Herbal Dietary Supplements Market Size

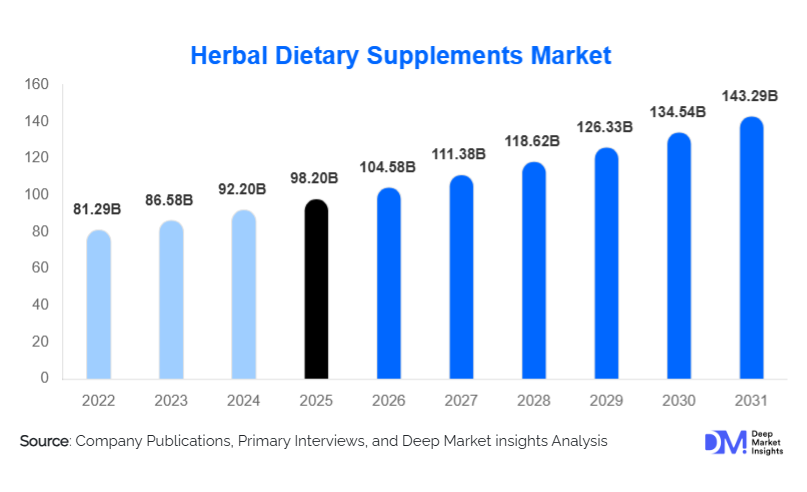

According to Deep Market Insights, the global herbal dietary supplements market size was valued at USD 98.20 billion in 2025 and is projected to grow from USD 104.58 billion in 2026 to reach USD 143.29 billion by 2031, expanding at a CAGR of 6.5% during the forecast period (2026–2031). The herbal dietary supplements market growth is primarily driven by rising consumer preference for natural and plant-based health solutions, increasing focus on preventive healthcare, and growing integration of traditional medicine systems into mainstream wellness and nutrition practices.

Key Market Insights

- Herbal supplements are transitioning from alternative remedies to daily wellness essentials, driven by immunity, digestive, and stress-management applications.

- Asia-Pacific dominates global demand, supported by strong domestic consumption and export-oriented production in China and India.

- Online and direct-to-consumer channels are reshaping distribution, improving accessibility, and enabling personalized herbal nutrition solutions.

- Standardized extracts and clinically validated formulations are gaining higher consumer trust and premium pricing.

- North America remains a key revenue-generating region, driven by plant-based lifestyle trends and aging populations.

- Technological advancements in extraction, encapsulation, and traceability are improving product efficacy and quality consistency.

What are the latest trends in the herbal dietary supplements market?

Premiumization and Scientific Validation of Herbal Products

The market is witnessing a strong shift toward premium, scientifically validated herbal supplements. Manufacturers are investing in standardized extracts, bioavailability-enhancing technologies, and clinical studies to substantiate health claims. This trend is particularly prominent in developed markets such as the U.S., Europe, and Japan, where regulatory scrutiny is higher, and consumers demand transparency and evidence-based benefits. Premium products emphasizing organic sourcing, clean-label formulations, and sustainability certifications are achieving higher margins and stronger brand loyalty.

Rise of Personalized and Digital-First Herbal Nutrition

Digital health platforms and AI-driven wellness tools are enabling personalized herbal supplementation based on lifestyle, age, and health goals. Subscription-based models, mobile apps, and direct-to-consumer brands are increasingly offering customized herbal blends, driving repeat purchases and long-term engagement. This trend resonates strongly with younger demographics and urban consumers seeking tailored wellness solutions, while also expanding market reach beyond traditional retail channels.

What are the key drivers in the herbal dietary supplements market?

Growing Preventive Healthcare Awareness

Rising awareness around preventive healthcare is a key driver of herbal dietary supplement adoption. Consumers are proactively using herbal supplements to manage immunity, digestion, metabolic health, and mental well-being. The long-term usability and perceived safety of herbal products make them attractive alternatives to synthetic supplements, particularly for daily consumption.

Aging Population and Chronic Health Management

The global increase in the geriatric population is significantly boosting demand for herbal supplements targeting joint health, cardiovascular support, cognitive wellness, and immunity. Older consumers favor herbal formulations due to their compatibility with long-term health management and lower perceived side effects, driving sustained market growth across developed economies.

What are the restraints for the global market?

