Furniture and Home Furnishing Market Size

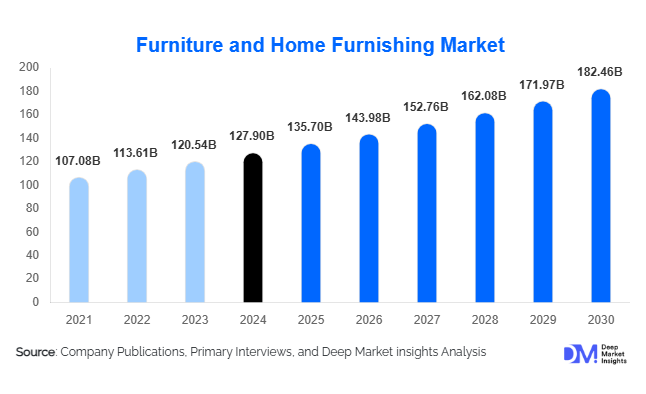

According to Deep Market Insights, the global furniture and home furnishing market size was valued at USD 127.90 billion in 2024 and is projected to grow from USD 135.70 billion in 2025 to reach USD 182.46 billion by 2030, expanding at a CAGR of 6.10% during the forecast period (2025–2030). The market’s growth is primarily driven by rising household spending, rapid urbanization, expanding residential construction, and a strong consumer shift toward modular, functional, and aesthetic home interiors across global markets.

Key Market Insights

- Living room furniture remains the largest revenue-generating segment, driven by rising demand for modular sofas, entertainment units, and aesthetic décor.

- Online and omni-channel retail is rapidly accelerating market penetration, supported by AR/VR-enabled product visualization and doorstep assembly services.

- Asia-Pacific dominates global consumption, with China, India, and Southeast Asia accounting for the highest share of new household formation.

- North America and Europe remain the most lucrative premium markets driven by renovation cycles, high disposable incomes, and design-focused consumer preferences.

- Sustainable and eco-friendly furniture is emerging as a key growth vector, fueled by regulatory requirements and consumer preferences for low-VOC, responsibly sourced materials.

- Technological integration, including smart furniture, IoT-enabled storage, and ergonomic designs, is reshaping product development and driving premiumization.

What are the latest trends in the furniture and home furnishing market?

Sustainable & Circular-Economy Furniture Gains Momentum

Manufacturers are increasingly adopting sustainability-driven production models, focusing on responsibly sourced wood, recycled composites, low-VOC paints, and modular designs that extend product life cycles. Circular economy initiatives such as furniture buy-back programs, refurbishment centers, and rental/leasing models are gaining widespread acceptance, especially in Europe and North America. Younger consumers are prioritizing ethical brands and durable, multifunctional furnishings that minimize waste. New certification standards, covering raw material traceability, carbon footprints, and durability, are strengthening, pushing the entire value chain toward greener manufacturing. This sustainability shift is helping brands differentiate themselves and command price premiums.

Technology-Enhanced Furniture & Digital Shopping Experiences

Advanced technologies are transforming furniture buying and usage. Augmented reality (AR) room planners, 3D configurators, and AI-driven design recommendations are becoming standard in online retail, reducing purchase uncertainty. Smart furniture, such as IoT-enabled desks, storage with sensors, integrated charging ports, and automated lighting systems, caters to tech-savvy urban consumers. E-commerce platforms now offer interactive showrooms, virtual consultations, and AI-assisted sizing tools, bringing in-person experiences previously online. As digital transformation accelerates, technology will be central to customer acquisition, customization, and after-sales support, especially among digitally native households.

What are the key drivers in the furniture and home furnishing market?

Rising Global Disposable Income and Lifestyle Upgrades

Growing middle-class populations, especially in the Asia-Pacific region, are driving robust demand for quality home furnishings. Rising disposable incomes are enabling consumers to prioritize comfort, aesthetics, and long-lasting designs. Lifestyle shifts, smaller families, increasing home ownership, and rising renovation activities are boosting purchase frequency for living room, bedroom, and storage furniture. The trend toward creating “home-centric lifestyles,” amplified by remote work, is further fueling demand for ergonomic, stylish, and multifunctional pieces.

