Handbag Market Size

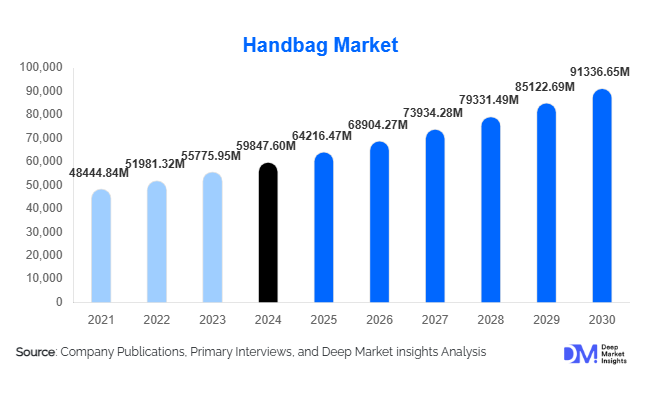

According to Deep Market Insights, the global handbag market size was valued at USD 59,847.60 million in 2024 and is projected to grow from USD 64,216.47 million in 2025 to reach USD 91,336.65 million by 2030, expanding at a CAGR of 7.30% during the forecast period (2025–2030). Market growth is driven by rising fashion consciousness among women, expanding middle-class purchasing power in emerging economies, rapid e-commerce penetration, and increasing demand for multi-functional handbags suitable for work, travel, and lifestyle use. Leather and mid-range handbags continue to dominate global demand, supported by strong brand positioning and durability preferences.

Key Market Insights

- Tote bags dominate the global handbag category, driven by rising demand for versatile, everyday-use bags among working women and students.

- Leather handbags continue to lead material demand, contributing nearly half of total global revenues due to premium appeal and durability.

- North America is the largest regional market, supported by high consumer spending and strong luxury brand penetration.

- Asia-Pacific remains the fastest-growing region, led by rising disposable incomes in China, India, Indonesia, and Southeast Asia.

- Mid-range and accessible premium handbags are rapidly expanding, appealing to aspirational middle-class consumers worldwide.

- E-commerce and omnichannel retail models are reshaping handbag distribution, enabling global access, personalization, and direct brand engagement.

What are the latest trends in the handbag market?

Sustainable & Eco-Friendly Handbags Gaining Momentum

The global handbag industry is accelerating toward sustainability, with brands adopting vegan leather, recycled fabrics, plant-based materials, and eco-certified dyes. Consumers increasingly seek environmentally responsible products, prompting manufacturers to implement transparent supply chains and reduced-waste production practices. Eco-luxury collections, upcycled designs, and biodegradable material blends are emerging across premium and mid-range categories. Many brands are partnering with environmental organisations and integrating carbon-neutral manufacturing models, responding to heightened demand for ethical fashion. This sustainability shift is redefining product innovation and reshaping brand differentiation.

Technology-Enhanced Handbag Shopping Experiences

Digital transformation is reshaping the handbag purchasing journey. Brands are utilising virtual try-ons, AI-driven style recommendations, and augmented reality (AR) previews to help customers visualise size, texture, and fit. RFID-enabled luxury bags support authentication and anti-counterfeiting, while D2C brands leverage data-driven personalisation to engage younger consumers. Social commerce, through TikTok Shop, Instagram Shops, and influencer-led campaigns, plays a major role in shaping purchasing decisions. 3D product visualisation, virtual showrooms, and AI-based trend forecasting are now mainstream tools for premium and mid-priced handbag brands.

What are the key drivers in the handbag market?

Growing Disposable Income & Expanding Middle-Class Consumer Base

Rising disposable incomes in emerging markets, particularly Asia-Pacific, Latin America, and select African economies, are fueling strong demand for branded and mid-range handbags. Handbags are increasingly viewed as essential lifestyle accessories and status symbols, especially among urban working women. The expansion of the female workforce globally further boosts demand for functional, stylish, and durable handbags suitable for professional environments.

Increasing Preference for Versatile, Functional Handbag Designs

Modern consumers prioritise handbags that seamlessly serve work, travel, and casual purposes. Tote bags, crossbody styles, satchels, and multifunctional backpacks have surged in popularity due to their storage capacity, lightweight construction, and fashion adaptability. Hybrid work-travel lifestyles, increased mobility, and the popularity of minimalist designs reinforce this shift toward practicality and versatility. This trend strongly supports the dominance of tote bags, which account for more than 40% of global revenues.

Rise of E-Commerce & Omnichannel Retail Strategies

E-commerce platforms have become critical growth engines for handbag brands, offering global access, competitive pricing, and convenience. Online marketplaces, brand-owned D2C sites, and social commerce integrations enable broader reach and efficient last-mile delivery. Omnichannel strategies, such as click-and-collect, virtual try-ons, and hybrid brand experiences, enhance customer engagement. Increased digital-native consumer segments and e-commerce penetration in Asia-Pacific are accelerating handbag market expansion through 2030.

What are the restraints for the global market?

Intense Competition & Market Saturation

Developed markets like North America and Western Europe face saturation due to the presence of numerous established brands and limited differentiation in mass-market categories. The constant influx of new styles, price competition, and rapid fashion cycles challenge brand loyalty. New entrants struggle to gain market share without significant marketing investments or unique value propositions, creating high entry barriers and margin pressures across segments.

