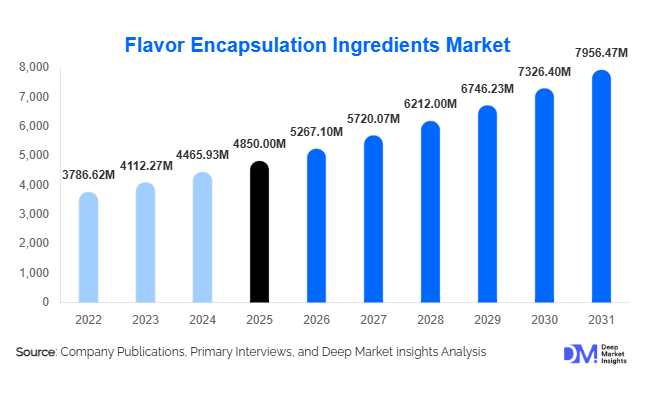

Flavor Encapsulation Ingredients Market Size

According to Deep Market Insights, the global flavor encapsulation ingredients market size was valued at USD 4,850 million in 2025 and is projected to grow from USD 5,267.10 million in 2026 to reach USD 7,956.47 million by 2031, expanding at a CAGR of 8.6% during the forecast period (2026–2031). Market growth is driven by rising consumption of processed foods, increasing adoption of functional and fortified products, and growing demand for advanced flavor protection and controlled-release technologies across food, beverage, pharmaceutical, and nutraceutical industries.

Key Market Insights

- Carbohydrate-based encapsulation materials dominate the market due to cost efficiency, neutral taste, and wide compatibility with food formulations.

- Spray drying remains the leading encapsulation technology, supported by scalability, high throughput, and lower production costs.

- Food and beverage applications account for nearly half of total demand, driven by packaged food and ready-to-drink product growth.

- Asia-Pacific is the fastest-growing regional market, fueled by food processing expansion in China and India.

- Controlled-release encapsulation systems are gaining momentum in nutraceutical, oral care, and pharmaceutical applications.

- Clean-label and plant-based encapsulation solutions are shaping innovation strategies across major manufacturers.

What are the latest trends in the flavor encapsulation ingredients market?

Rising Adoption of Clean-Label Encapsulation Systems

Manufacturers are increasingly shifting toward natural encapsulation materials such as modified starches, gum arabic, and protein-based systems to meet clean-label requirements. Regulatory pressure and growing consumer demand for transparency are accelerating adoption across food and beverage formulations. These materials provide effective flavor protection while maintaining label simplicity, particularly in bakery, dairy, and beverage products.

Advancement in Controlled and Triggered Release Technologies

Controlled and triggered release encapsulation systems are emerging as a key trend, especially in nutraceuticals and functional foods. These systems allow flavors to be released under specific conditions such as pH changes, temperature, or enzymatic activity, improving taste perception and product differentiation. Ongoing improvements in coacervation and fluidized bed coating technologies are enhancing release precision and product stability.

What are the key drivers in the flavor encapsulation ingredients market?

Growth of Processed and Convenience Foods

Increasing global consumption of ready-to-eat meals, packaged snacks, instant beverages, and frozen foods is driving demand for encapsulated flavors. Encapsulation protects volatile flavor compounds during high-temperature processing and extended storage, ensuring consistent sensory performance throughout product shelf life.

Expansion of Functional Foods and Nutraceutical Products

The rapid growth of functional foods, dietary supplements, and protein-enriched products has significantly boosted the need for flavor encapsulation. Encapsulation masks bitterness from vitamins, minerals, and bioactive compounds while protecting sensitive ingredients, supporting consumer acceptance and repeat purchases.

What are the restraints for the global market?

Fluctuating Raw Material Prices

Key encapsulation materials such as gum arabic, specialty starches, and protein isolates are subject to supply volatility and agricultural dependency. Price fluctuations can affect production costs and profit margins, particularly for manufacturers operating in cost-sensitive markets.

High Initial Capital Requirements

Advanced encapsulation technologies require significant investment in specialized equipment, process optimization, and quality assurance systems. These high entry barriers can limit technology adoption among small and mid-sized manufacturers, especially in emerging economies.

What are the key opportunities in the flavor encapsulation ingredients industry?

Emerging Market Expansion

Rapid urbanization, rising disposable incomes, and the growth of organized food retail in Asia-Pacific, Latin America, and the Middle East present strong expansion opportunities. Local food manufacturers are upgrading processing capabilities, increasing demand for advanced encapsulation ingredients, and seeking technical expertise.

Integration with Health and Wellness Formulations

Flavor encapsulation solutions that combine taste enhancement with nutrient protection are gaining traction in personalized nutrition and wellness products. Dual-function encapsulation systems offer premium pricing opportunities and long-term partnerships with nutraceutical and pharmaceutical brands.

