Smart Furniture Market Size

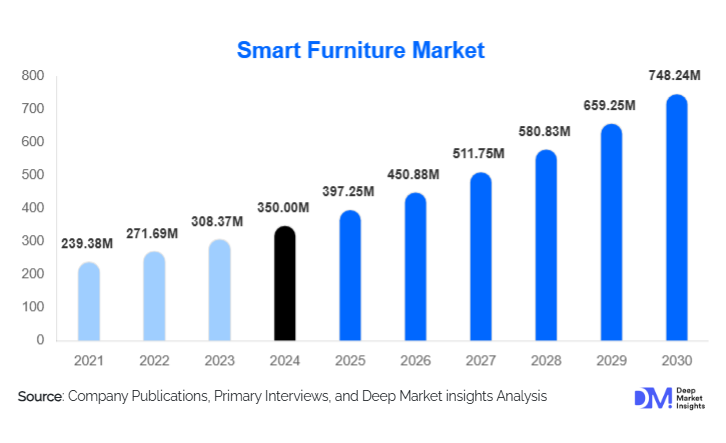

According to Deep Market Insights, the global smart furniture market size was valued at USD 350.00 million in 2024 and is projected to grow from USD 397.25 million in 2025 to reach USD 748.24 million by 2030, expanding at a CAGR of 13.5% during the forecast period (2025–2030). The smart furniture market growth is primarily driven by rising adoption of IoT-enabled and AI-integrated furniture solutions, increasing awareness of ergonomic and health benefits, and the growing demand for smart homes and connected office environments globally.

Key Market Insights

- Smart furniture is transforming both residential and commercial spaces, offering multi-functional solutions such as adjustable desks, smart beds, and sensor-enabled chairs that enhance productivity and comfort.

- IoT and AI integration is reshaping product design, enabling automation, personalization, and real-time monitoring, which is driving premium furniture adoption.

- Residential applications dominate, accounting for a significant share of global market demand, driven by home offices, smart bedrooms, and living room innovations.

- North America holds the largest market share due to early adoption of smart homes and high disposable incomes in the U.S. and Canada.

- Asia-Pacific is the fastest-growing region, with emerging demand from China, India, and Japan fueled by urbanization, rising middle-class income, and technology adoption.

- Online retail channels are increasingly capturing market revenue, driven by consumer preference for digital shopping convenience and wider product selections.

What are the latest trends in the smart furniture market?

AI and IoT-Enabled Personalization

Smart furniture manufacturers are increasingly embedding AI and IoT technologies to offer personalized experiences. Adjustable desks can automatically modify height based on user posture, beds track sleep patterns, and chairs provide real-time ergonomic adjustments. These features appeal to both health-conscious consumers and corporates seeking efficient office environments. Integration with mobile apps allows seamless remote control, enhancing user engagement and creating opportunities for data-driven product innovation.

Rise of Ergonomic and Wellness-Focused Furniture

Awareness of posture, back health, and wellness has prompted demand for smart furniture solutions that actively promote user well-being. Products like smart beds, standing desks, and posture-monitoring chairs are increasingly adopted in homes and offices. The trend is especially pronounced in corporate and healthcare sectors, where ergonomics directly impacts productivity and patient care. Companies are incorporating advanced sensors, AI analytics, and connectivity features to enhance user comfort and health outcomes.

What are the key drivers in the smart furniture market?

Increasing Adoption of Smart Homes and Workspaces

Global adoption of smart homes and modern offices is a primary growth driver. Consumers are investing in integrated furniture systems that connect with smart home ecosystems, providing convenience, comfort, and energy efficiency. In offices, adjustable desks, smart seating, and IoT-enabled storage improve workplace ergonomics and operational efficiency, reinforcing the demand for connected furniture solutions.

Technological Advancements in Furniture Design

Continuous advancements in robotics, IoT, and AI are enhancing furniture functionality, creating market differentiation. For instance, self-adjusting beds, desks with usage analytics, and smart seating with posture reminders appeal to tech-savvy consumers seeking convenience and value-added features. The integration of cloud-based and mobile app controls further increases adoption across residential and commercial segments.

Health and Ergonomic Awareness

Rising awareness of the impact of sedentary lifestyles has accelerated smart furniture adoption. Consumers and organizations prioritize ergonomic designs to reduce back pain, improve posture, and enhance overall health. This trend is particularly strong in home offices, corporate workplaces, and healthcare environments, making health-conscious design a critical factor for market growth.

What are the restraints for the global market?

High Cost of Smart Furniture

Premium pricing of smart furniture solutions remains a significant barrier, particularly in emerging economies. High costs limit accessibility for price-sensitive consumers, restricting adoption in large population segments. Integration of advanced electronics, sensors, and AI contributes to higher manufacturing and retail prices.