Fluctuating Raw Material Costs & Supply Chain Vulnerabilities

The handbag industry relies heavily on leather, synthetic fabrics, and hardware components, all of which face price volatility due to supply chain disruptions, global trade fluctuations, and environmental regulations. Manufacturing hubs in Asia are susceptible to logistical delays, labour shortages, and geopolitical uncertainties. These factors affect production stability, elevate costs, and compress profit margins, particularly for mid-range and mass-market brands dependent on imported materials.

What are the key opportunities in the handbag industry?

Expansion into Emerging Consumer Markets

Emerging economies represent some of the most lucrative growth opportunities for handbag brands. Rising incomes, urbanisation, and exposure to global fashion trends are driving significant demand in countries such as India, China, Vietnam, Brazil, and the UAE. Brands can unlock strong growth by developing localised designs, strengthening retail distribution, and investing in region-specific digital marketing campaigns. Premium and mid-range segments are particularly well-positioned to capitalise on this demographic shift.

Growth of Sustainable & Vegan Handbag Segments

The surge in environmental consciousness presents opportunities for brands specialising in eco-friendly handbags. Vegan leather, recycled plastic blends, organic cotton, and plant-based materials appeal to younger demographics and ethical shoppers in Europe and APAC. Companies that integrate sustainability into product design, packaging, and supply chain practices can build strong competitive advantages and cultivate long-term brand loyalty.

Product Type Insights

Tote bags are the dominant product category, accounting for approximately 40–42% of global market share in 2024. Their functional design, spacious capacity, and aesthetic versatility make them ideal for daily activities, professional use, and travel. Crossbody bags, satchels, clutches, and structured handbags follow, with consumer preferences shifting toward lightweight designs and minimalist silhouettes. Fashion backpacks and hybrid bag formats are also gaining traction among younger urban consumers.

Application Insights

Everyday-use handbags represent the largest application segment, driven by rising female workforce participation, increased urban mobility, and changing fashion habits. Handbags for fashion and lifestyle applications remain popular as statement accessories for social gatherings and formal events. Travel-friendly handbags, lightweight totes, organized crossbody bags, and compact backpacks are expanding rapidly, supported by tourism growth. Export-oriented manufacturing across Asia continues to supply mid-range and premium handbags to North America and Europe.

Distribution Channel Insights

Online sales channels, including D2C websites, online marketplaces, and social commerce platforms, represent 35–40% of global handbag revenue in 2024. Consumers increasingly rely on e-commerce for product variety, convenience, and competitive pricing. Offline channels, department stores, brand boutiques, and specialty retailers remain essential for luxury and premium handbags, where tactile evaluation and personalized shopping experiences matter. Omnichannel integration is becoming standard as brands create seamless transitions between digital and in-store engagement.

Traveler Type Insights

Women remain the dominant buyer segment, contributing 80–85% of total handbag demand. Younger buyers, particularly millennials and Gen Z consumers, drive demand for trendy, sustainable, and digitally-discovered handbags. Working professionals and urban commuters prefer practical designs, such as totes and crossbody bags, while fashion-forward consumers seek seasonal and limited-edition styles. Men represent a growing but still niche segment, primarily purchasing messenger bags, sling bags, and compact crossbodies.

Age Group Insights

Consumers aged 25–45 years represent the largest share of the handbag market, driven by high purchasing power and strong interest in fashion-forward designs. Younger adults (18–30 years) contribute significantly to mid-range and budget handbag categories, favoring digital shopping experiences and influencer-led trends. Older consumers (45–65 years) remain major contributors to premium and luxury handbag sales, valuing timeless design, durability, and brand heritage.

| By Product Type | By Material Type | By Price Range | By Distribution Channel | By End User |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for 30–32% of global handbag revenue in 2024, making it the largest regional market. The U.S. drives premium and luxury handbag sales due to strong brand presence, high consumer spending, and retail maturity. Online and omnichannel adoption is particularly strong in this region, with personalized digital shopping transforming brand engagement.

Europe

Europe holds 20–25% of the global market share and remains a major center for luxury and high-end handbag brands. Italy, France, Germany, and the U.K. dominate regional sales, driven by deep-rooted fashion culture and strong market affinity for quality craftsmanship. Sustainable handbags and vegan leather alternatives have strong traction in European markets.

Asia-Pacific

APAC is the fastest-growing region, contributing 25–30% of total global revenue. Rising middle-class wealth, mass adoption of e-commerce, and expanding retail infrastructure are fueling handbag purchases in China, India, Japan, and Southeast Asia. Accessible luxury and mid-range handbags are particularly popular among urban millennials and new workforce entrants.

Latin America

Latin America shows steady growth, with demand driven by urbanization in Brazil, Mexico, and Argentina. Consumers in this region prioritize mid-priced handbags that balance style and affordability. Exposure to global fashion trends through social media is enhancing demand for international brands.

Middle East & Africa

MEA markets contribute modest but rising demand, particularly in the UAE, Saudi Arabia, Kenya, and South Africa. High-income consumers in Gulf countries favor luxury handbags, while African urban hubs show growing interest in mid-range styles. Increasing tourism and retail expansion support long-term regional growth.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|