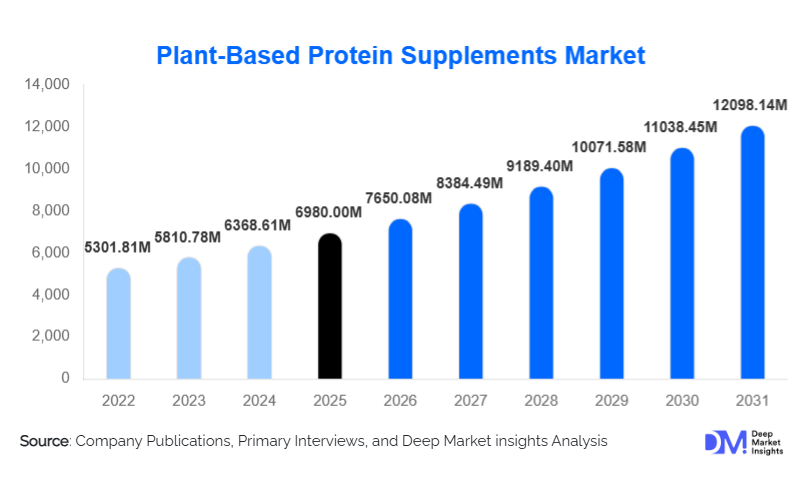

Plant-Based Protein Supplements Market Size

According to Deep Market Insights, the global plant-based protein supplements market size was valued at USD 6,980.00 million in 2025 and is projected to grow from USD 7,650.08 million in 2026 to reach USD 12,098.14 million by 2031, expanding at a CAGR of 9.6% during the forecast period (2026–2031). The market growth is driven by the rapid shift toward plant-forward diets, rising participation in sports and fitness activities, increasing prevalence of lactose intolerance and food allergies, and growing consumer preference for sustainable and clean-label nutrition products.

Key Market Insights

- Pea protein dominates the market due to its high digestibility, allergen-free nature, and sustainability advantages.

- Powdered plant-based protein supplements account for over half of global demand, supported by cost efficiency and flexible consumption.

- North America leads the global market, driven by strong sports nutrition demand and widespread vegan and flexitarian adoption.

- Asia-Pacific is the fastest-growing region, fueled by rising disposable incomes, urbanization, and growing health awareness.

- Online direct-to-consumer channels are rapidly expanding, reshaping pricing transparency and brand engagement.

- Technological advancements in fermentation and protein blending are improving taste, texture, and amino acid completeness.

What are the latest trends in the plant-based protein supplements market?

Rise of Clean-Label and Minimal-Ingredient Formulations

Consumers are increasingly scrutinizing ingredient lists, driving demand for clean-label plant-based protein supplements with minimal additives, natural sweeteners, and transparent sourcing. Manufacturers are responding by eliminating artificial flavors, preservatives, and genetically modified ingredients, positioning products as “free-from” allergens and chemicals. This trend is particularly strong among lifestyle consumers and aging populations seeking daily nutrition rather than performance-focused supplementation.

Advancements in Fermentation and Blended Proteins

Precision fermentation and multi-plant protein blending are reshaping the market by addressing historical concerns around taste, solubility, and amino acid completeness. Blends combining pea, rice, seed, and algae proteins are gaining traction, especially in sports nutrition, as they offer balanced amino acid profiles comparable to whey. These innovations are enabling premium pricing and broader adoption among professional athletes.

What are the key drivers in the plant-based protein supplements market?

Growing Sports and Fitness Participation

The rebound of the global fitness industry and the normalization of plant-based diets among athletes are major growth drivers. Improved formulation quality has reduced performance gaps between plant-based and animal-derived proteins, accelerating adoption in muscle-building and recovery applications.

Rising Lactose Intolerance and Dietary Restrictions

Increasing lactose intolerance and dairy allergies, particularly in Asia and Africa, are expanding the addressable consumer base for plant-based protein supplements. These products offer inclusive nutrition solutions suitable for diverse dietary needs.

What are the restraints for the global market?

Higher Production and Processing Costs

Advanced processing technologies required to improve flavor and texture increase production costs, resulting in premium pricing compared to whey protein. This limits adoption among price-sensitive consumers.

Perception of Inferior Muscle Performance

Despite scientific improvements, a segment of consumers still perceives plant-based proteins as less effective for muscle gain, necessitating sustained education and marketing investments.

What are the key opportunities in the plant-based protein supplements industry?

Clinical and Elderly Nutrition Expansion

Plant-based protein supplements are increasingly being incorporated into clinical nutrition for metabolic disorders, sarcopenia, and post-surgical recovery. This segment is underpenetrated and represents a high-growth opportunity.

Emerging Market Demand in Asia-Pacific and Latin America

Rapid urbanization, expanding middle-class populations, and growing fitness culture in countries such as China, India, Brazil, and Mexico are creating strong demand for affordable and localized plant-based protein products.

Product Type Insights

Powdered plant-based protein supplements continue to dominate the market, accounting for approximately 52% of global revenue in 2025. Their dominance is driven by their versatility, long shelf life, and cost efficiency, making them suitable for both mass-market and premium segments. Additionally, innovations in flavor, solubility, and amino acid fortification have further strengthened consumer acceptance. Ready-to-drink (RTD) beverages are the fastest-growing product type, fueled by busy, on-the-go lifestyles and increasing demand for convenient nutrition. Protein bars and bites are gaining popularity among lifestyle consumers and younger demographics due to portability and functional benefits, while capsules and tablets remain niche, primarily catering to clinical and medical nutrition applications where precise dosing and formulation stability are critical. Overall, product innovation and convenience are the key drivers for growth across all formats.