Complex Integration and Maintenance

Smart furniture often requires setup, software updates, and ecosystem compatibility, which can pose challenges for end-users. Maintenance complexity, technical malfunctions, and connectivity issues may slow adoption, particularly in regions with low digital literacy or limited technical support.

What are the key opportunities in the smart furniture industry?

AI-Driven Customization

Manufacturers can leverage AI and data analytics to offer fully customized furniture solutions. Predictive adjustments, user preference tracking, and smart alerts enhance user experience, enabling companies to differentiate products in a competitive landscape. There is also potential for subscription-based smart furniture services offering regular software updates and feature enhancements.

Expansion in Emerging Markets

Emerging economies in APAC and LATAM present high-growth potential due to urbanization, rising disposable incomes, and the proliferation of smart offices and modern homes. India, China, Brazil, and Mexico are particularly promising, as investments in residential and commercial infrastructure increase demand for connected and ergonomic furniture solutions.

Sustainable and Energy-Efficient Furniture

Eco-friendly and energy-efficient smart furniture represents a growing opportunity. Products integrating sustainable materials, low-power electronics, and recyclable components appeal to environmentally conscious consumers. Companies can gain a competitive advantage through green certifications, renewable energy integration, and alignment with ESG objectives, especially in premium market segments.

Product Type Insights

Smart beds lead the market, accounting for 28% of the total market in 2024, driven by sleep-tracking features and adjustable functionality that enhance health and comfort. Smart desks and tables follow closely, capturing significant interest from remote workers and corporate offices due to their ergonomic benefits and IoT integration. Smart chairs, storage units, and smart sofas are growing steadily, reflecting demand for multi-functional, connected furniture across homes and commercial environments.

Technology Insights

IoT-enabled furniture dominates with a 35% share, as it allows remote control, automation, and connectivity with smart home systems. AI-integrated furniture is emerging strongly, offering predictive analytics, voice control, and adaptive functionality. Sensor-based furniture is widely adopted in ergonomic and health-focused applications, while robotics integration remains a niche but growing segment in high-end commercial and healthcare setups.

Material Insights

Wood-based smart furniture holds 42% market share due to its aesthetic appeal, versatility, and compatibility with residential and office interiors. Metal-based furniture is preferred in corporate and industrial setups for durability, while hybrid and composite materials are gaining traction for modular and lightweight applications. Plastic and composite furniture are popular for cost-effective and mobile smart solutions.

End-Use Insights

Residential applications lead the market with 45% share in 2024, driven by home offices, smart bedrooms, and living room furniture. Commercial demand from offices, co-working spaces, and hotels is growing steadily. Healthcare and assisted-living facilities are adopting smart beds and chairs, while educational institutions are exploring smart desks and interactive classroom furniture. Export-driven demand is rising, with developed regions like North America and Europe importing smart furniture from APAC manufacturers.

| By Product Type | By Technology | By Material | By End-Use | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America dominates the smart furniture market with a 33% share in 2024. High disposable income, early smart home adoption, and corporate office investments in ergonomic furniture drive demand. The U.S. is the largest contributor, followed by Canada, both showing consistent growth in home and commercial segments.

Europe

Europe holds a 28% share, with Germany, the U.K., and France leading demand. Sustainability and ergonomic awareness are key drivers. The region is also a testing ground for AI-integrated and IoT-connected furniture due to advanced technological infrastructure and eco-conscious consumer trends.

Asia-Pacific

APAC is the fastest-growing region, particularly in China, India, Japan, and Australia. Rapid urbanization, rising middle-class income, and technological adoption fuel growth. Smart furniture imports are increasing, especially from local and regional manufacturers, to meet booming residential and office demands.

Latin America

Brazil, Mexico, and Argentina are emerging markets, with rising interest in smart residential and commercial furniture. Adoption remains lower than in APAC and Europe due to higher prices, but premium and niche segments are expanding steadily.

Middle East & Africa

The Middle East shows growing demand in the UAE, Saudi Arabia, and Qatar for luxury smart furniture, driven by high-income consumers and tech-savvy populations. Africa presents limited but emerging opportunities, with South Africa and Nigeria exploring commercial and residential smart furniture solutions.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Smart Furniture Market

- IKEA

- Herman Miller

- Steelcase

- HNI Corporation

- Haworth

- Okamura Corporation

- FlexiSpot

- Humanscale

- Ergotron

- Loctek

- Uplift Desk

- FLEXISPOT

- Actiu

- Varidesk

- Knoll

Recent Developments

- In January 2025, IKEA launched a new line of AI-enabled smart desks with integrated posture monitoring and adjustable settings for home and office users.

- In March 2025, Herman Miller introduced sensor-integrated smart chairs for corporate offices, focusing on health tracking and ergonomic optimization.

- In July 2025, FlexiSpot expanded its smart furniture portfolio in APAC, offering IoT-enabled standing desks and connected ergonomic chairs targeted at home offices.