Real Estate Expansion and Residential Construction Growth

New housing supply across emerging markets, coupled with rising renovation cycles in developed economies, remains a core driver of furniture demand. Compact urban apartments are driving interest in modular and multifunctional furniture, such as sofa beds, folding tables, and intelligent storage systems. Governments worldwide are investing in affordable housing schemes, indirectly expanding long-term furniture consumption. Commercial construction, hotels, offices, educational and medical institutions, also contribute significantly to contract furniture demand.

E-Commerce Penetration and Digital Retail Transformation

The rapid rise of e-commerce has democratized access to furniture, enabling consumers to browse thousands of styles, compare prices, and receive doorstep delivery with installation. Online furniture sales have grown sharply in the post-pandemic era, driven by convenience, greater product variety, and improved return policies. Omni-channel retailers now integrate physical showrooms, online configurators, and real-time inventory systems to improve the purchase experience. As digital adoption deepens, online channels will significantly outpace traditional retail growth through 2030.

What are the restraints for the global market?

High Raw Material Costs and Supply-Chain Volatility

Fluctuating prices of wood, metal, foam, textiles, and adhesives significantly impact manufacturing margins. Global supply chain disruptions, freight cost spikes, and shortages of sustainable certified wood can increase costs, causing price hikes that may slow consumer purchases. Manufacturers must adopt diversified sourcing and automated production to mitigate these challenges.

Economic Slowdowns Impacting Discretionary Spending

Furniture is often considered a semi-discretionary purchase. Economic downturns or inflationary pressures may prompt consumers to delay upgrades or shift toward budget alternatives. Interest rate fluctuations and housing market slowdowns can also dampen furniture demand. Brands must strengthen value propositions, durability, and financing options to offset these pressures.

What are the key opportunities in the furniture and home furnishing industry?

Urbanization-Driven Demand for Modular & Space-Saving Furniture

Compact living spaces in metropolitan regions are creating significant opportunities for modular and multifunctional furniture. Manufacturers offering foldable tables, sofa beds, wall-mounted storage, and transformable units can capture high-growth urban markets. This trend is particularly strong in Asia-Pacific and Europe, where micro-apartments and organized rental housing are gaining popularity.

Expansion of E-Commerce and Digital-First Brands

Direct-to-consumer (D2C) brands leveraging online channels, simplified logistics, and virtual design tools can rapidly scale and reach international customers. E-commerce also supports high-margin customization models, such as made-to-order sofas, configurable storage systems, and personalized décor. With consumers increasingly comfortable making large purchases online, digital-first furniture brands can disrupt traditional retail ecosystems.

Growing Demand for Sustainable and Long-Life Furniture

Eco-friendly materials, durability-focused designs, circular manufacturing, and low-waste production open major growth avenues. Brands offering certified sustainable wood, recycled composites, and eco-friendly finishes can tap into premium, environmentally conscious market segments. Governments are also incentivizing greener manufacturing through regulations and certifications, strengthening demand for sustainable furniture globally.

Product Type Insights

Living room furniture dominates the global market, accounting for approximately 25–30% of total 2024 revenues. Sofas, entertainment units, and modern seating solutions continue to be top sellers due to their central role in home aesthetics and social interaction. Bedroom furniture follows closely, driven by mattress upgrades and rising demand for modern wardrobes and storage beds. Home office furniture is expanding rapidly due to hybrid work trends, with ergonomic chairs, adjustable desks, and space-efficient shelves gaining strong traction. Outdoor and patio furniture, propelled by lifestyle upgrades and rising participation in home-improvement activities, is also becoming a lucrative category.