Application Insights

Muscle building and sports nutrition remain the largest application segment, contributing nearly 38% of the 2025 market. This segment is driven by a growing global fitness culture and increased adoption of plant-based proteins among professional athletes, bodybuilders, and gym enthusiasts seeking allergen-free alternatives. Weight management and meal replacement applications are rapidly expanding due to rising obesity and metabolic disorder prevalence, particularly in North America and Europe. Clinical and medical nutrition applications are emerging as high-growth segments, propelled by aging populations, hospital-adopted nutritional protocols, and the preference for plant proteins in patient care. General wellness applications cater to everyday protein supplementation for non-athletic consumers, supported by rising awareness of preventive healthcare and immunity-boosting nutrition. In sum, functional performance and health benefits are the leading growth drivers across applications.

Distribution Channel Insights

Online direct-to-consumer (D2C) channels account for approximately 29% of global sales, reflecting the increasing role of e-commerce, subscription-based delivery models, influencer marketing, and transparent pricing in shaping purchase decisions. Specialty nutrition stores remain critical for premium and performance-oriented products, offering personalized recommendations and professional guidance. Supermarkets and pharmacies support mass-market penetration, particularly for powders, RTDs, and bars. Fitness centers and professional channels continue to influence athlete and gym-focused consumption, with on-site promotions, tastings, and branded partnerships driving adoption. Digital engagement, convenience, and education are the primary drivers behind channel evolution.

End-User Insights

Lifestyle consumers represent the largest end-user segment, accounting for around 41% of global demand. Their growth is driven by urbanization, rising disposable incomes, and a shift toward flexitarian or vegan diets. Athletes and bodybuilders drive high-value sales, particularly for protein powders and RTDs, as these formats offer customizable dosing and improved performance. The aging population segment is expanding rapidly due to preventive healthcare adoption, with plant-based proteins being preferred for lower allergenicity and heart-healthy profiles. Medical and clinical patients represent a smaller but fast-growing segment, driven by hospital and home-based nutritional programs. Overall, health consciousness, lifestyle changes, and functional benefits are the key drivers for end-user adoption.

| By Product Type | By Application | By Distribution Channel | By End-User |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 36% of the global market in 2025, with the United States leading demand. Growth is driven by a strong sports nutrition culture, high awareness of plant-based diets, widespread lactose intolerance, and premium pricing acceptance. Consumers in this region are also early adopters of innovative formats such as RTDs and protein bars. Regulatory support, high supplement penetration, and strong online D2C channels further fuel market expansion. The combination of performance-focused consumption and health-conscious lifestyle trends drives steady adoption in both powder and functional beverage segments.

Europe

Europe holds around 29% market share, with Germany, the U.K., and France driving demand. Sustainability-focused consumer behavior, strict quality standards, and high awareness of plant-based nutrition are major growth drivers. Functional applications such as muscle building, weight management, and elderly nutrition are particularly strong in Western Europe. The increasing popularity of eco-friendly products and organic certification is encouraging product differentiation and premium pricing. Additionally, online channels and specialty nutrition stores are key distribution drivers, providing education and convenience to end-users seeking protein supplements with clean-label credentials.

Asia-Pacific

Asia-Pacific is the fastest-growing region, expanding at over 15% CAGR. China and India are the largest contributors, driven by urbanization, rising disposable incomes, and increasing protein deficiency awareness. Growth is fueled by a young population increasingly engaged in sports, fitness, and lifestyle nutrition. Japan and Australia represent more mature markets, with consumers prioritizing performance and wellness products. The region’s growth is further supported by expanding online sales, evolving dietary preferences toward plant-based alternatives, and government initiatives promoting health and wellness. Rising awareness of functional benefits, combined with cultural shifts toward non-dairy nutrition, positions APAC as a long-term growth engine.

Latin America

Brazil and Mexico are emerging markets, with growing fitness participation, urban middle-class expansion, and gradual adoption of plant-based diets among younger consumers. Awareness campaigns highlighting the benefits of protein supplementation and functional nutrition are contributing to market growth. Convenience formats such as RTDs and protein bars are particularly popular in urban centers. Additionally, online retail growth and influencer-led marketing are driving increased visibility. The region’s adoption is primarily fueled by urban health-conscious populations and rising disposable income, with muscle building and lifestyle wellness leading application demand.

Middle East & Africa

Growth in the Middle East is driven by premium nutrition demand in the UAE, Saudi Arabia, and Qatar, supported by high-income consumers and lifestyle-driven dietary choices. South Africa leads adoption in Africa due to increasing health and wellness awareness, rising sports participation, and growing availability of plant-based protein products. Urbanization, international food trends, and fitness-oriented campaigns are accelerating adoption. Functional applications, particularly muscle building and general wellness, are driving revenue growth, while D2C channels and specialty stores support premium product penetration. Overall, urbanization, rising health consciousness, and functional nutrition awareness are the key drivers in this combined region.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|