Product Type Insights

Carbohydrate-based encapsulation ingredients accounted for approximately 38% of global market revenue in 2025, making them the dominant product type segment. Their leadership is driven by the widespread use of maltodextrin and modified starches, which offer high solubility, neutral taste, excellent film-forming properties, and cost efficiency. These characteristics make carbohydrate-based encapsulants ideally suited for spray drying applications in high-volume food and beverage manufacturing, particularly in bakery, dairy, and beverage formulations. In addition, their strong regulatory acceptance and compatibility with clean-label requirements further reinforce their market dominance.

Protein-based encapsulation systems are expanding rapidly, especially within nutraceutical and pharmaceutical applications, where controlled release, bioavailability, and taste masking are critical. Ingredients such as whey protein, gelatin, and casein are increasingly used to encapsulate sensitive bioactive compounds, supporting growth in dietary supplements and medical nutrition. Lipid-based encapsulation systems, while smaller in overall volume, play a critical role in specialized controlled-release formulations, particularly for fat-soluble flavors and nutraceutical ingredients. Synthetic and specialty polymers represent a relatively smaller share of total volume but command higher margins due to their use in advanced, high-performance applications requiring precise release profiles and enhanced stability.

Technology Insights

Spray drying remains the dominant encapsulation technology, accounting for nearly 45% of the global market share. Its leadership is driven by high scalability, low processing costs, compatibility with carbohydrate-based encapsulants, and suitability for mass production. Spray drying is extensively used in beverage flavors, dairy powders, and savory seasonings, where consistent particle size, high yield, and cost efficiency are critical.

Coacervation and fluidized bed coating technologies are gaining increased adoption in premium and high-value applications. These technologies offer superior encapsulation efficiency, improved flavor retention, and more precise control over release mechanisms. Fluidized bed coating, in particular, is expanding rapidly in nutraceuticals, chewing gum, and oral care products due to its ability to deliver controlled and sustained flavor release. The growing demand for customized, application-specific encapsulation solutions is expected to accelerate investment in these advanced technologies.

End-Use Industry Insights

The food and beverage industry represents nearly 50% of total global demand for flavor encapsulation ingredients, supported by strong consumption across bakery, dairy, beverages, confectionery, and savory foods. Rising demand for processed and convenience foods, coupled with the need for extended shelf life and consistent sensory performance, continues to drive encapsulation adoption within this segment.

Nutraceuticals and dietary supplements are the fastest-growing end-use segment, expanding at a CAGR exceeding 10%. Growth is driven by increasing consumer focus on health, immunity, and personalized nutrition, where flavor encapsulation plays a vital role in masking bitterness and enhancing the palatability of functional ingredients. Pharmaceutical applications are also expanding steadily, particularly in pediatric and geriatric formulations, while animal nutrition and pet food applications are emerging as niche growth areas due to premiumization trends and rising demand for fortified feed products.

| By Product Type | By Technology | By End-Use Industry | By Release Mechanism |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounted for approximately 30% of the global market share in 2025, led by the United States. Regional growth is driven by strong demand for functional foods, nutraceuticals, and clean-label products, supported by advanced food processing infrastructure and high R&D spending. The presence of major flavor and ingredient manufacturers, along with early adoption of controlled-release technologies, further strengthens the region’s leadership. Regulatory support for fortified foods and widespread consumer awareness of ingredient transparency continue to fuel demand.

Europe

Europe held around 25% of the global market, driven primarily by Germany, France, and the United Kingdom. Growth in the region is supported by strict food quality and safety regulations, which encourage the use of encapsulated flavors to improve stability and compliance. High adoption of natural and clean-label encapsulation materials, combined with strong demand for premium and functional food products, contributes to stable market expansion. Europe also benefits from well-established pharmaceutical and nutraceutical industries that increasingly rely on advanced encapsulation technologies.

Asia-Pacific

Asia-Pacific represented nearly 28% of global demand in 2025 and remains the fastest-growing regional market. Growth is driven by rapid urbanization, rising disposable incomes, and the expansion of large-scale food processing industries in China and India. China accounted for approximately 11% of the global market value, supported by strong domestic consumption and export-oriented food manufacturing. India is the fastest-growing country in the region, with double-digit growth driven by packaged food exports, government support for food processing infrastructure, and increasing adoption of modern manufacturing technologies.

Latin America

Latin America accounted for about 9% of global demand, led by Brazil and Mexico. Regional growth is driven by expanding beverage, dairy, and confectionery industries, along with rising consumption of processed foods. Increasing foreign investment in food manufacturing and the gradual adoption of advanced processing technologies are supporting demand for flavor encapsulation ingredients across the region.

Middle East & Africa

The Middle East & Africa region held approximately 8% market share in 2025. Growth is primarily driven by increasing food imports, rising demand for shelf-stable and packaged foods, and growing local food processing capacity. Government initiatives aimed at improving food security, combined with expanding urban populations and changing dietary patterns, are accelerating the adoption of encapsulated flavor solutions, particularly in Gulf countries and South Africa.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Flavor Encapsulation Ingredients Market

- Givaudan

- IFF

- Symrise

- Kerry Group

- DSM-Firmenich

- Sensient Technologies

- Tate & Lyle

- Cargill

- Ingredion

- Roquette

- Ashland

- Balchem

- Avebe

- Archer Daniels Midland

- Frutarom