Application Insights

The residential segment leads the market with nearly 65–70% share of 2024 demand. Urban housing developments, renovation projects, and first-time homebuyers drive strong consumption across all furniture categories. The commercial segment, including offices, coworking spaces, educational institutions, and hospitality, shows robust growth, particularly for ergonomic office furniture and contract-grade installations. Hospitality furniture demand is recovering strongly post-pandemic, driven by hotel renovations and new resort constructions. Institutional furniture, including school desks, healthcare beds, and public seating, continues to expand in line with government infrastructure investments.

Distribution Channel Insights

Offline retail remains the largest distribution channel, contributing nearly 60–70% of global sales in 2024. Furniture showrooms, specialty stores, and multi-brand retail outlets remain essential due to the high-touch nature of furniture purchases. However, online platforms are the fastest-growing channel, supported by AR visualization tools, flexible return policies, and doorstep assembly services. Omni-channel retail, integrating physical stores, digital showrooms, and mobile applications, is becoming the dominant model among global brands. D2C brands, subscription furniture, and rental platforms are gaining traction among millennials and young professionals.

End-User Insights

Residential users dominate global consumption, driven by rising homeownership and expanding apartment construction. Millennials and Gen Z are major contributors, with high preferences for stylish, affordable, and multifunctional furniture. The commercial end-user segment is witnessing strong growth in office spaces, retail outlets, coworking hubs, and educational institutions. Hospitality-driven demand is gaining momentum, with hotels and resorts investing in high-quality, modern, and durable furniture. New applications in smart homes, tech-integrated offices, and elderly-care facilities are also emerging as high-potential segments.

| By Product Type | By Material Type | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific leads the global market with a 45–50% share of 2024 demand. China, India, Vietnam, and Indonesia account for the majority of consumption due to rapid urbanization, expanding middle-class populations, and strong domestic manufacturing ecosystems. India and Southeast Asia are the fastest-growing subregions, supported by rising household formation and government-backed housing initiatives. Premium and modular furniture categories are expanding quickly as consumer lifestyles evolve.

North America

North America accounts for 20–25% of global revenues, driven by high consumer spending, strong renovation activity, and demand for premium and sustainable furniture. The U.S. is the dominant market, supported by mature e-commerce adoption and preference for high-quality, design-centric furnishings. Rising adoption of home offices and ergonomic furniture continues to influence demand patterns across the region.

Europe

Europe holds 15–20% global share, with strong markets in Germany, the U.K., France, Italy, and Scandinavian countries. The region is a global leader in eco-friendly and design-focused furniture, emphasizing durability, minimalism, and sustainable sourcing. Stringent regulations on materials and production standards further shape product offerings. Northern Europe shows a high preference for modular, premium, and sustainable furniture models.

Latin America

Latin America represents 3–5% of global demand, led by Brazil, Mexico, and Colombia. Economic variability remains a challenge, but rising middle-class consumption and home renovation trends are supporting growth. Locally manufactured wooden furniture remains a popular consumer preference.

Middle East & Africa

MEA accounts for roughly 5–7% of the global market, with significant growth in the Gulf Cooperation Council (GCC) nations. Rising construction of premium residential and hospitality projects, especially in the UAE, Saudi Arabia, and Qatar, is driving demand for luxury and modern furniture. Africa is witnessing growth in urban housing and institutional furniture demand, although from a smaller base.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Furniture and Home Furnishing Market

- IKEA (Ingka Group)

- Ashley Furniture Industries

- Herman Miller (MillerKnoll)

- Steelcase

- Williams-Sonoma, Inc.

- La-Z-Boy Incorporated

- Ethan Allen Interiors

- Wayfair

- Sauder Woodworking

- Hooker Furnishings

- Kimball International

- DFS Furniture plc

- Restoration Hardware (RH)

- B&B Italia (Design Holding)

- Haverty Furniture Companies

Recent Developments

- In April 2025, IKEA announced new investments into sustainable wood sourcing and circular manufacturing centers across Europe and Asia.

- In February 2025, Ashley Furniture expanded its India manufacturing unit to support APAC market penetration and export capacity.

- In January 2025, MillerKnoll introduced a new line of AI-enhanced ergonomic office furniture designed for hybrid workplaces.