Green Lentils Market Size

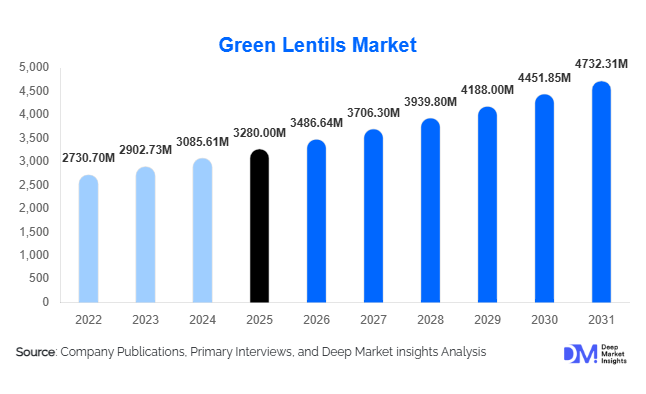

According to Deep Market Insights, the global green lentils market size was valued at USD 3,280 million in 2025 and is projected to grow from USD 3,486.64 million in 2026 to reach USD 4,732.31 million by 2031, expanding at a CAGR of 6.3% during the forecast period (2026–2031). The green lentils market growth is primarily driven by increasing global demand for plant-based protein, rising health awareness, expanding food processing applications, and strong export activity from major producing countries such as Canada, Australia, and India.

Key Market Insights

- Plant-based protein adoption is accelerating globally, positioning green lentils as a cost-effective and nutrient-dense alternative to animal protein.

- Food processing applications are expanding rapidly, particularly in plant-based meat, soups, ready meals, protein snacks, and gluten-free bakery products.

- North America dominates global supply and exports, with Canada leading international trade volumes.

- Asia-Pacific is the fastest-growing consumption region, supported by rising urbanization, government nutrition programs, and expanding middle-class demand.

- Conventional green lentils account for over 80% of global sales, while organic variants are witnessing faster-than-average growth.

- Technological advancements in sorting, cleaning, and protein fractionation are enhancing product quality and value-added processing.

What are the latest trends in the green lentils market?

Rising Integration into Plant-Based Meat and Protein Products

Green lentils are increasingly being incorporated into plant-based meat analogs, protein concentrates, and high-protein snacks. Food manufacturers are leveraging lentil flour and protein isolates to enhance texture, nutritional value, and clean-label positioning. The expansion of the global plant-based food industry has significantly boosted B2B demand for lentil-based ingredients. Lentil protein fractionation facilities are being established in North America and Australia to cater to premium product formulations, supporting higher-margin opportunities beyond bulk commodity trade.

Growth in Clean-Label and Functional Foods

Consumers are prioritizing minimally processed, natural ingredients. Green lentils, known for high protein (24–26%), fiber, and micronutrient content, align strongly with clean-label trends. Ready-to-cook lentil packs, pre-cooked vacuum-sealed lentils, and fortified pulse blends are gaining shelf space in supermarkets. Additionally, gluten-free and diabetic-friendly food categories are increasingly incorporating lentil flour as a base ingredient, expanding retail penetration globally.

What are the key drivers in the green lentils market?

Increasing Global Demand for Plant-Based Diets

The growing adoption of vegetarian, vegan, and flexitarian diets worldwide is a major growth driver. Consumers are actively replacing animal protein with pulses due to sustainability, health, and ethical considerations. Green lentils offer a balanced amino acid profile and affordability, making them attractive across both developed and emerging economies.

Government Support for Pulse Cultivation

Several countries are promoting pulses under sustainable agriculture initiatives. Green lentils contribute to soil nitrogen fixation, reduce fertilizer dependency, and support crop rotation practices. Public procurement programs in India and Middle Eastern countries incorporating pulses into school and food security schemes are boosting domestic demand.

What are the restraints for the global market?

