Global Green Tea Market Size

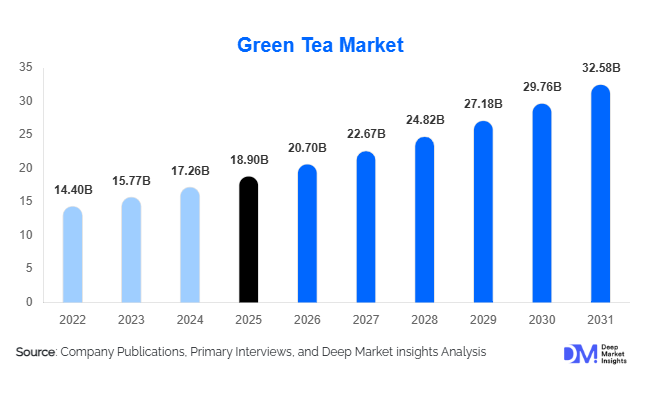

According to Deep Market Insights,the global green tea market size was valued at USD 18.9 billion in 2025 and is projected to grow from USD 20.70 billion in 2026 to reach USD 32.58 billion by 2031, expanding at a CAGR of 9.5% during the forecast period (2026–2031). The market growth is primarily driven by rising health awareness, increasing consumer preference for natural and functional beverages, expansion of ready-to-drink offerings, and the growing adoption of green tea in nutraceuticals, cosmetics, and dietary supplements.

Key Market Insights

- Green tea consumption is increasingly shifting toward functional and fortified products, including probiotic, vitamin-enriched, and adaptogen-infused formulations, appealing to health-conscious consumers.

- Organic and sustainably sourced green tea is gaining traction globally, supported by certification programs, government incentives, and consumer willingness to pay a premium for clean-label products.

- Asia-Pacific dominates the market, led by China, Japan, and India, where cultural integration and high domestic consumption sustain demand.

- North America and Europe are emerging as key growth regions, driven by premiumization, RTD beverages, and the functional beverage trend.

- Technological adoption in processing, packaging, and e-commerce, including cold-brew systems, D2C subscriptions, and online marketing, is reshaping market dynamics.

What are the latest trends in the global green tea market?

Functional & Fortified Green Tea Products

Manufacturers are increasingly offering green tea products fortified with probiotics, vitamins, minerals, and plant-based adaptogens. These products target consumers seeking immunity support, metabolic benefits, and stress relief. Functional green teas are particularly popular in North America, Japan, and South Korea, with premium pricing supported by scientific validation of health benefits. The trend extends across tea bags, loose leaf, and ready-to-drink formulations, creating differentiation opportunities for both new and established players.

Organic & Sustainable Green Tea

Organic green tea consumption is growing rapidly due to increasing awareness of pesticide-free cultivation and ethical sourcing. Governments in Asia-Pacific are incentivizing organic farming, while Europe and North America see strong consumer demand for traceable, certified products. Sustainable packaging solutions, carbon-neutral supply chains, and fair-trade certifications are increasingly influencing purchasing decisions, particularly among younger, eco-conscious demographics.

What are the key drivers in the global green tea market?

Rising Health Awareness & Preventive Healthcare

The global shift toward preventive healthcare has made green tea a preferred alternative to sugar-laden beverages. Clinical studies highlighting green tea’s antioxidant, cardiovascular, and metabolism-boosting benefits have increased consumer adoption. Urbanization, higher disposable income, and busy lifestyles further amplify demand for convenient green tea formats such as tea bags and ready-to-drink beverages.

Growth of Ready-to-Drink (RTD) Beverages

RTD green tea is gaining popularity due to convenience and lifestyle adoption, especially among younger consumers in North America, Europe, and APAC urban centers. Beverage companies are investing in cold-brew and low-sugar innovations, expanding the reach of green tea beyond traditional household consumption and into on-the-go markets.

Digital & E-commerce Penetration

Online retail platforms and D2C models enable wider distribution of premium and specialty green tea products. Subscription models, targeted digital campaigns, and influencer marketing are enhancing customer engagement, particularly in organic and functional segments.

What are the restraints for the global market?

Volatility in Raw Material Prices

Fluctuations in tea leaf supply, driven by climate change, labor shortages, and agricultural yield variability in China and India, create pricing pressures and affect profit margins, especially for smaller producers and mass-market products.