Regulatory Fragmentation and Compliance Challenges

Differences in regulatory frameworks, ingredient approvals, and health claim standards across regions pose challenges for global market expansion. Compliance costs and lengthy approval processes can slow product launches and limit cross-border trade, particularly for smaller manufacturers.

Raw Material Supply Volatility

The market is sensitive to fluctuations in the availability and pricing of medicinal herbs due to climate variability, seasonal dependency, and overharvesting risks. Supply chain disruptions can impact production costs, profit margins, and pricing stability, creating operational challenges for manufacturers.

What are the key opportunities in the herbal dietary supplements industry?

Government Support for Traditional Medicine Systems

Government initiatives supporting traditional medicine systems, such as Ayurveda in India and Traditional Chinese Medicine in China, are creating new growth avenues. Policy-backed integration of herbal supplements into public healthcare, research funding, and export promotion is strengthening global competitiveness and encouraging innovation.

Expansion into Emerging and Underpenetrated Markets

Rising disposable incomes and increasing health awareness in Southeast Asia, Africa, and Latin America present significant growth opportunities. These regions offer both expanding consumer bases and access to indigenous medicinal plants, enabling localized production and export-driven business models.

Product Type Insights

Multi-herb and polyherbal formulations dominate the market, accounting for approximately 38% of the global revenue in 2024. These products are widely preferred due to their synergistic health benefits and strong alignment with traditional medicine practices. Single-herb supplements continue to maintain demand for targeted health applications, while standardized extracts are gaining traction in premium and clinical segments due to consistent potency and efficacy.

Formulation Insights

Capsules and tablets represent the leading formulation segment, contributing nearly 44% of the total market value in 2024. Their convenience, dosage accuracy, and compatibility with standardized extracts support widespread adoption. Powders and liquids remain popular in traditional and therapeutic uses, while gummies and chewables are emerging rapidly, particularly among younger and pediatric consumers.

Application Insights

General wellness and preventive health applications lead the market with around 31% share, driven by daily-use consumption patterns. Immunity enhancement and digestive health supplements follow closely, supported by post-pandemic health consciousness. Cognitive wellness, metabolic health, and women’s health segments are growing steadily as awareness and targeted formulations increase.

Distribution Channel Insights

Online retail and direct-to-consumer platforms account for approximately 29% of global sales, making them the fastest-growing distribution channel. Pharmacies and drug stores remain important for consumer trust and clinical positioning, while health and wellness specialty stores continue to play a key role in premium product sales.

Consumer Group Insights

Adults aged 18–59 years represent the largest consumer group due to broad preventive health usage. The geriatric population is the fastest-growing segment, expanding at over 11% CAGR, driven by chronic health management needs. Pediatric herbal supplements, though smaller in volume, are gaining acceptance through improved safety standards and mild formulations.

| By Product Type | By Formulation | By Application | By Distribution Channel | By Consumer Group |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific leads the global herbal dietary supplements market with approximately 42% share in 2024. China and India are the largest contributors, supported by strong domestic consumption, export-oriented manufacturing, and government-backed traditional medicine systems. Japan and Southeast Asia contribute steady growth through premium and functional herbal products.

North America

North America accounts for nearly 26% of the global market share, led by the United States. Demand is driven by plant-based lifestyle trends, aging populations, and high adoption of preventive healthcare supplements. Clinically validated and organic herbal products are particularly popular in this region.

Europe

Europe holds around 19% of the global market, with Germany, France, and Italy leading demand. Acceptance of phytomedicine and strong regulatory frameworks support stable growth, particularly in standardized and pharmaceutical-grade herbal supplements.

Latin America

Latin America represents an emerging growth region, led by Brazil and Mexico. Rising health awareness and increasing availability of herbal products through retail and online channels are gradually expanding market penetration.

Middle East & Africa

The Middle East and Africa region is witnessing growing demand, supported by increasing disposable incomes, wellness trends, and traditional herbal usage. Saudi Arabia, UAE, and South Africa are key markets, while Africa’s biodiversity offers long-term sourcing and export opportunities.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Herbal Dietary Supplements Market

- Herbalife Nutrition

- Amway

- Nestlé Health Science

- Himalaya Wellness

- Blackmores

- Dabur India

- NOW Health Group

- Nature’s Way (Pharmavite)

- Swisse Wellness

- Nature’s Sunshine Products