Weather-Driven Production Volatility

Green lentil production is highly dependent on climatic conditions. Droughts, irregular rainfall, and extreme weather in key producing regions such as Canada and Australia can cause supply fluctuations and price volatility, affecting trade stability.

Competition from Alternative Plant Proteins

Pea protein, soy protein, chickpeas, and fava beans compete directly in plant-based applications. Established processing infrastructure for peas and soy can create competitive pressure, especially in industrial protein extraction markets.

What are the key opportunities in the green lentils industry?

Expansion in Emerging Asian and African Markets

Urbanization and rising disposable incomes in Asia-Pacific and Africa are increasing demand for affordable protein sources. Exporters can tap into underpenetrated retail markets with localized packaging, fortified blends, and value-added ready-to-cook formats.

Value-Added Processing and Protein Fractionation

Investment in lentil protein extraction, flour milling, and ready-to-eat processing presents strong growth potential. Higher-margin applications in sports nutrition, functional foods, and plant-based meat alternatives are enabling manufacturers to diversify beyond bulk commodity sales.

Product Type Insights

The global green lentils market is segmented by product type into whole green lentils, split green lentils, dehulled lentils, organic lentils, and specialty varieties. Whole green lentils continue to lead the market, accounting for approximately 42% of the global market share in 2025. The dominance of this segment is primarily driven by strong household consumption across South Asia and the Middle East, expanding export demand from major producing countries such as Canada and Australia, and increasing use in bulk foodservice and processing applications due to their high protein content, long shelf life, and versatility in culinary applications. Whole lentils are widely preferred for soups, curries, salads, and ready-to-cook packaged products, reinforcing their consistent global demand.

Split and dehulled green lentils hold a substantial share due to their faster cooking time and suitability for traditional cuisines, particularly in India and Turkey. Their ease of digestion and adaptability in processed food formulations further support stable growth. Organic green lentils represent approximately 18% of the market but are expanding at a faster pace compared to conventional varieties. Growth in this segment is supported by rising consumer awareness regarding clean-label products, pesticide-free cultivation, and sustainable farming practices, particularly in Europe and North America. Specialty varieties such as Laird and Eston lentils command premium pricing in export markets due to superior size uniformity, color consistency, and cooking performance, making them attractive for branded retail packaging and high-end foodservice applications.

Form Insights

Based on form, the market is categorized into raw/dry lentils, canned/pre-cooked lentils, lentil flour, and protein concentrates. Raw or dry green lentils account for nearly 55% of the total market in 2025, maintaining their leadership due to efficient bulk trade logistics, long storage stability, and strong demand from both retail and industrial buyers. The leading driver for this segment is its cost-effectiveness combined with extended shelf life, which makes it suitable for international exports and government procurement programs.

Canned and pre-cooked lentils are experiencing steady expansion, particularly in Western markets where convenience-oriented consumption patterns are prominent. Busy lifestyles, increasing demand for ready-to-eat meals, and growing retail private-label offerings are accelerating segment growth. Lentil flour and protein concentrates represent the fastest-growing sub-segment, driven primarily by the rapid expansion of plant-based food manufacturing. These forms are increasingly incorporated into meat alternatives, bakery fortification, gluten-free formulations, and high-protein snacks, supported by rising demand for sustainable plant-derived protein ingredients.

Distribution Channel Insights

The market is distributed through B2B industrial channels, supermarkets and hypermarkets, specialty stores, and online retail platforms. B2B industrial sales account for approximately 48% of global revenue, making it the leading distribution channel. The primary growth driver for this segment is large-scale procurement by food processors, ingredient manufacturers, and private-label brands seeking reliable protein sources for processed foods and ready-meal production. Long-term supply contracts and global trade networks further strengthen this channel’s dominance.

Within the B2C segment, supermarkets and hypermarkets remain the dominant retail channels due to extensive product visibility, promotional pricing strategies, and broad consumer access. Online retail is expanding rapidly, supported by increasing digital penetration, subscription-based grocery models, and direct-to-consumer organic brands. Specialty organic stores contribute significantly in developed markets, particularly in Europe and North America, where consumers actively seek certified organic and sustainably sourced lentil products.

