Modular Furniture Market Size

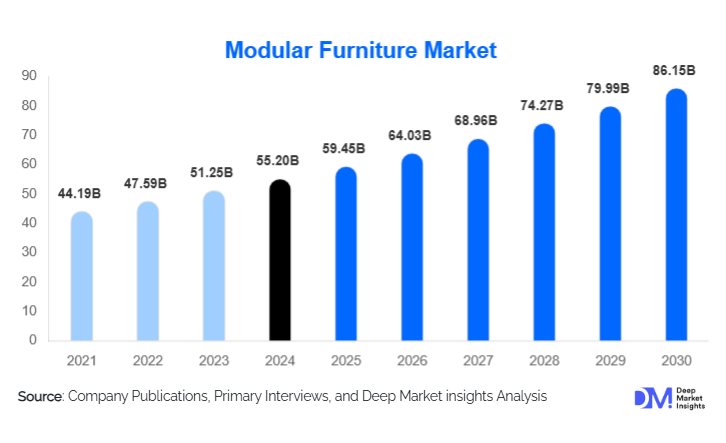

According to Deep Market Insights, the global modular furniture market size was valued at USD 55.2 billion in 2024 and is projected to grow from USD 59.45 billion in 2025 to reach USD 86.15 billion by 2030, expanding at a CAGR of 7.7% during the forecast period (2025–2030). The modular furniture market growth is primarily driven by the increasing demand for flexible, space-saving furniture solutions, the surge in urban housing and commercial infrastructure projects, and the rapid adoption of sustainable and customizable interior designs.

Key Market Insights

- Growing urbanization and smaller living spaces are fueling the demand for compact, multifunctional furniture with modular configurations.

- Rising corporate focus on agile workplaces is boosting demand for modular office systems that enhance flexibility, collaboration, and design adaptability.

- North America dominates the global modular furniture market, supported by strong residential renovation activity and corporate office refurbishments.

- Asia-Pacific is the fastest-growing regional market, driven by booming real estate sectors in China, India, and Southeast Asia.

- Eco-friendly materials and circular economy principles are reshaping product development and supply chains.

- Technology integration, including 3D customization tools and AR-based room visualization, is enhancing customer experience and purchase confidence.

What are the latest trends in the modular furniture market?

Sustainable and Eco-Conscious Designs

Manufacturers are increasingly focusing on sustainability, integrating recycled wood, metal, and biodegradable materials into modular furniture production. Consumers are prioritizing environmentally friendly options that reduce carbon footprints, while government initiatives promoting green building standards further amplify this trend. Brands are also adopting circular design models, offering take-back or reconfigurable solutions to minimize waste and extend product life cycles.

Smart and Connected Furniture

The rise of smart homes and digital workplaces has spurred demand for modular furniture integrated with IoT-enabled features. Products equipped with wireless charging, USB hubs, and smart lighting systems are becoming popular in both residential and office segments. This convergence of technology and furniture design enhances convenience and functionality, catering to tech-savvy consumers and hybrid work setups.

What are the key drivers in the modular furniture market?

Rising Demand for Space Optimization

With urban populations increasing and apartment sizes shrinking, modular furniture offers a practical solution for maximizing limited spaces. Modular sofas, wall-mounted desks, and convertible storage units provide flexibility and efficiency for modern homes. The global trend toward minimalistic interior design further strengthens this demand.

Expansion of Commercial Real Estate and Corporate Offices

The growth of commercial infrastructure, especially in emerging economies, is significantly driving modular furniture adoption. Corporations are prioritizing flexible, reconfigurable workspaces that support collaborative environments. Demand is rising for modular desks, partitions, and ergonomic seating solutions that can easily adapt to evolving office layouts.

What are the restraints for the global market?

High Initial Costs and Durability Concerns

Although modular furniture offers flexibility and design versatility, higher initial investment and durability concerns remain barriers for some consumers. Custom modular setups often come with premium pricing compared to conventional furniture. Additionally, frequent reconfiguration can impact product longevity, particularly in low-cost material variants.