Regional Taste Preference Variability

Green tea taste and aroma preferences vary across regions, requiring formulation adjustments in Western markets. Flavor modifications increase production complexity and cost, potentially impacting adoption rates in non-traditional green tea markets.

What are the key opportunities in the green tea industry?

Functional Beverages & Nutraceutical Integration

The convergence of green tea with nutraceuticals, dietary supplements, and wellness-focused products presents substantial growth potential. Green tea extracts are increasingly used for metabolism support, immunity enhancement, and stress reduction. Companies can leverage R&D to introduce scientifically validated products, while new entrants can target niche wellness-oriented sub-segments.

Expansion of Organic & Sustainable Products

Organic green tea represents a high-margin segment due to premium pricing and consumer willingness to pay for certified clean-label products. Sustainable sourcing, carbon-neutral packaging, and ethical production practices are becoming differentiators, especially in Europe and North America, driving both market expansion and brand loyalty.

Green Tea in Non-Traditional Applications

Cosmetics, personal care, and pharmaceuticals are emerging as key growth avenues. Green tea extracts are increasingly incorporated into skincare, anti-aging, acne treatments, and dietary supplements. Diversifying into these higher-margin applications reduces reliance on beverage consumption and opens B2B ingredient markets for manufacturers.

Product Type Insights

Tea bags dominate with a 38% share of the 2025 market, driven by convenience and affordability. Loose leaf green tea accounts for 26%, with premiumization and specialty consumption fueling demand. Ready-to-drink (RTD) green tea is the fastest-growing product, supported by urban lifestyles and functional beverage trends. Powdered green tea, including matcha, is expanding in nutraceutical and food applications due to high antioxidant content and versatile culinary use.

Application Insights

Household consumption remains the largest application, accounting for 54% of the 2025 market. Nutraceutical and cosmetic applications are growing rapidly, collectively representing 18%. Ready-to-drink beverages, dietary supplements, and skincare formulations are driving diversification and higher-margin opportunities for manufacturers globally.

Distribution Channel Insights

Supermarkets and hypermarkets lead distribution with 41% share, benefiting from high visibility and mass-market reach. Online retail accounts for 19% and is expanding rapidly due to subscription models, D2C channels, and cross-border sales. Specialty stores, convenience stores, and HoReCa channels collectively drive niche and premium demand, particularly for functional and organic products.

End-Use Insights

Household consumption is the primary driver, with strong demand in Asia-Pacific. Foodservice and café adoption is growing in urban markets globally, while nutraceuticals and cosmetics are emerging high-margin end uses. The global nutraceutical market exceeds USD 400 billion, and green tea is a key ingredient in dietary supplements and wellness products, further boosting market growth.

| By Product Type | By Nature | By Flavor Profile | By Packaging Type | By Distribution Channel | By End Use |

|---|---|---|---|---|---|

|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific dominates with 61% of global market share in 2025. China leads at 34%, followed by Japan (9%) and India (7%). Cultural integration, high domestic consumption, and strong export capacity sustain demand. Rapid urbanization and growing health-conscious middle-class populations are driving continued expansion.

North America

North America holds 15% market share, led by the U.S. at 11%. Demand is fueled by RTD green tea, functional beverages, and premium tea products. Health-conscious and younger demographics are driving market growth through both online and offline channels.

Europe

Europe accounts for 14% of global market share, with the U.K., Germany, and France leading. Organic and premium products are particularly strong, supported by high willingness to pay and sustainable consumption trends.

Latin America

Latin America is emerging, led by Brazil, Argentina, and Mexico. Outbound demand and growing health awareness are slowly increasing green tea adoption, particularly in premium and RTD formats.

Middle East & Africa

Africa is the primary production hub, while the Middle East (UAE, Saudi Arabia, Qatar) is an emerging consumer market. Strong purchasing power, growing health awareness, and premiumization trends support expansion.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Green Tea Market

- Unilever

- Nestlé

- Ito En Ltd.

- Tata Consumer Products

- Suntory Holdings

- The Coca-Cola Company

- Starbucks Corporation

- Twinings (Associated British Foods)

- Lipton Teas & Infusions

- Kirin Holdings

- Barry’s Tea

- Dilmah Ceylon Tea Company

- Bigelow Tea

- Harney & Sons

- Yamamotoyama Co.