Tote Bags Market Size

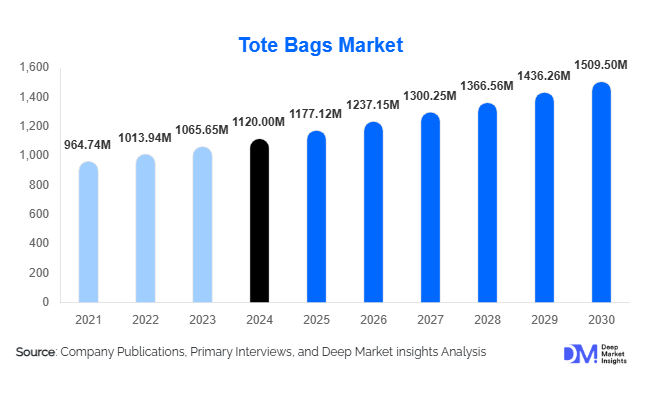

According to Deep Market Insights, the global tote bags market size was valued at USD 1,120 million in 2024 and is projected to grow from USD 1,177.12 million in 2025 to reach USD 1,509.5 million by 2030, expanding at a CAGR of 5.1 during the forecast period (2025–2030). The growth of the tote bags market is primarily driven by rising consumer preference for sustainable and reusable bags, increasing fashion consciousness, the expansion of e-commerce packaging solutions, and growing demand from retail, corporate, and promotional sectors globally.

Key Market Insights

- Sustainability is driving consumer adoption of tote bags, with environmentally conscious shoppers preferring reusable options over single-use plastic bags.

- Fashion-forward designs and premium materials are boosting the lifestyle segment, creating demand for branded and designer tote bags in North America and Europe.

- Asia-Pacific dominates production, particularly in China, India, and Vietnam, supplying both domestic demand and export markets.

- North America and Europe are the fastest-growing markets, driven by e-commerce packaging, corporate gifting, and promotional campaigns.

- Technological integration, including smart tote bags with RFID tags and sustainable material innovations, is reshaping product differentiation.

What are the latest trends in the tote bags market?

Eco-Friendly and Reusable Bags in High Demand

Consumers worldwide are increasingly prioritizing sustainable choices, fueling demand for cotton, jute, canvas, and recycled material tote bags. Retailers and e-commerce platforms are promoting reusable tote bags as part of green initiatives, with many incorporating recycled plastics and biodegradable materials. Governments across Europe and North America have implemented regulations to reduce single-use plastics, directly benefiting the tote bags market. Brands are marketing tote bags as a sustainable lifestyle accessory, encouraging repeated usage and brand loyalty.

Fashion and Customization Trends

Tote bags are evolving beyond utilitarian purposes into style statements. Custom printing, embroidery, and designer collaborations are gaining traction, especially in luxury and mid-tier fashion segments. Personalization for corporate gifting, events, and promotional campaigns is also expanding. Retailers are leveraging digital platforms to offer custom tote bag designs, appealing to younger, socially conscious consumers who value both aesthetics and environmental responsibility.

What are the key drivers in the tote bags market?

Rising E-Commerce and Retail Demand

The growth of global e-commerce has significantly boosted demand for tote bags as packaging and shopping accessories. Retailers are increasingly using branded tote bags to enhance customer loyalty and reduce plastic usage. The surge in online shopping in North America, Europe, and the Asia-Pacific, coupled with seasonal and promotional campaigns, is positively impacting market growth.

Environmental Awareness and Regulatory Support

Government regulations limiting single-use plastics and promoting reusable alternatives are key growth drivers. European Union directives, U.S. state bans on plastic bags, and initiatives in Asia-Pacific countries encourage the use of tote bags. Increased consumer awareness about climate change and plastic pollution reinforces sustainable purchasing behavior.

Fashion and Lifestyle Adoption

The adoption of tote bags as a fashion accessory, particularly among urban youth, has spurred market growth. Designer collaborations, social media-driven trends, and celebrity endorsements are influencing consumer preferences. Tote bags are now considered an essential wardrobe accessory, blending functionality with style, particularly in Europe and North America.

What are the restraints for the global market?

Price Sensitivity of Consumers

High-quality tote bags, especially those made from organic or premium materials, can be expensive compared to conventional plastic or non-branded bags. This limits mass adoption in price-sensitive regions such as parts of Latin America, Africa, and South Asia.

Competition from Alternative Bags

Other reusable bag formats, such as backpacks, drawstring bags, and foldable shopping bags, create competitive pressure. The need for differentiation and continuous innovation is crucial to sustain market growth, as consumers seek multifunctional alternatives.

What are the key opportunities in the tote bags market?