Supply Chain and Raw Material Volatility

Fluctuating raw material prices, particularly for wood, steel, and polymer components, can impact production costs and profitability. Supply chain disruptions and increased transportation costs, especially post-pandemic, have added complexity for manufacturers seeking cost stability and timely delivery.

What are the key opportunities in the modular furniture market?

Customization and E-Commerce Growth

The rapid rise of e-commerce platforms and direct-to-consumer brands presents a major opportunity for modular furniture players. Online customization tools now allow customers to design, visualize, and configure furniture according to personal preferences. The fusion of digital retail and modular product design is expanding market accessibility and consumer engagement globally.

Growth in Co-Living and Flexible Workspaces

The increasing prevalence of co-living spaces, serviced apartments, and coworking hubs is creating new avenues for modular furniture adoption. These environments require flexible, multifunctional furniture that supports dynamic usage patterns and quick reconfiguration. This trend is particularly strong in metropolitan regions across the Asia-Pacific and Europe.

Product Type Insights

Storage furniture dominates the market due to its versatility and essential role in space optimization. Seating and workstations are witnessing robust demand in the commercial segment, driven by flexible office setups. Kitchen and bedroom modular systems continue to grow rapidly, supported by urban housing projects and rising consumer preference for modern interiors. The integration of smart and sustainable materials across all product types is a defining trend.

Application Insights

Residential applications lead global demand, particularly in apartments and urban homes where modular designs enhance space functionality. Commercial applications, including offices, retail stores, and hospitality spaces, represent the fastest-growing segment due to workplace modernization and flexible interior solutions. Institutional applications such as schools and healthcare facilities are also adopting modular designs to improve adaptability and ergonomic performance.

Distribution Channel Insights

Offline retail remains dominant, with specialty furniture stores and home improvement chains driving sales. However, online platforms are gaining rapid traction, supported by AR-based design tools, digital catalogs, and improved last-mile logistics. Direct-to-consumer (D2C) brands are disrupting traditional retail channels by offering cost-effective, customizable solutions directly to end users.

| By Product Type | By Application | By Distribution Channel | By Material |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America holds a significant share of the modular furniture market, driven by strong residential renovation trends, eco-friendly design adoption, and a growing preference for open-plan workspaces. The U.S. and Canada are key contributors, with corporate and home office setups driving steady demand.

Europe

Europe represents a mature market with a strong emphasis on sustainability and design innovation. Countries such as Germany, Italy, and the U.K. are leaders in modular furniture manufacturing and exports. Growing adoption of recycled materials and circular economy initiatives further supports regional market growth.

Asia-Pacific

Asia-Pacific is projected to record the fastest growth, propelled by rapid urbanization, expanding middle-class populations, and increasing disposable income in China, India, and Southeast Asia. The region’s booming real estate sector and growing focus on modern interiors are creating significant opportunities for manufacturers.

Latin America

Rising residential construction and growing awareness of space-efficient design are driving modular furniture demand in Brazil, Mexico, and Argentina. The region’s improving e-commerce infrastructure also supports online furniture sales growth.

Middle East & Africa

The modular furniture market in the Middle East & Africa is expanding due to large-scale real estate developments, luxury housing projects, and the increasing penetration of international furniture brands. The UAE and Saudi Arabia are key markets with strong consumer inclination toward modern, customizable interior solutions.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Modular Furniture Market

- IKEA

- HNI Corporation

- Haworth Inc.

- Herman Miller Inc.

- Godrej Interio

- Okamura Corporation

- Steelcase Inc.

- Williams-Sonoma, Inc.

Recent Developments

- In August 2025, IKEA announced the expansion of its sustainable modular furniture range under its “Circular by Design” initiative, integrating recycled materials across major product lines.

- In June 2025, Steelcase introduced a new series of modular workstations optimized for hybrid offices, featuring smart connectivity and ergonomic flexibility.

- In March 2025, Godrej Interio launched a customizable modular kitchen series tailored for Indian urban apartments, emphasizing eco-friendly materials and digital design tools.