End-Use Insights

By end use, the green lentils market is segmented into food processing, household consumption, foodservice, animal feed, and pet food applications. The food processing industry leads the market, accounting for nearly 38% of total market share in 2025. The leading driver for this segment is the increasing incorporation of lentils into value-added food products such as soups, ready meals, plant-based meat substitutes, protein snacks, and fortified bakery goods. Manufacturers are increasingly leveraging lentils for their protein density, fiber content, and clean-label positioning.

Household consumption remains a strong and stable segment, particularly in India, Turkey, and several Middle Eastern countries where lentils are staple dietary components. Rising health awareness and affordability compared to animal protein sources continue to support domestic demand. Foodservice demand is recovering steadily as restaurants and catering services expand plant-based menu offerings. Animal feed and pet food applications are emerging niche areas, driven by the need for alternative plant-based protein ingredients in sustainable feed formulations.

| By Product Type | By Form | By Distribution Channel | By End-Use Industry | By Nature |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds approximately 35% of the global market share in 2025, maintaining its position as the largest regional contributor. Regional growth is primarily driven by Canada’s dominance as a leading global exporter, supported by advanced mechanized farming, high-yield seed varieties, and strong trade agreements. The United States contributes significantly to demand growth through rising adoption of lentil-based protein ingredients in plant-based foods and clean-label packaged products. Increasing consumer preference for high-protein diets, expanding vegan populations, and strong infrastructure for bulk exports further reinforce regional leadership.

Europe

Europe accounts for around 27% of global demand, with strong consumption across France, Germany, Italy, and the United Kingdom. Regional growth is driven by stringent food quality standards, increasing consumer preference for organic and sustainably sourced pulses, and supportive agricultural policies promoting plant-based protein production. The region’s focus on reducing carbon footprints and meat consumption has significantly accelerated lentil usage in both retail and food processing sectors. The popularity of organic lentils is particularly strong due to well-established certification frameworks and premium pricing acceptance.

Asia-Pacific

Asia-Pacific represents the fastest-growing regional market, expanding at nearly 7.5% CAGR. Growth is primarily driven by high domestic consumption in India, where lentils are a staple protein source supported by government nutrition initiatives and food security programs. Rising population levels, urbanization, and increasing health awareness across Southeast Asia are contributing to sustained demand growth. Australia plays a key export role within the region, benefiting from strong trade links with South Asian and Middle Eastern markets. Expanding middle-class populations and increasing plant-based dietary shifts further accelerate regional expansion.

Latin America

Latin America is witnessing gradual yet steady growth, particularly in Brazil and Mexico. Regional expansion is driven by rising plant-based dietary adoption, growing retail penetration of packaged lentil products, and increasing awareness of affordable protein alternatives. Government initiatives promoting pulse cultivation and improving agricultural productivity are supporting domestic supply. Expanding supermarket networks and improving cross-border trade logistics are further enhancing market accessibility across the region.

Middle East & Africa

The Middle East & Africa region demonstrates stable demand growth, supported by strong cultural integration of lentils into traditional diets. Turkey and the United Arab Emirates function as major import and re-export hubs due to their strategic trade positioning. Rising population growth, food security concerns, and increasing reliance on pulse imports are key growth drivers across the Middle East. In Africa, expanding intra-regional trade agreements, improvements in agricultural productivity, and rising awareness of affordable plant protein sources are gradually strengthening market development.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Green Lentils Market

- AGT Food and Ingredients Inc.

- Viterra Inc.

- Richardson International

- Archer Daniels Midland Company

- Cargill Incorporated

- Olam Agri

- Bunge Limited

- BroadGrain Commodities

- Columbia Grain International

- Adani Wilmar Limited

- Arbel Group

- Simpson Seeds Inc.

- ETG Global

- Prairie Pulse Inc.

- Sun Impex