Corporate Gifting and Promotional Segment

Corporate gifting and promotional campaigns offer a substantial growth opportunity. Brands increasingly use branded tote bags for marketing, events, and giveaways. This segment is expanding due to growing business consciousness around sustainability and visibility, particularly in North America and Europe. Customization options, eco-friendly materials, and bulk orders enhance the attractiveness of tote bags in B2B markets.

Smart and Tech-Integrated Tote Bags

The integration of technology such as RFID tags, GPS trackers, and mobile charging capabilities is emerging as a premium niche. Smart tote bags cater to tech-savvy consumers and the urban working population, creating differentiation in crowded markets. This innovation provides potential for higher margins and brand loyalty.

Expansion in Emerging Markets

Rising urbanization, disposable income, and awareness about sustainability in India, China, and Southeast Asia are creating new demand pockets. Local manufacturing hubs, coupled with government support for eco-friendly products, provide opportunities for both new entrants and established players to expand market penetration in these regions.

Product Type Insights

Canvas tote bags dominate the global market, accounting for approximately 40% of the 2024 market share. Their durability, eco-friendly appeal, and affordability make them the most popular choice among consumers. Jute tote bags follow, especially in Europe and India, due to their biodegradable nature and government-supported eco campaigns. Leather tote bags are leading in the premium lifestyle segment, primarily in North America and Europe, as they combine functionality with fashion appeal. Polyester and synthetic tote bags occupy the mid-tier segment, balancing cost and durability.

Application Insights

Retail shopping remains the largest application segment, accounting for 35% of market usage in 2024. E-commerce packaging and grocery shopping follow closely due to the increasing adoption of reusable bags. Corporate gifting, promotional giveaways, and educational institutions are emerging applications, particularly in developed markets. Eco-conscious consumers are also driving adoption in lifestyle and fashion segments, enhancing the versatility of tote bags as both utility and fashion products.

Distribution Channel Insights

Online channels dominate tote bag distribution, particularly e-commerce marketplaces and brand websites, due to convenience, customization options, and competitive pricing. Offline channels such as department stores, specialty fashion stores, and supermarkets remain significant, especially for premium and branded tote bags. Corporate procurement channels are expanding as B2B sales of branded tote bags grow for promotions, events, and exhibitions. Subscription-based and membership-focused gifting services are emerging as niche distribution models, particularly in North America and Europe.

End-Use Insights

Retail, e-commerce, and corporate sectors are driving global demand for tote bags. Retailers use them for brand visibility, promotions, and sustainable packaging. E-commerce platforms increasingly adopt branded tote bags as reusable packaging to enhance customer experience. Corporate gifting and events create steady demand for customized, eco-friendly tote bags. Emerging applications in tourism, hospitality, and lifestyle accessories are expanding the market base. Export demand is led by North America and Europe, with Asia-Pacific being the primary manufacturing hub supplying global markets.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America accounts for 28% of the global tote bags market in 2024, driven by environmental awareness, corporate gifting, and fashion adoption. The U.S. leads in demand, with strong consumer preference for sustainable bags and designer tote bags. Canada follows closely, driven by eco-friendly retail campaigns. Fast adoption of smart and tech-integrated bags is also prominent in this region.

Europe

Europe holds 25% of the market share in 2024. Countries like Germany, the U.K., and France are leading markets due to strict regulations on plastic bags and growing demand for premium and eco-friendly tote bags. Emerging trends include designer collaborations, biodegradable material adoption, and sustainable fashion integration. The region is among the fastest-growing globally, with a CAGR projected at 9.5% during 2025–2030.

Asia-Pacific

Asia-Pacific is the largest manufacturing hub and a growing consumption market. China, India, and Vietnam dominate production, with strong export volumes to North America and Europe. Rising urbanization and disposable income in India and Southeast Asia are driving domestic consumption.

Latin America

Brazil, Mexico, and Argentina show steady growth, primarily in urban centers with corporate gifting and retail adoption. CAGR in this region is moderate, around 8%.

Middle East & Africa

Middle East demand is led by the UAE and Saudi Arabia, focusing on luxury and promotional tote bags. Africa remains a smaller market, with growth potential tied to urban retail and corporate adoption.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Tote Bags Market

- H&M

- Zara

- Baggu

- Longchamp

- EcoRight

- L.L. Bean

- Calvin Klein

- Madewell

- LeSportsac

- Patagonia

- Everlane

- Fjällräven

- Hermès

- Tote & Co

- Kipling

Recent Developments

- In March 2025, Baggu launched a new line of biodegradable canvas tote bags in collaboration with eco-friendly fashion initiatives.

- In January 2025, Madewell introduced a customization platform for personalized tote bags targeting millennials in North America.

- In November 2024, Longchamp expanded its sustainable leather tote bag collection in Europe, emphasizing eco-certified materials and ethical sourcing.